Analyst sees bitcoin at $220,000 in 2025

- Bitcoin to rise to $220,000 based on a power-law model and a comparison with gold.

- For the advance to continue, the liquidity cluster in the $105,000–$110,000 band must be cleared; support sits around $98,000–$100,000.

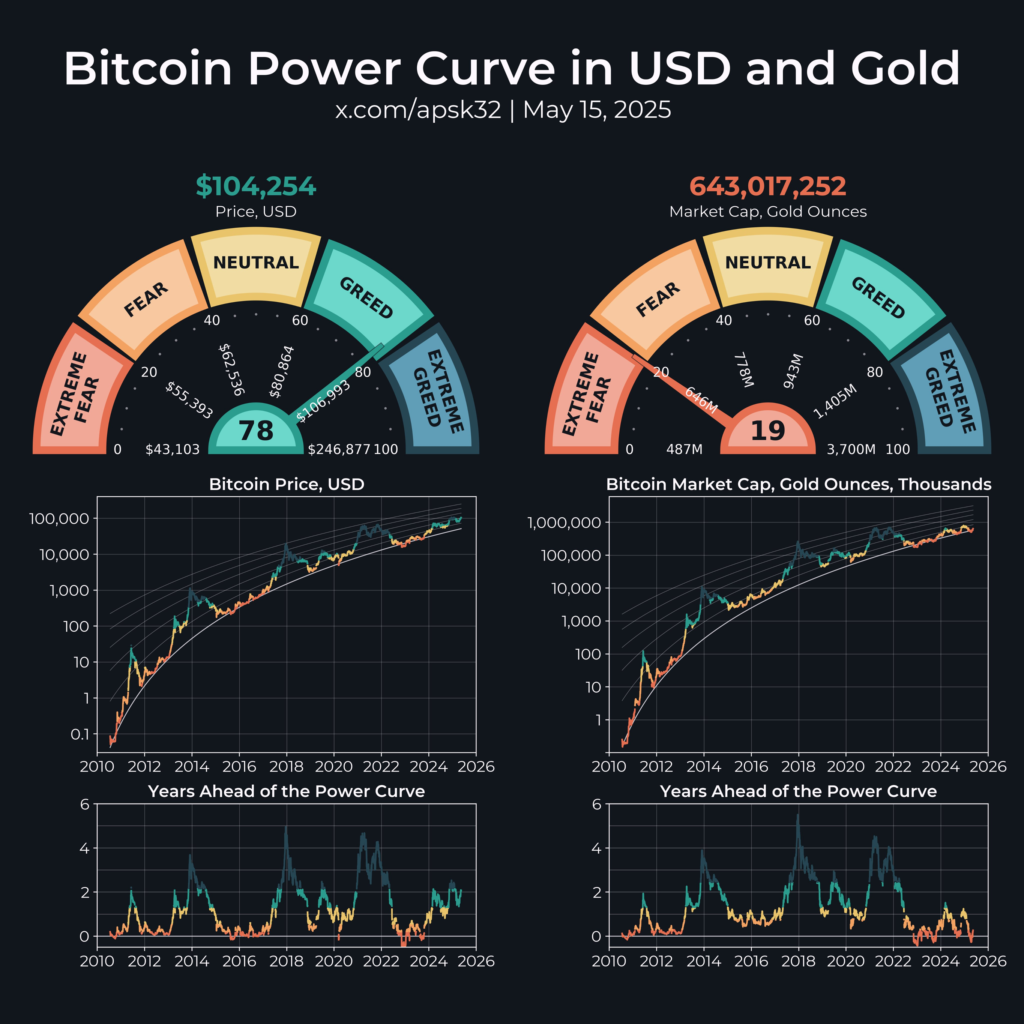

By year-end, bitcoin could reach $220,000 or higher if its correlation with gold persists, according to a user going by Apsk32.

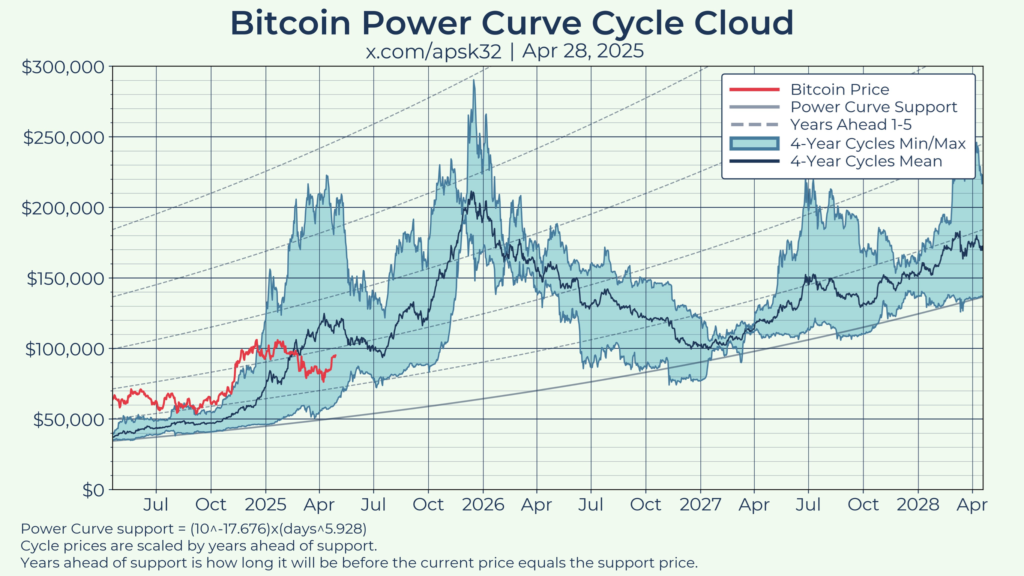

Watch this before you tell me the four-year cycle is dead.

Expecting $200,000+ Bitcoin in Q4.

Gold suggests we could go significantly higher. pic.twitter.com/DB9gm3NNdy— apsk32 (@apsk32) April 24, 2025

The forecast is based on valuing bitcoin in ounces of the precious metal and projecting it via a power function, taking the asset’s cyclicality into account.

He argues that dollar pricing distorts real value because fiat currency is inflationary. The idea is that gold’s price should compensate for the USD’s real decline.

According to Apsk32’s calculations, bitcoin’s current market capitalisation equals 643.02 million ounces.

Historically, BTC/USD has followed XAU/USD with a lag of several months, the expert noted. Gold’s recent rise to a record $3,500 sets a “very rosy” backdrop for the cryptocurrency.

Modelled values in the power function align with bitcoin’s 2017 peak at $20,000. Year-end calculations point to $444,000, but the analyst considers it “more reasonable” to prepare for $220,000.

“Above $250,000 will be above expectations,” the specialist commented.

Analyst Sam Callahan proposed valuing bitcoin by the ratio of its market capitalisation to gold’s. His matrix showed a rise to $924,000 by 2030 if that ratio reaches 50% and the metal trades at $5,000.

Came across this great valuation matrix in the new In Gold We Trust report showing where Bitcoin’s price could go if it captures different percentages of gold’s future market cap.

If gold hits $5,000/oz by 2030 and Bitcoin captures 50% of its market cap, that puts BTC at $924K. pic.twitter.com/pltfGJNX7O

— Sam Callahan (@samcallah) May 15, 2025

Near-term levels

Specialists at Material Indicators attributed bitcoin’s pause near $105,000 to large liquidity clusters from that mark up to $110,000.

Unless we have a serious catalyst, I’m not expecting to see a sustainable breakout to ATH territory until BTC has a legit support test at $100k, and FireCharts shows that the order book is priming for that with asks stacking and bids moving lower.

Of course we also have a Golden… pic.twitter.com/qIQdletCiE

— Material Indicators (@MI_Algos) May 15, 2025

“If we don’t have a serious catalyst, we do not expect a sustainable breakout to ATH until the price tests $100,000,” the message said.

Analyst and MN Trading founder Michaël van de Poppe highlighted key support at $98,000.

The view remains unchanged on #Bitcoin.

As long as it stays above $98K, we’ll be fine for further continuation upwards.

Last consolidation before we’ll break ATHs and start having fun. pic.twitter.com/l9mQSvPrcq

— Michaël van de Poppe (@CryptoMichNL) May 16, 2025

“This is a critical area […] for the continuation of the uptrend. The last consolidation before we break out and start having fun,” he added.

Earlier, experts pointed to the reasons for bitcoin’s shift to consolidation after testing $105,000.

Earlier, Blockstream’s co-founder called digital gold undervalued and predicted it would rise to $1 million.

Standard Chartered urged buying the cryptocurrency and forecast a rise to $120,000 in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!