Week in Review: Bitcoin Nears $30,000 as SEC Goes After Ripple

As the week draws to a close, we note Bitcoin’s new price records, the SEC’s case against Ripple, and a leadership shake‑up at the United States’ main financial regulator, as well as further hacks of crypto exchanges.

Bitcoin price

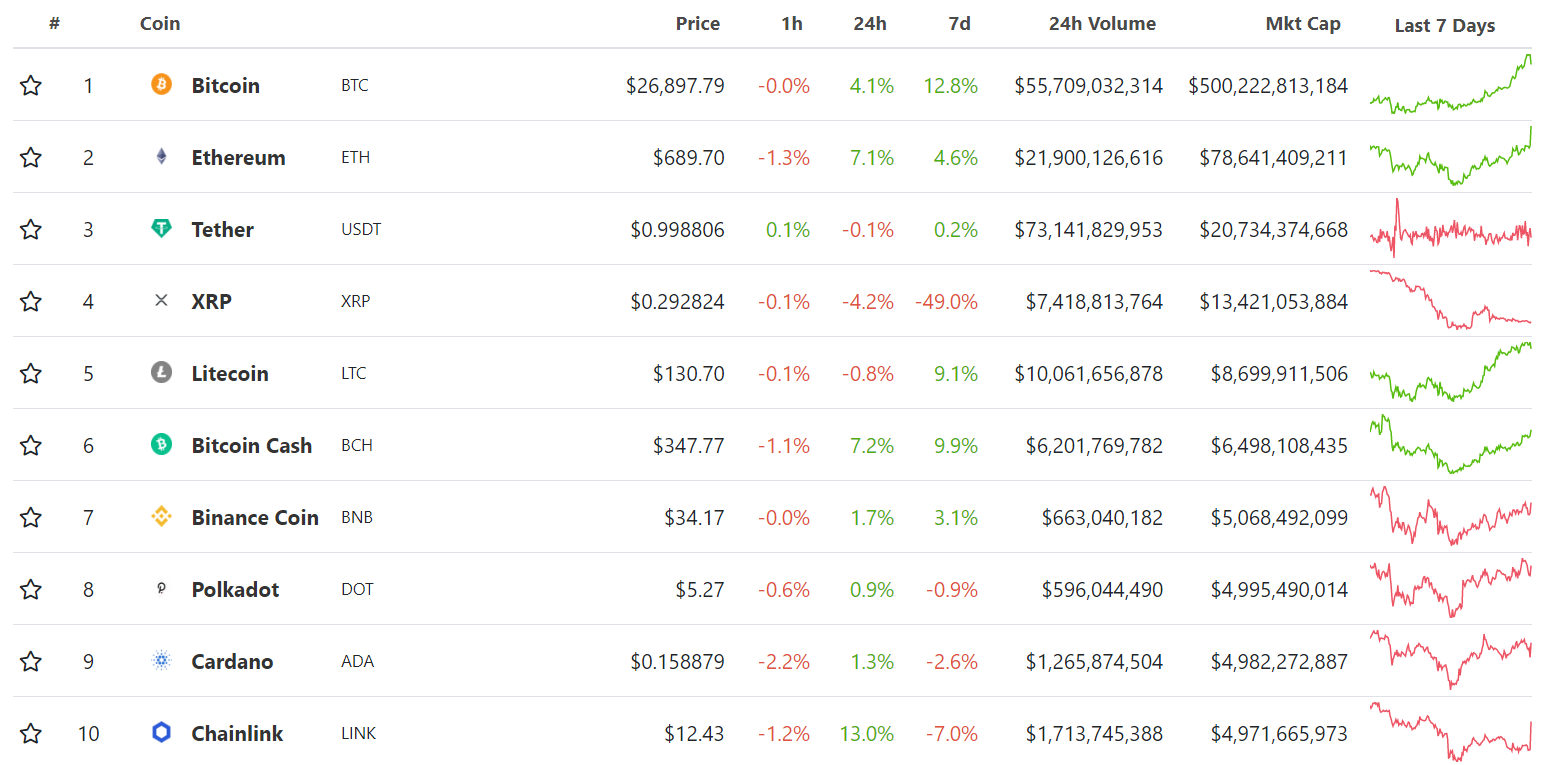

This week, the first cryptocurrency continued its rapid rise, updating on Sunday a new all‑time high at above $28 000. Despite a subsequent pullback below $27 000, weekly gains stood at nearly 13%.

New highs were reached across these days: after falling below $23 000 on Monday, the cryptocurrency cleared the $24 500 level on Friday and the $26 500 mark on Saturday. The advance above $28 000 on Sunday followed an early breach of $27 000.

Market capitalisation for the first time surpassed $500 billion. At the time of writing, Bitcoin was trading around $26 800.

BTC/USD hourly chart from TradingView.

Ethereum, the second-largest by market cap, approached $690 by Sunday evening. Weekly gain: 4.6%.

Among other major digital assets, the strongest weekly gains were shown by Bitcoin Cash and Litecoin – 9.99% and 9.1% respectively.

Data: CoinGecko.

SEC files suit against Ripple for selling unregistered securities

On 23 December the U.S. Securities and Exchange Commission (SEC) filed a suit against Ripple, CEO Brad Garlinghouse and its co‑founder Chris Larsen. According to the agency, over seven years the company sold unregistered securities to retail investors in the form of XRP tokens and raised $1.3 billion.

The Commission asserts that Ripple paid for various services in tokens, including market making. For example, the XRP‑based payments network (On‑Demand Liquidity, ODL) attracted only 15 firms in the remittance sector, none of which were banks. The reason, presumably, is the high costs that ODL is meant to address.

The SEC found that the California company subsidised use of this solution with clients, making the collaboration attractive for them. For instance, in the second quarter of this year MoneyGram received $15 million from Ripple in the form of incentives.

The suit will be heard in the federal court of the Southern District of New York. The SEC accuses the defendants of violating the registration provisions of the Securities Act of 1933 and seeks a court order banning further sales, the return of all raised funds with damages, and civil penalties.

Brad Garlinghouse said the SEC filing could spell trouble for other crypto firms and digital assets. For the moment, however, the trouble appears confined to Ripple: trading of XRP for U.S. residents has been halted by several major platforms, including Galaxy Digital, Bitstamp and B2C2. Moreover, Bitwise Asset Management excluded XRP from its flagship Bitwise 10 Crypto Index Fund.

The asset’s price fell nearly 50% over the week and, at the time of writing, was around $0.296.

Leadership change at the SEC

On Wednesday, 23 December, SEC Chairman Jay Clayton stepped down after more than three years at the agency. Under his tenure the SEC secured orders for penalties and restitution totalling more than $14 billion and returned $3.5 billion to investors.

The regulator also paid whistleblowers $565 million, including a record award of $114 million. For the 2020 fiscal year, the SEC collected $4.68 billion, of which $1.26 billion related to ICOs and crypto token offerings.

Under Clayton’s leadership, regulated futures on Bitcoin and Ethereum were launched, but ETF applications for Bitcoin have not yet been approved.

Elad Roisman

Acting SEC chair became Republican Elad Roisman. The final decision on the regulator’s leadership will be taken by the incoming U.S. president Joe Biden.

Roisman is known for backing exchange‑traded funds. After his appointment as a commissioner in 2018, some experts suggested that the chances of a Bitcoin ETF had risen significantly.

Roisman has also distinguished himself with a clear stance on regulating the crypto industry. In his view, the approach should be fair and transparent, and existing rules should be re‑examined to reflect new economic realities.

SEC unveils rules for broker‑dealers handling digital securities

This week the U.S. Securities and Exchange Commission (SEC) unveiled rules for broker‑dealers in the field of tokenised securities. The agency argues that broker‑dealers perform a full range of intermediary functions in relation to digital assets, and their activities are subject to oversight by the SEC and the Financial Industry Regulatory Authority (FINRA).

Under the SEC’s expectations, broker‑dealers should disclose risks to clients and implement “policies and procedures reasonably designed to mitigate risk.” Written broker‑dealer policies should include risk assessments related to the assets and technologies underlying them. They should also prepare contingency plans for emergencies, including a hard fork, a 51% attack, theft or unauthorised use of keys.

If firms comply with these rules, the SEC pledges not to sue them for five years. The regulator hopes such a window will help foster a favourable environment for cutting‑edge developments.

SkyBridge Capital invested $25 million in Bitcoin

SkyBridge Capital confirmed a Bitcoin investment of $25 million through its new fund.

Founder Anthony Scaramucci said the assets have already been moved and the firm has launched a full node on the Bitcoin network. Technical support and custody services were provided by Fidelity Digital Assets.

The new fund’s structure will give investors access to the cryptocurrency at net asset value and avoid premiums like those seen when buying Grayscale Bitcoin Trust shares on the secondary market. The minimum investment is $50,000.

“We will make Bitcoin more accessible, as we did for the hedge‑fund industry a decade ago,” said Anthony Scaramucci.

According to him, the fund will be a suitable vehicle for a broad range of wealthy investors and investment advisers. It will open to external investors in 2021.

DeFi project 1inch launches its governance token

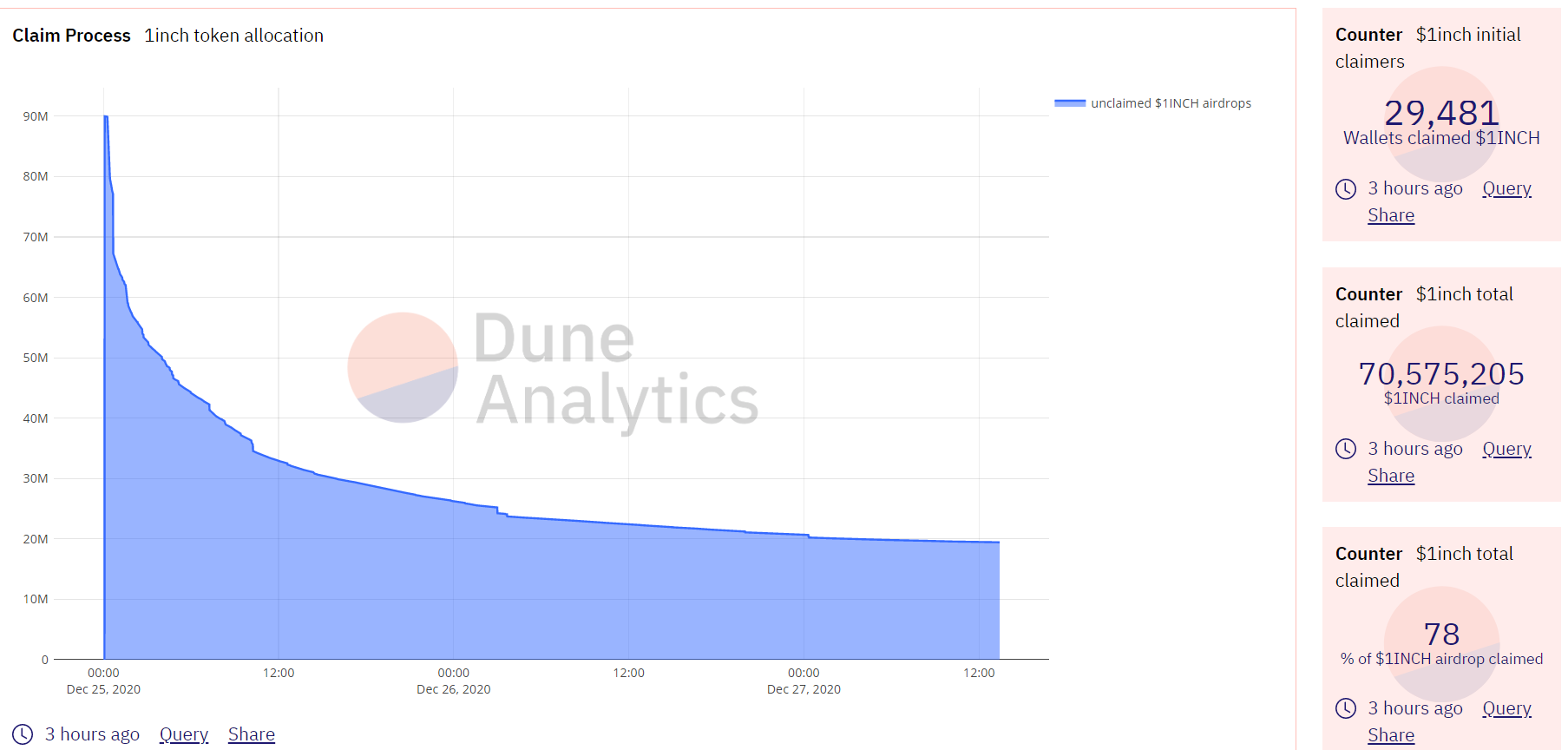

This week the decentralized exchanges liquidity aggregator 1inch released the “instant governance” token 1INCH. It is used only within the ecosystem and allows the community to vote on protocol settings.

Total supply is 1.5 billion 1INCH. An initial 6% will be issued. 30% is allocated to the community, 14.5% to the development fund. They will be distributed over four years.

The tokens will go to participants of two liquidity‑mining programs and wallets that interacted with the aggregator before 00:00 UTC on 24 December and met a set of criteria. As of writing, 70.5 million coins have been distributed among almost 29,500 wallets. This represents 78% of the 1INCH tokens allocated for the airdrop.

On Friday the token price reached $2.78, but since then it has fallen by more than 50%, and as of writing trades at around $1.34.

Data: Dune Analytics.

EXMO exchange hit by hack

On Monday, 21 December, the cryptocurrency exchange EXMO reported an unauthorised withdrawal of assets from its hot wallets, after which deposits and withdrawals were halted. Preliminary estimates put the loss from the theft of BTC, XRP, ZEC, USDT, ETC and ETH at $10.5 million, or 6% of the exchange’s total assets.

A portion of the stolen funds, nearly $4 million, was withdrawn via Poloniex.

“After we received information from EXMO, we quickly identified and froze two accounts. Unfortunately, all affected assets were withdrawn a few hours before EXMO contacted us,” said a Poloniex representative.

According to EXMO, the hackers managed to move $1 million in XRP and $2.8 million in ZEC.

Representatives said they had reported the incident to London police and circulated transaction details to analytics firms, including CipherTrace.

On Saturday, 26 December, EXMO resumed deposits and withdrawals in Bitcoin, Bitcoin Cash and fiat.

Livecoin leadership suspected of exit scam

On 24 December Livecoin representatives said the exchange was subjected to a “carefully planned attack” that had been in the works for months. It was claimed the exchange had completely lost control of its servers, backend and nodes, preventing it from stopping the service. Communication channels with customers via social media were reportedly compromised.

Preliminary estimates put the theft at 106 BTC, 361 ETH and 236 BCH. However, one user said withdrawals of high‑capitalisation tokens were disabled a day before the hack, and others a few hours after.

Additionally, EXMO’s business development director Maria Stankevich said Livecoin’s CEO Svetlana Geller deleted her Telegram account:

“I wrote to Svetlana – there was a live account and it suddenly became deleted. We were still in touch yesterday.”

This was followed by other strange events: a day before the incident, Bitcoin on Livecoin surged to $220,000, Ethereum to $6,500 per coin. Withdrawals from the platform remain unavailable.

Also users noted that one of the addresses receiving allegedly stolen Ethereum had been used by attackers during EXMO’s hack that week.

A few days earlier, ForkLog was approached by Veros FP, which said it had been victimised by Livecoin. According to them, for three years Livecoin, using its own trading bots, posted sell orders for the project’s native VRS tokens that were not backed on the exchange’s balance. By creating an artificial price dump, the platform subsequently bought tokens from users.

The total damage from the platform’s actions is estimated at more than $800,000. Veros FP says that a similar fraudulent scheme has been used across most trading pairs on the exchange since 2014.

As of writing, Livecoin’s website still greets visitors with a maintenance notice.

Russia approves cryptocurrency taxation bill

On Thursday 24 December, the State Duma Committee on the Financial Market backed the draft law “On amendments to Parts One and Two of the Tax Code of the Russian Federation” and recommended its first reading.

The committee justified its decision by “the widespread adoption of digital technologies and the expanding use of cryptocurrencies, including for illicit purposes.”

According to the document, digital currencies are recognised as property. Individuals and Russian entities will be required to report holdings of digital currencies to the tax authorities if “the amount of inflows or outflows for the calendar year exceeds the equivalent of 600,000 rubles.”

Earlier, ForkLog, with experts, explored the specifics of the document.

Ledger wallet user data go public

The Ledger hardware wallet user database, stolen in June 2020, went public. The leak exposed 1 million email addresses, 272,000 home addresses and phone numbers.

In late October, a user under the handle Polaris published the database on the hacker forum exploit.in. Initially, he asked for 12.5 BTC, later changing the price several times.

The buyer was user hyperdrill, who reportedly paid 5 BTC for the data. However, on 20 December another user posted the same database on the forum at lower rates—the starting price was 1.5 BTC.

Ledger representatives suggested that this could be the very database that leaked in June 2020. Users began receiving notices about wallet deactivation and phishing links, and in some cases threats of physical harm.

Ledger urged not to share recovery data, but they ruled out compensation for victims of the leak.

ForkLog Live

This week our guest again was trader-analyst Tone Vays, sharing his view on what could stop Bitcoin’s explosive rise, as he put it.

We also launched a new HUB Webinars column, where HUB residents will share their expertise with the community in video form. The first session was hosted by Attic Lab CEO and Everstake staking platform founder Sergey Vasilychuk.

Special project: Oil, gas and Bitcoin

Bitcoin miners consume as much electricity as Chile, Kazakhstan or Belgium. And oil producers burn billions of cubic metres of associated gas in flares. That gas could be used to generate electricity… for mining.

In a new ForkLog special, we explain how Gazprom Neft launched a project to convert associated gas into electricity for mining: what the gas is, why oilmen burn it, and how miners are extracting bitcoins near oil fields.

Subscribe to Forklog’s YouTube channel here!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!