Bitcoin may ‘overheat’ around $180,000, analyst says

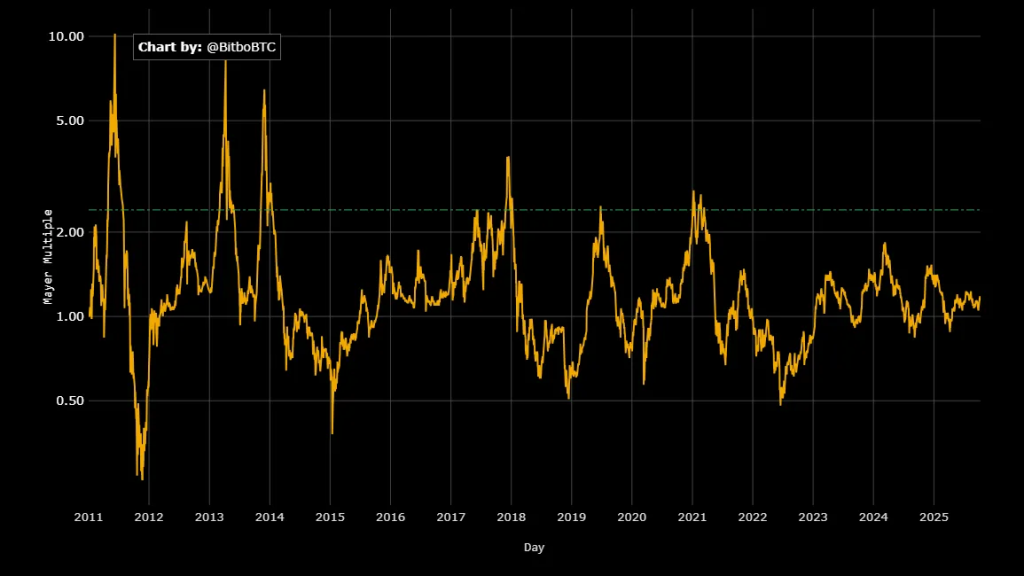

Fetter sees room for a Bitcoin rally as the Mayer Multiple stays subdued.

Crypto markets remain far from overbought, leaving room for the rally to extend, according to analyst Frank Fetter, who cites the Mayer Multiple.

Bitcoin is at all-time highs and the Mayer Multiple is ice cold. I like the setup. $BTC pic.twitter.com/I5pNkydV2l

— Frank (@FrankAFetter) October 9, 2025

“Bitcoin is near ATH, and the Mayer Multiple is just ice cold. I like this setup,” the analyst said.

The metric tracks deviations from the 200-day simple moving average (MA). These help identify speculative bubbles and periods of seller exhaustion that often precede a long-term trend reversal higher.

Readings above 1 mean bitcoin trades above its 200-day MA; below 1 means price is under the 200-day MA.

Historically, a Mayer Multiple above 2.4 signals a speculative bubble. The metric’s creator and Bitcoin Knowledge host Trace Mayer argues investors achieve the best long-term results when most accumulation occurs with readings below 2.4.

At the time of writing, the Mayer Multiple is 1.14. Digital gold changes hands around $121,360 — 3.6% below the ATH reached on October 6 (per CoinGecko).

Fetter’s attached chart highlights $180,000 as the level corresponding to the “speculative” 2.4 threshold.

Fuel for further gains

Readings are markedly lower than in prior market phases. In the current cycle, the peak was 1.84 in March 2024, when bitcoin traded around $72,000.

In July, CryptoQuant analyst Axel Adler Jr. said that readings near 1.1 can be seen as a kind of “fuel reserve” for a fresh impulse higher.

The Bitcoin Mayer Multiple is another classic model in analysis. Currently, the metric stands at 1.1х (price to 200-day moving average), which falls within the neutral zone (0.8–1.5х) and is significantly below overbought thresholds (1.5х).

Today’s Mayer Multiple indicates that… pic.twitter.com/xqhfnNm051

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) July 8, 2025

What do other metrics say?

Glassnode analysts note that bitcoin trades above the short-term holders’ (STH) cost basis.

“The rally remains below the overheat zone (+1 STD). This suggests a strong impulse persists, but also that short-term risk levels are approaching,” the researchers explained.

The company also points to “moderate” profit-taking as realized gains rise.

“There are no signs of a price top yet — unlike December 2021, when the advance began to slow,” the experts observed.

Still Uptober?

Many analysts see the pullback as a pause rather than the start of a reversal.

“Short-term holders took profits, some leveraged longs were liquidated, but long-term holders’ supply remains untouched,” noted Arctic Digital analyst Justin d’Anethan in a conversation with The Block.

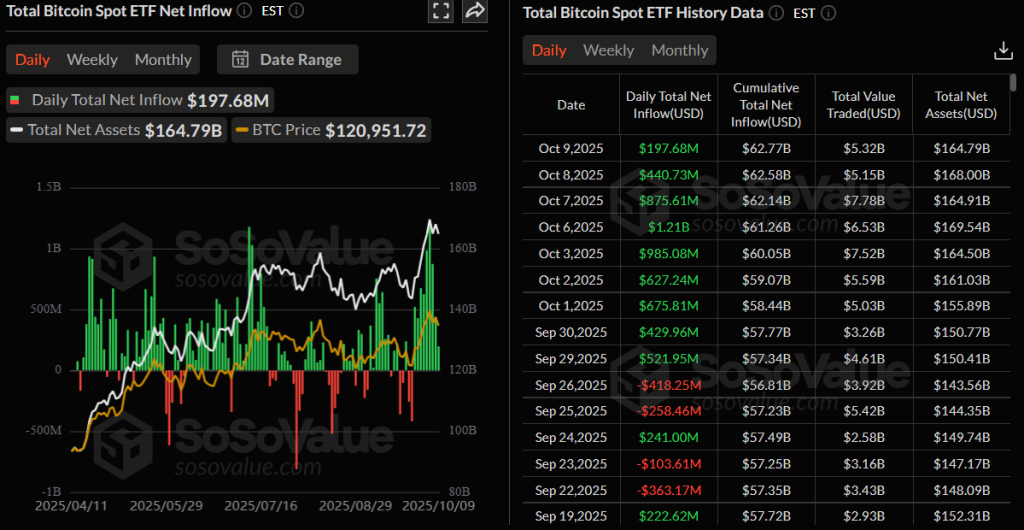

He also noted that inflows into spot bitcoin ETFs remain substantial, while exchange balances have fallen to a six-year low.

According to Glassnode, institutional demand remains resilient despite a “leverage reset” in derivatives markets.

“This indicates that constructive buying continues to support the market, helping to smooth volatility and steady price action,” the experts said.

In d’Anethan’s view, the market is under pressure from macro factors: a stronger dollar, persistently high yields and uncertainty around further Fed rate decisions.

The US is undergoing a partial shutdown. Analysts note that such episodes typically boost interest in havens like gold and bitcoin.

Fed chair Jerome Powell has been equivocal on the prospects for monetary easing, but the FedWatch tool from CME assigns a 94.6% probability of another cut at month-end.

Kronos Research CIO Vincent Liu said sentiment remains “mixed but resilient,” with long-term investors continuing to accumulate. Thus, the Uptober narrative endures — market structure is stable despite a modest pullback.

“Historically, bitcoin has risen an average of 22% in October, and Ethereum about 5%. This trend fuels the Uptober narrative. […] On-chain data show ongoing accumulation and resilient positioning, though macro uncertainty remains a meaningful part of the equation,” Liu said.

According to d’Anethan, his October outlook remains moderately bullish, though the advance may be less brisk.

Meanwhile, Presto Research analyst Min Jeong argued the market lacks a dominant narrative.

“For now, traders should watch macro indicators and policy-linked headlines — they will set the tone for crypto in the near term,” she said.

Former BitMEX head Arthur Hayes said the customary four-year crypto-market cycle has lost relevance.

In his view, price action is now driven by central-bank monetary policy rather than historical patterns tied to the halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!