This week: a market rout, Buterin’s ZKID concept and Durov’s bleak warning

Record $19.3bn liquidations, Buterin’s ZKID and Durov’s bleak warning—this week in crypto.

A sweeping market sell-off led to record liquidations of $19.3bn, Vitalik Buterin unveiled the ZKID concept, Pavel Durov warned of the “imminent demise” of the free internet, and other events of the week.

US–China trade tensions were a factor in bitcoin’s decline

On 6 October the price of the first cryptocurrency tested a new all-time high of $126,080 (CoinGecko). After a brief pullback, the asset moved sideways, holding above $120,000.

Prices began to fall on the evening of 10 October. According to experts, the move was driven by a confluence of technical factors, including a long-overdue correction.

The drop accelerated sharply after US president Donald Trump announced 100% tariffs on imports from China. On America’s biggest crypto exchange, Coinbase, the price briefly plunged to $107,000.

According to CoinGecko, the local low came on 12 October at about $101,800. By Sunday evening, prices had steadied and recovered above $112,500.

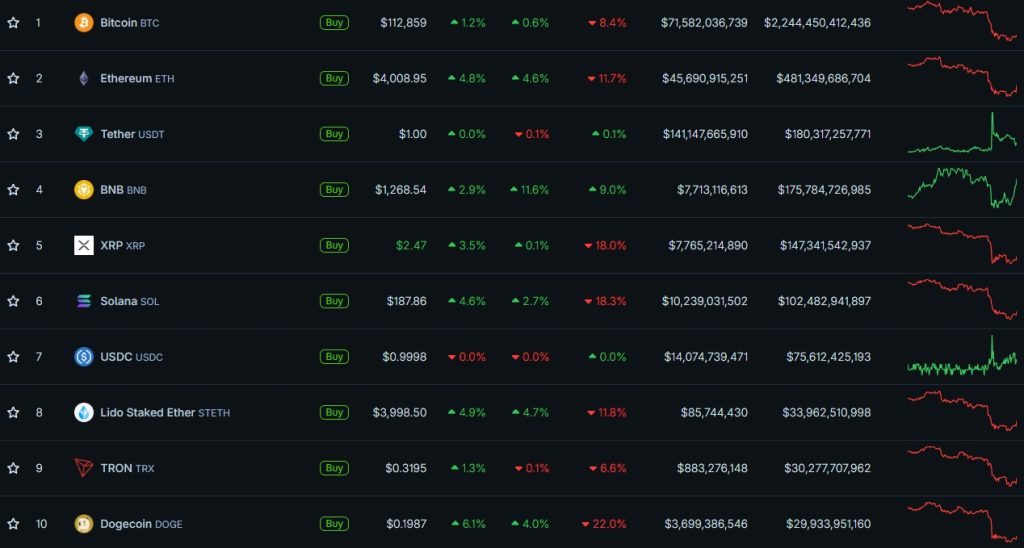

The net result was an 8.4% weekly decline for digital gold.

Large-cap altcoins reacted more sharply to the market’s slump. Dogecoin fell 22% over seven days; Solana and XRP lost roughly 18% each; Ethereum dropped about 12%. The exception was BNB, up 9%.

Outside the top 10, Zcash stood out: the privacy-focused coin rose 80% in seven days.

Total crypto-market capitalisation shrank to $3.9trn; bitcoin’s dominance approached 60%.

The 11 October rout triggered a cascade of liquidations totalling a record $19.3bn. Analysts noted this was an order of magnitude above the figures recorded during the COVID-19 crash ($1.2bn) and the FTX collapse ($1.6bn).

Leading the exchanges by forced position closures was the perp-DEX Hyperliquid with around $10bn.

Next, at a considerable distance, were Bybit ($4.6bn) and Binance ($2.4bn). The latter’s team acknowledged that a large share of liquidations was linked to the depeg of three tokens: USDE, BNSOL and WBETH. The assets were used as collateral for margin positions.

By experts’ assessment, trading volume in these coins on Binance during the crash amounted to $3.5–4bn, while traders’ losses reached $0.5–1bn. The exchange’s management pledged to reimburse losses but warned that all cases would be reviewed individually.

The crypto fear-and-greed index plunged to 24 points, having reached 74 a week earlier. The current reading signals “extreme fear”.

The altseason index on CoinMarketCap fell to 38 from 55 at the start of the week. Reaching the 75 threshold typically signals investors are expecting a rally beyond bitcoin.

Buterin unveiled ZKID as a foundation for new financial models

The emergence of “low-risk DeFi” and breakthrough ZKID-based applications could transform financial markets, said Ethereum co-founder Vitalik Buterin.

“Lately I have been talking a lot about ZKID. Why? Because identity and privacy are extremely important in the modern world,” he said.

According to the programmer, centralised databases are “inevitably hacked”, causing leaks. ZKID uses zk-SNARKs to verify information without third parties.

Buterin noted that the technology can be used in undercollateralised lending. A borrower can prove creditworthiness through analysis of transaction history without having to disclose total assets.

What to discuss with friends?

- Scientists created an exoskeleton to train robots.

- The CEO of Crypto.com urged regulators to investigate after $19bn of liquidations.

- An Israeli firm unveiled a technology to detect cancer by the smell of breath.

- K33 analysts “buried” bitcoin’s four-year cycle.

Pavel Durov warned of the “imminent demise” of the free internet

We are approaching a “dark, dystopian world” in which governments are gradually depriving users of privacy, said Telegram’s creator Pavel Durov.

“I turned 41, but I do not really feel like celebrating. Our generation is running out of time to save the free internet created by our fathers,” he wrote.

According to Durov, countries that were once free have lately been introducing increasingly “bleak” measures.

As examples, the Telegram founder cited Britain’s introduction of a national digital ID system and the rollout of age verification in Australia.

Also on ForkLog:

- Square launched fee-free bitcoin payments for businesses.

- Figma is integrating Gemini by Google.

- A post by Polymarket’s founder sparked rumours of an imminent launch of the POLY token.

- Ethereum Foundation assembled a team to protect privacy.

MetaMask announced a $30m rewards programme

Developers of the ConsenSys-owned Web3 wallet MetaMask will launch an on-chain rewards programme in the coming days.

Rewards in the first season will total more than 30m in LINEA tokens. Referral bonuses, incentives in the stablecoin mUSD and exclusive partner rewards are also expected.

The MetaMask team also launched trading in perpetual contracts directly in the mobile app. The solution uses Hyperliquid’s perp-DEX infrastructure.

Monero and Polygon teams shipped blockchain upgrades

Developers of the privacy-focused cryptocurrency Monero in the new client version (v0.18.4.3) dubbed Flourine Fermi improved mechanisms to counter so-called spy nodes.

“This is a strongly recommended update,” project representatives emphasised.

In the Monero community, the term “spy nodes” refers to malicious nodes, their clusters or botnets capable of linking IP addresses to transactions on the network.

The update introduces an improved peer-selection algorithm that avoids connecting to large subnets often used by spy nodes. Users will now connect to safer nodes.

General improvements have been added to enhance the network’s stability and reliability.

The Polygon Labs team also upgraded the Polygon mainnet. Developers activated the Rio update to increase the blockchain’s speed, reliability and scalability, especially for payment solutions.

The upgrade lifted network throughput to 5,000 transactions per second and delivered near-instant finality. The key change eliminates the risk of blockchain reorganisations.

What else to read?

Looked at how major developers such as OpenAI and Anthropic are adapting large-language-model technologies to perform corporate employees’ tasks.

Explained how the Nepalese authorities’ attempt to control the internet led to a revolution.

Explored the evolution of crypto derivatives exchanges and the essence of the perp-DEX trend.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!