Black Saturday, 11 October: what happened?

Liquidations topped $19bn as crypto’s value shrank by $660bn in a day.

On 11 October, liquidations in the crypto market surged past $19bn, the largest on record. Over 24 hours, the capitalisation of digital assets fell by almost $660bn, according to CoinGecko.

Bitcoin fell below $111,000, recording for the first time a daily candle at $20,000. On Binance, the price briefly dipped to $102,000.

Ethereum dropped to $3,700. Many altcoins suffered double-digit losses—among the top ten by market value, XRP, Solana and Dogecoin fared worst, each down by roughly 20%.

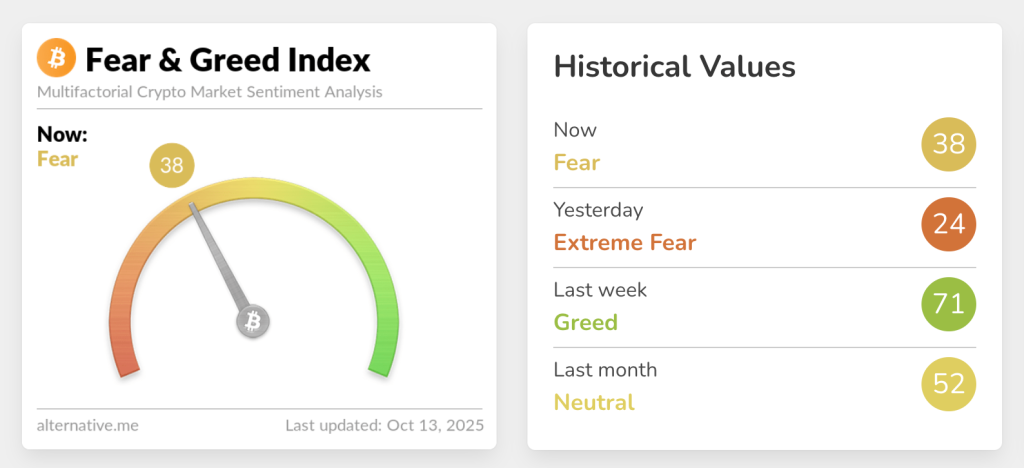

The Crypto Fear and Greed Index fell to 24, signalling “extreme fear” on the market. At the time of writing it had recovered to 38.

Analysts linked the panic to a post by US president Donald Trump on the social network Truth Social. In a 10 October post he said 100% tariffs on Chinese imports could be introduced from 1 November.

Stock markets reacted first: the Nasdaq and S&P 500 indices fell by 3.5% and 2.7% respectively. The negativity then spilled over into crypto.

Problems at Binance

More than 1.6m traders were liquidated in the sell-off, most of them on Binance and Hyperliquid. Some market participants suggested that mass position closures on the largest CEX were a “co-ordinated attack”, which triggered the broad fall in crypto prices.

Journalist Colin Wu was among the first to note this. He said attackers exploited a vulnerability in the Unified Account feature, which allows users to post the stablecoin USDe as collateral.

Unlike other platforms, Binance valued such assets not by market data from oracles but by its own order book. The exchange was aware of this—a fix was scheduled for 14 October.

Attackers took advantage of the window, dumping $90m of USDe onto the market. The “stablecoin” temporarily lost its US dollar peg, triggering $1bn in liquidations. The depeg also hit bnSOL and wBETH.

Minutes before Trump’s message, the attackers also allegedly opened short positions in bitcoin and Ethereum on Hyperliquid. This netted them $192m in profit.

Amid the incident, Crypto.com CEO Kris Marszalek urged regulators to conduct thorough reviews of crypto exchanges.

Binance acknowledged that some liquidations were tied to the temporary loss of pegs in USDe, bnSOL and wBETH, and assured users the exchange would cover losses caused by it. On 13 October, the platform reported $283m in compensation.

Representatives of the platform deny any link between the depeg and the market crash. Analysts also dismiss theories of a co-ordinated attack. Wu cited observations by analyst Jian Zhu’er, who stressed that USDe’s loss of its dollar peg came after the price collapse. He pointed to poor wBETH liquidity as the root cause.

Community views

Selini Capital’s founder, Jordi Alexander, argued that the sell-off was driven by the market’s accumulated “fragility”. He believes that amid FOMO participants forgot about risks.

Lot of crypto folks asking me “What happened?”…

It’s probably time to dust off the Taleb book ‘Antifragile’.

The amount of Open Interest that has been taken off in one day is unreal. 15B -> 6B on hyperliquid alone, the real total number must be insane!

People always want a… pic.twitter.com/Au0UmqPMnh

— Jordi Alexander (@gametheorizing) October 11, 2025

“In recent months I’ve been hearing ever more insane theses for buying coins. Did you know that the gardener’s dog of CZ is called ASTERIX? Time to bet on that crap, it’s ‘BSC season”,’ the expert wrote.

Alexander was particularly scathing about a loss of “self-awareness” in parts of the community:

“Solana traders used to flipping shitcoins in the mobile Phantom are trying to explain to me why this or that crappy perp-DEX is worth billions. Zero self-awareness about the game they’re playing and what it is. […] In recent months, when we were literally flooded with liquidity and every launch came with a pile of money, fragility lay beneath it all.”

He also drew a parallel with May 2021. Then, as now, a long stretch of gains and abnormally low volatility convinced market participants that risks were manageable, he noted.

Meanwhile, Moonrock Capital’s founder, Simon Dedic, urged people not to give in to fear and to see a unique opportunity.

My thoughts on yesterday’s crypto crash:

TLDR: We’ll be fine. We always are.

I’ve been in this industry for 9 years now, and I’d say I’ve really seen it all. The COVID crash, the $LUNA meltdown, the FTX collapse, you name it.

But what we witnessed yesterday felt very different…

— Simon Dedic (@sjdedic) October 11, 2025

“We’ll be fine. That’s how it always goes,” he reassured the community.

In Dedic’s view, the key difference between this crash and the collapses of FTX or LUNA is the lack of fundamental causes.

“Having analysed everything, my gut tells me this was a massive technical failure, not a fundamental one. And that is, in its own way, a bullish factor. Nothing fundamental in this industry has changed. The only question you should ask yourself right now is: ‘How much do I truly believe in crypto over the long term?’”

On 13 October, bitcoin recovered above $115,000, and Ethereum rose to $4,190.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!