Dragonfly partner calls the current correction ‘minor’ and urges calm

Dragonfly’s Haseeb Kerem calls the sell-off minor and urges calm as fundamentals hold

The current slide in the cryptocurrency market is far gentler than the 2022 crisis. Fundamentals remain strong and the system is functioning steadily, said Haseeb Kerem, managing partner at venture firm Dragonfly.

TBH this is the easiest bear market I’ve ever seen.

Seems like most of you have forgotten what 2022 was like. Luna collapsing, then 3AC, then FTX, then Genesis, BlockFi, Axie, NFTs—pretty much everything felt like a house of cards.

And then after all that stuff collapsed, the… https://t.co/DUwOZCBG3K

— Haseeb >|< (@hosseeb) November 14, 2025

“To be honest, this is the easiest bear phase I have ever seen,” he wrote.

He recalled the cascade of failures during the last industry crisis: the collapse of Luna, the bankruptcies of Three Arrows Capital, FTX, Genesis and BlockFi, the crash of the NFT sector, subsequent banking problems and a string of de-pegs among stablecoins. Against that backdrop, the current correction looks “minor”.

“Prices are down, yes—so what? Fundamentals are great. Crypto works. So relax, grab a snack. Focus. Everything will be fine,” Kerem stressed.

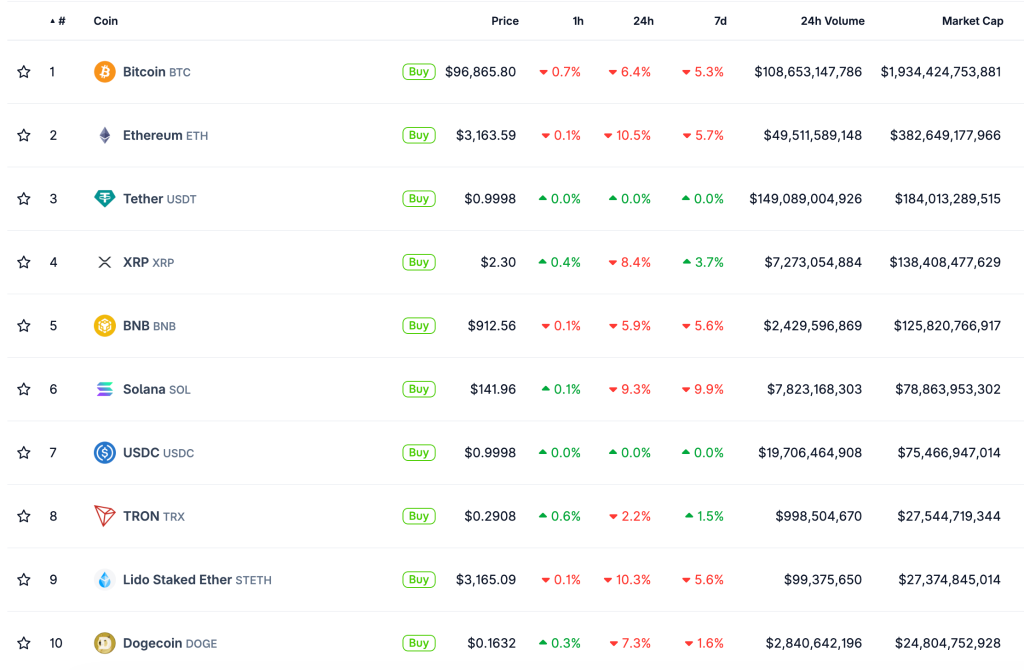

In the past 24 hours the crypto market’s capitalisation fell 6.5% to $3.3 trillion. Bitcoin slipped below the psychologically important $100,000 level, dropping to about $96,800.

The first cryptocurrency dragged the entire market lower. The price of Ethereum fell 10.4% to around $3,100.

Quotes of the other top-ten assets by market capitalisation also plunged.

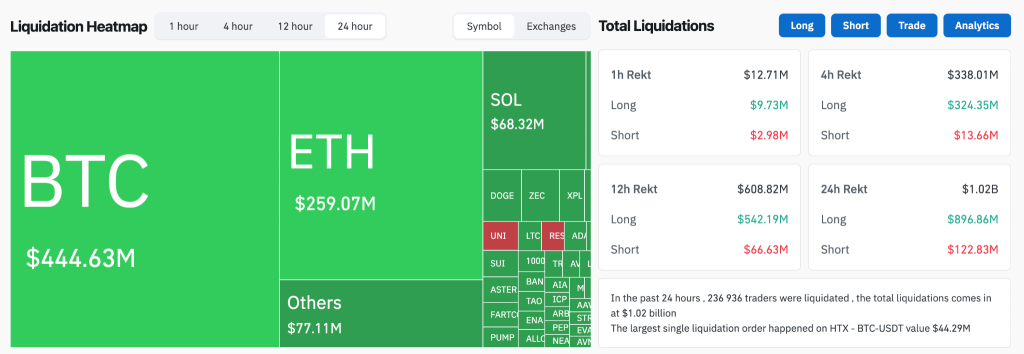

Total liquidations over the past 24 hours exceeded $1bn, with most forced closures concentrated in bitcoin longs.

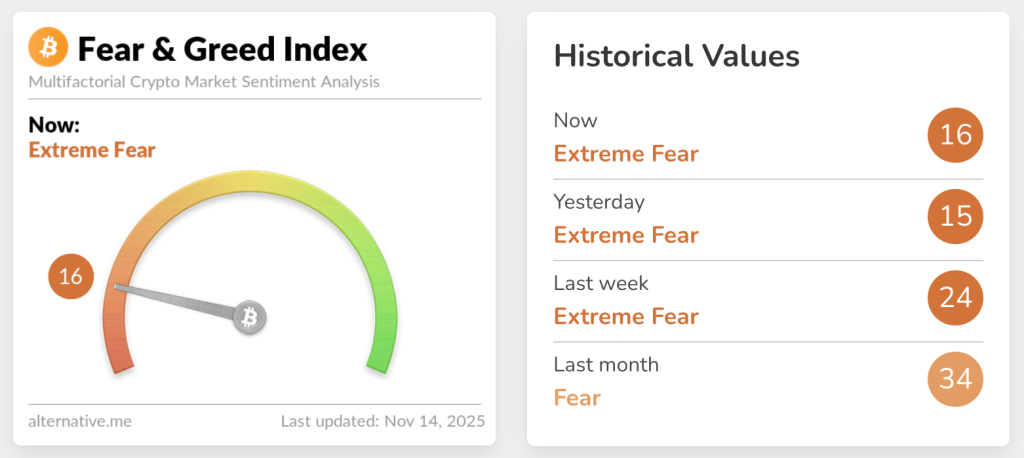

The market sentiment indicator remains in “extreme fear”.

Whales buy the dip

Large investors became active amid the pull-back. Lookonchain analysts highlighted a whale nicknamed 66kETHBorrow, who on 14 November bought 19,508 ETH worth $61m.

Whale #66kETHBorrow just bought another 19,508 $ETH($61M) — bringing his total purchases since Nov 4 to 405,238 $ETH($1.29B) at $3,489 avg, currently sitting on ~$126M in unrealized losses.https://t.co/1RbizBgRd2 pic.twitter.com/7kU6bD0KxM

— Lookonchain (@lookonchain) November 14, 2025

A few hours after the post, he bought another 16,937 ETH for $53.9m. Since the start of the month, his purchases have reached 422,175 ETH worth $1.3bn at an average price of $3,489 per coin. Unrealised losses have exceeded $126m.

Institutional players also added during the correction. A wallet linked to BitMine received 9,176 ETH worth $29.1m from Galaxy Digital’s OTC address.

Despite the market downturn, Tom Lee(@fundstrat)’s #Bitmine is still buying $ETH.

A new wallet 0x9973 — likely linked to #Bitmine — just received 9,176 $ETH($29.14M) from the Galaxy Digital OTC wallet.https://t.co/bHVxpnFfaq pic.twitter.com/YDz22E0QP0

— Lookonchain (@lookonchain) November 14, 2025

According to Strategic ETH Reserve, the firm manages more than 3.5m ETH worth about $11.1bn, excluding the latest transaction.

Lookonchain specialists also recorded large transfers linked to Anchorage Digital. It received 4,094 BTC, about $405m, from Coinbase, Cumberland, Galaxy Digital and Wintermute.

Closer to a bottom than a peak

According to Wintermute, the correlation between bitcoin and the Nasdaq-100 remains high—around 0.8.

BTC still moves with equities, but only when it hurts

The correlation remains high at ~0.8, but BTC reacts more to Nasdaq losses than gains

This negative performance skew is now at levels last seen in late 2022, yet we’re sitting near all-time highs pic.twitter.com/TO5OGSjzx1

— Wintermute (@wintermute_t) November 13, 2025

Levels like this were last seen in late 2022, even though bitcoin now trades not far from its ATH.

Historically, such negative asymmetry tends to appear when the market is forming a local bottom, not a peak.

Glassnode expressed a similar view, pointing to a jump in the 25-delta skew. According to them, it is currently showing sharp spikes.

When downside hedging demand rises, the 25-delta skew spikes. Recent spikes have consistently aligned with short-term lows, signalling elevated fear and heavy short positioning. Useful for low-timeframe traders. https://t.co/95P0q75chJ pic.twitter.com/G93g4jjxOj

— glassnode (@glassnode) November 14, 2025

“In recent months, such spikes have consistently coincided with short-term price lows, signalling elevated fear and significant short positioning,” the analysts noted.

Warning signs

At the same time, Glassnode specialists pointed to selling by long-term Ethereum holders.

Since late August, as Ethereum pulled back from its new peak, 3–10 year holders have ramped up their average daily spending to >45K ETH/day (90D-SMA).

This marks the highest spending level by seasoned investors since Feb 2021.

📉 https://t.co/EO1LpkLbmL pic.twitter.com/eMw5rKteTX

— glassnode (@glassnode) November 14, 2025

Holders with coin ages of three to ten years have increased daily distribution to 45,000 ETH—a high since February 2021.

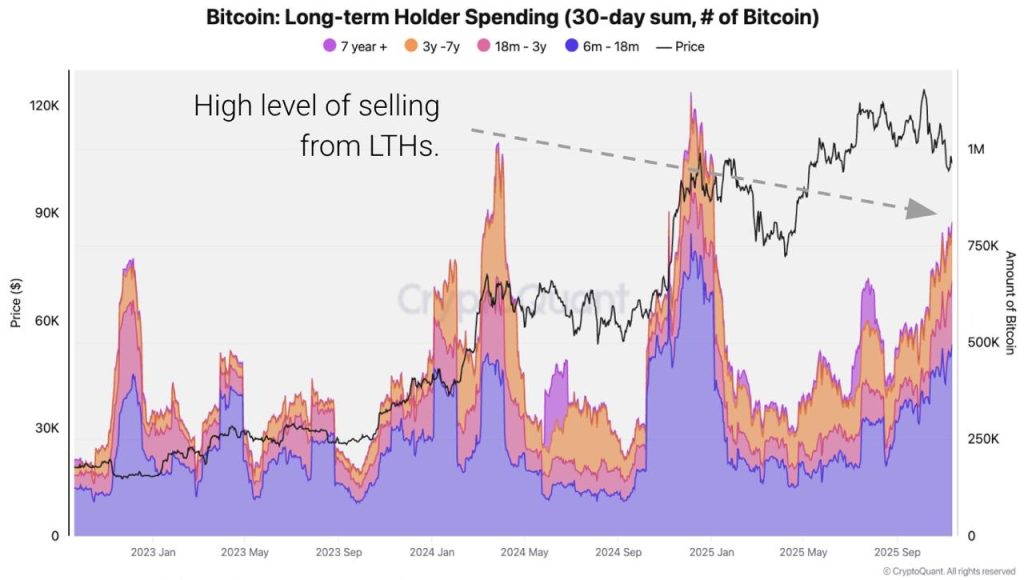

Long-term bitcoin holders are selling actively as well. According to CryptoQuant, over the past month they have released 815,000 BTC to the market—the highest reading since January 2024.

This wave of selling has coincided with weaker demand and a negative Coinbase premium.

“In previous episodes of active selling by long-term holders, demand was strong enough to absorb supply in a rising market, but the current situation is different,” the specialists noted.

However, Glassnode emphasised that such investor behaviour is typical of the late stage of a market cycle and should not be a major concern.

A closer look at the monthly average spending by long-term holders reveals a clear trend: outflows have climbed from roughly 12.5k BTC/day in early July to 26.5k BTC/day today (30D-SMA).

This steady rise reflects increasing distribution pressure from older investor cohorts — a… pic.twitter.com/wECe58CV66— glassnode (@glassnode) November 13, 2025

By their estimates, the monthly average daily distribution by long-term holders has risen from just over 12,000 BTC a day in early July to about 26,000 BTC as of 13 November.

This pattern points to regular, orderly distribution rather than a targeted dump, and is consistent with normal bull-market behaviour, the experts concluded.

Earlier, QCP Capital analysts outlined factors that could support bitcoin into year-end. They include a possible rate cut by the Fed and resilient corporate earnings.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!