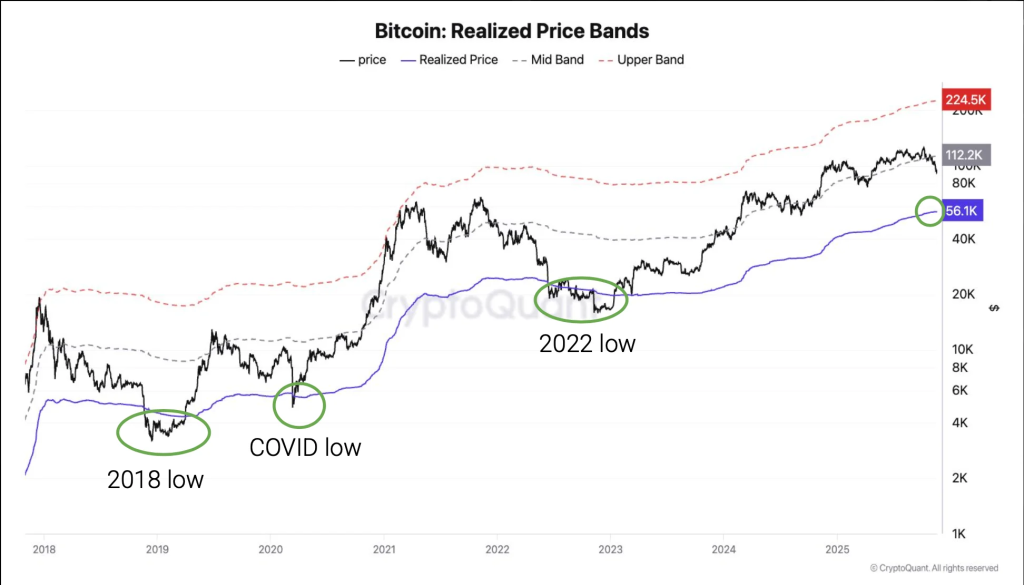

Analysts Warn of ‘Crypto Winter’ Onset: Bottom Expected at $56,000

Analysts at CryptoQuant suggest a bear market shift as demand slows.

The surge in demand for the leading cryptocurrency has slowed, potentially indicating a shift to a bear market, according to analysts at CryptoQuant.

Experts predict that the bottom will form near the realised price, approximately $56,000. This would represent a 55% drop from the historical peak. An interim support level is identified at $70,000.

Analysts noted that since 2023, the industry has experienced three major waves of activity, driven by the launch of spot ETFs in the US, the outcomes of American elections, and the growth of corporate treasuries.

Since the beginning of October 2025, demand indicators have fallen below trend values. According to experts, the main volume of purchases in the current cycle has already been realised, depriving the price of key support.

Institutional investors have begun reducing positions. In the fourth quarter of 2025, American spot bitcoin ETFs became net sellers, offloading 24,000 BTC. This contrasts with the active accumulation at the end of 2024.

Addresses with balances from 100 to 1,000 BTC also show below-trend dynamics. A similar situation was observed at the end of 2021 before the onset of the ‘crypto winter.’

The derivatives market confirms a decline in risk appetite. Funding rates have fallen to December 2023 lows. The price of the leading cryptocurrency has dropped below the 365-day moving average. Historically, this level separates bullish and bearish phases.

CryptoQuant emphasised that bitcoin’s four-year cycles depend on demand expansion and contraction, rather than halving.

Opinion: Bitcoin Network ‘Cools Down’

The bitcoin market has entered a bearish phase, according to CryptoQuant analyst GugaOnChain. Technical indicators and reduced network activity point to a trend reversal.

Bitcoin Network Cools Down as Confirmation of the Current Moment

“Historically, when highly active addresses shrink, it signals retreat by traders and institutions, reinforcing the transition into quiet accumulation phases that precede future volatility.” – By @GugaOnChain pic.twitter.com/vTw3GYiI3e

— CryptoQuant.com (@cryptoquant_com) December 22, 2025

The expert noted that the 30-day moving average has fallen below the 365-day by 0.52%. The downward trend is also confirmed by the Bull-Bear indicator.

The consistent reduction in active addresses indicates a withdrawal of speculators and a decline in trading interest.

The network slowdown is evident from the 7-day moving average of key metrics:

- Number of transactions: fell from ~460,000 to ~438,000;

- Fees: total volume decreased from ~$233,000 to ~$230,000;

- Highly active addresses: the figure dropped from 43,300 to 41,500. Institutional and other major players have shifted to a ‘defensive’ and accumulation phase.

Comparing current data with 2018 figures, GugaOnChain identified identical patterns: a decline in transactional activity, low fees, and the withdrawal of ‘whales.’

The difference lies in the size of the user base: 800,000 active participants now versus 600,000 in the previous cycle. This indicates a more mature network. The expert concluded that such a lull often precedes a surge in volatility.

Earlier, Fidelity’s Director of Global Macro Research, Jurrien Timmer, predicted the end of the bull cycle in 2026.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!