First government debt, then equities—and now oil

RWA moves from bonds to equities to oil, as tokenised commodities and compute finance take shape.

In 2025 the RWA sector moved from conceptual talk to a phase of aggressive integration with traditional markets. The focus shifted from simple debt instruments to energy resources and critical infrastructure.

In this analysis ForkLog examines the architecture of the commodities market, unpacks the cases of key startups and assesses the risks of an emerging financial reality.

The evolution of tokenisation

At the end of 2025 BlackRock executives Larry Fink and Rob Goldstein, in an essay for The Economist, described what is happening at the junction of traditional institutions and digital innovation as building a bridge from opposite sides of a river:

“These two sides do not so much compete as learn to interact. In future, people will not hold stocks and bonds in one portfolio and cryptocurrency in another. Assets of all kinds will one day be bought, sold and stored in a single digital wallet.”

By last year the RWA sector was the most profitable in crypto. Success, buttressed by predictions of a bright future for tokenising real‑world assets and a rather bleak backdrop across the blockchain industry, made the niche virtually the only hope for investors.

In October analysts at Standard Chartered estimated the RWA segment’s capitalisation at $2 trillion by 2028. In December Grayscale forecast a 1,000-fold expansion over the next four years.

ARK Invest joined the trend, contending that tokenisation could add up to 50,000% over the next five years.

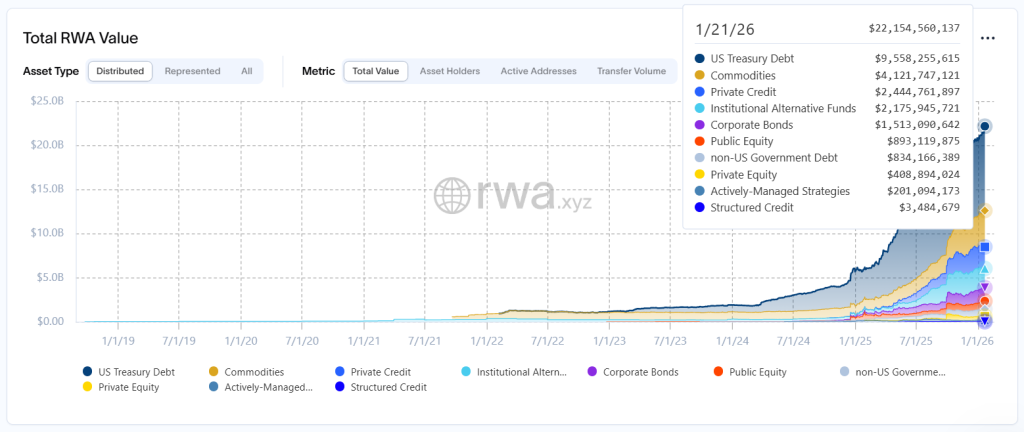

According to RWA.xyz, on 22 January 2026 the sector’s value excluding stablecoins surpassed $22 billion. Tokenised US government debt led with $9.5 billion.

Whereas at the outset US Treasuries were the driver, startups now digitise pooled exposure to private corporate credit and real estate.

The craze of 2025 was trading public‑company equities on crypto rails. Many large CEX and DEX enabled the feature. In addition, Telegram users could buy securities from TradFi markets right in the app.

The next vector for RWA is forming around commodities. At the time of writing the market capitalisation of the subcategory amounted to $4.8 billion, of which more than 80% was Tether Gold (XAUT) and Paxos Gold (PAXG).

Despite pioneers of tokenising gold, silver and other precious metals such as Tether having done so for more than five years, oil was not in scope. Serious discussion of digital rights to that asset began only about two years ago.

As regulatory clarity takes shape and tokenisation advances, the markets for oil, gas and inputs critical to the AI economy could join RWA—and even lead the trend—in the near future.

The economics of the subsurface

Tokenising subsurface assets is an unobvious trend in the shadow of broader RWA: not yet backed by reportable figures, but already “charged” with first movers. Early experiments with commodity products proved the technology can swiftly pool liquidity into capital‑intensive sectors, bypassing banks that struggle to meet the needs of an accelerating AI economy.

The tokenised commodities market has undergone natural selection. Early Solana startup Elmnts, which offered fractional participation in oil‑production revenues, has been moved into withdrawal mode. The project’s social activity ceased four months after its public beta launched in October 2024.

Projects that lost momentum, for various reasons, yielded to players with institutional backing and improved business models. Moreover, under today’s regulatory environment in the US, EU and UAE, organisations can operate within tangible legal parameters that pioneers lacked.

Hadron from USDT issuer Tether offers turnkey tokenisation using institutional‑grade verification and a broad range that includes the commodities segment.

UAE‑based Tharwa (TRWA) operates in Abu Dhabi’s financial centre. Focused on Middle Eastern markets, the project tokenises gold, real estate and stakes in the oil industry. Its integration with the decentralised protocol Pendle lets investors split and trade the base asset (Principal Token, PT) and expected yield (Yield Token, YT) separately, providing access to sharia‑compliant finance without elements of Riba.

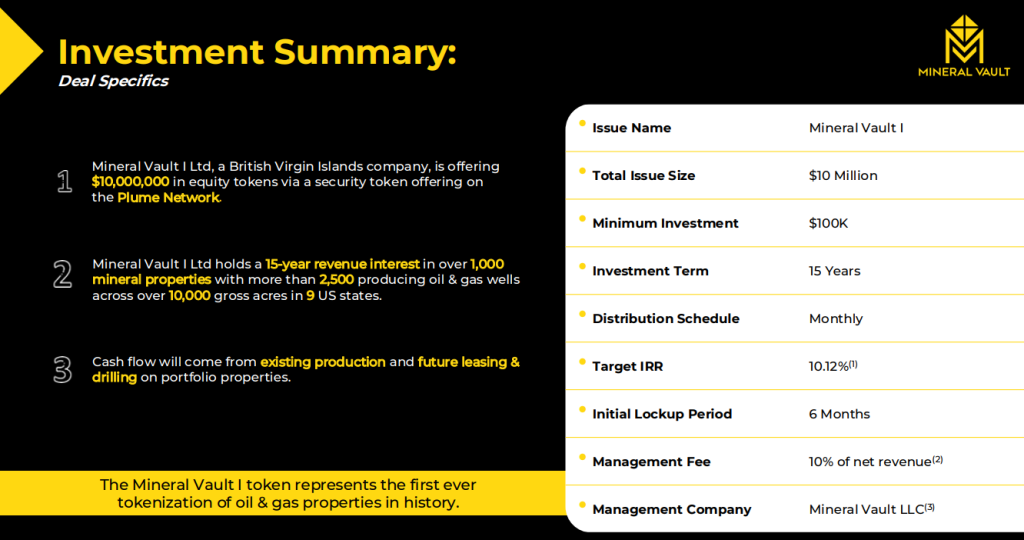

Another RWA startup, Mineral Vault (MNRL), which chose the specialised Plume Network, offers built‑in compliance mechanisms at the protocol layer.

The team is working to tokenise royalties from 2,500+ producing oil and gas wells in the US owned by partner Allegiance Oil & Gas. In effect, a holder of Mineral Vault I owns a share of mineral rights worth $10 million in aggregate.

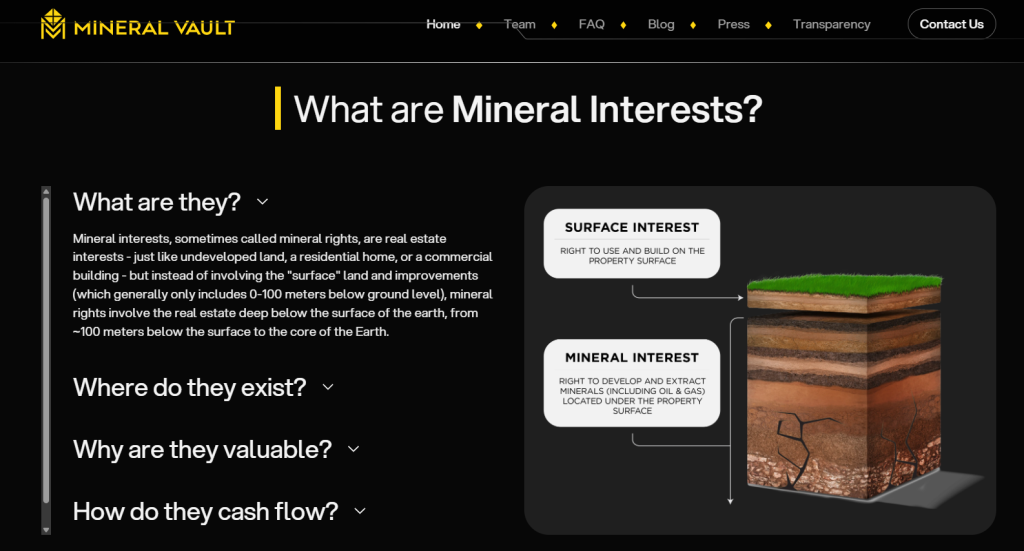

Mineral rights are a distinct form of subsurface property that grant the owner rights to extract oil, gas and other resources beneath a parcel, independent of surface rights.

Mineral rights can be leased to American energy companies that extract resources in exchange for royalty payments to the rights holder. The structure allows owners to receive passive income, inflation protection and long‑term appreciation while bearing virtually none of the costs or risks associated with drilling or maintaining wells.

The legal structure, built through bankruptcy‑remote special‑purpose vehicles, guarantees investor distributions in the USDC stablecoin. A target yield of 10–12% makes the asset a competitor to traditional bonds.

On 1 October 2025 tokenisation‑as‑a‑service startup Zoniqx announced the launch of “the world’s first tokenised private placement in the oil sector” on Hedera.

Developed with support from One World Petroleum, the project combines the acquisition of proven oil‑producing assets with secured lending to operators. Each ownership unit is issued as a security token, ensuring automated regulatory compliance, investor rights verification and full lifecycle management.

In today’s RWA sector, technical enforcement of rights is achieved via purpose‑built token standards:

- ERC-7518 from Zoniqx is based on ERC‑1155 but adds dynamic compliance. Unlike older versions it is designed for cross‑chain transfers while preserving all legal constraints and owner data;

- ERC-3643—a “smart” token with built‑in black‑ and whitelists, used by the category leader, Ondo Finance. Before each transaction the algorithm asks an oracle to confirm: “Has the buyer passed KYC? Are they under sanctions? Is the buyer allowed to own this asset under their country’s laws?” Otherwise the transaction is blocked automatically;

- ERC-1400—one of the earliest and most flexible standards for tokenising complex financial instruments. It supports collective ownership of assets, partitioned rights (eg income or governance shares), court‑ordered forced transfers and attaching legal documents to token metadata;

- ERC-4626—the standard for tokenised yield vaults that underpins many RWA funds such as Ondo OUSG and BlackRock BUIDL. It standardises deposits, withdrawals and yield accounting, simplifying their use as collateral in DeFi.

Amid real projects, the USOR (U.S. Oil Reserve) token on Solana drew attention. In January 2026 it was discussed actively on social media thanks to rumours of accumulation by BlackRock wallets and Donald Trump’s family. However, an examination by Arkham Intelligence and a project audit showed no real links to the US Department of Energy. The startup’s description contains technical inaccuracies and exhibits signs of a scam.

RWA once again proved its significance not only for corporations but also for the administration of the sitting US president.

On 22 January American Resources Corporation, via subsidiary ReElement Technologies and blockchain‑infrastructure provider SAGINT, announced the successful issuance of the world’s first token for critical minerals. The project confirmed technical readiness to comply with US Defense procurement rules.

The utility token, issued on Sui, provides supply‑chain traceability for refined neodymium oxide produced at ReElement’s plant in Noblesville, Indiana. It is designed as an internal audit and compliance tool for the ReElement platform and its clients, integrating data and control protocols that meet standards.

Resource finance

Tokenising physical assets on blockchain creates new financial instruments and accelerates the migration of traditional finance to crypto infrastructure. The synergy of the two systems is already evident.

As analysts at Messari noted in The Crypto Theses 2026, the response to the limits of traditional banking is InfraFi—a breakthrough at the intersection of RWA and DePIN.

Until 2025 most attempts at private on‑chain lending suffered from “toxic flow” and adverse selection. Goldfinch is illustrative: conceived as a tool to lend efficiently to emerging markets, it ran into underwriting issues. The best borrowers went to traditional lenders, leaving on‑chain pools with riskier assets. By 2026 the focus shifted from refinancing debt to creating new assets: tokenising infrastructure (GPU, energy) secured by real‑world objects, where income is generated by use rather than speculation.

Messari coined a term for linking on‑chain capital with lending to real infrastructure whose yields do not correlate with crypto volatility. Attention has shifted to productive assets and equipment that generate predictable cashflows yet remain outside traditional capital markets due to fragmented demand.

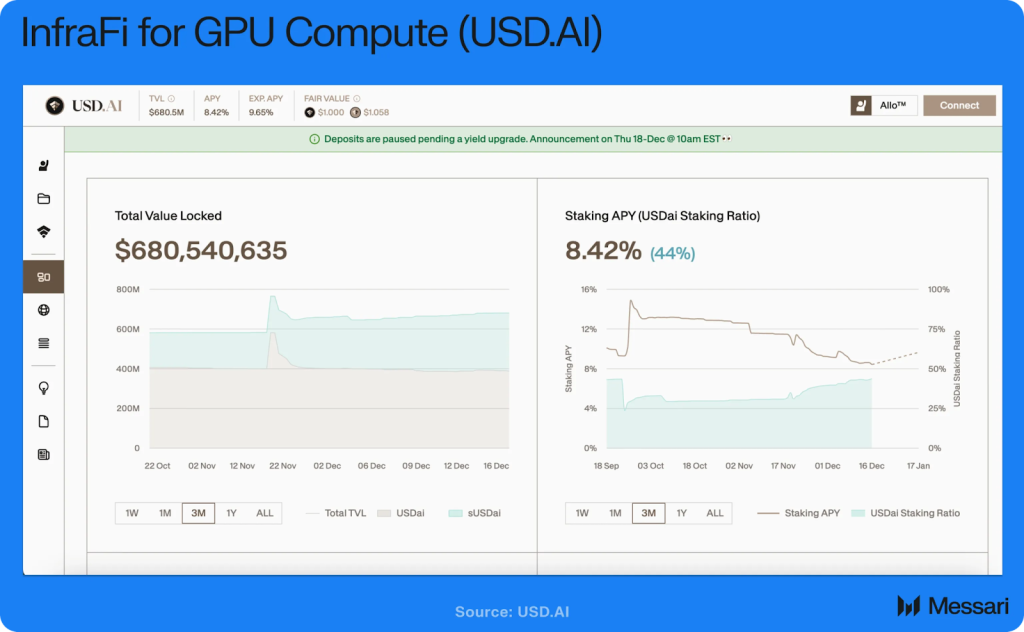

Turning compute into a standalone productive resource of the future AI economy set the stage for startup USD.AI. Traditional private‑credit funds ignore the segment of small and mid‑sized AI firms. Their tickets typically start at $20 million for hyperscalers like CoreWeave. AI startups needing six‑figure sums to buy GPUs find themselves in a “financial desert”.

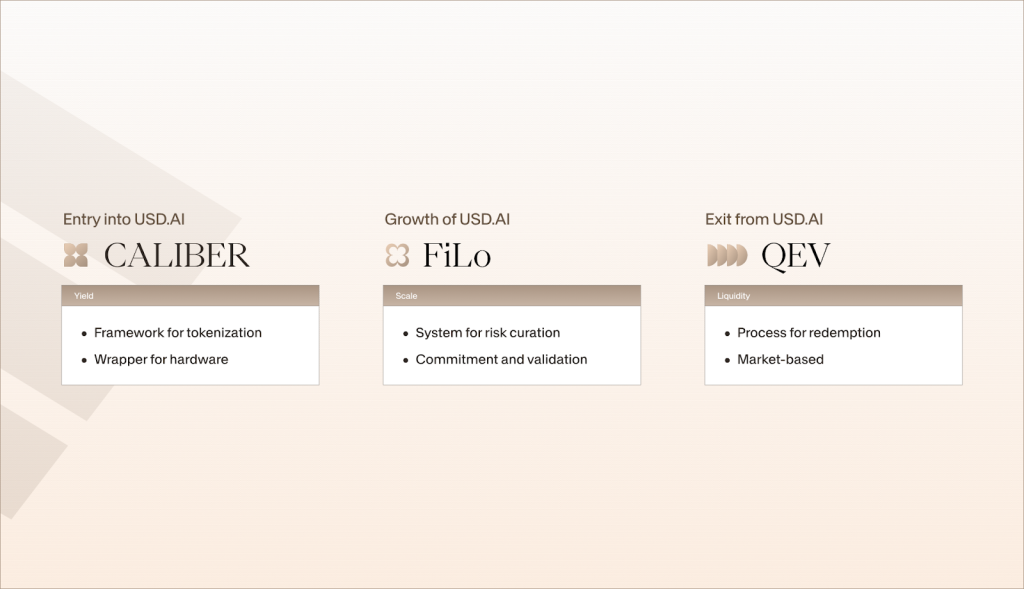

USD.AI tackles the gap through a combination of frameworks. The core innovation is to forgo physical ownership of equipment by the borrower:

- placement—GPUs are delivered directly to a third‑party data centre;

- usage rights—the borrower gets the legal right to operate the compute but not ownership until the three‑year loan is fully repaid;

- liquidation—in default there is no court repossession but reassignment of access rights to compute, which can be executed via on‑chain governance. Access to GPUs is reallocated to a new tenant. This turns graphics cards into reusable, yield‑bearing assets that can pass through multiple credit cycles without physical movement.

A parallel model is taking shape in energy via DePIN project Daylight. Distributed energy resources such as solar panels and home batteries have much in common with GPUs: high upfront capex and predictable future cashflows.

Daylight lets users invest in installing equipment and receive income from real‑time power generation. In 2026 the intersection of energy and compute became a strategic frontier: derivatives on compute now often include hedges for both electricity prices and GPU availability.

For InfraFi to function, reliable links between on‑chain systems and real‑world assets and processes are critical. That is where blockchain oracles such as Chainlink and Pyth come in.

The convergence of on‑chain and off‑chain worlds requires large, continuous data flows, which materially increase the applied value of these protocols and their tokens. The segment’s undervaluation suggests a future rally as it becomes a foundational settlement layer for the new economy—something recent news supports.

Oracle provider Chainlink launched 24/5 U.S. Equities Streams. It supplies DeFi protocols with round‑the‑clock weekday quotes for American stocks and ETF.

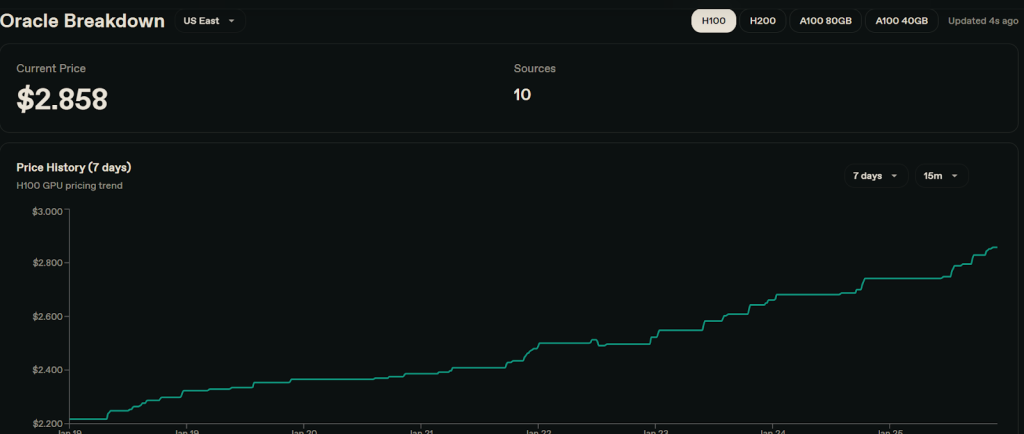

As market structure grows more complex, indices and derivatives are becoming the dominant instruments. As Messari notes, compute (GPU‑hours) has become a new commodity. Yet compute markets are fragmented and opaque. Prices vary by chip (H100 vs A100), geography and contract tenor.

Projects such as Ornn and Global Compute Index’s are creating a “gold standard” price for compute power by aggregating data from around the world.

Platform Squaretower launched GPU futures, allowing AI labs to lock in operating costs and hedge chip shortages.

The RWA sphere demands thoughtful protection against very real threat vectors.

The transparency of registries needed for an edge becomes an Achilles’ heel when safeguarding large fortunes. A public wallet holding a substantial stake in oil rigs or GPU farms becomes a target. One response may be ZKP mechanics, which allow ownership to be proven without revealing balances.

For anchoring rights to strategic assets, PoW blockchains look the strongest; yet in RWA a specialised‑network approach predominates. Because of narrower scenarios and participant sets, lower economic diversification and concentrated trust points, such networks may prove especially attractive to hackers.

Also remember: blockchain protects the record of ownership, not the physical object itself. In the event of nationalisation or destruction of a tokenised asset such as an oil rig, the token becomes a claim on an insurer or the state. The effectiveness of RWA here depends directly on jurisdictional stability.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!