How Digital Cash Became Digital Gold

How Bitcoin’s values have shifted over 17 years

On 31 October 2008, a member of the cypherpunk mailing list using the pseudonym Satoshi Nakamoto introduced Bitcoin — a system of “digital peer-to-peer cash” that dispensed with banks, preserved decentralisation and relative anonymity. Trust was ensured by cryptography, and transfers anywhere in the world incurred minimal costs. The first cryptocurrency had an elegant architecture, and in the early days a simple computer was enough to run a node.

On the 17th anniversary of the Bitcoin white paper, ForkLog examines how, and why, free money became digital gold.

Supernova

The animating idea behind the entire crypto movement is decentralisation. Though now discussed mostly in the context of digital assets, its roots run far deeper.

The first cryptocurrency’s white paper described a simple distributed system built on a P2P network. Nakamoto’s peer-to-peer architecture solved the double-spending problem — the risk that the same digital coin could be spent twice.

In the physical world, you cannot hand over the same banknote twice. In the digital realm, data are copyable, so without robust protections the same sum could be “sent” to multiple recipients.

In the traditional financial system the task is addressed with digital signatures.

Banks partly act as controllers via a centralised ledger, but this makes participants dependent on a third party that polices the transparency of a transaction.

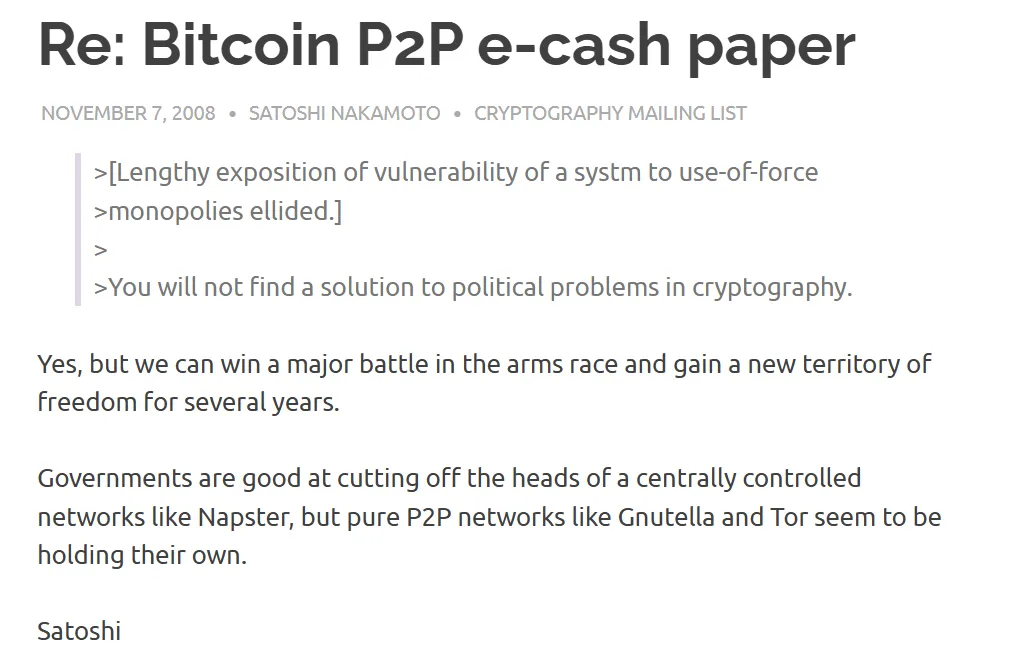

Satoshi’s aim was to remove the intermediary — the third party that knows everything about the other two. Code enabled censorship-resistance and greater privacy. Bitcoin’s blockchain addressed the problems in a decentralised way — using a public ledger, cryptographic hashing, UTXO and the Proof-of-Work consensus mechanism — making the network exceptionally resistant to attack.

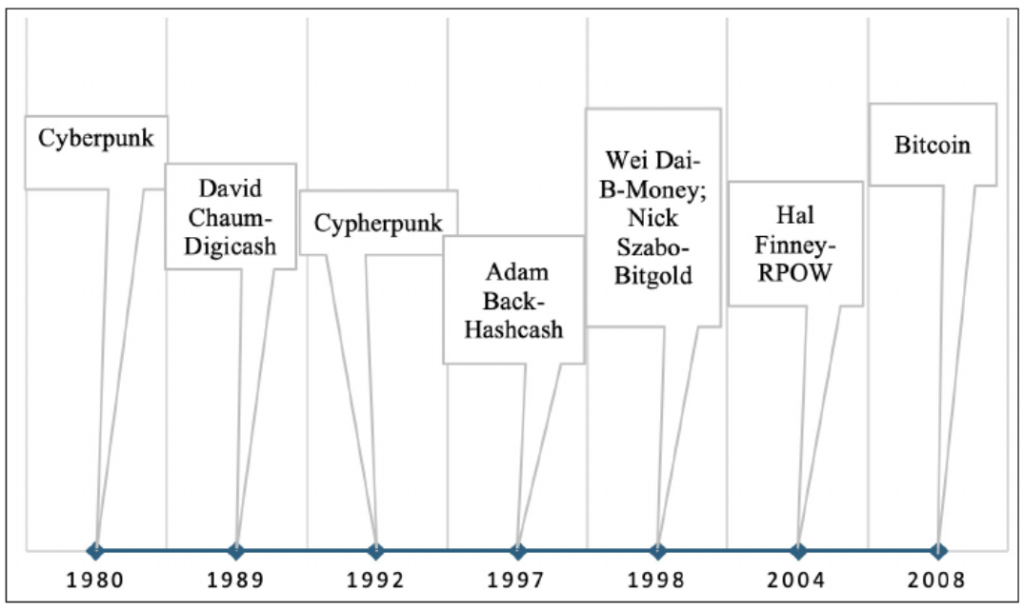

The creator of the first cryptocurrency did not invent decentralisation or anonymity. He drew on the work of cypherpunk programmers and libertarian thinkers who, in turn, took inspiration from the Austrian and Virginia schools of economics.

Designers of pre-Bitcoin electronic-cash systems came close, but could not offer conditional confidentiality, transparency, security and participant incentives all at once.

In the digital age, decentralisation and privacy became a necessity. As the internet grew dependent on single points of failure run by cloud giants such as Amazon Web Services (AWS) and as state surveillance expanded through digital IDs, such solutions looked like a lifeline.

The general principles of distributed ledgers created an environment in which users themselves are responsible for managing and protecting their data, and for the reliability of those with whom they transact.

Transmutation

A system of trust built on algorithms turned Bitcoin into a symbol of the anti-establishment. In this climate, governments and institutional investors distrusted it, feared it, and tried not to be left behind by a new financial order.

The human craving for simplicity and speed made centralised exchanges (CEX) the market’s dominant actors. Government intervention, however, denied them the ability to live up to the ideals set out in the Bitcoin white paper. Privacy and freedom from censorship were traded for convenience and access to traditional finance.

The world’s first crypto exchange is considered to be New Liberty Standard. Launched in October 2009, it was rudimentary — more of an experiment — enabling swaps between bitcoins and US dollars.

In 2010 came Bitcoin Market and the infamous Mt. Gox. Over the next two years, the first large, user-friendly CEX — Coinbase and Bitstamp — arrived.

2013 was marked by a Bitcoin bull run. Against the backdrop of Cyprus’s banking crisis and a media frenzy, the price exceeded $1,000 for the first time. In December, the People’s Bank of China banned local financial institutions from dealing with digital gold, sparking instant panic and a price crash.

Mt. Gox then became the largest venue for trading the first cryptocurrency. It suffered technical outages and withdrawal freezes. Ultimately, a hack led to its collapse in February 2014.

That episode was a turning point: regulators began to intervene aggressively. The trend towards custodial storage by users led to an inevitable loss of freedom.

In 2015, blockchain developers Joseph Poon and Thaddeus Dryja proposed the first prototypes of a technology that might fix things: a second-layer solution for Bitcoin, the Lightning Network (LN).

The blocksize wars and SegWit’s 2017 activation took disagreements over Bitcoin’s purpose to a new level. Some saw it as a store of value; others as a means of payment. The rise of Ethereum’s ecosystem and advanced smart contracts widened the technological gap and tilted the balance toward “Bitcoin as digital gold for long-term investment”.

SegWit opened the way for Lightning Network, whose beta launched in 2018. Later integrated into mobile apps, it gave people in countries with hyperinflation, dollar shortages and weak banking infrastructure access to a full financial system. Satoshi’s idea — a system without the need to trust a third party — found a real, vital application.

2017–2018 were pivotal for institutional adoption. Futures trading was launched on the traditional CME and CBOE. A specialised crypto platform for big capital, Bakkt, also appeared.

The crypto winter that followed became a comfortable entry point for incumbents. The investment firm Grayscale was among the first to open the door to large capital. Its flagship asset was the Grayscale Bitcoin Trust (GBTC), available since 2013.

Entropy

In 2020–2021, the pandemic reinforced the notion of Bitcoin as digital gold. The arrival of MicroStrategy, Block (Square) and Tesla took the asset to a new level. Bitcoin’s price rose to $69,000, setting a record high. El Salvador became the first country to recognise bitcoin as legal tender.

In 2022, the Terra/Luna disaster set off a chain reaction that led to the collapse of FTX and several crypto firms. The crisis was a reminder of the risks of centralised platforms and a reason for many to move to self-custody.

But people tend to forget. Within a year or two, for the mass market the first cryptocurrency seemed ever more reliable and endorsed by authorities — even as it shed the freedom Satoshi Nakamoto had given it.

The launch of the first ETFs marked the definitive arrival of big money in a cypherpunk instrument. At the same time, ubiquitous KYC/AML rules on centralised platforms stripped digital gold of the global privacy model to which Nakamoto devoted an entire section of the white paper.

For Web3 enthusiasts, though, little changed: those hewing to the original ethos use hardware and cold wallets, mixers, DeFi and other tools of digital hygiene.

In 2024, after Donald Trump’s victory in the US presidential election, policy changed radically. What had been “a dangerous tool for fraudsters and bandits” became a reliable source of income with “incredible” functions of cheap cross-border transfers and high fault tolerance.

Trump’s push to build a strategic bitcoin reserve sparked a wave of crypto treasuries, finally wiring cypherpunk money into the old financial system.

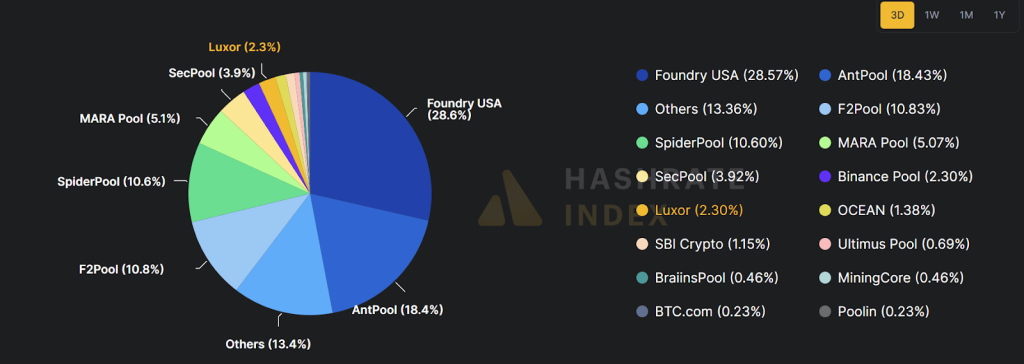

Miners remain Bitcoin’s foundation — they keep the network running and resilient. Over time, though, Nakamoto’s decentralised network of nodes changed. Corporations and states joined the mining of “digital gold”, putting the even distribution of hashpower at risk.

According to Hashrate Index as of 30 October 2025, almost half of all mining power is concentrated in two pools: Foundry USA (28.6%) and AntPool (18.4%).

In August, their share exceeded 51%, potentially opening the possibility of an attack.

Seventeen years ago, few imagined Bitcoin would be discussed in grand government halls, or that you could buy water, rice cakes and mansions for satoshis. It was also hard to believe that something so technically and ideologically revolutionary would, in time, become an instrument not only of profit but of control.

State mining of digital gold has become a race in which participants, fearing exclusion from a new financial system, pragmatically gain — along with a seat at the table — an element of control over the network. The top three are led by China, the United States and Russia.

Allies of officials with deep pockets are steadily capturing the cypherpunks’ money flows, effectively gaining sway over the price — ETFs have proved a convenient instrument. And the authorities’ favourite cover — the fight against money-laundering and terrorism — has served to excuse the loss of one of Nakamoto’s core ideas: privacy.

Many of the white paper’s theses have evaporated or faded from view over 17 years. A chasm between ideologies now cleaves the crypto industry like two tectonic plates. Historically that led to hard forks. What happens next — only Satoshi knows.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!