Analyst notes waning influence of bitcoin miners on the market

The HODL strategy is becoming increasingly popular among bitcoin miners — a macro trend of coin accumulation is stabilising toward higher prices. According to an analyst with the nickname TXMC, the consequence will be a reduction in their influence on the market.

2/ This contrasts with past eras where miners would dump large quantities on the market in price discovery.

Many old miners are gone, and those remaining are more sophisticated and efficient.

There is a future timeline where the impact of miner selling is trivial.

— TXMC (@TXMCtrades) October 23, 2021

“This contrasts with the past, when miners dumped large volumes of BTC into the market during price rallies. Many old miners have left, and those remaining have become more cunning and efficient. There is a future where the impact of their selling is negligible,” TXMC added.

In 2020, Coin Metrics analysts also noted that the miners’ coin supply held on addresses over time is shrinking, and net flows from their addresses stabilise. In their view, this signals a gradual decline in their influence on the market.

As of Q3 2021, the aggregate value of coins on their balance sheets surpassed $1 billion. To cover current expenses such organisations use Bitcoin-collateralised loans.

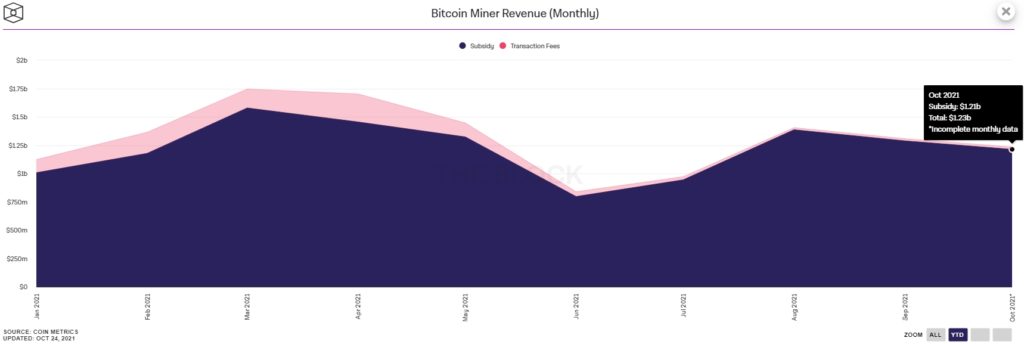

According to The Block, in September bitcoin miners earned around $1.31 billion, with the incomplete October — $1.23 billion. This is lower than the March maximum of $1.75 billion, but well above the revenues they earned following the market crash in May ($839 million in June, $972 million in July).

In September, bitcoin miners’ electricity consumption surpassed 2020 levels.

Read ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!