Analyst Sees Retail Investor Panic as a Bitcoin Buying Signal

Experts also saw the decline in altcoins as a signal for growth.

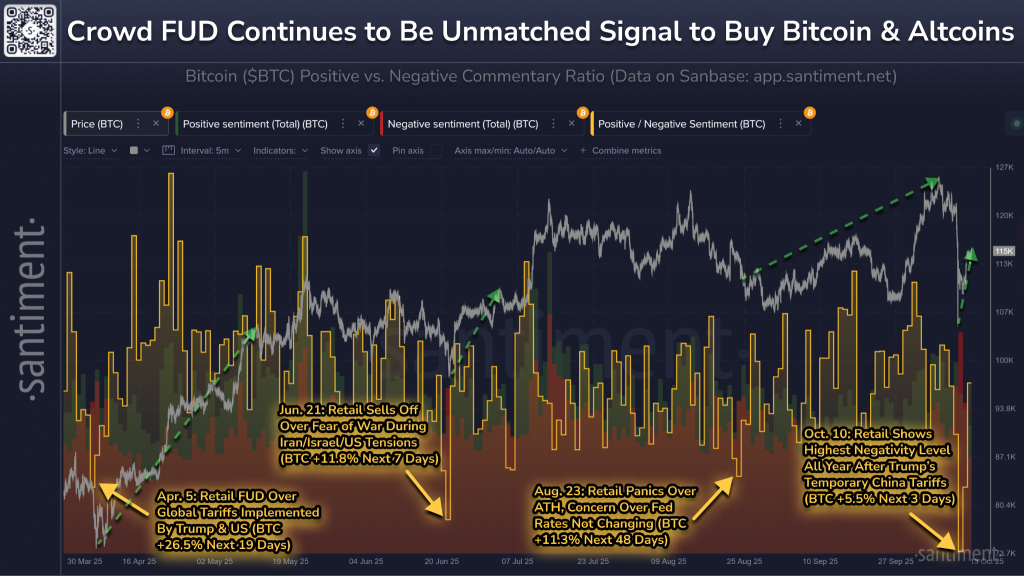

Fear and uncertainty among retail investors remain one of the most accurate signals for accumulating the premier cryptocurrency. This insight was shared by Santiment analyst Brian Q.

According to him, “smart traders” were actively buying digital gold and altcoins when retail investors reacted “overly sharply” to President Donald Trump’s plans to impose 100% tariffs on imports from China. Negative sentiment among this market segment reached an annual high.

“Retail emotions often signal that bitcoin and altcoin prices are about to reverse,” the expert noted.

Following the events of October 11, FUD drove retail investors out of the market. However, they quickly returned when the US Treasury Secretary stated that there was a misunderstanding and the tariffs “might not be imposed.”

A similar pattern was observed during the announcement of the first round of tariffs in April, the escalation of the Middle East conflict in June, and the anticipation of the Fed‘s rate decision in August.

“The crypto market is driven by sentiment — traders collectively decide which news should affect their confidence. There is ample evidence that Trump’s tariff statements instantly impact trend reversals with each development. Emotion-driven trading related to political news dominates short-term market behavior — more so than at any other time in cryptocurrency history,” Q emphasized.

Altseason Approaches

During the latest correction, major altcoins lost between 18% and 28% of their value in less than a day. Historical data shows that sharp declines often precede the most powerful rallies in the cycle, noted analyst Bull Theory.

ALTCOIN MARKET CAP JUST REPEATED HISTORY.

This chart tracks the total crypto market cap excluding $BTC & $ETH, the pure altcoin cycle.

And it tells a very simple story:

Every major expansion in crypto has included sharp 30–60% resets along the way.Let’s break it down 👇… pic.twitter.com/OBGn3yVpIY

— Bull Theory (@BullTheoryio) October 13, 2025

The expert recalled the events of March 2020 and May 2021, when the market fell by 50-60%.

“Each of the declines looked like the end [of the cycle], yet each was followed by the most powerful rallies of the entire period,” Bull Theory emphasized.

The market crash in April 2025 was also seen by many as the start of a bear phase, but subsequently, bitcoin and several other assets reached new all-time highs.

Researcher Ash Crypto also agreed with the analyst’s conclusions, highlighting that past corrections led to altcoins appreciating by 25-100 times.

MARCH 2020 VS. OCTOBER 2025

Same manipulation, Different year

After March 2020 flash crash We had a huge altseason where alts pumped 25x-100x

I think it will happen again. Maybe not a 100x season due to millions of coins but I think good ones can still pull 10x-50x. pic.twitter.com/elL0KFehiz

— Ash Crypto (@Ashcryptoreal) October 13, 2025

Market participant Merlijn The Trader pointed to the formation of a bullish MACD crossover on the monthly chart of bitcoin and altcoins. This pattern was observed before the altseasons of 2017 and 2021.

THIS IS THE SETUP FOR ALTSEASON 3.0

Macro support

Monthly bullish MACD cross

Same pattern as 2017 & 2020You can ignore it…

Altseason is inevitable. pic.twitter.com/MNwIjgsCv4

— Merlijn The Trader (@MerlijnTrader) October 13, 2025

In the past 24 hours, some coins have shown signs of recovery. Ethereum’s price rose to $4000 after falling below $3700, and BNB stabilized at $1200. Previously, the price of the Binance-linked cryptocurrency had dropped to $1090.

Contributor EgyHash from CryptoQuant identified bullish signals in bitcoin’s decline.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!