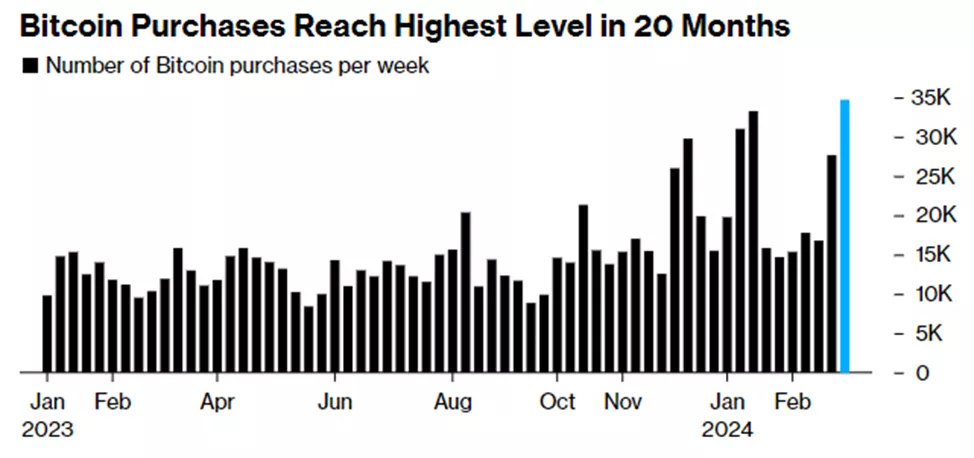

Argentine Demand for Bitcoin Reaches 20-Month High

Weekly Bitcoin purchases in Argentina on the popular local exchange Lemon have reached a 20-month peak with 35,000 transactions, doubling the average for 2023, according to Bloomberg.

A similar trend is observed on other platforms like Ripio and Below.

According to the agency, Argentines are striving to protect their personal funds from inflation, which has reached an annual rate of 276%. There has been a shift in interest from the US dollar, which made the country one of the world leaders in cash holdings, towards digital gold. Economist Nicolás Gadano estimates that residents hold $200 billion “under the mattress”—a figure surpassed only by the US and Russia.

President Javier Milei’s shock therapy has triggered a surge in consumer prices and an economic recession. Over the past two months, the peso has strengthened by 10% against the USD, while Bitcoin has risen by 60%. This was made possible by the authorities’ strict control over the issuance of the national currency and the replenishment of cash dollars.

CEO of the Belo wallet, Manuel Beaudroit, reported a tenfold increase in transactions involving digital gold and Ethereum since the beginning of the year. Meanwhile, the volume of stablecoin transactions has dropped by 60–70% over the same period, he added.

“A user decides to buy their first cryptocurrency when they see news about the rising price. ‘Stablecoins’ are often used as a means of payment abroad,” said the top manager.

According to Gabriela Battiato, head of the legal department at Bitcoin Argentina, the desperate desire of Argentines to make it to the end of the month without losing their savings leads them to make hasty decisions without assessing risks, making them easy prey for fraudsters.

Back in 2023, the Central Bank of Argentina proposed new guidelines that could complicate the operations of companies related to digital assets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!