Bernstein Predicts USDC Market Cap to Triple

Circle to benefit from new U.S. stablecoin regulations; USDC supply to triple in two years.

Circle is poised to benefit significantly from new U.S. regulations on stablecoins. Analysts at Bernstein forecast nearly a threefold increase in the supply of USDC over the next two years, according to The Block.

They estimate that by the end of 2027, the asset’s share of the stablecoin market will rise to 33%.

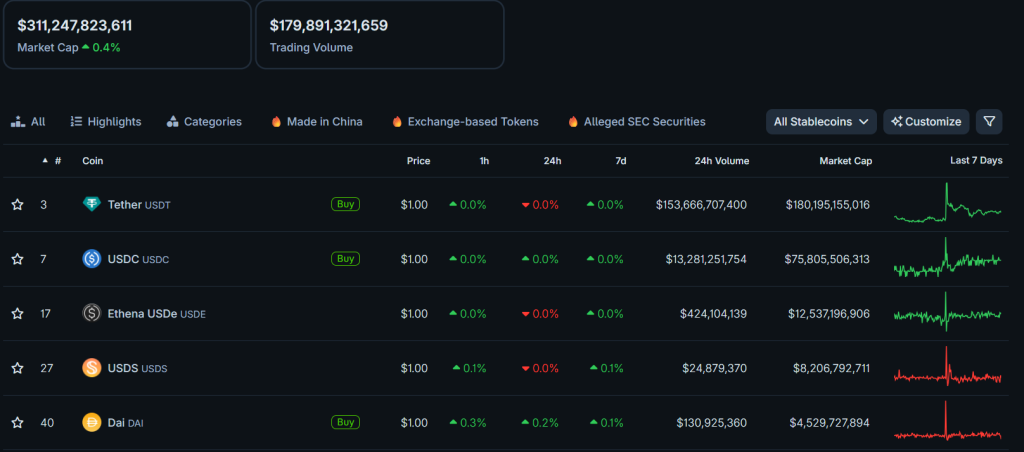

The segment leader remains USDT from Tether, with a total value exceeding $180 billion (62%). USDC’s figure stands at about $76 billion. The overall market capitalization exceeds $311 billion.

Analysts attribute Circle’s success to its focus on regulatory compliance and partnerships with major exchanges like Coinbase, Binance, and OKX, which enhance liquidity. Integration into 28 blockchains also supports growth.

The company’s position was bolstered by the GENIUS Act passed in July, which sets federal rules for payment stablecoins and limits foreign issuers.

Bernstein expects the overall stablecoin market to grow to $670 billion by the end of 2027, with Circle’s share potentially reaching $220 billion.

The issuer’s financial model relies on income from reserves, and a reduction in interest rates could impact this. However, analysts believe that the growth in USDC supply and new revenue sources will offset this effect. They predict Circle’s total revenue will grow by 47% by the end of 2027.

According to Bernstein, stablecoins will transform financial services in the long term. By 2035, the total capitalization of such assets could reach $4 trillion, with 30% attributed to USDC.

“Digital dollars will become the monetary rails of the internet, and Circle is best positioned due to its early start,” the analysts concluded.

Partnership with Safe

Circle has chosen the crypto security platform Safe as the primary solution for institutional USDC custody.

According to the issuer’s Chief Commercial Officer, Kash Razzaghi, large investors are increasingly moving on-chain and require reliable infrastructure for capital management. He noted that the partnership aims to meet the growing demand for regulated and secure digital dollars in treasury operations and DeFi.

Safe manages over $60 billion in cryptocurrencies, including $2.5 billion in USDC. Safe’s founder, Lukas Schor, stated that the collaboration will make Circle’s asset a central element of the ecosystem and “the home for institutional DeFi on stablecoins.”

Additionally, the platform’s multisignature technology accounts for nearly 4% of all transactions on the Ethereum network.

According to Dune, the crypto security platform has already processed $25 billion in USDC transfers this year.

In September, Circle President Heath Tarbert announced that the company is exploring ways to reverse transactions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!