Bitcoin Eyes Return to $70,000 as Inflation Slows

In May, annual inflation in the United States slowed from 3.4% to 3.3%, falling short of the consensus forecast of 3.4%. This marks the lowest rate since April 2021.

On a monthly basis, the consumer price index remained unchanged, defying expectations of a 0.3% increase and matching April’s figure.

Excluding food and energy prices, the index rose by 0.2% from the previous month and by 3.5% compared to May of the previous year. The previous month’s figures were 0.3% and 3.6%, respectively.

Analysts had anticipated a slowdown in annual rates to 3.5% and monthly rates to 0.3%.

Prices for services, excluding housing and energy, fell by 0.04%, marking the first negative reading since September 2021. The Fed has highlighted the importance of this metric in analyzing inflation trends.

“Investors wondered if Fed members might alter their forecasts following the inflation data release. Today’s report is unlikely to significantly change expectations. We considered the November and December reductions as baseline, and this data supports that view,” commented Ira Jersey from Bloomberg.

The market reacted positively to the macroeconomic data. Treasury yields fell, S&P 500 futures rose, and the dollar weakened. The interest rate swap market fully anticipates a rate cut at the November meeting.

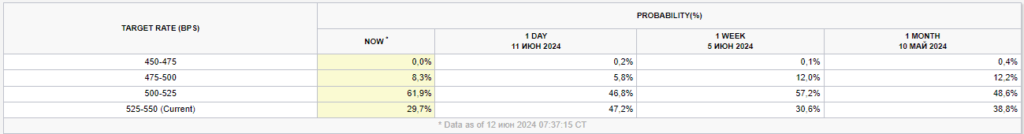

Traders increased the likelihood of a September rate cut to approximately 70.1% from 52.6% the previous day.

According to Bloomberg, interest rate futures indicate that traders are slightly more confident in two Fed rate cuts this year. In the latest economist survey, 41% of respondents believe the Fed will forecast two cuts. An equal number expect one cut or no change.

The macroeconomic data spurred a rise in Bitcoin, which increased by 2% in the first 15 minutes. Ethereum rose by 2.5% in the same period. At the time of writing, the price of the leading cryptocurrency exceeded $69,400, while the second stood at $3600.

Earlier, K33 Research warned crypto traders of high risk ahead of the Fed meeting.

Former BitMEX CEO Arthur Hayes previously noted a shift in the macroeconomic backdrop and urged buying the leading cryptocurrency.

Experts at Bitfinex believe that during the current bull market, Bitcoin will form a peak at some point in the fourth quarter of 2024. They also noted the potential for further growth.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!