Bitcoin slides below $105,000

Bitcoin and the broader market fell further amid mass liquidations of long positions.

Bitcoin and the broader market extended their correction amid mass liquidations — mostly of long positions.

At the time of writing, the cryptocurrency is nearing $105,000, with a spike in trading volumes:

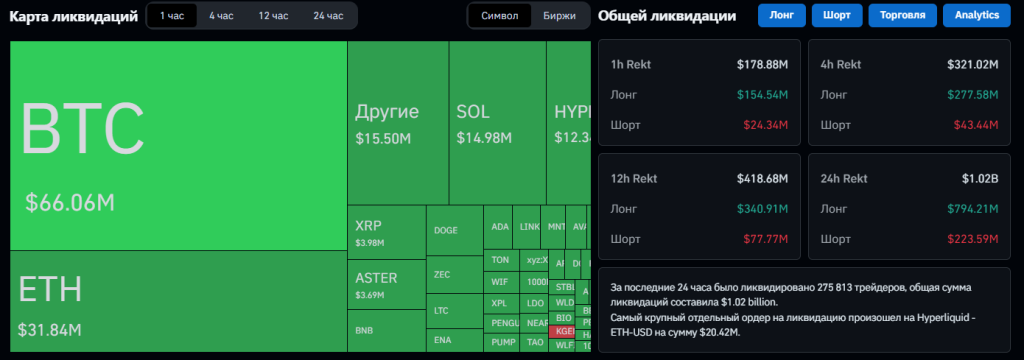

Liquidations over the past 24 hours topped $1bn — mostly longs (almost $800m).

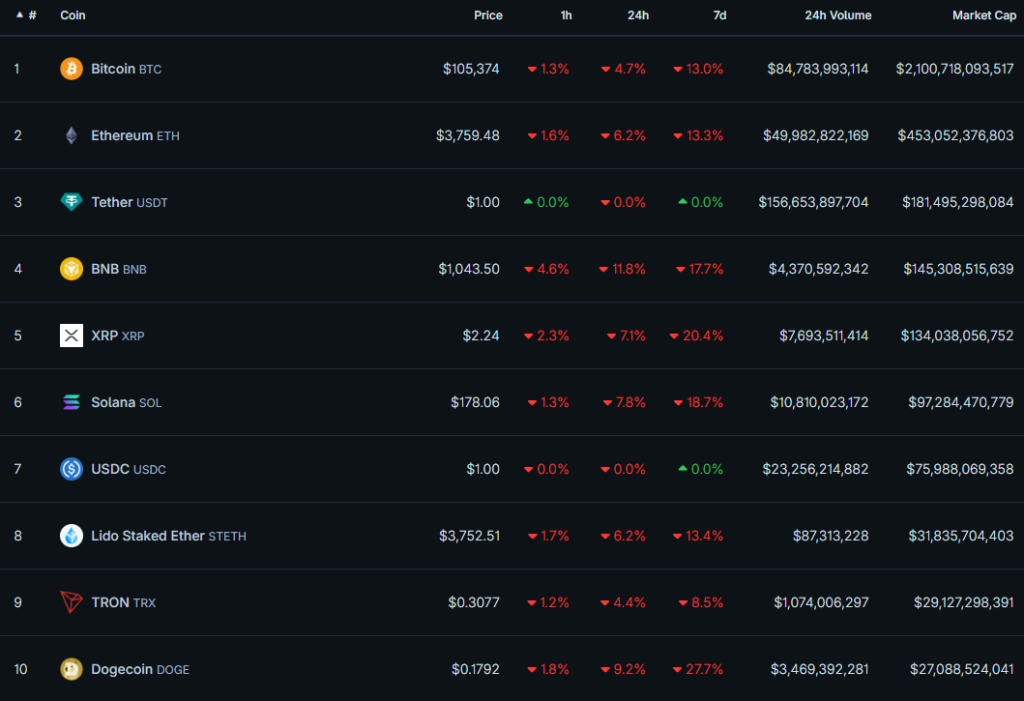

As usual, bitcoin’s pullback dragged the rest of the market lower:

Over the past day, bitcoin fell 4.7%; Ethereum 6.2%. BNB declined 6.2%, XRP 7.1%, Solana 7.8%.

Total market capitalisation — ~$3.65tn (-5.3% in 24 hours).

CryptoQuant analyst Axel Adler Jr noted that losing support in the $106,000–107,000 range risks a test of the psychological $100,000 level. The 365-day moving average passes through the latter.

The main support zone is currently concentrated in the $106K–107K range (STH 1M-3M Realized Price — SMA 200D). Loss of this zone will lead to a test of $100K, where the yearly moving average (SMA 365D) passes. As long as this base holds, the market structure remains bullish. pic.twitter.com/1D9PWhViCs

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 17, 2025

“As long as this base holds, the market structure remains bullish,” he stressed.

Glassnode analysts highlighted the importance of the $99,900 level. In their view, a drop below the 365DMA would heighten the risk of a deeper correction.

Bitcoin sits between key support levels, below the 200DMA ($107.4k) and just above the 365DMA ($99.9k), with the 111DMA ($114.7k) overhead.

Holding the 365DMA could steady the trend, while a break lower risks a much deeper correction. pic.twitter.com/GMZbQq0eYB

— glassnode (@glassnode) October 17, 2025

XWIN Research experts, in a post for CryptoQuant, stressed that today’s market structure differs markedly from 2020–2021.

Same Shock, Different Market Structure: Why Bitcoin in 2025 Isn’t 2021 or 2020

“With exchange reserves shrinking and long-term holders steady, temporary volatility does not equate to structural weakness.” – By @xwinfinance pic.twitter.com/J3cFZBFEVo

— CryptoQuant.com (@cryptoquant_com) October 17, 2025

“Shrinking exchange reserves and the resilience of long-term holders indicate that short-term volatility does not equal structural weakness,” the researchers noted.

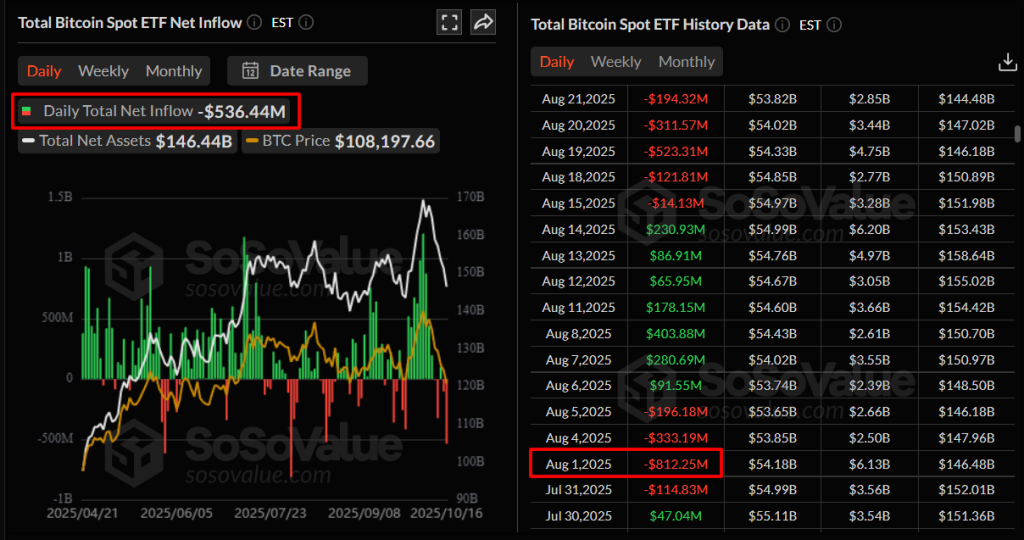

ETF outflows

The renewed correction was preceded by outflows from exchange-traded funds. Over the past day, investors withdrew $536.44m from bitcoin ETFs — the worst reading since August 1 ($812.25m).

The largest outflow was ARKB from Ark & 21Shares: -$275.15m on the day; Fidelity’s FBTC shed $132m.

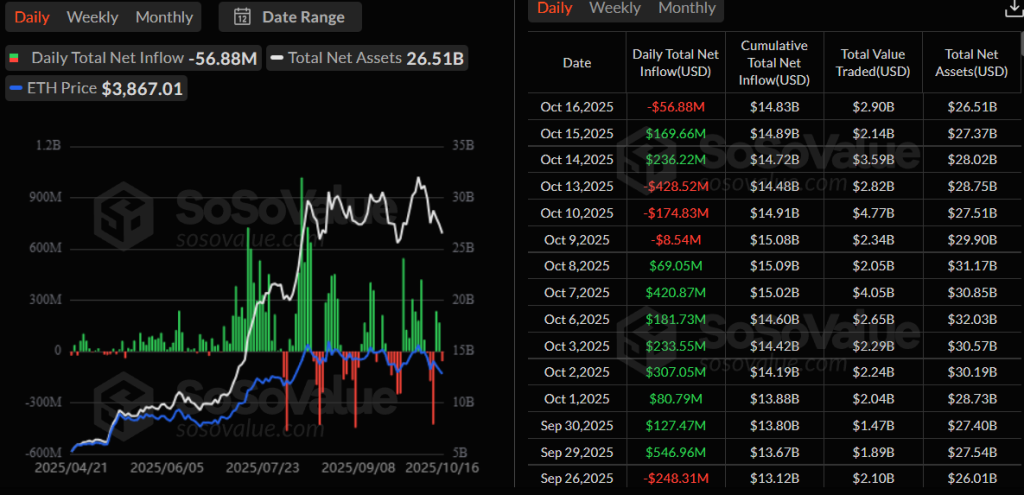

Ethereum ETFs

Capital outflows were also recorded at 8 of 12 ether-based funds; total daily outflows were a comparatively modest $56.88m.

“The $536 million net outflow primarily reflects a surge in investor risk-off appetite,” LVRG Research director Nick Ruck told The Block.

He attributed the caution to several macroeconomic factors — in particular, changes in US tariff policy. Another important aspect is “a broader process of deleveraging in the market,” which led to large-scale liquidations.

Ruck noted that ETF outflows point to “fragility in the short term” and the likelihood of increased price pressure.

“In my view, the market is moving toward stabilisation,” said Justin d’Anethan, head of research at Arctic Digital.

He added that the market remains driven by two factors — geopolitical uncertainty and the continued impact of tight monetary policy, “which has yet to change course.”

“Overall, the market has grounds for cautious optimism,” d’Anethan added. “Inflationary pressures are gradually easing, and central banks are on the verge of a pivot.”

He noted that until clear signals appear — whether CPI data, statements by regulators or “real diplomatic shifts” — volatility will remain elevated.

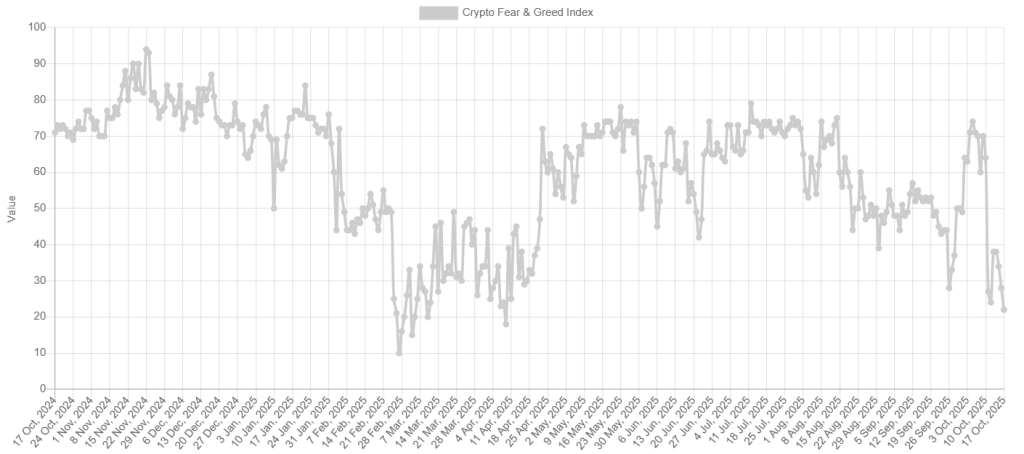

Extreme fear

A popular sentiment indicator plunged to 22, signalling panic among a broad swathe of market participants.

Such low readings were last seen in April.

No longer a safe haven?

Amid tariff uncertainty between the US and China, gold hit an all-time high above $4,300 per troy ounce. The metal’s market capitalisation topped $30tn for the first time.

Gold supporters pointed to its rise alongside bitcoin’s drop. Noted cryptocurrency critic Peter Schiff said the precious metal will reach $1m per ounce before bitcoin.

Gold is more likely to hit $1 million than Bitcoin.

— Peter Schiff (@PeterSchiff) October 16, 2025

“It’s not just about de-dollarisation, but de-bitcoinisation. The cryptocurrency has failed the test as a viable alternative to the dollar or as digital gold. HODLers deny the obvious and refuse to accept reality,” he noted in a separate post.

Others, however, suggested a rotation of capital into the first cryptocurrency.

Gold going absolutely crazy, people standing in line at the Bullion stores, and Peter Schiff is deepthroating himself.

Time for a new rotation to digital gold?

Either way, makes sense to see profits flow out of Gold soon with the way the market behaves.$BTC pic.twitter.com/XCQ6PYVxVt

— Jelle (@CryptoJelleNL) October 17, 2025

“Either way, given the current market situation, it makes sense to expect profits to start flowing out of gold soon,” investor Jelle suggested.

The chart attached to his post illustrates how bitcoin has, at various times, outpaced gold and then “caught up.”

In early October, the first cryptocurrency hit a record high above $125,000. It is now 16% below that peak.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!