Bitcoin slips below $85,500

Bitcoin fell below $85,500 amid macro jitters and a Yearn Finance hack.

The price of the leading cryptocurrency slipped below $85,500. Macro factors and an incident involving the Yearn Finance protocol may have weighed on the market.

At the time of writing, bitcoin trades at $86,143, down 5% over the past 24 hours.

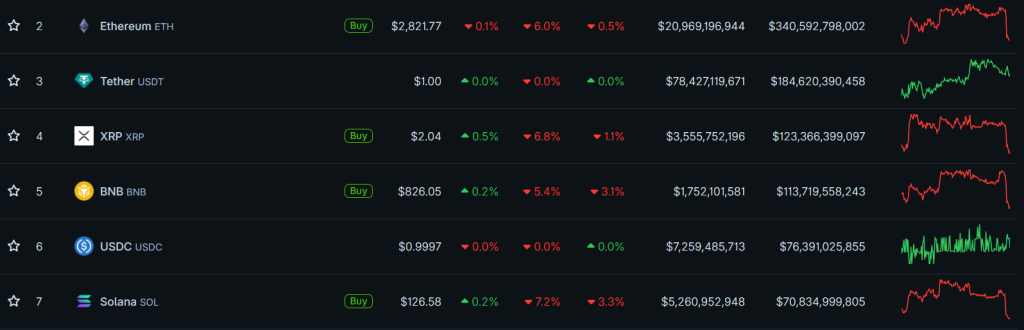

The pullback extended to other assets: Ethereum fell 6% ($2,821), XRP 6.8% ($2.04), BNB 5.4% ($826) and Solana 7.2% ($126).

Total market capitalisation fell 4.9% to $3 trillion.

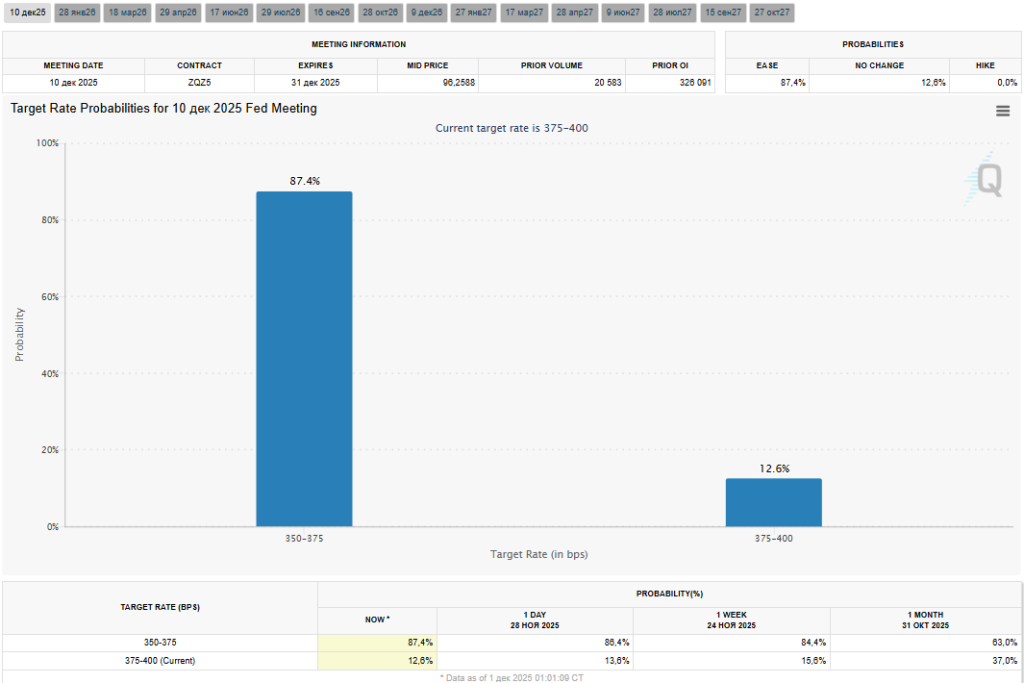

Earlier, bitcoin’s rise had been underpinned by expectations of a December key-rate cut by the Fed. Market participants put the odds at 87.4%. Many experts, however, argue that hopes alone will not restore risk appetite.

BTC Markets analyst Rachael Lucas called the move a “classic deleveraging spiral”. In her view, a December cut was priced in back in autumn. Risk appetite is now constrained by inflation and talk of tariffs. The pressure was compounded by a November outflow of $3.5bn from spot bitcoin-ETF.

Panic intensified after a hack of the DeFi aggregator Yearn Finance. Attackers drained a yETH token pool and sent 1,000 ETH to the Tornado Cash mixer.

BTSE chief operating officer Jeff Mei noted that traders fear a chain reaction. Yearn Finance interacts with large protocols such as Aave and Curve, so concern about further withdrawals is prompting selling.

Lucas outlined key support and resistance levels:

- $87,000 — a pivotal threshold; holding it could allow a bounce;

- $80,400 and $75,000 — next targets if support breaks;

- $95,000-100,000 — a range if the Fed cuts rates;

- $110,000-120,000 — possible if Fed chair Jerome Powell strikes a “dovish” tone.

Venture investors believe that clarity on macroeconomics will be the main catalyst in the coming months. Boris Revsin of Tribe Capital thinks the market underestimates the potential for policy easing under a new Fed chair. US President Donald Trump said he has already chosen a nominee.

Spot trading volume on crypto exchanges

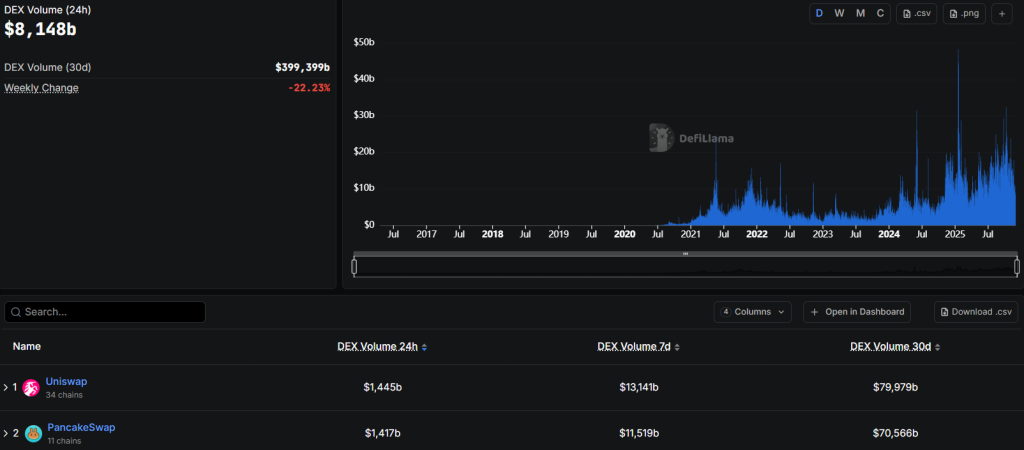

In November, aggregate spot volume on centralised exchanges (CEX) fell by 26.7% versus October to $1.59 trillion, the lowest since June.

Binance remained the market leader with $599.34bn in turnover, though activity declined markedly from October’s $810.44bn. Bybit ranked second with $105.8bn, followed closely by Gate.io ($96.75bn) and Coinbase ($93.41bn).

Kronos Research CIO Vincent Liu attributed the drop to a shift from October’s frenzy to stagnation. Volatility has ebbed, he observed, and traders have started to take profits after the rally.

Activity also waned across decentralised exchanges (DEX). Monthly volume fell from $568.43bn to $399.39bn. Uniswap remained on top ($79.97bn), followed by PancakeSwap ($70.56bn). Turnover on both dropped substantially.

DEX share relative to CEX fell from 17.56% to 15.73%. Liu linked this to structural factors: in tight trading ranges, centralised venues benefit from deeper liquidity and narrower spreads. Reduced speculative flows and fewer incentives in DeFi added pressure.

Support levels

Glassnode analysts observed a shift in key on-chain levels for bitcoin.

The realised price of short-term holders stands at $104,200. This metric reflects the average cost of coins acquired over the past 155 days. The current price sits well below this mark, creating an overhang from speculators looking to break even.

The experts highlighted several key support levels below the asset’s current price:

- $88,100 — average entry price of active investors;

- $81,700 — the market’s true average price;

- $56,400 — the global realised price of all coins on the network.

The market structure indicates that bitcoin is boxed into a range between short-term holders’ losses and the average profit of active network participants, the experts concluded.

In November, analysts at XWIN Research Japan noted rising liquidity and the potential for a rally in digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!