Bitcoin slumps to its lowest since November 2024

Bitcoin fell to $73,111, the lowest since early November 2024.

On 3 February, bitcoin fell to $73,111 — a level last seen in early November 2024.

At the time of writing, the “digital gold” trades at $76,715 (down 2.3% over 24 hours).

In October 2025, the price reached an all-time high of $126,080. From February to March bitcoin consolidated around $80,000, then turned lower. Other cryptoassets have reinforced the downtrend.

Glassnode manager Sean Rose noted that 44% of bitcoin’s supply is in unrealised loss. A 30% drop from the recent $108,000 peak cut the share of profitable coins from 78% to 56%.

“Buyers who entered the market near the all-time high now sit on losses. Investors’ patience and conviction will be tested in the coming weeks,” Rose said.

According to CoinGlass, futures liquidations over the past 24 hours totalled $704 million.

The RSI slipped into oversold territory (reading 30). Analysts at The Block noted that if the pattern mirrors the 2022 bear-market bottom, prices could fall a further 20% to $60,000.

Macro backdrop and altcoins

Additional pressure comes from macroeconomic uncertainty around a possible US government shutdown. Equities are soft too: the Nasdaq Composite lost 2.2%.

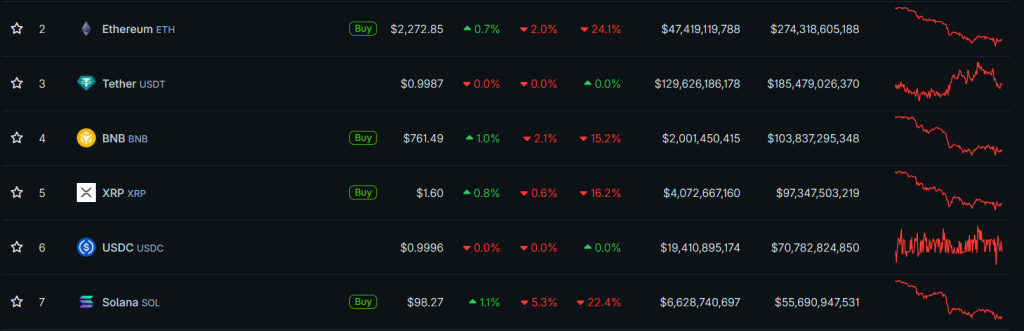

Major altcoins followed bitcoin:

Crypto-equity quotes are also falling. Coinbase shares lost 6%, and Strategy dropped more than 8%. Only the mining firm Terawulf advanced.

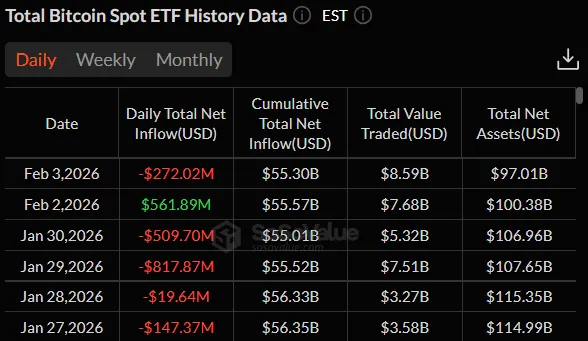

On 2 February, spot bitcoin-ETFs attracted $561.9 million, breaking a two-week streak of outflows. Even so, market conditions remain tense.

On 3 February, net outflows from the exchange-traded funds reached $272 million.

Investors pulled the most from Fidelity’s FBTC — $149 million.

By contrast, altcoin funds saw inflows. Spot Ethereum ETFs attracted $14.06 million, XRP funds received $19.46 million, and Solana products took in $1.24 million.

“Feature, not a bug”

Bitmine chairman Tom Lee addressed market concerns over the company’s $6.6 billion unrealised loss. He rejected suggestions that future asset sales by the firm would cap Ethereum’s price.

These tweets miss the point of an ethereum treasury:

— BitMine is designed to track the price of $ETH

— outperform over the cycle (think up ETH)

— crypto is in a downturn, so naturally ETH is down$BMNR will see “unrealized” losses on our holdings of ETH during these times:

-… https://t.co/VpoNjAnJdC— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) February 3, 2026

According to Lee, critics miss the point of the Ethereum-treasury strategy. Bitmine’s model is designed to track the second-largest cryptocurrency and outperform over a full cycle.

The executive stressed that paper losses during downturns are “a feature, not a bug”. He drew an analogy with index ETFs, which also suffer drawdowns during broad corrections.

Finding the bottom

According to CryptoQuant, from November 2024 to February 2025 the number of bitcoins in profit fell from 19.8 million to 11.2 million. About 8 million BTC moved into unrealised-loss territory.

An analyst going by RugaResearch said current on-chain metrics signal capitulation and bottom-finding. Holders who bought near local peaks are starting to realise losses.

The expert compared the current setup with patterns in 2018, 2020 and 2022 that preceded market recoveries.

“If you have an appetite for risk, this is usually where the best risk–reward opportunities emerge,” the analyst emphasised.

However, RugaResearch warned that being in a “bottom-finding” zone does not guarantee an immediate reversal. History shows different durations for this phase:

- 2018: the market stayed in this zone for eight months;

- 2020: a brief stay before a quick rebound;

- 2022: the phase lasted six months.

CryptoQuant also dismissed rumours of trouble at Binance. On-chain data show no signs of stress: the exchange’s reserves are stable at around 659,000 BTC.

Net flows remain within normal ranges, and balance fluctuations do not exceed 0.6%. For comparison, after the FTX collapse panic outflows reached 12% of the platform’s reserves.

In February, Bitwise CIO Matt Hougan said that “a full-fledged crypto winter” is nearing its end.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!