Bitcoin tests $123,000 as analysts warn of risks

Bitcoin tops $123,000; analysts caution about near-term risks.

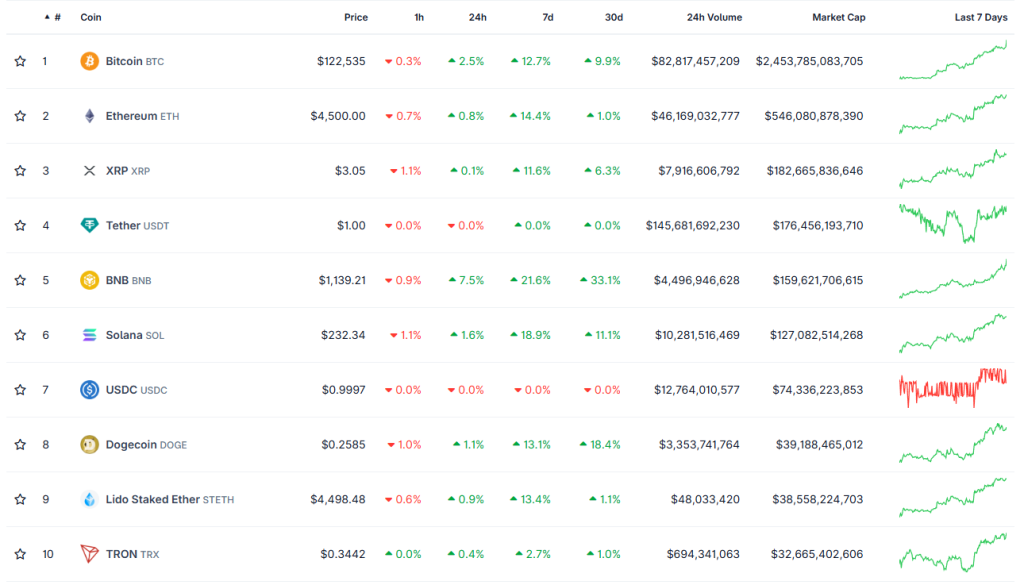

On the evening of October 3, the leading cryptocurrency climbed above $123,000; Ethereum crossed $4,500.

At the time of writing, bitcoin had eased to $122,800. The asset is up nearly 10% over the week.

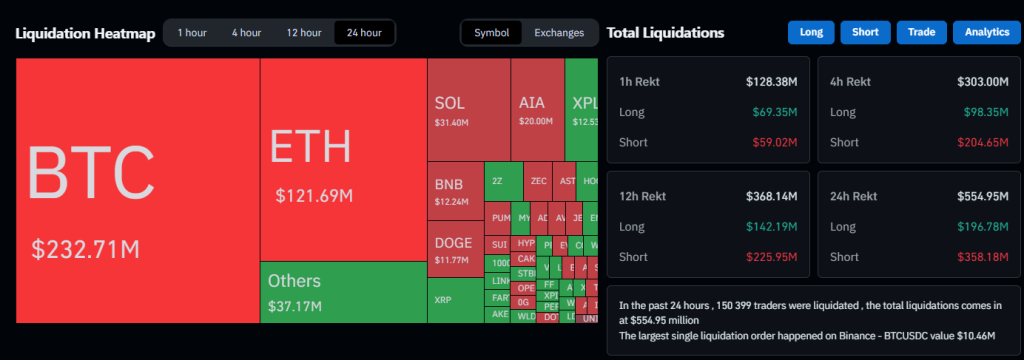

In the past 24 hours, liquidations reached $554 million, of which $358 million were shorts.

Other top-ten cryptocurrencies by capitalisation reacted more modestly to the bellwether’s rise. One exception was BNB, which hit an all-time high.

The market remains buoyed by the “positive” from the US government shutdown. Momentum is fuelled by the Uptober narrative, steady funding rates and inflows into exchange-traded funds. Yet some participants fear a pullback.

Fear of a correction

A trader using the moniker BitBull said the current surge marks the start of a Q4 rally.

$BTC Q4 pump has started.

But don’t think we will go up-only.

In the next 1-2 weeks, BTC and alts will have a big leverage flush.

This’ll force people to sell their coins as they think that Uptober is over.

After that, Bitcoin and alts will rally again and hit new highs. pic.twitter.com/fb11snGZzP

— BitBull (@AkaBull_) October 3, 2025

“But don’t think we will go up-only. In the next one to two weeks, bitcoin and altcoins will face a major leverage flush,” he warned.

In his view, this will force people to sell, thinking Uptober is over. The market would then rally to new highs.

A user going by Roman wondered how long bitcoin can ignore “bearish divergences and the lack of momentum on the weekly and monthly charts”.

He noted that the RSI remains in overbought territory, strengthening expectations of cooling on lower time frames.

“Volume also points to a lack of strength. When these factors play out is only a matter of time. Be careful holding positions,” Roman warned.

Earlier, CryptoQuant analysts outlined the conditions for bitcoin to rise to $200,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!