Bitcoin’s realised capitalisation hits a record high — a sign of a new bull run?

- The average purchase price for “new whales” was $91,922; they now control 52.4% of coins held by large holders.

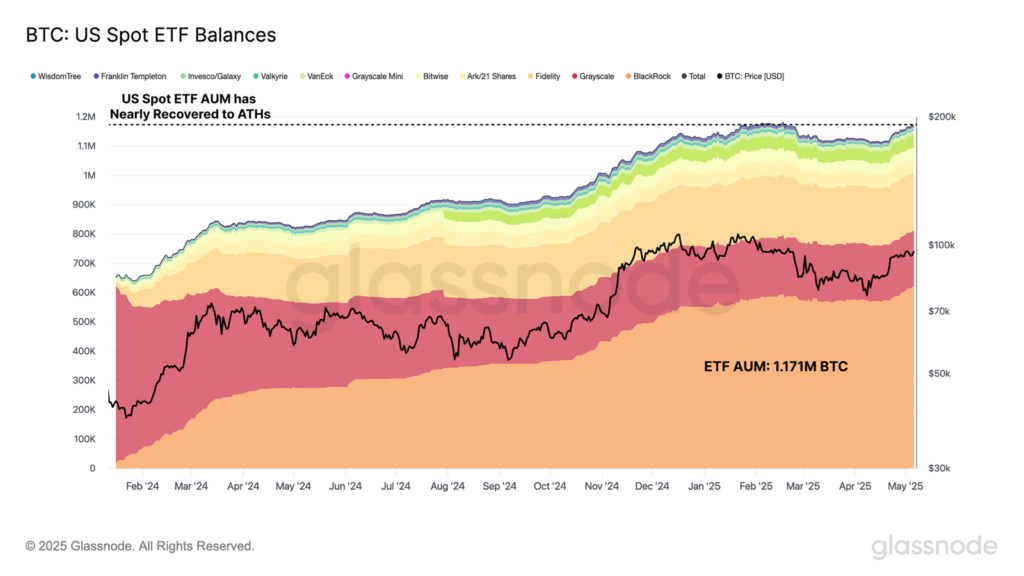

- Bitcoin held in spot ETFs is nearing the record 1.182m BTC.

- Falling implied volatility has set the stage for abrupt price moves.

On 8 May Bitcoin’s realised capitalisation reached a record $890.74bn — a potential sign that the price is primed for a significant rise. That is the conclusion at CryptoQuant.

Specialists said this scenario is likely if investment into the leading cryptocurrency continues to grow.

The metric is the aggregate USD value of all circulating coins based on the prices at which they last changed hands.

“The record-high level of realised capitalisation reflects not only a sharp rise in investment, but also a strengthening conviction in the long-term potential of digital gold as a financial asset. If the trend continues, we may witness the early stages of a new bull run,” the report says.

Analysing the indicator, experts estimated the share of “new” Bitcoin whales (addresses active in the past 155 days) at 52.4% of the combined holdings of large players. By comparison, in mid-2024 it did not exceed 20%. The average purchase price for this cohort was $91,922.

New Bitcoin whales hold 52.4% of BTC whale capital, surpassing long-term holders for the first time ??@cryptoquant_com data shows most big buyers paid $92K.

If prices drop, will they hold or sell? ?

Report by @AnolShaeed https://t.co/9xhZZoNOFr

— BeInCrypto (@beincrypto) May 7, 2025

A drop below that mark could set off widespread selling; holding above it would raise the odds of the rally continuing.

$100,000 and beyond?

Separately, CryptoQuant pointed to bears retreating from the bitcoin futures market, with odds of a move to $100,000.

Bullish pressure continues on the futures, it has decreased slightly compared to May 6 and 7, but it’s not so important now — the bears have already surrendered. Next stop $100K. pic.twitter.com/NujBp1gtic

— Axel ?? Adler Jr (@AxelAdlerJr) May 8, 2025

Analyst Ali Martinez cited resistance at $101,673 and support at $94,719, based on the volume of coins accumulated.

#Bitcoin has established a strong support floor at $94,719, where 195,320 $BTC were accumulated. On the upside, a key resistance wall stands at $101,673, with 81,910 #BTC accumulated at that level. pic.twitter.com/PRFCKAeDFY

— Ali (@ali_charts) May 8, 2025

Glassnode’s view

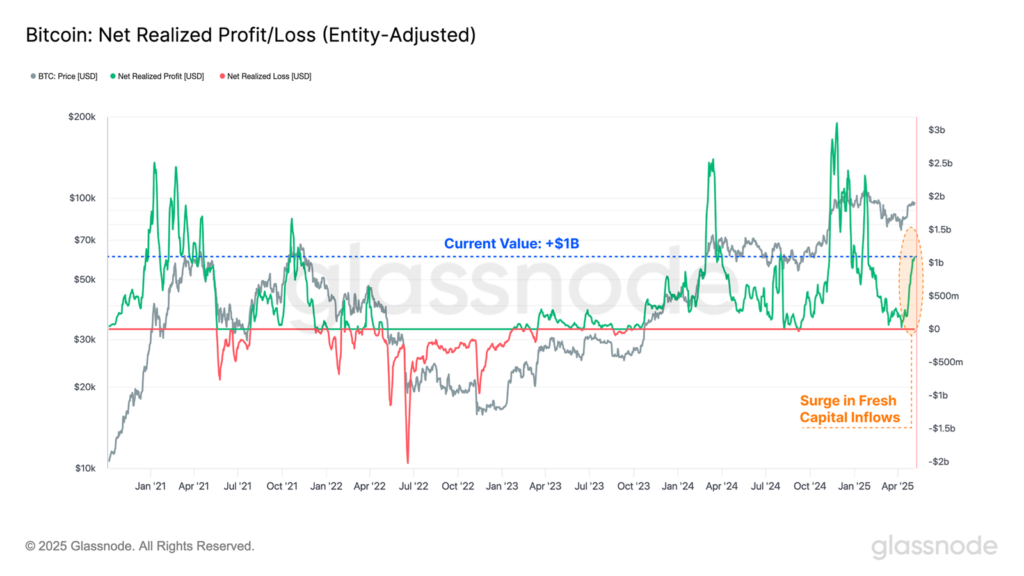

At Glassnode analysts highlighted the rise in realised capitalisation across cryptocurrencies and an increased willingness among some holders to lock in profits.

The recent rally led to net inflows of more than $1bn a day. In other words, demand has been strong enough to absorb incoming supply.

Since October 2023, the market has operated in a profit-taking regime in which capital inflows consistently exceed outflows — an overall constructive signal.

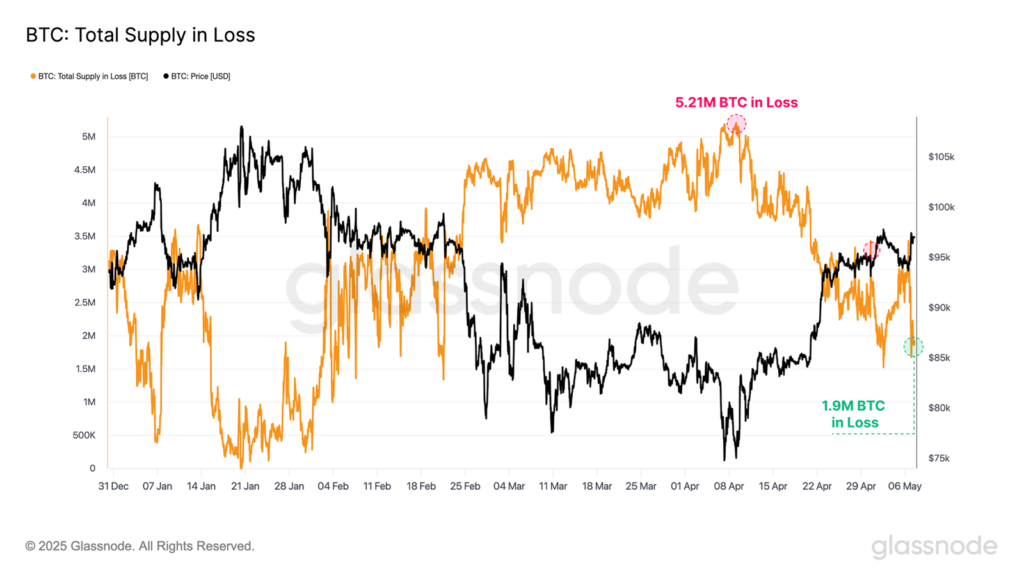

Since mid-April, when the price dipped toward $74,000, the number of coins “in loss” has fallen from 5m BTC to 1.9m BTC.

Analysts stressed that how these holders realise profits will be pivotal. By their estimate, 83% of that number belongs to speculators.

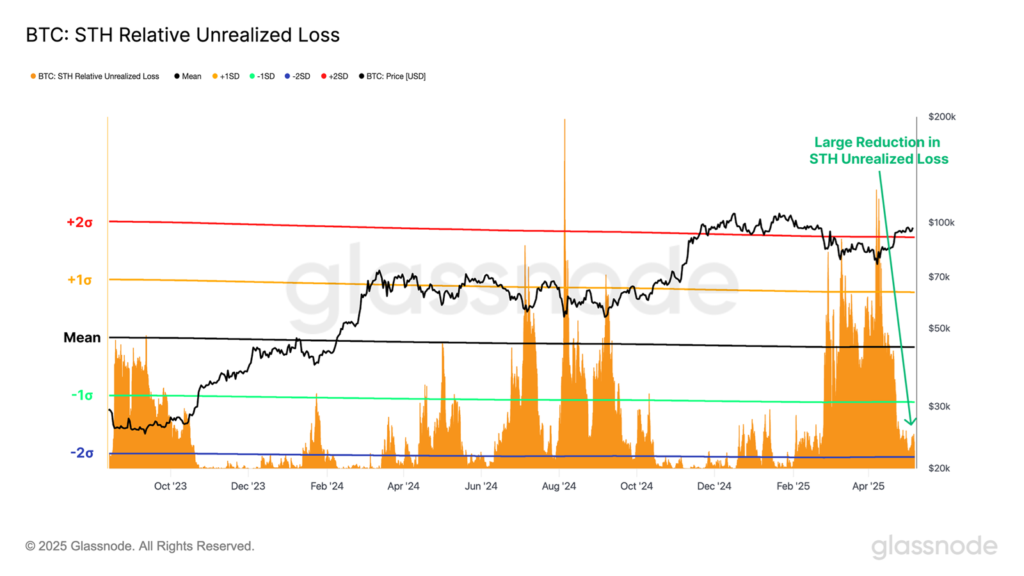

The relative size of “losses” in this last category is far from the two-standard-deviation extremes seen in August 2024 and March–April 2025.

Analysts also noted the resumption of active inflows into spot Bitcoin ETFs. As a result, AUM in these products rose to more than 1.171m BTC, close to the all-time high of 1.182m BTC.

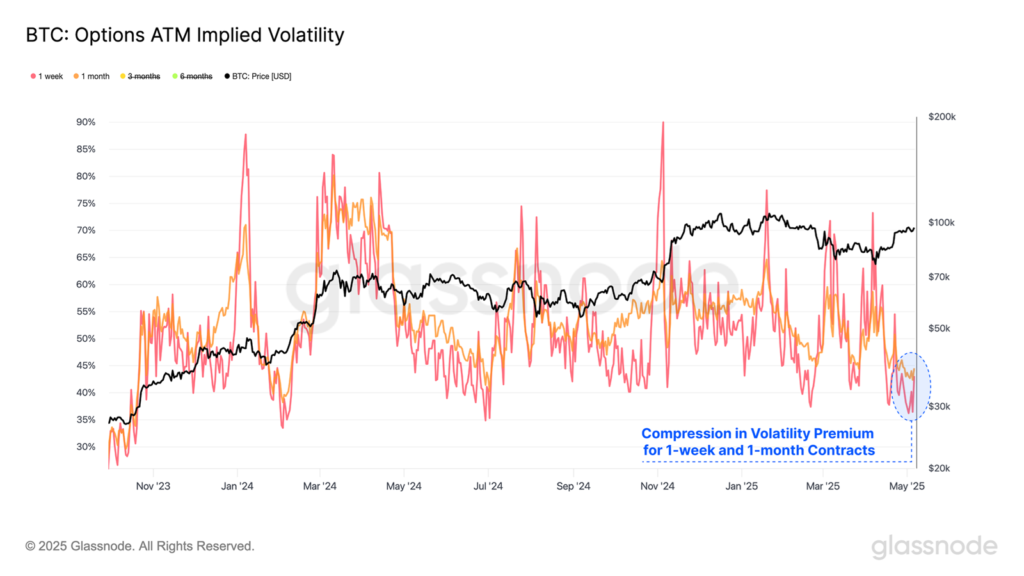

They warned of the risk of sharp price swings given compressed expected-volatility gauges over both the one-to-four-week horizon and the next three to six months. That may indicate investors are underestimating the shape of the path ahead.

Together with reclaiming and consolidating above the speculators’ “cost basis” ($93,100) and the 111 DMA ($91,300), this suggests the market is at a critical decision point, they concluded.

Binance founder Changpeng Zhao has said the price of digital gold could reach $500,000 and even $1m in the current cycle.

Earlier, Standard Chartered urged investors to buy the leading cryptocurrency and forecast a rise to $120,000 in Q4.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!