BlackRock’s Crypto ETF Inflows Reach $3 Billion in Q1

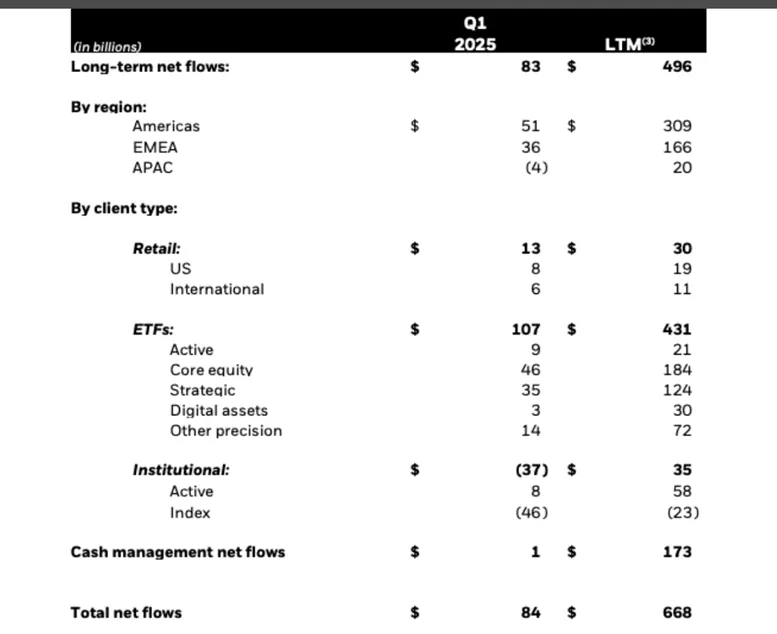

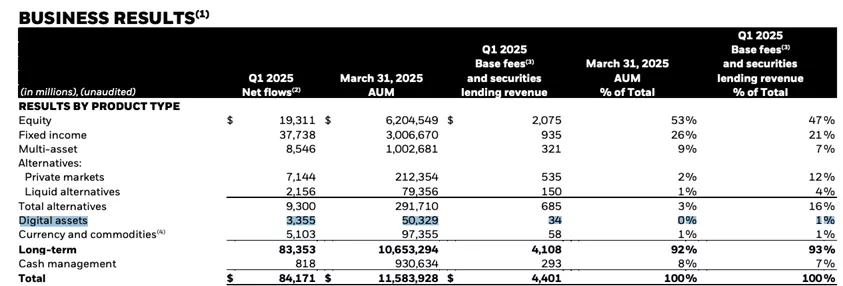

Of the $107 billion in net inflows to BlackRock’s ETFs under the iShares brand from January to March, $3 billion (2.8%) were allocated to digital asset products, according to the report by the asset management company.

BlackRock earned $34 million in fees from BTC-ETF and ETH-ETF operations, accounting for less than 1% of the total amount.

By the end of Q1, BlackRock’s total digital assets under management amounted to ~$50.3 billion, or 0.5% of the company’s $11.6 trillion AUM.

As of April 10, IBIT, with a figure of $45.4 billion, leads among exchange-traded funds based on digital gold. The product accounts for 51.3% of all net inflows.

In February, the government-owned Abu Dhabi company Mubadala Investment Company disclosed investments in BlackRock’s bitcoin ETF amounting to $436.9 million.

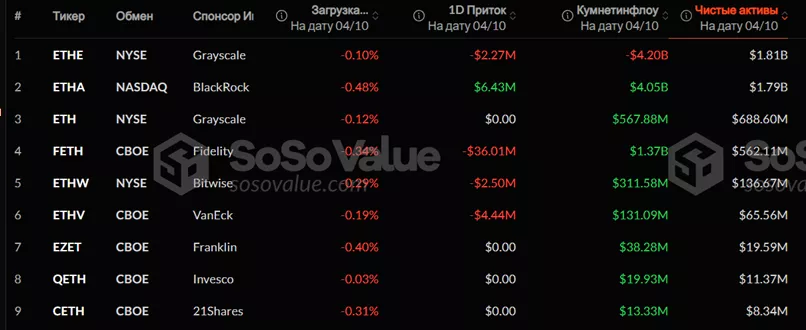

In the Ethereum fund segment, BlackRock’s ETHA holds the second position ($1.79 billion), slightly trailing Grayscale’s ETHE ($1.81 billion).

On April 10, the SEC approved the listing and trading of options on spot ETFs based on the second-largest cryptocurrency from BlackRock, Bitwise and Grayscale.

In September 2024, the regulator made a similar decision regarding derivatives based on BTC-ETF. Less than two months later, the open interest in IBIT derivatives reached half the level on Deribit.

In March 2025, BlackRock launched a bitcoin ETF on European exchanges.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!