Assessing BTCFi: Is the Bitcoin DeFi Dream Hitting a Wall?

BTCFi’s promise meets reality: weak uptake, low yields and clunky UX weigh on growth.

Bitcoin-based decentralised finance (BTCFi) was initially was seen as a new growth engine and the next logical step in the evolution of the original cryptocurrency. Yet current market dynamics invite a rethink.

A look at the numbers reveals a clutch of structural problems: from critically low adoption and stagnant financial metrics to a poor user experience. These factors cast doubt on the viability and near-term prospects of the entire niche.

The user barrier: why bitcoin holders ignore BTCFi

User activity is the key gauge of any technology’s health. Without a growing audience, even advanced solutions risk remaining niche.

At first BTCFi grew briskly: in just the second half of 2024 the segment’s TVL rose more than tenfold, topping $7bn. By early 2025 the momentum had faded, giving way to stagnation and a retreat in the metric.

BTCFi remains among the market’s most underappreciated niches, given bitcoin’s trillion‑plus market capitalisation, vast stores of “dormant” liquidity and the still‑unrealised potential of L2.

A recent GoMining survey of more than 700 respondents from North America and Europe выявил a telling statistic: 77% of holders of the original cryptocurrency have never interacted with protocols in this seemingly promising segment. The main barriers: lack of trust and the complexity of engaging with the ecosystem.

40% of participants are unwilling to allocate more than 20% of their crypto to BTCFi. Two-thirds cannot name a single project in the nascent segment.

Only 10% have any hands-on experience with such protocols. Just 8% use farming and lending tools on an ongoing basis.

These figures point to significant barriers, including poor awareness. When three-quarters of the target audience ignore the ecosystem, sector-wide financial metrics inevitably stall.

Stalling TVL and lacklustre yields

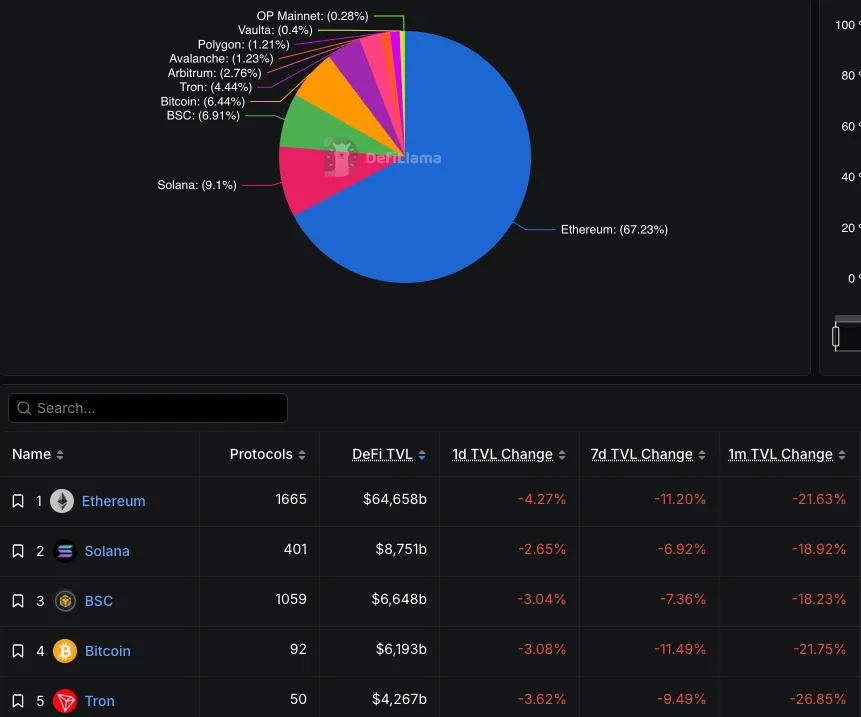

BTCFi still sits in DefiLlama’s top five, trailing only ecosystems built on Ethereum, Solana and BNB Chain.

That the segment remains in the top five despite the absence of growth may signal stagnation across DeFi amid the crypto‑market correction.

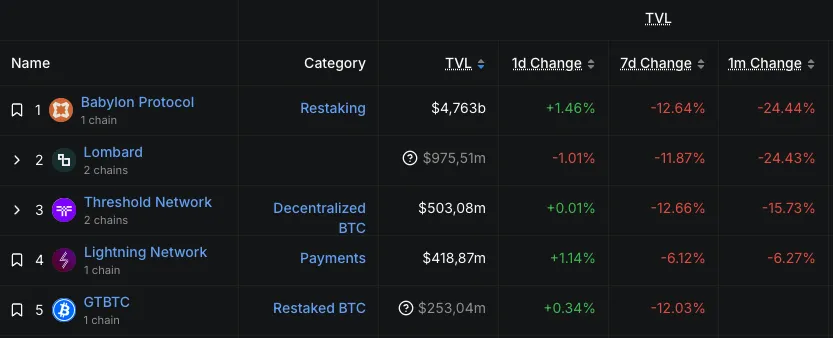

As before, BTCFi is dominated—by a wide margin—by the restaking protocol Babylon. Its TVL exceeds $4.7bn.

A brief burst of activity in the final quarter of last year was likely linked to the dominant project. It did not alter the broader negative trend and proved a local episode.

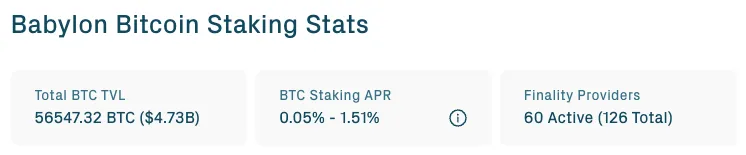

One likely reason for fading demand is extremely low yield. Staking BTC alone offers a mere 0.05% a year; locking bitcoin alongside the native BABY token yields 1.51%.

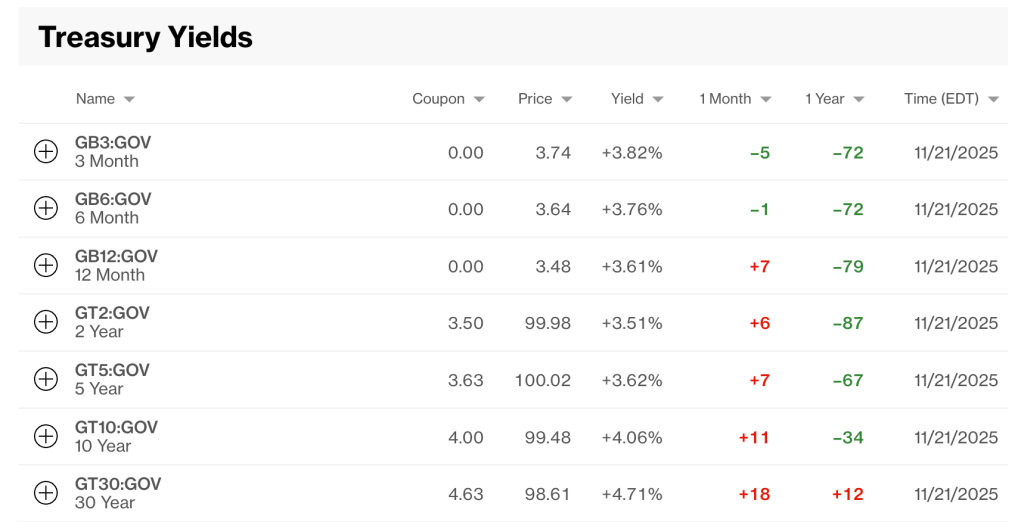

Given crypto’s particular risks (high volatility, hacks and smart‑contract vulnerabilities), such a low APR is uncompetitive and unlikely to attract meaningful capital. By comparison, ten‑year Treasuries yield about 4% a year—far above Babylon’s rate.

Using wrapped bitcoins such as WBTC in mature DeFi protocols on other blockchains also looks the more attractive alternative.

“If you hold bitcoin, are you really doing it for an extra 1% yield? That’s the psychological barrier,” — поделился мыслями CEO of infrastructure firm Twinstake Andrew Gibb.

Low yields and stagnating TVL are only symptoms of a deeper problem tied to the practical use of BTCFi products.

The central challenge: usability

Market participants increasingly recognise the potential of bitcoin-based decentralised finance. Stacks co‑founder Muneeb Ali, for instance, stresses the need to build a “thriving on‑chain economy”.

bitcoin is different from crypto but we need to be better at creating a thriving on-chain BTC economy. frankly, some crypto projects are doing a better job of developer traction and usage of decentralized apps: https://t.co/KKMzc8pbkG

— muneeb.btc (@muneeb) October 19, 2025

BTCFi does shift how bitcoin is used: from a passive store of value to a working financial instrument. The asset is being integrated into DeFi, opening access to staking, lending, yield farming and other operations.

Yet the main brake on growth is the services’ poor usability. Some analysts argue the apps in this segment are “impossible for the average person to use”.

“If you want to use bitcoin in DeFi today, you will have to move it to other networks. At that, you need to choose from more than 50 fragmented providers, which often lack transparency,” — отметил Build on Bitcoin (BOB) co‑founder Alexei Zamyatin.

GoMining’s head Mark Zalan shares the view. He подчеркнул that “cryptocurrencies in general, and bitcoin in particular, remain very difficult in terms of usability”.

“The next obstacle on the path to mass adoption is the need to make the tools significantly more convenient for users,” the expert commented.

Do L2s have a future?

Galaxy Research concluded that most L2s for the original cryptocurrency may prove non‑viable in the long run, despite their promise of cheap, fast and decentralised payments.

Rollups on the bitcoin network face the high cost of posting data to the base layer. Using the latter is necessary so that a regular node can reconstruct the latest state of the second‑layer solution at any time.

Bitcoin’s block size is capped at 4MB, and data posting requires significant space. A single such transaction can reach 400KB (0.4MB), effectively taking up about 10% of available capacity.

Analysts noted that if numerous rollups were to publish their data every six to eight blocks, base‑layer fees could rise markedly. That creates a risk of small transfers being priced out of the network.

To “survive”, L2s will have to outdo one another in generating fees, as that will determine their priority in blocks, the researchers said.

With low fees, when a standard transaction costs ten sat/VB, rollups would spend about $460,000 per month on security. In a high‑fee environment around 50 sat/VB, costs could rise to $2.3m.

***

BTCFi’s chief problem is its difficulty for the average user. A high barrier to entry constrains capital inflows and dampens audience interest.

Even project founders concede the sector is still forming. Using it feels more like a command‑line exercise than an intuitive, Apple‑like experience.

The statistics bear this out: three‑quarters of bitcoin holders have never tried such products, TVL is stagnating and returns are meagre.

In its current guise the segment falls short, remaining a niche experiment rather than an engine of ecosystem growth. Its future hinges on whether developers can remove technical hurdles and improve the UX, offering accessible and genuinely attractive financial tools.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!