Chainalysis: Russia’s crypto market hits a record $376bn

Drivers include a DeFi boom and a surge in large institutional transfers

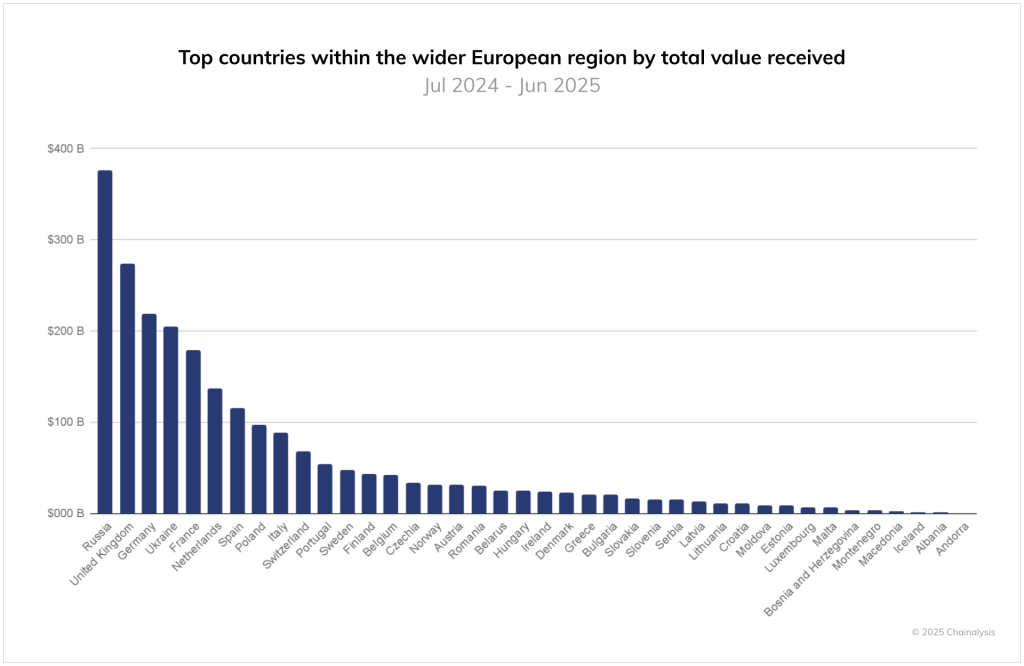

Between July 2024 and June 2025, Russia’s crypto market reached $376bn, putting the country first among European nations, according to a report by Сhainalysis.

The UK, which traditionally topped the ranking, slipped to second with $273.2bn. Germany ($219.4bn), Ukraine ($206.3bn) and France ($180.1bn) rounded out the top five.

Analysts also recorded a record rise in crypto transaction volume attributable to Russia, which reached $379.3bn.

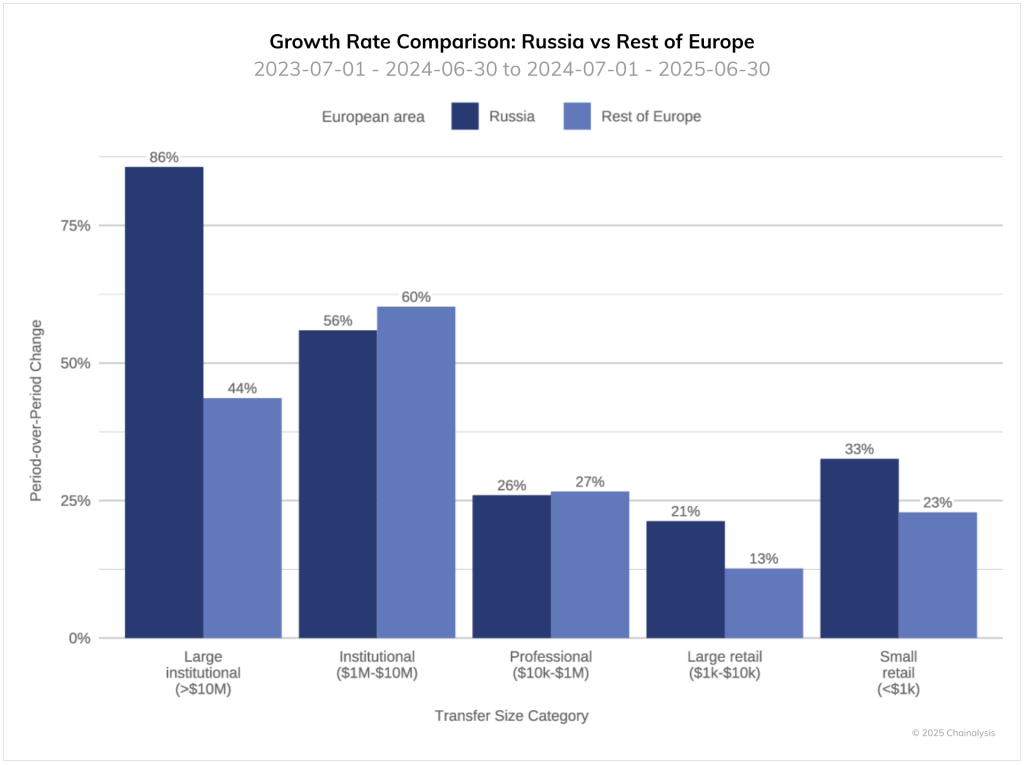

Key drivers included a jump in large institutional transfers. Transactions over $10m rose 86%, nearly twice the European average.

“Other segments of Russia’s crypto ecosystem, in particular the activity of small retail investors, showed growth rates moderately ahead of European averages,” the specialists added.

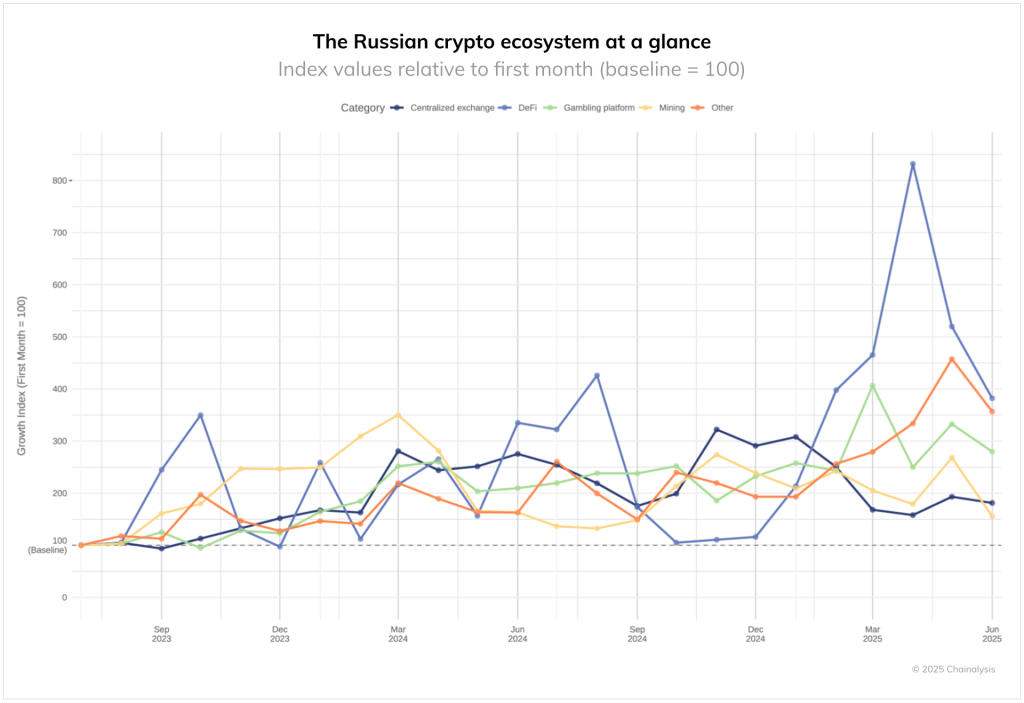

Another factor was the rise of DeFi. In early 2025, activity in this segment jumped nearly eightfold versus mid-2023. It later corrected, but remains above initial levels.

What about Europe?

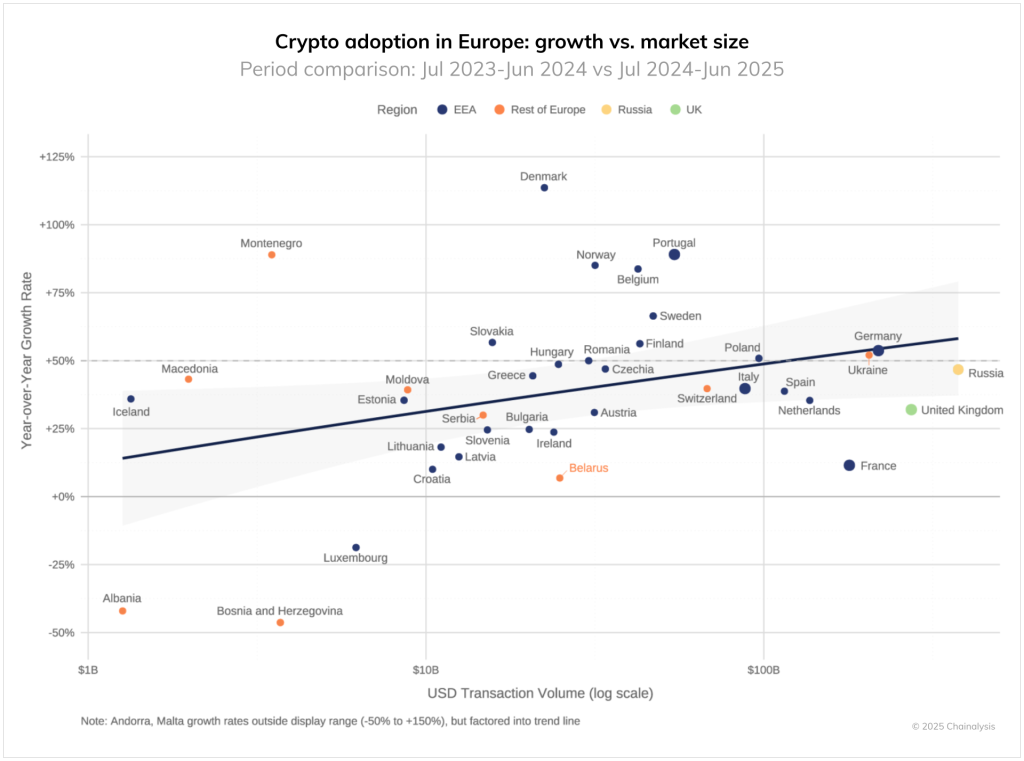

Over the year, Europe’s largest economies saw crypto transactions grow by more than 50%. The fastest growth was in Germany, Ukraine and Poland.

Analysts noted that the observed pattern aligns with the S-curve of technology adoption, but with one feature: even in mature markets, growth remains steady rather than reaching a plateau.

“The region shows an unexpected positive correlation between transaction volume and growth rates, which challenges the conventional notion that large markets grow more slowly,” they added.

The rollout of MiCA also buoyed market dynamics, Chainalysis said. Analysts pointed to a surge in institutional interest in the sector.

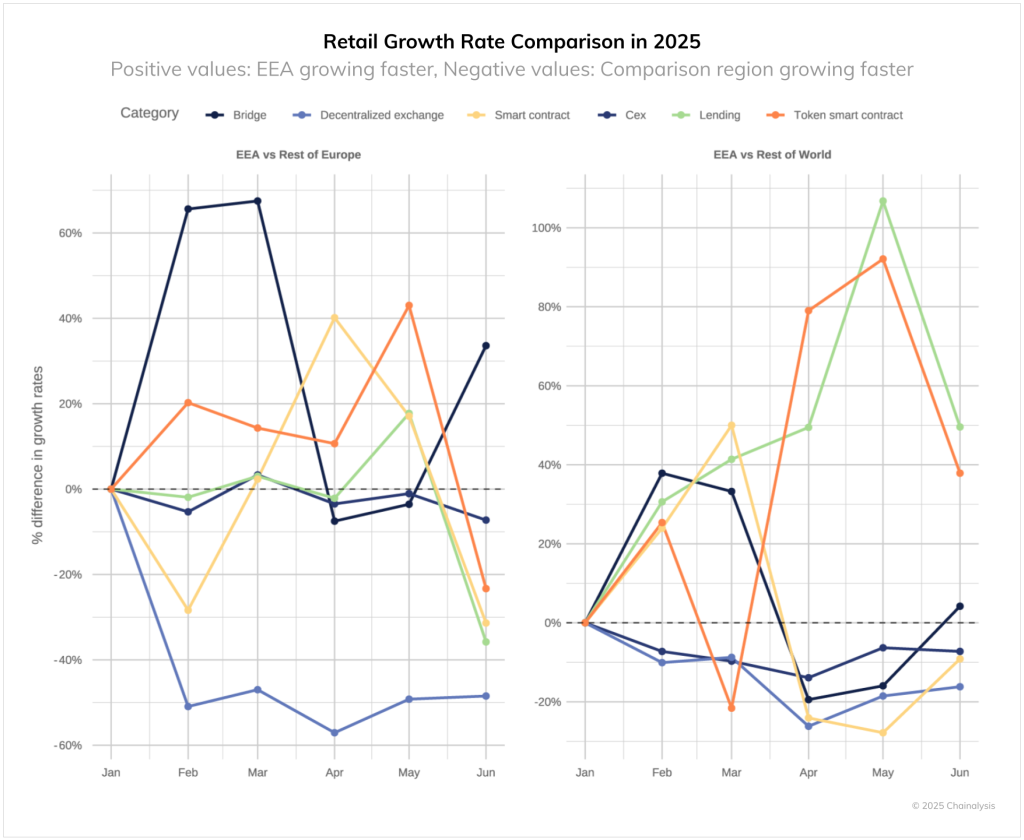

In DeFi, growth was steady as well. Countries in the European Economic Area stood out for cross-chain operations — in February and March 2025, activity in this category was 65% higher than in other regions. Interest in crypto lending also rose among European users.

Shifts in the stablecoin market

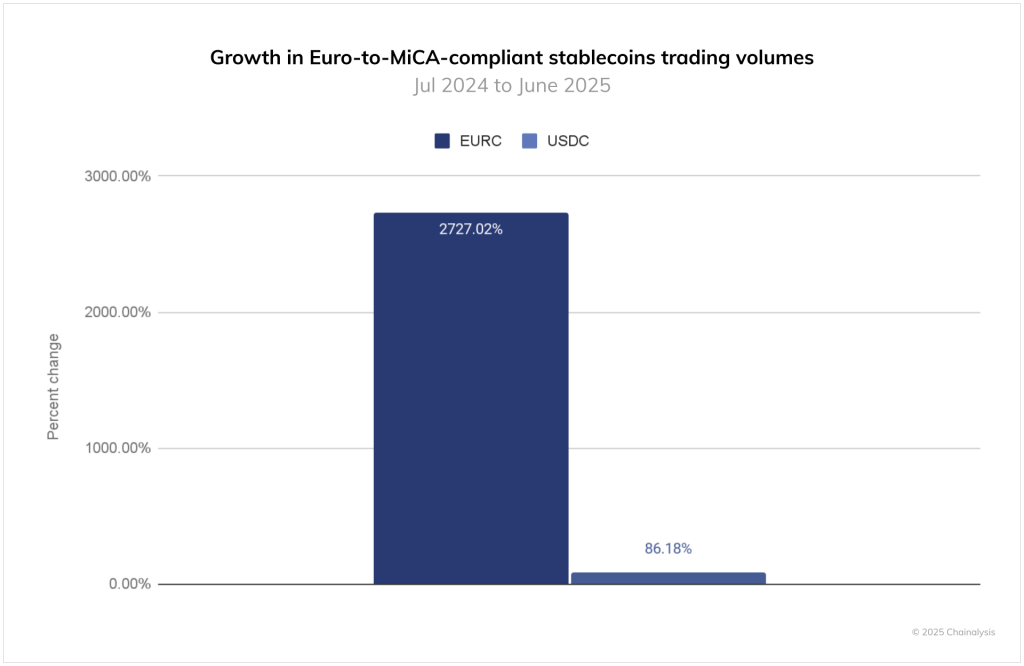

The new rules also reshaped the landscape for stablecoins. The European Securities and Markets Authority issued 15 licences to stablecoin issuers.

Restrictions on access to non–MiCA-compliant assets such as USDT prompted a reallocation of liquidity. Use of EURC from Circle jumped 2,727% between July 2024 and June 2025.

European banks have also begun to explore launching their own euro stablecoins. In September, nine major financial institutions announced the creation of a consortium to issue a MiCA-compliant “stablecoin”.

In October, the French banking giant ODDO BHF also announced the release of EUROD, pegged to the euro on Polygon.

Earlier, Ukraine and Russia ranked eighth and tenth, respectively, in Chainalysis’s 2025 global crypto adoption index.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!