Lending Trust

Why is the crypto lending market moving to DeFi?

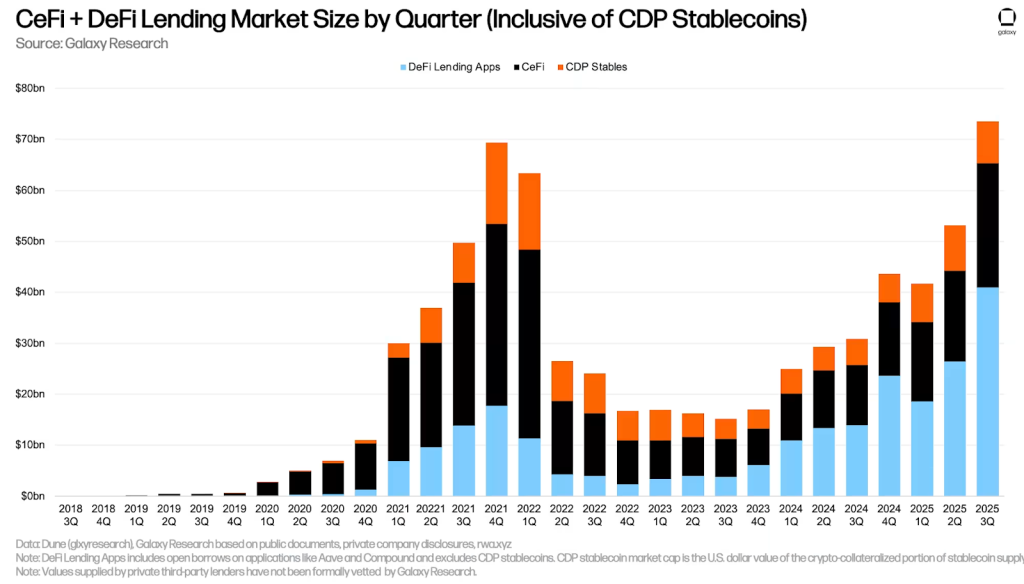

About half of DeFi market is collateralised crypto lending. In Q3 2025, the sector’s hit a record $73bn.

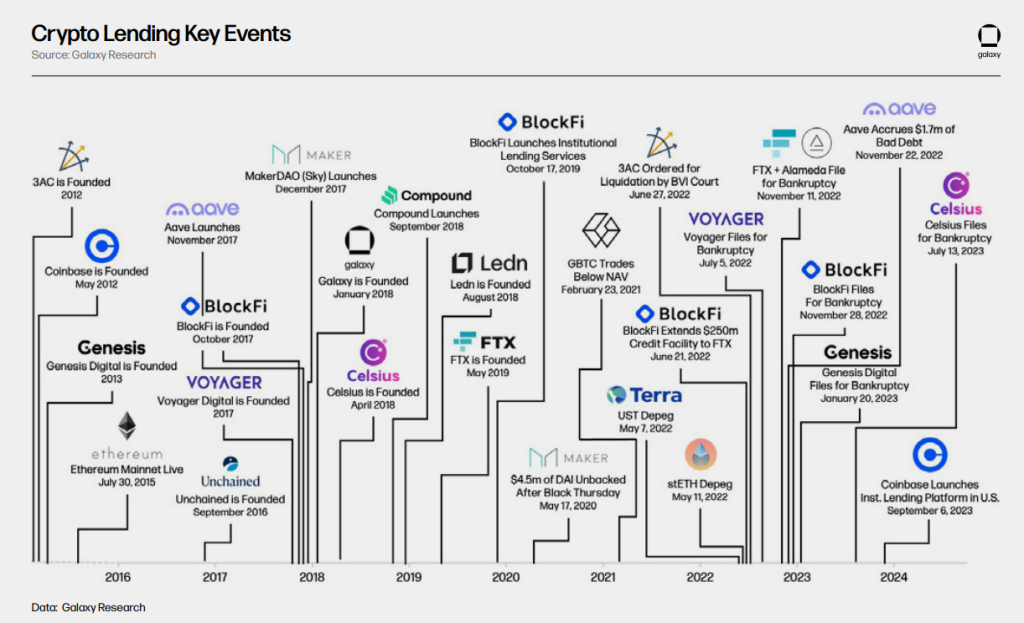

After the collapses of BlockFi, Celsius and Genesis, CeFi platforms lost their dominance as users shifted towards decentralised venues for depositing and borrowing crypto.

ForkLog examines the state of crypto lending and the challenges facing lenders.

Trust, betrayed

After the collapse of Terra and the ensuing bankruptcies of the largest centralised lenders, users became markedly more cautious about platforms that require trusting a third party.

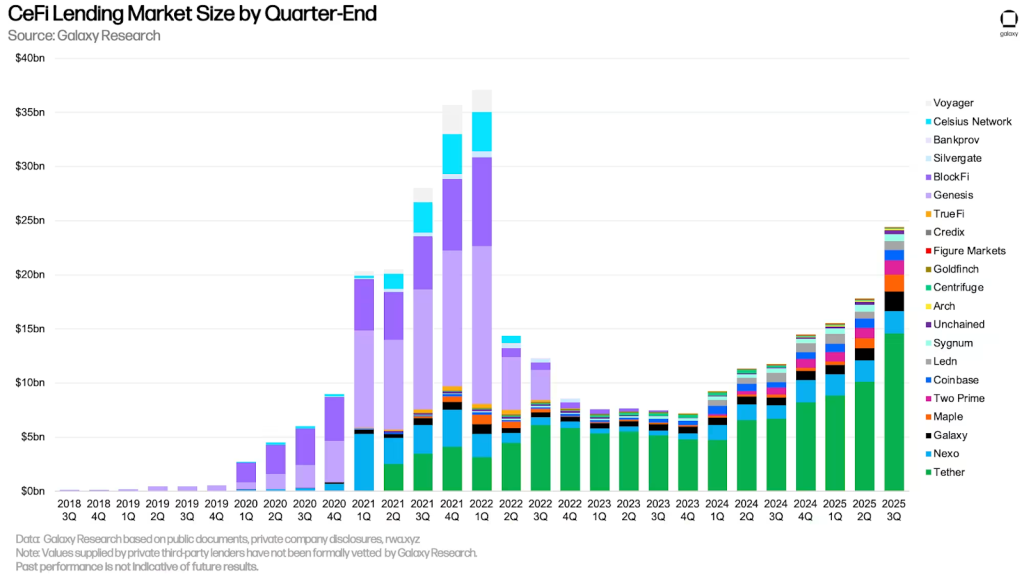

Despite the broader growth of crypto lending, CeFi platforms have not regained their former scale.

According to Galaxy Research, in Q3 2025 loan volumes on centralised venues rose 37.11% quarter-on-quarter. The $24.37bn achieved is still 34.3% below the ATH recorded in Q1 2022.

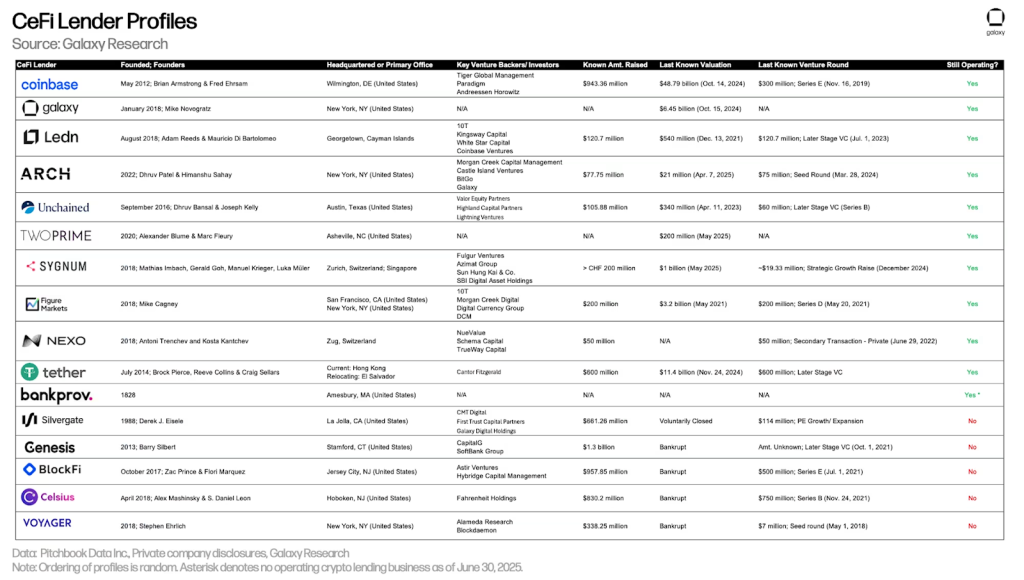

The market leader remains Tether, with an open loan book of $14.6bn and a 59.91% share. Nexo ($2.04bn) and Galaxy ($1.8bn) round out the top three.

The USDT issuer pursues a diversified presence across sectors, including building gold reserves and investing in US Treasuries. Despite borrowing being ancillary to its business, the company has grown its market share by investing in Ledn, a top-ten crypto lender.

Surviving CeFi platforms have tightened policies. They now resemble bank vaults—regulated businesses leaning on rigorous risk management.

From 1 July 2025, Ledn sharply narrowed its earning channels, removing Ethereum from its product line and shutting interest accounts for deposited BTC.

Such steps help the sector stay afloat, gradually restoring institutional trust.

A tilt to decentralisation

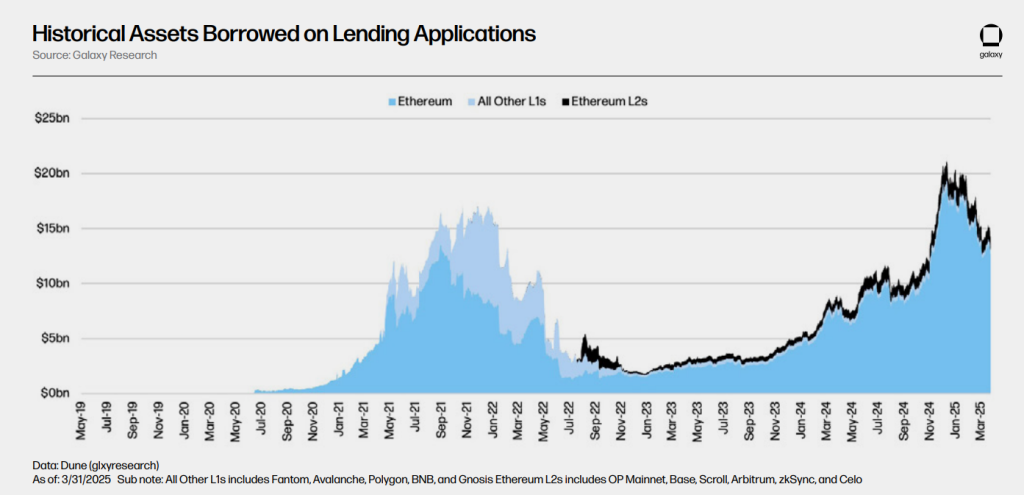

Galaxy Research estimates total crypto loans reached a record $73.59bn in Q3 2025, more than 6% above the previous peak at end-2021.

The main driver was the expansion of on-chain lending across DeFi protocols.

Analysts say the decentralised share rose to 66.9%, up from 48.6% at the top of the 2021 cycle.

Total DeFi loans reached $40.99bn, up 54.84% quarter-on-quarter.

Growth was fuelled by points-incentive schemes, rising prices for Bitcoin, Ethereum and Solana, and more efficient collateral types such as Principal Tokens on Pendle.

By Q3, DeFi saw a marked shift: over 80% of volume flowed to lending protocols such as Aave, Morpho and Fluid. The share of stablecoins minted against collateral—led by DAI—fell to 16%, from 53% in 2021.

Code-governed platforms like Aave and Compound require collateral that exceeds the loan, eliminating most of the credit risk that felled CeFi.

Automated smart contracts remove the counterparty from transactions—an anathema to the most conservative institutions.

Galaxy Research finds lending is the largest DeFi category across blockchains, with Ethereum the clear leader. As of 31 March 2025, $33.9bn of assets sat on 12 EVM-compatible chains, with another $2.99bn on Solana. Ethereum L1 held 81% of all deposits.

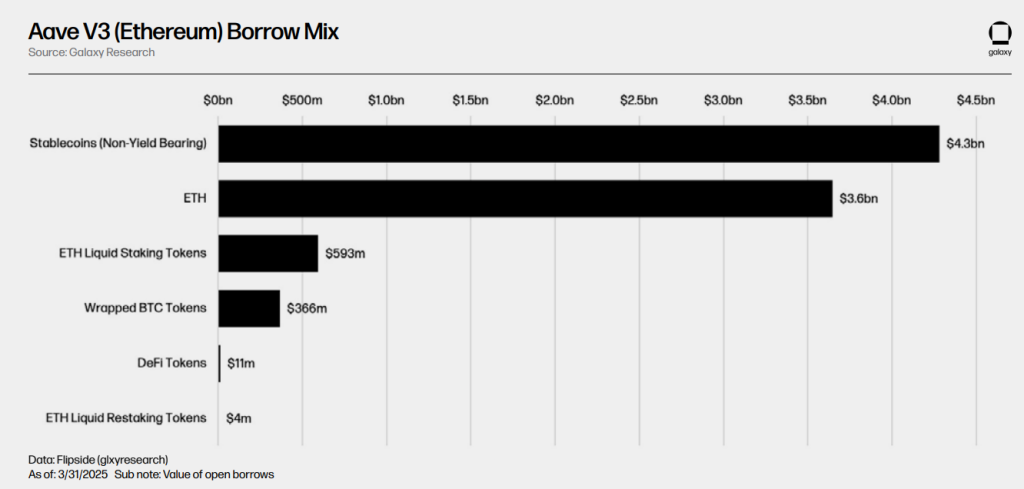

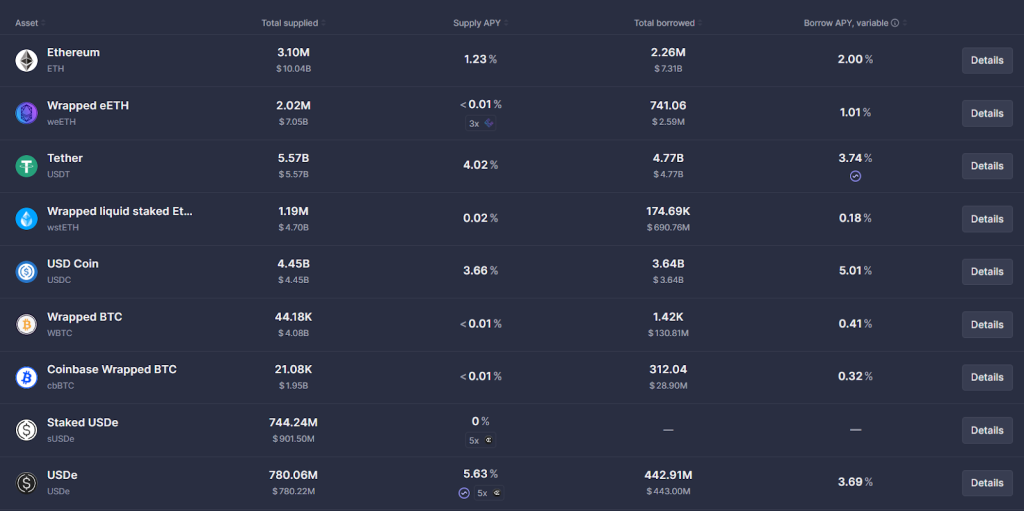

Aave V3 on Ethereum is the largest lending market, with $23.6bn deposited at the time of the report. The most in-demand assets are stablecoins and unstaked ETH.

In the view of Aave founder Stani Kulechov, cuts in central-bank rates will create favourable conditions for DeFi to deliver higher yields.

“We have built a truly powerful infrastructure. We are now moving to the stage where DeFi can integrate into the broader fintech ecosystem, distributing yield,” Kulechov said at TOKEN2049 in Singapore in October.

Another lender, Maple Finance, blends CeFi+DeFi strategies. It seeks institutional flows by expanding to chains with fast transactions and ample cross-chain liquidity, while complying with KYC/AML norms.

In 2025, to serve large trading firms, Maple integrated Solana, Arbitrum and Plasma.

In October, co-founder Sid Powell set out his view of institutions’ role in crypto lending:

“The role that, in our view, they will play in collaboration with us will be more on the borrower side, as well as in distributing funds into syrupUSDC vaults. We have seen that this has already largely happened when we launched Plasma. A number of institutional hedge funds allocated capital to this vault, and we are seeing more and more such funds raise capital from traditional investors.”

Regulators are also taking note. On 8 December, America’s Commodity Futures Trading Commission (CFTC) launched a pilot programme to use digital assets as collateral in derivatives markets.

This initiative is implemented under the GENIUS Act. In the first phase, Bitcoin, Ethereum, and the USDC stablecoin were included in the list of acceptable collateral assets.

The programme allows futures commission merchants to accept these assets to secure clients’ margin positions.

Who Benefits from This

Companies and individuals participate in depositing and borrowing assets for several reasons:

-

Liquidity. Allows borrowers to access funds without selling assets, preserving their potential for future appreciation.

-

Yield. Enables lenders to earn passive interest on idle assets.

-

Trading leverage. Traders can amplify their position size using borrowed funds.

-

Hedging long positions. Helps reduce risk on existing long positions by opening offsetting short positions, aiding in portfolio delta management and decreasing directional exposure.

-

Bearish speculation. Provides the ability to borrow assets and sell them, aiming to repurchase later at a lower price.

-

Business operation financing. Allows companies to secure liquidity for operational needs.

Profitable on-chain lending strategies attract diverse user categories. The main groups include:

-

Individuals — ranging from retail traders to ultra-large capital holders, who store assets on-chain and need liquidity or yield. They can participate in farming and investment opportunities, obtain funds for personal needs and emergencies, and earn income on idle assets.

-

Corporate users — companies seeking instant, 24/7 on-chain lending liquidity to finance current operational activities and maintain stable cash flow. For organisations willing to manage the associated risks, the advantages are transparency of fund movement and relatively low-cost financing options.

-

Treasury operators — professionals managing the financial reserves of organisations, aiming to generate yield from idle assets while overseeing DAO treasuries or traditional accounts. For such entities, the benefit is diversification of profit sources and the ability to earn yield on virtually any assets.

This practice is common in the crypto industry and is used by fund managers to enhance the profitability of tokens that companies are not looking to sell.

For example, in February 2025, the non-profit Ethereum Foundation (EF) deposited ETH worth $120 million with several lending protocols to increase the yield on its reserves.

Based on a rate of 1.5%, the organization is expected to earn approximately $1.5 million from this over a year. The EF transferred:

-

30,800 ETH ($81.6 million) to Aave;

-

10,000 ETH ($26 million) to Spark;

-

4,200 ETH ($11.2 million) to Compound.

Not All Rosy

On-chain lending is associated with numerous risks, the most serious of which can lead to temporary or permanent loss of access to funds or the funds themselves.

According to Galaxy Research, the main technological risks stem from smart contract vulnerabilities and oracle manipulations or failures.

Examples include:

-

Liquidity pools. A hack of a pool contract often results in the complete draining of users’ funds.

-

Token issuance contracts. These issue “voucher” tokens like aTokens and cTokens that represent a user’s deposit or debt. Vulnerabilities can allow attackers to steal others’ assets or manipulate balances. This is precisely how $197 million was stolen from Euler Finance.

-

Access control contracts. Errors in role systems can grant an attacker unauthorised control.

Furthermore, manipulations and failures in price oracles, which determine collateral and debt values, can lead to erroneous liquidations.

For instance, on one of Morpho’s markets, an error in an oracle’s decimal value artificially inflated a token’s price. As a result, a user was able to post just $350 in collateral to borrow 230,000 USDC.

Protocol design and governance risks also pose a threat. Parameters like Loan-to-Value (LTV) ratios must strike a balance between security and capital efficiency. If set too “tight,” a protocol loses competitiveness; if too “loose,” systemic risks are created.

Application complexity also increases the number of potential failure points. This was clearly demonstrated by the hack of Platypus Finance, where an attacker used AMM LP-tokens to attack the USP stablecoin, whose issuance was backed by the same protocol.

Experts also warn against abrupt parameter changes or the release of a new application version, as such events heighten the probability of fund loss.

The listed problems are not the only ones in the crypto lending sector.

In 2025, DeFi protocols actively integrated tokenized private credit via Real-World Assets (RWA). Using such assets as loan collateral transfers the opacity and risks of TradFi into DeFi.

This migration creates the potential for “financial contagion,” where problems with weak assets like corporate debt can directly spill over into lending pools, echoing the causes of the 2022 CeFi giant collapses.

Alongside the inherent volatility and liquidation risks of the DeFi sector, the unresolved issue of regulation persists. The European Union is taking the lead in this regard.

Effective January 1, 2026, the DAC8 Directive, implementing the CARF regulatory initiative, comes into force in the EU. Cryptocurrency exchanges, brokers, and custodial services will begin reporting user transaction data to tax authorities starting in 2027.

The impact of the MiCA regulation’s adoption in Europe is already being felt in the crypto lending sector.

According to SQ Magazine, lending volumes in the EU fell by 23% in 2025, as stricter identification rules deterred anonymous participants. 78% of former users migrated to centralized, regulated platforms for clearer compliance norms. As a result, major DeFi protocols lost an average of 18% of their European user base.

Despite these challenges, the sector is experiencing a boom—primarily driven by decentralised platforms as the main growth engine.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!