Crypto Is Getting Stale

How the industry got stuck in a forever-postponed future

In the summer of 2020, I devoured a book on decentralised finance called “How to DeFi”. I was impressed and inspired. “This is definitely the future,” my heart told me.

Five years later, that future has not arrived. Sure, DEXs and lending protocols exist and are broadly successful. But where is everything else? The book offered examples of services such as insurance without centralised governance. Where are they?

This is not a dig at the authors. That was the future they envisaged and wanted. I wanted it too.

As for the functioning DEXs and lenders: is it normal that, eleven years after Ethereum’s debut, decentralised-exchange interfaces are still clunky and user-hostile? Why does everything work so clumsily?

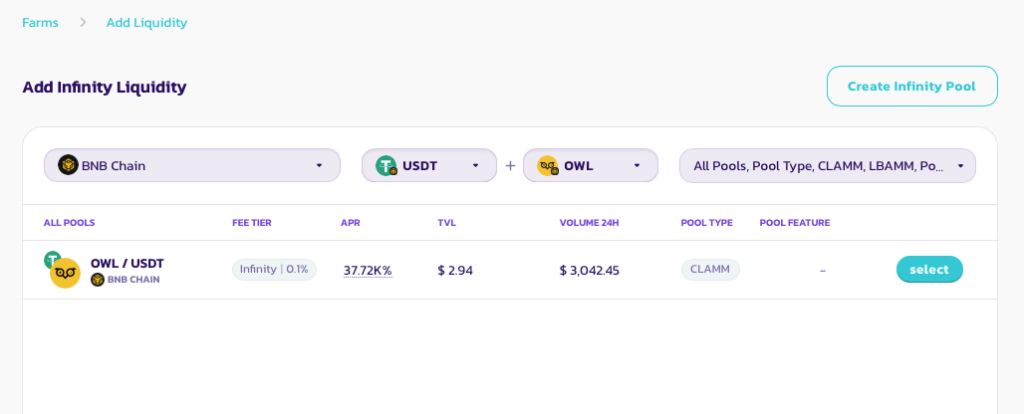

PancakeSwap announced V4-contract support almost two years ago. On April 28, 2025, they went live. Why, more than half a year after the feature was added, can I still not add liquidity to V4 pools via the official interface? It simply fails to see a pool that definitely exists.

PancakeSwap will not show any of the needed V4 pools for any token. What is the point of the feature if I must hunt down custom tools to add liquidity and pay third-party fees? Good thing such tools exist at all. Even so, finding a service with V4 support was painfully hard — and the one I found has a miserable interface and works only intermittently.

This is just one botched implementation. Active DeFi users encounter friction and failure everywhere:

- you cannot set a price range in Chrome, yet it works fine in Safari (but MetaMask runs in Google’s browser);

- pools fail to load when you need to pull liquidity fast and sell tokens;

- transactions fail to execute;

- data on an open position does not update in real time (V4 only, V3 is fine).

Swapping on DEXs via non-custodial wallets is another saga:

- the wallet or PancakeSwap does not see tokens; you must add them via the smart contract address;

- “approve spending amount” — one call. “Approve something else” — a second call. “Confirm the swap” — a third call;

- FaceID did not work. Start over. It failed again; enter the password.

It is maddening when every second counts and you need to sell tokens instantly.

Sometimes, in PancakeSwap’s official interface, the routing path goes through an illiquid pool — so illiquid that any swap returns $0.000087 in tokens. A perfectly decent pool with good liquidity exists, but the interface somehow fails to see it. You must sit and wait for it to recalculate.

Semi-custodial wallets such as Binance Wallet or OKX Wallet are more convenient, but they charge 0.5%.

BNB Chain is outright chaos. Every day heaps of tokens with Chinese characters are minted, just like during the Pump.fun boom. Other assets are pumped and dumped without the slightest pang of conscience from their creators. The patterns are so formulaic that the manipulation is impossible to miss.

As for the past memecoin mania on Solana, say no more. Entire pieces of software and strategies were built to cash out on retail. Well, if Donald Trump can, why can’t a rank-and-file scammer? This is not the direction in which one would like crypto to evolve. Even so, it could have been interesting if you stripped out the scammers and kept decent tokens — the idea of fair distribution without endless unlocks and fund dumps is not so bad.

I’m losing interest

Recently I caught myself paying far less attention to industry news. I have been switching off alerts on more and more channels, keeping only a handful that post rarely but offer substance. I used to monitor dozens of feeds and scan the main media daily for the next clever project, gem, narrative or trend to get in on first.

There aren’t any. There simply aren’t. The news is the same every day. Russia still cannot decide on regulation; another L2 project launched; the probabilities of an event X on Polymarket are so and so; Sui, Sei and other Ethereum killers were down for two hours; the Fed rate; inflation; ETF inflows of $164m; ETF outflows of $150m; Tether froze USDT; a company minted tokens; Trump said this; Trump did that; tariffs, rates, trade wars.

The last truly clever project I remember is STEPN with engaging mechanics, maths, market inefficiencies and opportunities. Walk and earn — great. It was interesting to farm Blast; its ecosystem bundled unique projects and kept pushing you to learn new things. Binance Alpha briefly broke the monotony — until it was overrun by Chinese abuse schemes. That’s it.

No promising idea, no innovative solution, no project with truly novel mechanics. Polymarket? Insiders and a lucky few make most of the money, and it’s hardly new: founded in 2020, while prediction markets date back to the last century. Hyperliquid? Just another venue for speculation and liquidations, sprinkled with decentralisation.

That’s all. Is the crypto industry really only capable of churning out betting and futures lookalikes?

Off the top of my head, I can recall only three standout moments from the entire 2025:

- The launch of Trump’s token — yes, it was loud; I saw dozens of TikTok videos from people utterly removed from crypto buying TRUMP.

- The April crash on Trump’s tariffs.

- The October crash caused by the mechanics of Binance futures.

None of these is positive, and none is tied to fundamental industry progress. And this is the final bull year of the past four-year cycle? Perhaps it is worth recalling 2017 or 2021.

What did we do in 2025? As for 2024 — everyone tapped the hamster. Where is the development of decentralised social networks, data transmission, the new Web3 internet? Such projects exist, but they do not make headlines or rack up views. They are not mass-market fodder because there is no fast money or hype.

After institutions arrived and ETFs launched, everyone has been waiting for their altcoin bags to be pumped. Influencers have spent years compounding hypothetical gains, and they still haven’t materialised.

In 2017 we awaited retail. In 2021 — institutions. Both are here. But crypto has become dull. Nothing is happening. No innovation; no fire in the eyes of the crazy geeks who want to propose something new, unorthodox and decentralised. Only Vitalik Buterin dances on stage and meows at robot dogs.

Today, 17 years after Bitcoin was born, real crypto usage is largely limited to payments in stablecoins. Not even in decentralised, censorship-resistant BTC, but in centralised dollar stablecoins with regular freezes.

To be fair, that is genuinely convenient — and far better than the banking system. Otherwise, everything remains stuck at an early stage. We have not built the financial Web3 future—and it seems we won’t. People are not interested. They would rather tap the hamster for pennies and dump them into memecoins.

Maybe I’m wrong. There is still the promising RWA sector. Perhaps one day we will trade stocks and bonds on-chain rather than via brokers and a thicket of intermediaries. I would like to see robust infrastructure and convenient, safe and reliable tools in that direction. The work has begun, but it is still raw, and it is hard to say whether RWA will share the sad fate of its predecessors.

Vladimir Sliper

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!