Cryptocurrency Inflows Surge Significantly

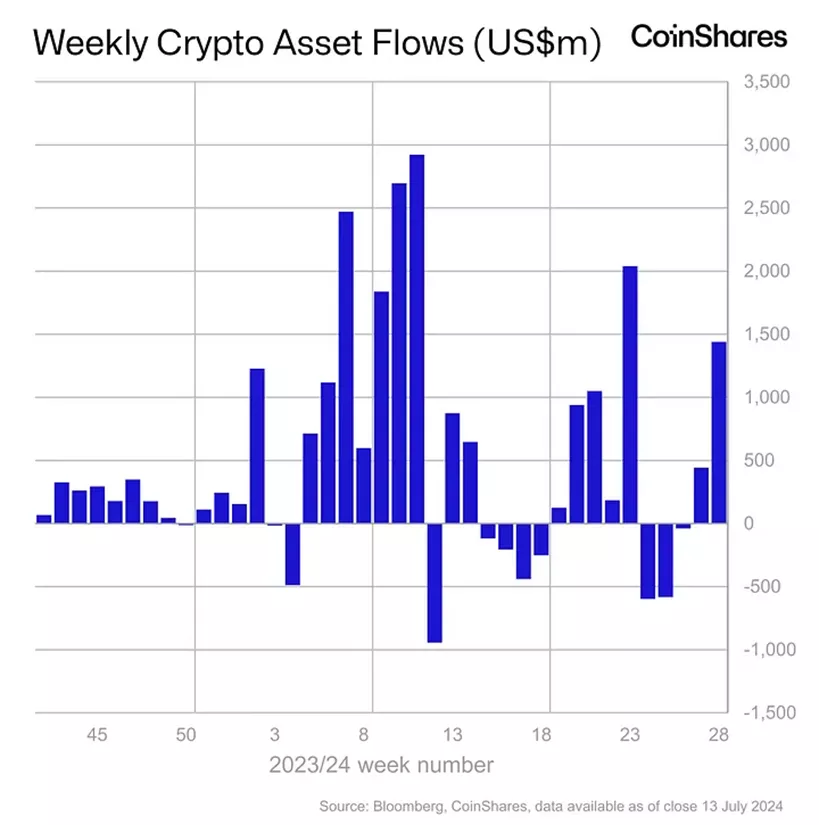

Inflows into cryptocurrency investment products surged from $441 million to $1.44 billion between July 6 and July 12. This figure marks the fifth-largest in history, according to CoinShares.

Since the beginning of the year, a record $17.8 billion has flowed into these instruments. For comparison, in 2021 this figure was $10.6 billion.

“Price weakness due to Bitcoin sales by German authorities and a shift in sentiment due to a lower-than-expected U.S. consumer price index prompted investors to increase their positions,” specialists reported.

Trading volume for ETP ($8.9 billion) remained below the average levels since the beginning of the year ($21 billion).

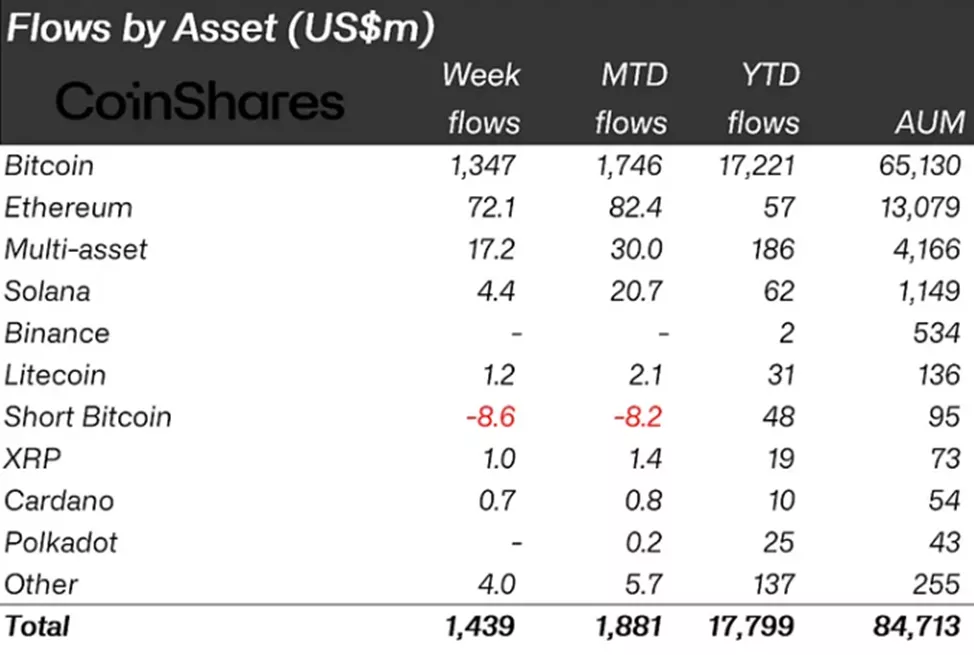

Clients added $1.35 billion to Bitcoin-related products (the fifth-largest figure in history), compared to $398 million in the previous reporting period.

Investors withdrew the largest amount since April, $8.6 million, from structures that allow shorting digital gold (previously they had added $0.5 million).

Inflows were observed across a range of altcoins.

In Ethereum funds, positive dynamics increased from $10 million to $72 million. Analysts attributed this to the likely approval of an ETF for the asset in the near future.

Inflows into instruments based on Solana, Avalanche, and Chainlink amounted to $4.4 million, $2 million, and $1.3 million, respectively.

Earlier, Standard Chartered maintained expectations for the return of the first cryptocurrency’s rate to ATH in August and subsequent growth to $100,000 by the U.S. presidential elections in November.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!