CZ-backed DEX Aster tops Hyperliquid by daily volume

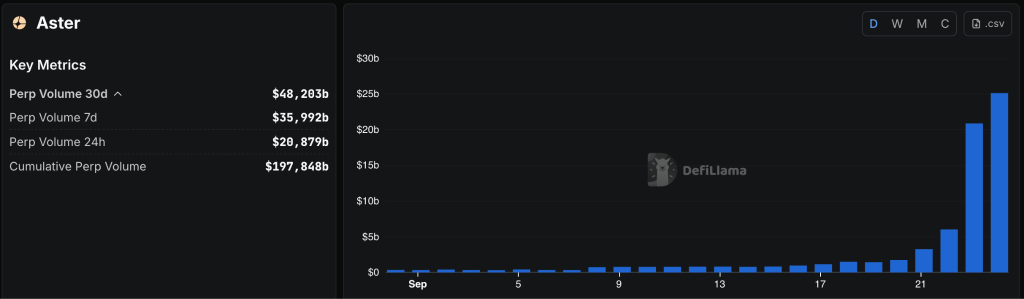

Aster’s 24h volume hit $20.8bn, topping Hyperliquid’s $9.7bn.

The decentralised exchange Aster has surpassed Hyperliquid by daily trading volume. According to DeFi Llama, over the past 24 hours the platform handled $20.8bn versus $9.7bn for its rival.

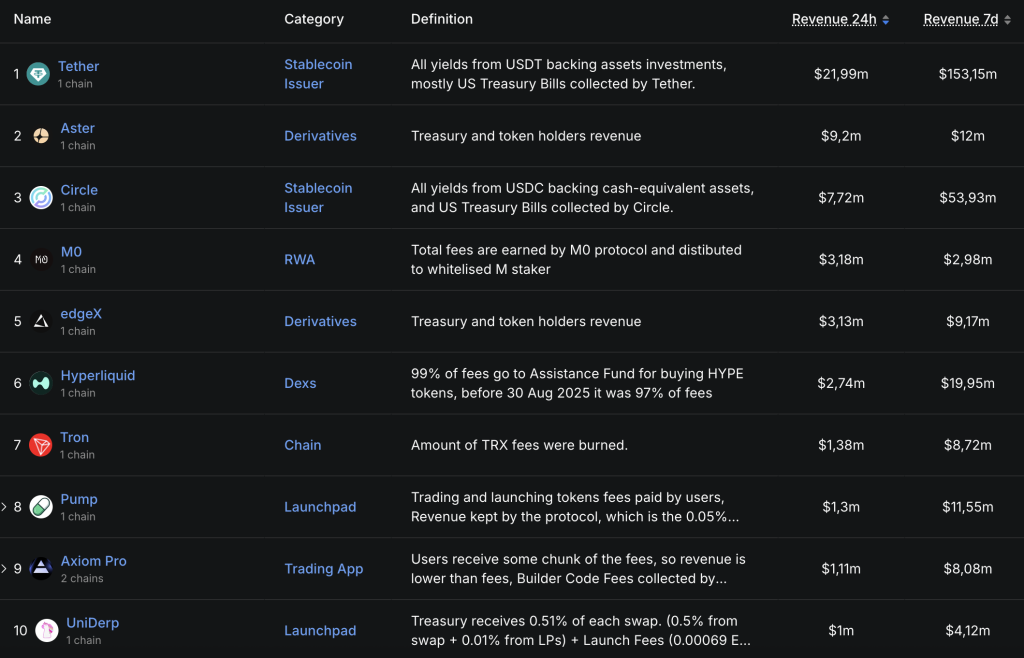

The BNB Chain–based DEX also out-earned its rival on fee revenue: $9.2m versus $2.7m in the past 24 hours. Aster ranked second among protocols, ahead of Circle, the firm behind USDC.

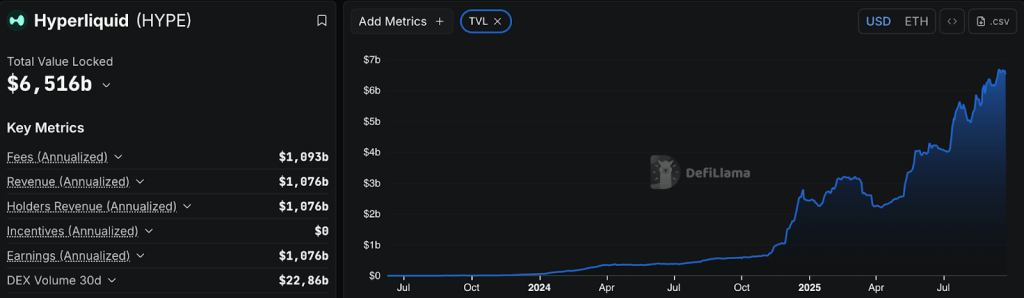

However, the platform still trails its competitor on TVL at $1.8bn. At the time of writing, Hyperliquid’s total value locked exceeds $6.5bn.

On Aster’s coattails, BNB Chain outstripped Solana for the first time by daily transaction fees. Until mid-September the network rarely topped $500,000, while its rival consistently hovered around $1.2m.

Where did Aster come from—and what does CZ have to do with it?

Aster emerged from a merger of APX Finance and Astherus in March. The exchange drew the crypto community’s attention after launching its eponymous token on September 17.

Its standout feature is hidden orders, allowing invisible limit orders to be placed in the order book. That sets Aster apart from the transparent mechanics of most on-chain exchanges and helped attract users.

But the main catalyst was a post by Binance founder Changpeng Zhao (CZ) congratulating the exchange on the release of its native coin.

Well done! 👏 Good start. Keep building! pic.twitter.com/oMfOxfsBRS

— CZ 🔶 BNB (@cz_binance) September 17, 2025

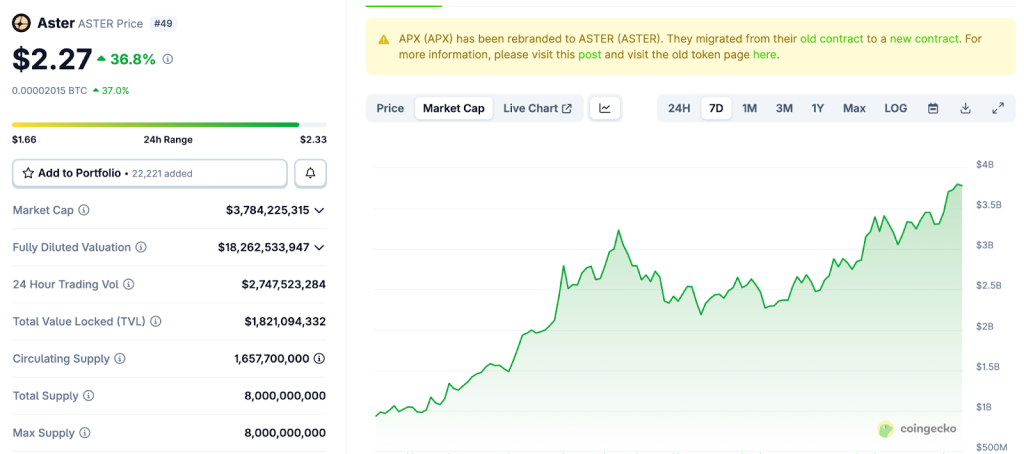

As a result, ASTER’s price surged more than tenfold within days, peaking at $2. The asset’s market capitalisation exceeded $3.7bn.

On September 24 the token set a new all-time high above $2.3, after Aster announced a 5% fee discount for spot trading.

To all our spot enjoyoors, you can now enjoy a 5% fees discount while trading spot on Aster as well! 🫡

Make sure you have $ASTER into your spot wallet, and toggle on ‘Pay fee in ASTER’ to pay fees using $ASTER and enjoy the discount. https://t.co/g1RmVQ07nJ pic.twitter.com/tesiqO1Z6P

— Aster (@Aster_DEX) September 24, 2025

Earlier, some users suggested that Zhao himself initiated the creation of the DEX in the BNB Chain ecosystem in response to Hyperliquid’s success. As evidence, they cited that in late 2024 Aster received funding from YZi Labs, Binance’s venture arm.

After striking a deal with US authorities, CZ was permanently barred from running the trading platform. He still plays a key role at YZi Labs, however—Zhao engages with founders of projects financed by the organisation and offers mentorship.

On September 24 Trust Wallet, the non-custodial wallet owned by the Binance founder, also said it plans to launch futures trading in partnership with Aster.

Perps are coming soon to Trust Wallet.

100+ markets & up to 100x leverage. Powered by @Aster_DEX

Advanced trading, designed for everyone. pic.twitter.com/aZOtF67ouT

— Trust Wallet (@TrustWallet) September 24, 2025

Controversy

Despite the frenzy and strong metrics, Aster has faced allegations of manipulation. On September 20 an on-chain analyst known as tracer claimed that Binance was dumping millions of ASTER coins in real time.

💥 BREAKING:

BINANCE DUMPING MILLIONS OF $ASTER RIGHT NOW

THIS IS HUGE MANIPULATION! pic.twitter.com/kthkqfOlQN

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) September 21, 2025

“Huge manipulation,” he said.

According to a crypto trader known as cyclop, 96% of the ASTER supply is controlled by six wallets, which he links to a single entity.

$ASTER is the biggest market manipulation I’ve seen in a while:

— 96% of the supply is controlled by 6 wallets (prob 1 entity)

— No working product, with just $500k daily volume on $BTC spot pair & 50% shadesYet it’s valued at $10B…

Everyone knows it’s complete garbage,… pic.twitter.com/8xBfYzKytK

— 𝗰𝘆𝗰𝗹𝗼𝗽 (@nobrainflip) September 20, 2025

“There is no value: the token’s daily trading volume in the bitcoin pair is only $500,000, and 50% is just phantom liquidity. Yet its market capitalisation runs into the billions of dollars,” he said.

cyclop warned that ASTER’s price is set by insiders who control almost the entire supply.

Many market participants, however, have taken a more measured view. An investor going by ionicXBT argues that support from CZ and the concentration of the coin’s float on Binance are what make the project promising.

An expert known as Whale.Guru echoed the view, calling ASTER undervalued.

$HYPE is sitting at a $20 billion market cap.$ASTER is only at $2 billion, with @cz_binance and @binance backing it.

Binance is a $100 billion CEX, and its native token $BNB sits at a $130 billion market cap.

Now Binance has launched a DEX with $ASTER as its token and it’s… pic.twitter.com/o60pW1l2vF

— Whale.Guru (@Whale_Guru) September 20, 2025

Gleb Kostarev, CEO of the Telegram project Blum, said the Aster story is not one of manipulation but an example of how the “mechanics of success in the crypto industry” really work.

“What matters is neither the name nor even the product, but the ultimate intentions of those who make the decisions. The examples of Broccoli, Mubarak and TST are living proof (they did not rip the market apart),” he explained.

The expert saw concentration and Binance’s backing as natural and significant elements of the platform’s popularity.

“In crypto, capital and the right time to market decide. The main marketing here is the token itself. If it rises, positivity and loyalty form; if it falls, the product will be buried, no matter how great it is,” Kostarev concluded.

Validators on BNB Chain have proposed cutting gas from 0.1 to 0.05 gwei and shortening block intervals from 750ms to 450ms amid competition with Base and Solana.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!