DeFi Bulletin: TVL Falls; Lido Posts Record Daily Deposit Inflow

The DeFi sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news from the past weeks into a digest.

Key DeFi Metrics

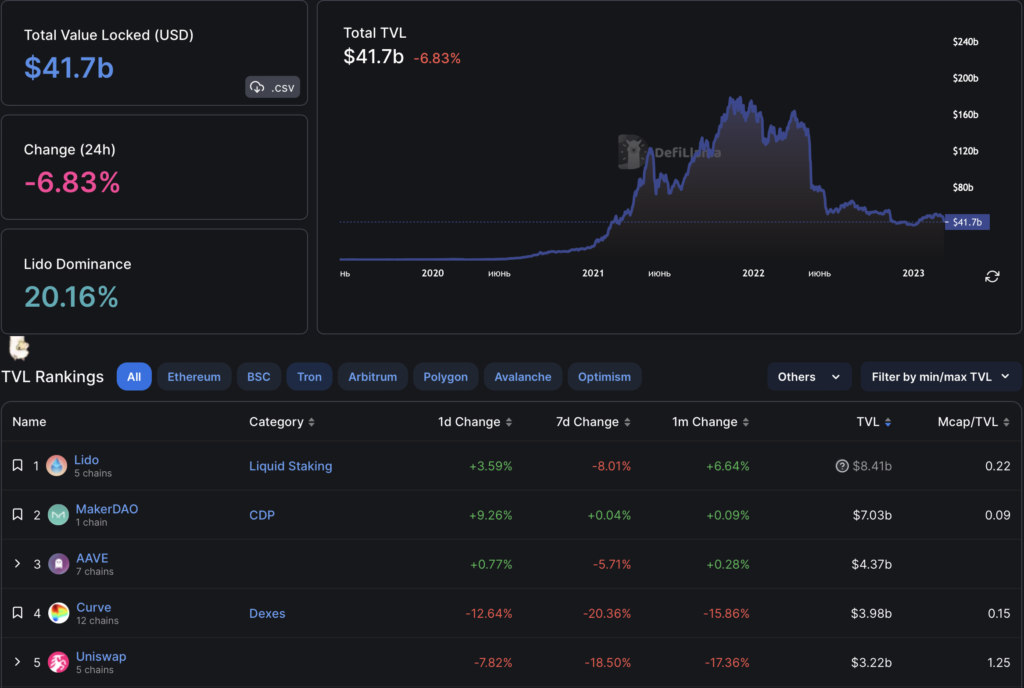

Total value locked (TVL) in DeFi protocols fell to $41.7 billion. Lido led with $8.41 billion, and MakerDAO ($7.03 billion) and AAVE ($4.37 billion) held the second and third spots, respectively.

TVL in Ethereum-based applications fell to $25.31 billion. Over the last 30 days the metric declined by 7% (the value on Feb 11 was $27.2 billion).

Trading volume on decentralized exchanges (DEX) over the last 30 days amounted to $93 billion.

Uniswap continues to dominate the non-custodial exchange market — accounting for 54.3% of total trading volume. The second DEX by volume is Curve (18.2%), the third is SushiSwap (10.8%).

Lido records a record daily inflow of 150,000 ETH

The daily inflow into the liquidity staking platform Lido Finance surpassed 150,000 ETH. Reaching this milestone activated the Staking Rate Limit feature.

The team called it ‘curious, but important.’ It is a dynamic mechanism to respond to significant inflows into staking to mitigate potential side effects such as dilution of rewards without the need to suspend deposits.

According to them, thanks to the rate of recovery at around 6,200 ETH/hour, most users will not feel the consequences of the Staking Rate Limit.

If the platform refuses to issue stETH, developers recommended reducing the deposit size or waiting for capacity to replenish the protocol.

In February, DeFi projects lost $21 million to hacks

In February 2023, as a result of seven incidents, DeFi projects incurred losses of about $21.4 million, according to DeFi Llama.

The largest loss was from the Platypus Finance protocol exploit for $8.5 million. The attackers used «instant loan» and a logic error in the collateral-check mechanism of the loan contract.

However, the team promptly contacted major crypto companies such as Binance, Tether and Circle to freeze and recover the stolen assets. At the end of the month French authorities arrested two suspects in the Platypus attack.

In early February, an unknown actor illicitly withdrew from the BonqDAO protocol approximately 114 million ALBT tokens and 98 million BEUR. Due to the low liquidity of the assets, the hacker could only partially convert them into Ethereum and DAI for about $1.7 million.

Also in the early days of the month, the decentralized platform Orion Protocol was affected. The hacker’s haul consisted of assets worth $3 million .

At the end of February, the DeFi project LaunchZone on the BNB Chain reported a hack. The damage amounted to $0.7 million, but the protocol’s native token lost 82% of its value.

After the hack of the dForce protocol, attackers withdrew assets worth $3.65 million. However, unknown actors returned all assets, acting as white hat hackers.

CoinGecko: investments in DeFi projects rose 190%

In 2022, DeFi projects attracted $2.71 billion in investments. This was 190% higher than the $0.93 billion a year earlier, according to CoinGecko analysts.

Investor interest in the centralized finance (CeFi) segment notably declined — year-on-year investments fell from $16.29 billion to $4.39 billion.

In DeFi metrics, Uniswap and Lido Finance contributed substantially, raising $165 million and $94 million respectively.

However, the largest round was the Luna Foundation Guard’s sale of LUNA tokens for $1 billion in February. About three months later, the Terra project crashed.

In CeFi, the largest recipient of investments in 2022 was the Bitcoin exchange FTX — $800 million or 18.6% of the total. The platform, along with roughly a hundred affiliated entities, filed for bankruptcy in November.

Experts noted the resilient nature of funding for blockchain infrastructure and services projects. The sector attracted $6.1 billion, which was 40.2% above the 2021 figure.

Analysts also noted growing investor interest in AI and data processing projects. Year-on-year investments rose 65.1%.

Also on ForkLog:

- The hacker returned assets worth $1.59 million to the Tender.fi platform for a reward.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!