Ethereum Staking Demand Hits Four-Month High

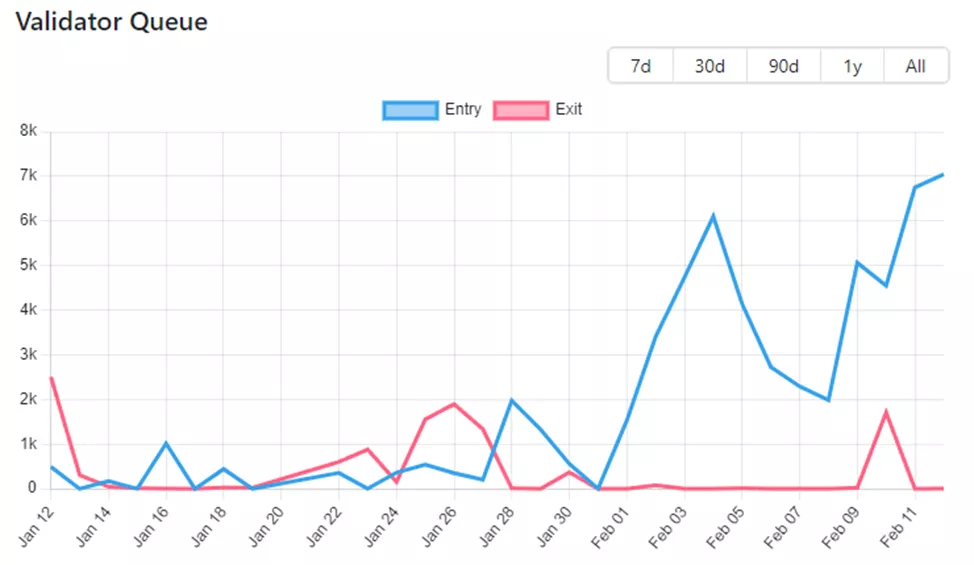

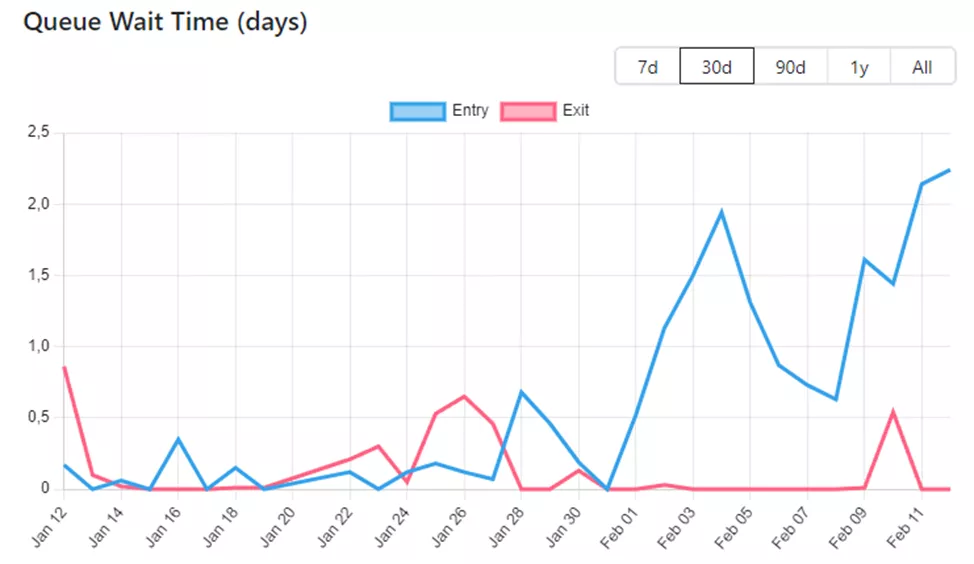

The queue of Ethereum validators has risen to 7045, the highest level since October 6, according to the service ValidatorQueue.

The figure reached a record 75,000 immediately after the activation of Shanghai in April 2023.

The upgrade enabled the release of accumulated rewards and allowed changing service providers. In October, this parameter dropped to zero for the first time, prompting skeptical assessments from JPMorgan analysts.

According to the network’s algorithm, it would take almost 54 hours to clear the current validator queue if no new applicants join. At the time of writing, the number of active participants reached 936,838.

“The surge in staking activity […] indicates the first signs of a recovery in [Ethereum] viability,” commented CoinDesk research head at FalconX, David Lawant.

The expert noted that the trend is notable given the low reward size. According to ultrasound.money, the rate is 3% per annum.

Lawant believes market participants are awaiting clarity on the possibility of Ethereum-ETF issuers staking part of their coins if the product is approved.

Specifically, ARK Invest and 21Shares have included such an option in their instrument proposal.

In recent months, the SEC has delayed decisions on applications to launch spot Ethereum-ETFs from several companies, including Grayscale, BlackRock, and Invesco with Galaxy.

Some experts believe the regulator will approve the products in May. Grayscale suggested a positive decision might come in the summer. However, some analysts doubt the swift registration of spot ETH-ETFs.

In February, the share of Ethereum supply in staking reached 25%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!