Expert Warns of Ethereum Pullback Risks Following ETF Launch

Ethereum options have seen a sharp rise in implied volatility (IV). According to Valentin Fournier from BRN, this suggests a risk of a sell-off wave following the ETF launch, with a gradual recovery thereafter, reports The Block.

The SEC approved July 23 as the start date for trading spot exchange-traded funds based on the second-largest cryptocurrency by market capitalization.

Against this backdrop, the monthly IV jumped from 56% to 70% over the week, according to Deribit.

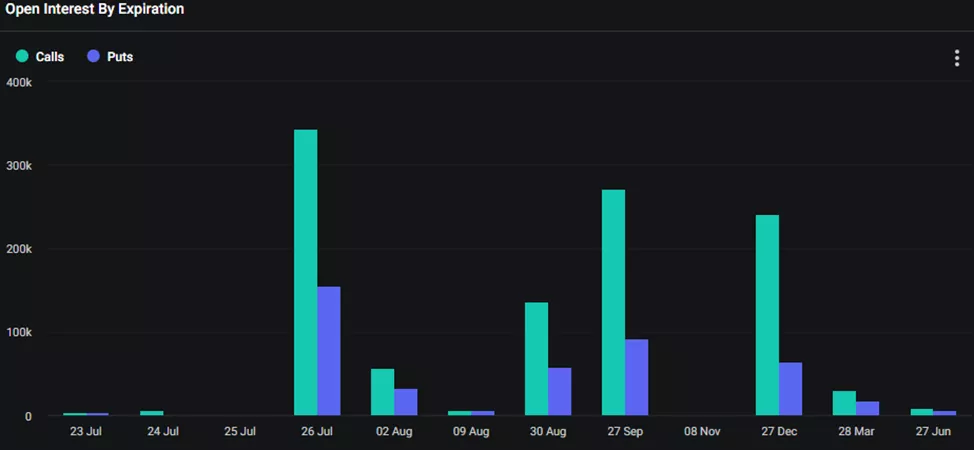

The put-to-call ratio for options expiring on July 26 rose to 0.45. This indicates traders’ desire to hedge long positions against price declines.

The largest open interest is concentrated in contracts with a strike price of $3700. In other words, traders expect movement towards this level in the coming days, writes The Block.

Fournier believes the ETF launch could push Ethereum down to the $2800-3100 range, followed by a rise to $4000 as the effect of inflows into the instruments becomes apparent.

The expert advised “not to lose hope for the asset’s positive dynamics.” The analyst explained a preference for Bitcoin, as “the hype and inflows [into exchange-traded products] are already reflected in the price of the second-largest digital asset by market capitalization.”

Earlier, Steno Research forecasted a net inflow of $15-20 billion into future funds over the year and a rise in Ethereum to $6500.

K33 Research estimated inflows into products in the first five months after trading begins at $3.1–4.8 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!