Experts Anticipate Bitcoin Surge Beyond $95,000

The bitcoin options market is dominated by calls with strikes at $95,000 for the end of April and May, indicating a sustained appetite for risk, according to observations shared by QCP Capital.

Asia Colour — 25 Apr 25

1/ President Trump softened his stance this week—reassuring investors that Fed Chair Powell’s job is safe and signaling plans to reduce the 145% tariff on Chinese goods. Markets responded swiftly, with Bitcoin surging to a high of $94.5K amid stabilizing…

— QCP (@QCPgroup) April 25, 2025

Analysts believe that the bullish positioning is supported by maintaining the price above $90,000.

Experts predict consolidation in the $90,000-94,500 range while awaiting a catalyst for a decisive push to $100,000.

“Given the pace of the recent rally, we maintain tactical caution. The structure has become tighter, which could lead to sharper reactions around key levels,” the review states.

Glassnode noted the market’s transition to a more balanced state.

#Bitcoin’s STH Profit/Loss Ratio has rebounded to the neutral 1.0 level, signaling a balance between coins in profit and loss. Historically, this threshold acts as resistance during bear phases. A sustained move above would suggest stronger momentum and recovery. pic.twitter.com/hpfrP3XKYH

— glassnode (@glassnode) April 25, 2025

Experts noted the return of the speculators’ realized profit and loss ratio to the equilibrium value (1). Historically, this threshold has served as resistance in bear market conditions. A sustained breakthrough above this level would signal a stronger bullish momentum, specialists concluded.

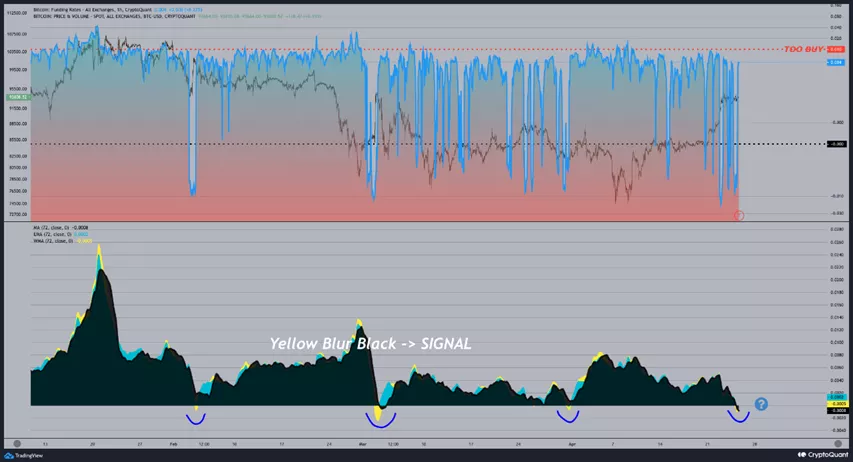

CryptoQuant highlighted the shift of perpetual contract funding rates into negative territory.

This situation has occurred for the fourth time this year. Analysts see this as a precursor to a subsequent wave of short position liquidations should the derivatives market heat up again.

ETF

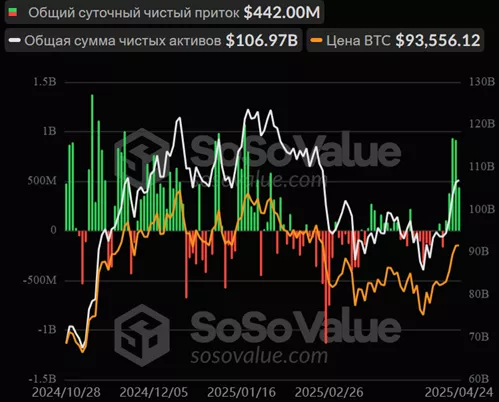

On April 24, investors directed $442 million into spot ETFs based on digital gold, totaling $2.79 billion over the past five days.

The cumulative inflow increased to $38.05 billion. AUM reached $106.97 billion.

Earlier, BitMEX co-founder Arthur Hayes predicted a rise in the value of digital gold above $100,000 due to the U.S. Treasury’s buyback of government bonds.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!