Experts Predict Volatility Following $10.1 Billion Bitcoin Options Expiry

On May 30, the Deribit platform will witness the expiry of bitcoin options with a nominal value of $10.1 billion. Current metrics suggest that the leading cryptocurrency may experience a sharp change in prices.

Vol down, Gamma up. $3.5 Billion BTC Options Delta on May 30 expiries! Big expiry this Friday!

BTC = $109.9K | BVIV = 47.38 | IBIT: $62.50 | Total OI = $54.30B | Total Delta = $12.60B

→ BTC options expiring this Friday (May 30) carry $3.5B in delta across Deribit BTC and IBIT… https://t.co/NmBHTNfz4J pic.twitter.com/zJoPpbHOuG

— Volmex σ (@volmexfinance) May 28, 2025

“Any movement could trigger aggressive dealer hedging, a fragile gamma environment! Expect volatility!” warned Volmex.

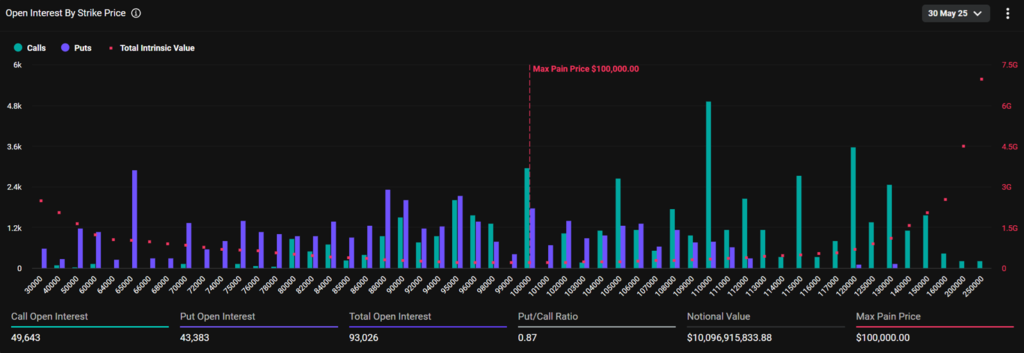

Experts noted the concentration of open interest (OI) at strikes of $100,000, $105,000, and $110,000. The large values of this indicator (totaling $2.8 billion) at these execution prices indicate a net directional risk for traders.

At the time of writing, the OI stands at 93,026 options ($10.1 billion), with 53.3% being calls and the rest puts.

The Deribit DVOL index, which characterizes 30-day expected volatility, continued to decline, indicating a reduced focus on potential price changes ahead of the expiry.

In contracts expiring in June-July, activity is dominated by calls with strikes at $115,000 and $120,000.

Previously, CoinDesk presented six charts of various metrics confirming a solid foundation for bitcoin’s rise above $100,000.

Standard Chartered urged the purchase of the leading cryptocurrency and predicted its price would rise to $120,000 in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!