Former Uphold CEO Backs Kamala Harris’s Presidential Aspirations

Board member and former CEO of the bitcoin exchange Uphold, J.P. Thieriot, has expressed support for U.S. Vice President Kamala Harris in her bid for the presidency, according to CoinDesk.

Thieriot plans to raise funds and secure industry endorsement for her candidacy. This initiative aims to counteract the impact of recent positive comments about the industry from Harris’s Democratic rival, Donald Trump.

According to Thieriot, Trump makes empty promises, whereas the Vice President signals “a new openness.”

The Uphold board member, along with unnamed lawyers, has developed a strategy for Harris, which he has forwarded to her representatives.

“Trump has already tried to ‘capture’ this space and attracted significant capital without making any meaningful political commitments,” commented the businessman.

Thieriot is convinced that Harris can “start with a clean slate”—she will make it clear that the administration will work with the industry and support clear regulations, showing a willingness to appoint a more crypto-friendly head of the SEC.

CEO of Galaxy Digital, Mike Novogratz, stated that the Democratic representative may soon express support for the industry.

“I hope she will announce […] that she wants to be a president who supports innovation and cryptocurrencies. We work a lot with Democrats because we don’t want to be a one-party industry,” explained the top manager.

Market Impact

According to Ruslan Lienkha, head of markets at YouHodler, investors are closely watching the election campaign, as they view a potential Harris victory as a bearish factor for bitcoin.

“A Democratic administration might impose stricter regulations, which could harm the leading cryptocurrency. Harris’s momentum in key states heightens these concerns,” commented the analyst.

The expert explained that a Democratic victory would mean no changes in industry oversight and a high likelihood of the SEC attempting to apply existing TradFi frameworks to digital assets.

According to QCP Capital, a Donald Trump victory in November could dramatically alter the cryptocurrency landscape.

“Creating an American or sovereign ‘put’ on the price of bitcoin could make accumulation during corrections a strategic investment approach,” concluded the specialists.

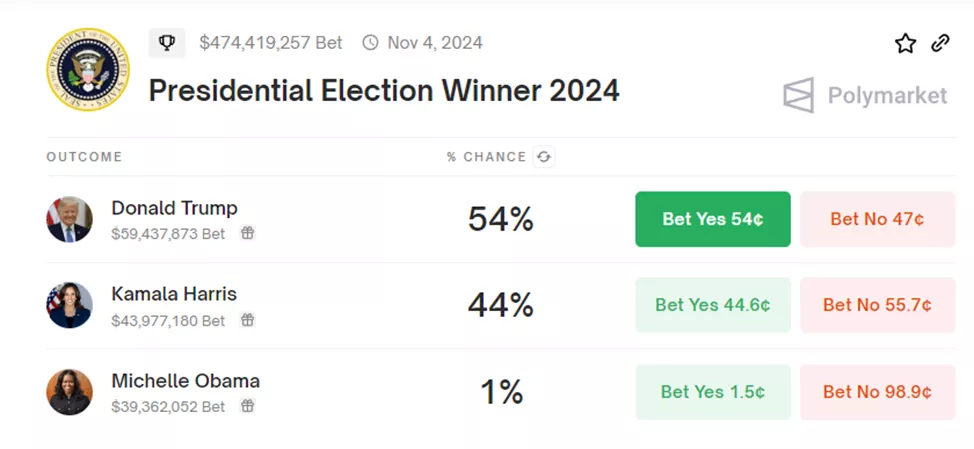

On the prediction platform Polymarket, Trump leads in a head-to-head with Harris, according to 54% of traders.

Unlike the Republican candidate, the Vice President has not publicly stated her position on digital assets or her strategy regarding their regulation.

Bloomberg has noted the hopes of bitcoin companies for Trump’s return to the White House.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!