Glassnode analysts flag potential short liquidations amid extreme leverage

A combination of on-chain indicators and record-high leverage in the derivatives market points to a high likelihood of heightened volatility and short-position liquidations. Glassnode analysts say.

The #Bitcoin market sold off again this week, seeing 6 of 7 days closing in the red.

Meanwhile, open interest in futures markets soars to new ATHs, longs are liquidated, and a possible short squeeze is developing.

Read our analysis in The Week Onchainhttps://t.co/fYetd9O6wA

— glassnode (@glassnode) January 10, 2022

Bitcoin sales during six days after the publication of the Fed’s latest meeting protocol led to reduced activity of new market participants and an increase in the average holding period of coins.

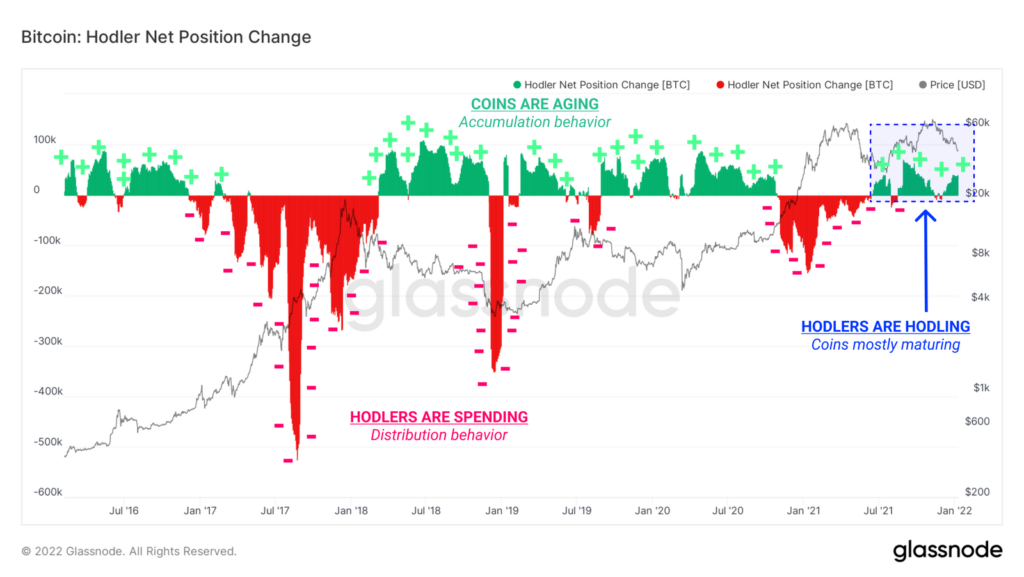

The Hodler Net Position metric has indicated since December 2021 that bitcoins are maturing more quickly than they are spent, a pattern typical of bear markets when retail buying interest is subdued and hodlers dominate.

Other metrics — Value Days Destroyed Multiple and Dormancy Flow — formed a similar picture. This pattern is typically observed in the late stages of macroeconomic bear trends, often accompanied by the capitulation of buyers.

Analysts remain far from certain that investors have felt all the pain, and that the prerequisites for a return to growth have fully formed.

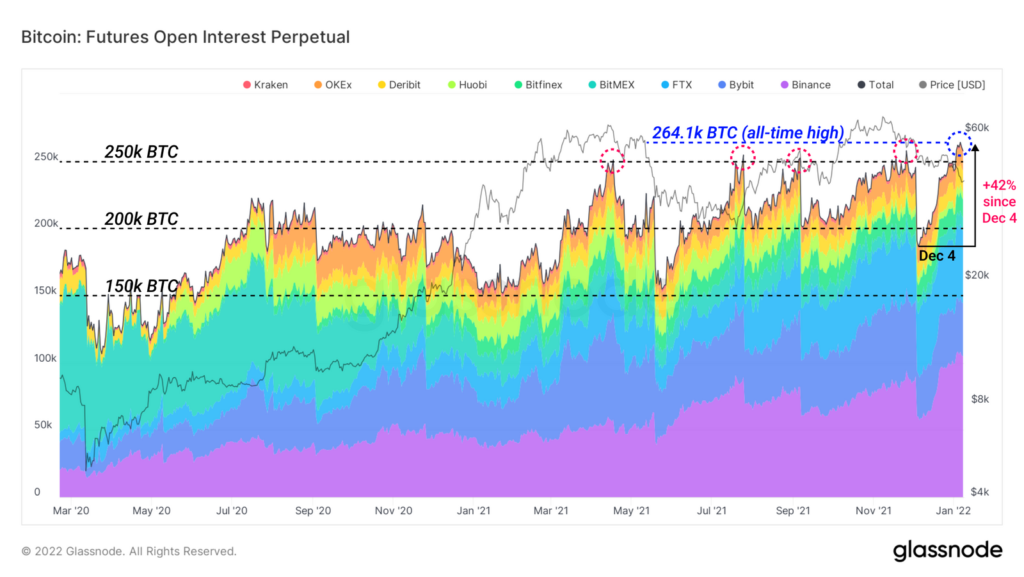

Despite the relative calm of on-chain indicators, there are evident signs of speculative activity in the crypto-derivatives market. Open interest in perpetual contracts reached a record 264,000 BTC. Since December 4 the metric has jumped by 42%, surpassing the previous all-time high of 258,000 BTC.

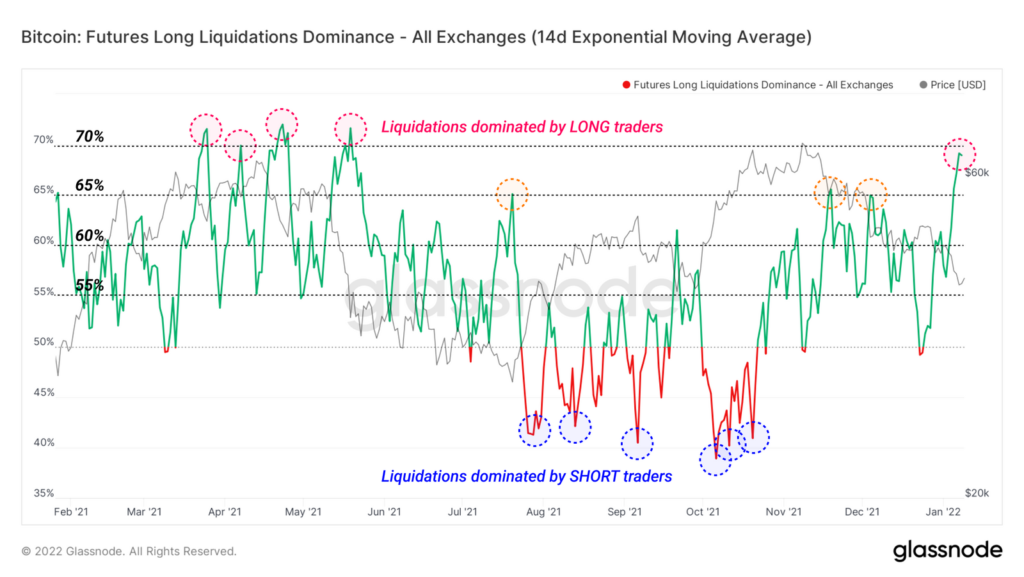

In terms of total market capitalization, open interest reached 2%, a level that previously signalled a squeeze of open positions. Since November, long liquidations have dominated the market. At the start of 2022, this metric reached 69% — the highest since the market crash in May 2021.

Given the current dominance of short positions, such a combination of metrics points to a high likelihood of a local upside reversal.

Earlier, bitcoin futures that for the uptrend to resume a break above $45 500 is required.

predicted a drop in Bitcoin below $40 000 in a high-inflation environment.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!