Hashrate slump, overheated market and cascade of liquidations: what is driving Bitcoin’s price decline

Last week the hashrate of leading Bitcoin pools collapsed amid power-supply problems in China. A few days after the incident the price of the first cryptocurrency fell abruptly by about 10% — from levels above $61,000 to below $52,000.

Discussions about the correlation between hashrate and price have reignited in the community. Some are convinced that there is a substantial causal link between the indicators. Others insist on the opposite — in their view, the correction is caused by a combination of factors.

We have investigated what happened, gathering a range of opinions on the latest market developments.

- Soon after the hashrate crash, Bitcoin’s price fell by 10%.

- Experts disagreed on the main causes of the market correction.

- Major players saw a good opportunity to scale up positions.

What happened in China?

According to Синьхуа, at the end of March methane exploded at a coal mine in Shanxi Province. On 9 April a gas release occurred during coal mining in Guizhou, and on 10 April a mine flooded in the Xinjiang Uygur Autonomous Region.

Managing partner Dovey Wan of Primitive Ventures reported widespread power outages due to comprehensive safety checks. In her observation, Bitcoin’s hashrate “instantly” collapsed by about 30%.

Xinjiang is facing a major power outage due to a coal mine explosion

Bitcoin hashrate drops almost 30% instantly lol

— Dovey “Rug The Fiat” Wan🪐🦖 (@DoveyWan) April 16, 2021

Wan expressed hope for stabilization of power supply in the coming weeks, and “a more distributed hashrate in the future.”

Expected to recover in a week or so. All data centers were shut as well.

Xinjiang+Sichuan combine together have well over 50% of the overall hashrate

Hope can have more distributed hashrate in the future for resilience purpose

— Dovey “Rug The Fiat” Wan🪐🦖 (@DoveyWan) April 16, 2021

«Все дата-центры тоже были закрыты. На Синьцзян и Сычуань приходится более 50% от общего хешрейта».

She also presented a list of mining pools whose computing power dropped most in the 24 hours.

these are pools affected the most by the incident. the accurate numbers at the global hash rate level will take days to refect

charts made by @officialpoolin stats and h/t from local news outlet 吴说区块链 pic.twitter.com/0Wgsng3OBN

— Dovey “Rug The Fiat” Wan🪐🦖 (@DoveyWan) April 16, 2021

Bitcoin price decline following hashrate

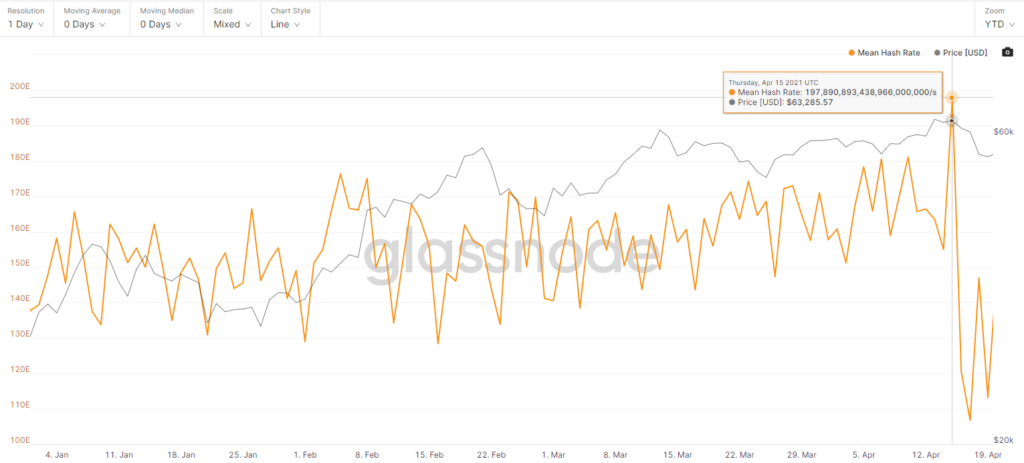

In the run-up to the outages, Bitcoin’s hashrate reached an all-time high near 200 EH/s.

On 17 April the indicator fell to 106.7 EH/s, a drop of 46% from the maximum.

If you smooth the 7-day moving average, the volatility range of the hashrate would narrow significantly and the drop over the corresponding period would be only around 10%.

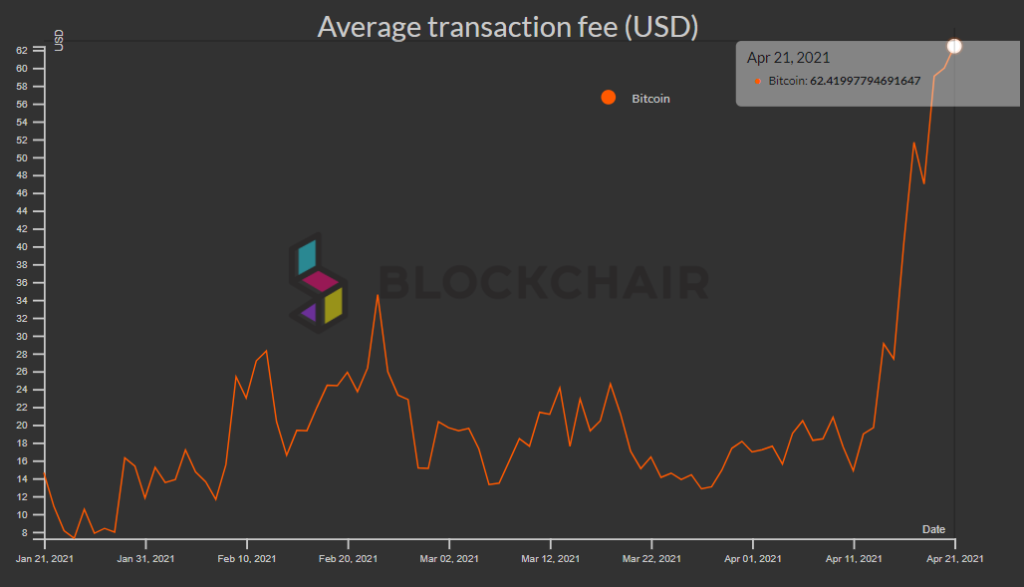

Against a backdrop of falling hashrate, the average transaction fee in the Bitcoin network exceeded $60. The last time such a high level was seen was at the end of 2017 — at the peak of the previous bull market.

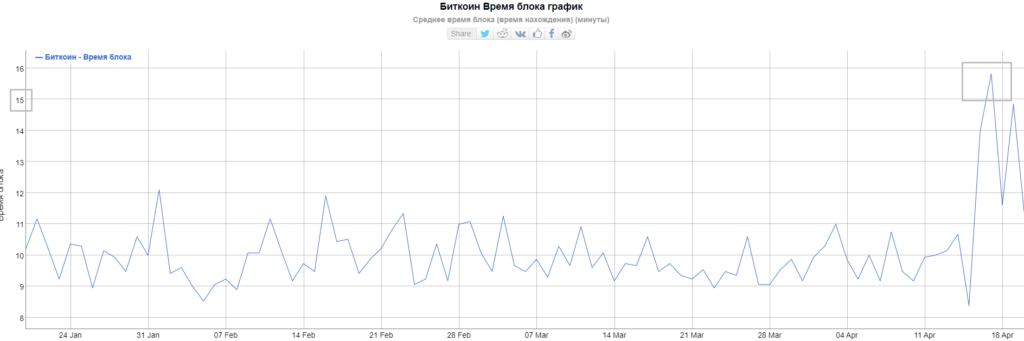

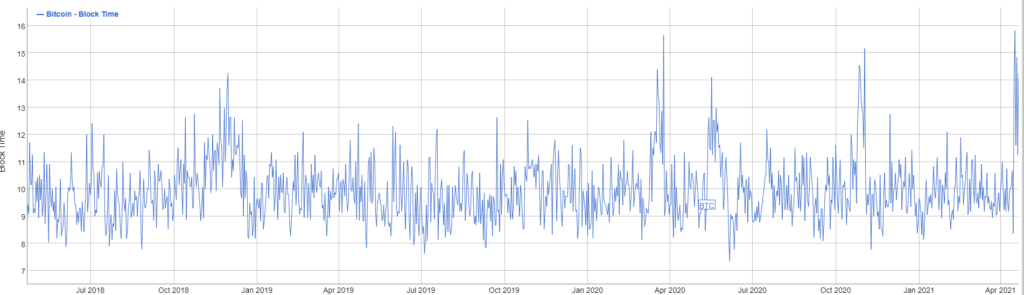

The decline in total network hashing power at the prior difficulty level led to an increase in the block interval to 15 minutes.

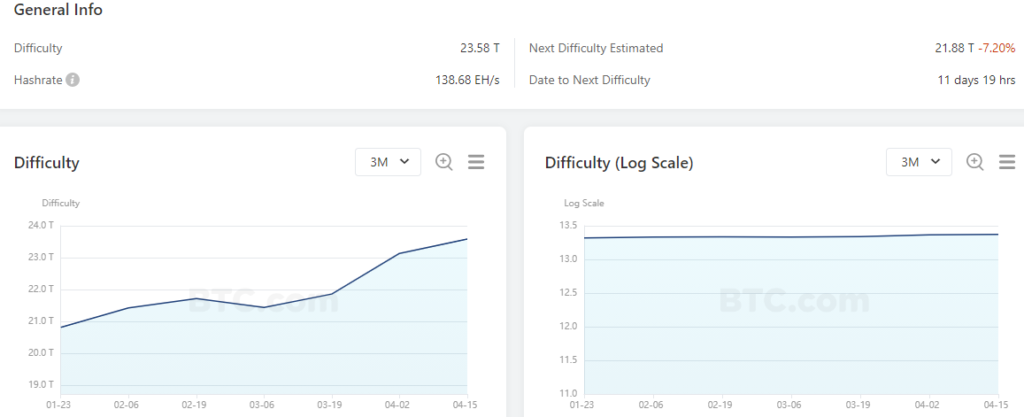

While the network difficulty remains at a record high — 23.58 T — BTC.com forecasts a 7.2% decline in the metric following the next recalculation, expected in roughly 11 days.

Soon after the hashrate drop, Bitcoin’s price fell by roughly 10%.

Against the backdrop of the correction, the volume of liquidations of long positions over 24 hours reached $9.26 billion, a historic record.

Bitcoin’s market capitalization nonetheless held the $1 trillion mark, though it came close several times. This may signal a solid support near $53,500, corresponding to a $1 trillion total value of digital gold.

On-chain data

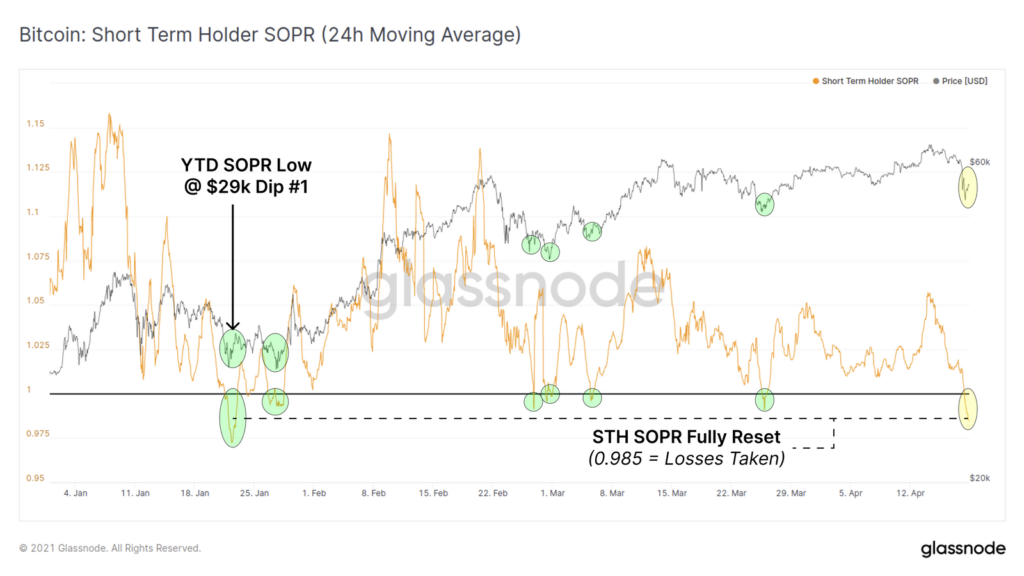

The Short-Term Holder SOPR (the profitability of coins spent by short-term holders) fell below 1, returning to January levels.

This means a substantial portion of investors holding assets for less than 155 days dumped Bitcoin in a panic.

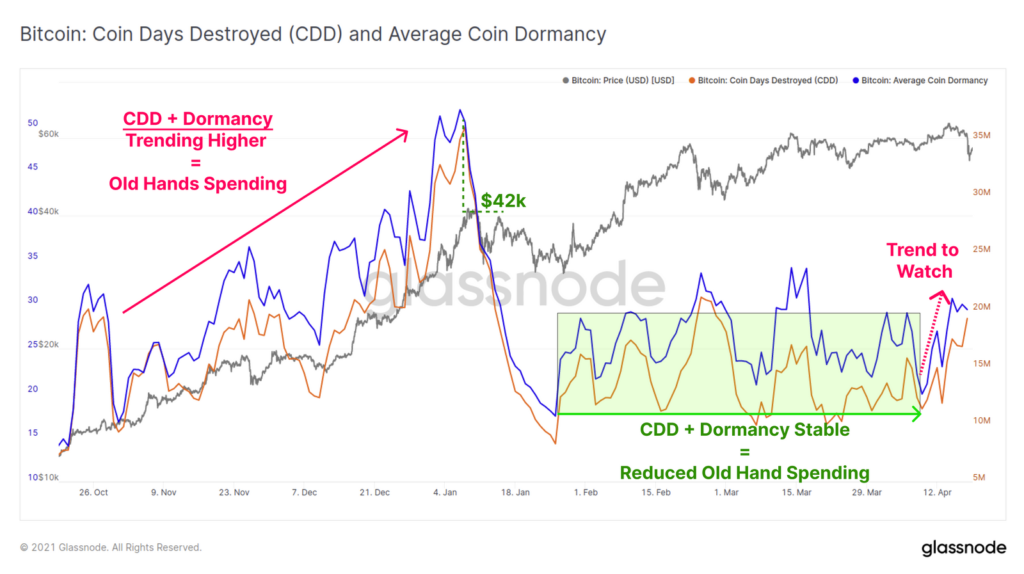

The Coin Days Destroyed and Average Coin Dormancy metric, which tracks movement of older coins, remained relatively calm. However, there is a slight push northward. Further development of this trend would indicate profit-taking by mid- and long-term holders.

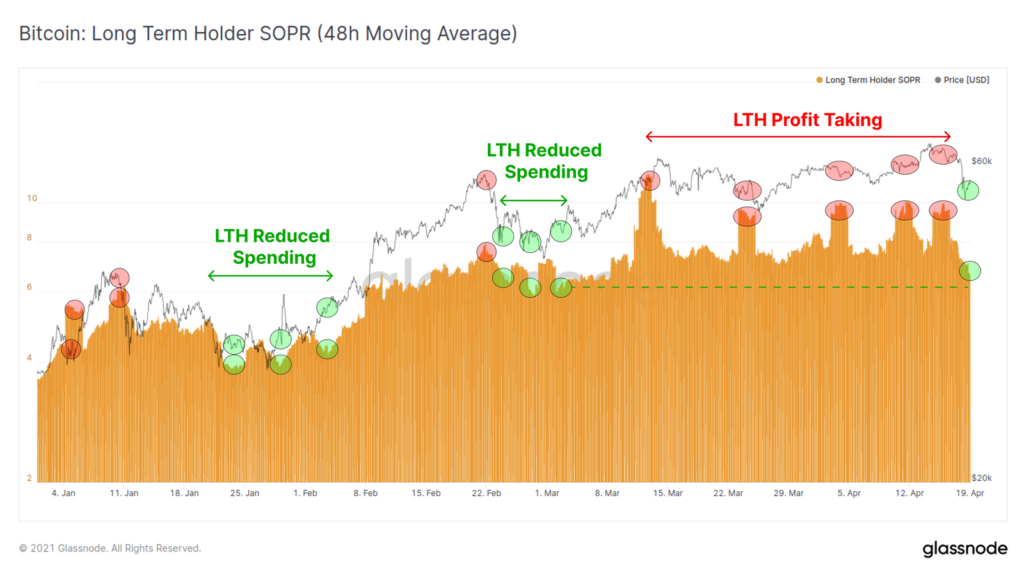

Values of the “long-term” SOPR modification indicate a lack of panic among holders of coins older than 155 days.

Experts’ opinions

Some analysts believe a persistent causal link exists between electricity outages in China and the Bitcoin price drop.

Price and hash rate has always been correlated.

This is BTC price vs today’s hash rate collapse (from the Xinjiang blackout). pic.twitter.com/mywEZLHlA0

— Willy Woo (@woonomic) April 18, 2021

“Price and hash rate have always correlated,” emphasized the infamous Willy Woo.

To support the thesis the expert cited a chart showing a similar situation in November 2017.

For those who remember the hash rate collapse of November 2017… pic.twitter.com/Peb9iuqze1

— Willy Woo (@woonomic) April 18, 2021

“LOL if you think the hashrate drop was the reason for the dump of Bitcoin.”.

LOL if you think the hashrate drop was the reason for the dump of Bitcoin — this is nonsense

— Larry Cermak (@lawmaster) April 18, 2021

“LOL, if you think the hashrate drop caused the Bitcoin dump.”.

For those looking for some explanation, corrections are natural after massive run ups. Weekends with low liquidity are perfect, some dumb catalyst to spook traders off and down we go. Markets were bid up for Coinbase and that ended up disappointing as well. Not surprising

— Larry Cermak (@lawmaster) April 18, 2021

“The best advice in this market is to stop looking for reasons and always be ready for large 20% down moves that have always happened. Stop massively overleveraging and you’re gonna be fine, folks. Hashrate has nothing to do with these; it’s just market exhaustion.”.

Chermak saw no reason for panic over the hashrate drop, calling it a temporary phenomenon. He added that the approaching May rainy season in hydro-rich Sichuan should materially reduce miners’ fixed costs as electricity prices fall.

Regardless of what it is, this is a temporary decline while miners can’t really do anything if they’re not getting electricity. On top of that, hydro season starts in late May and will get significantly cheaper. No reason to panic

— Larry Cermak (@lawmaster) April 18, 2021

The overall hashrate dynamics are heavily distorted if you don’t use moving averages. It’s better to study the data by individual pools.

Hashrate estimators calculate it from the number of blocks being mined in the last 24h and the current block difficulty. On a daily basis, it’s often not accurate because it’s skewed without looking at moving averages. Always better to look at what the pools are reporting

— Larry Cermak (@lawmaster) April 18, 2021

“Hashrate estimators calculate it from the number of blocks being mined in the last 24h …”.

Later he noted that hashrate is recovering as China’s energy situation stabilises.

Hashrate is now down “only” about 13% after Xinjiang miners started gradually getting power today. The outage took about a week.

The largest drop was 20-25%, not 40%+ like many people who don’t understand how hashrate is measured said. pic.twitter.com/kyIzIestqo

— Larry Cermak (@lawmaster) April 22, 2021

“The largest drop was 20-25%. Not 40%, as some people say who don’t understand how hashing is measured.”.

Another well-known analyst — Nic Carter — called the Xinjiang episode a “natural experiment,” a very useful source of information.

The Xinjiang grid going down and its effects on bitcoin hashrate are what economists call a “natural experiment”. Very helpful source of data

— nic carter (@nic__carter) April 17, 2021

In his view, the recent hashrate drop is not statistically significant. Carter stressed that the picture will become clearer on larger timeframes.

— BTC hashrate down 40% day over day, but much of that could be variance. Whole decline not statistically significant (HR variance extremely high). Need to look at longer timeframes (ideally 7d) to determine effect on hashrate

— nic carter (@nic__carter) April 17, 2021

«Наибольшее падение составило 20-25%. Не 40%, как говорят многие люди, которые не понимают, как измеряется хешрейт».

In his view, Xinjiang’s share in the overall hashrate may be smaller than thought, and miners could migrate beyond China.

Based on data that comes in we could end up learning that Xinjiang is a smaller share of the network than we thought (cbeci is great but data is a year old now). My theory has been that HR is migrating out of China, would be great to see confirmation

— nic carter (@nic__carter) April 17, 2021

«Наконец — для тех, кто думает, что запрет майнинга убьёт биткоин, так это будет выглядеть: блоки будут медленнее на время — и всё. Запрет майнинга в одном месте не сделает биткоин менее безопасным — порога для хешрейта не существует.».

Renowned trader Tone Vays suggested that many market participants succumbed to panic after news from China. The May rains season in hydro-rich Sichuan was cited as a period when costs for miners should fall due to lower electricity prices.

Similarly, CEO Luke Salls of Ledgermatic commented that many traders were selling on the news.

“The Bitcoin network is decentralised, which is not true of mining,” added Salli.

Co-founder Edan Yago of Sovryn saw nothing extraordinary in the developments.

“Usually sharp hashrate spikes do not cause price drops. A fall in hashrate slows transactions, which paradoxically makes it harder to move coins to exchanges for sale. The recent price decline is within normal volatility. This is noise, not a signal.”.

BitBull Capital’s Joe Di Pasquale told CoinDesk that market mood may have been worsened by news from Turkey, where the central bank banned crypto settlements centrobanc ban on crypto settlements.

FUD from FXHedge’s Twitter posts, citing unnamed sources reported that several US Treasury investigations into money laundering via digital currencies were underway. The tweets were later deleted.

Option trader Victor Franke of Orca Traders linked Bitcoin’s price drop directly to mass liquidations of long futures positions.

«Moreover, these were weekend days with low liquidity; this is typical, and a catalyst to spook traders and push prices down. Markets were bid up for Coinbase, which disappointed as well.»

Hashrate, moving averages and timeframes

Notes on Blockchain.com’s hashrate graph state:

«Daily values can rise or fall sharply due to block finding randomness. Even with a constant hashrate, the number of blocks found can vary day to day. Our analysts have concluded that the 7-day moving average best represents the underlying power.».

According to the same service’s methodology, hashrate is estimated from the number of blocks found in the last 24 hours and the current network difficulty.

The hashrate formula is:

H = 2^32*D / T

where

D — difficulty;

T — time between blocks.

The chart below shows the historical dynamics of the block interval.

This shows that the interval is not always 10 minutes as originally envisioned by Bitcoin’s creator, Satoshi Nakamoto. Blocks are often found every 8, 9, 11, 12 minutes, and sometimes 15 minutes, as recently observed.

Consequently, the timeframes-dependent hashrate exhibits notable volatility. Therefore, as Larry Cermak and Nic Carter advise, it is prudent to smooth the metric with a moving average and view the trend over longer horizons.

Whale reaction

The NYDIG strategist Greg Sipolaro said that large clients on the platform seized the dip to accumulate more Bitcoin.

«Our platform has been on the buy side over the last 24-48 hours», wrote the analyst.

Sipolaro stressed that NYDIG clients are unfazed by Bitcoin’s volatility; they are “prepared to buy any dips.”

«In our view, the current decline is driven by re-positioning in long positions due to high leverage, rather than a change in the fundamental backdrop», the analyst explained.

He also pointed to the price premium of Bitcoin on Coinbase relative to Binance. Sipolaro concluded that the main price pressure came from Asian holders.

According to CoinShares’ latest report, from 12 to 18 April inflows into crypto-based investment products totalled $233 million, including $108 million into Bitcoin. The figure was the highest in five weeks, reinforcing the thesis of large-capital inflows during sell-offs.

Conclusion

The rise of any asset cannot be endless — corrections occur sooner or later. Most likely, the recent price pullback was caused by a confluence of factors, not solely hashrate or a cascade of liquidations. This implies that understanding the market requires considering a broader picture rather than seeking simple explanations.

The mining industry is expanding not only in China. Recently Australian Mawson Infrastructure agreed with Canaan Creative to supply 11,760 AvalonMiner A1246 devices. Canadian DMG Blockchain Solutions purchased 3,600 ASIC miners to lift its hashrate from 140 PH/s to more than 500 PH/s.

In a Cambridge Centre for Alternative Finance study it states that North America has the highest share of renewable energy use in mining. Increasing computing power in more stable and ‘energy-efficient’ jurisdictions benefits the environment, decentralisation of mining and the industry as a whole.

Despite the recent correction, Bitcoin’s price so far this year has risen by more than 80%. Capital inflows from large investors are growing; Bitcoin ETFs are launching; more companies are accepting crypto payments. That suggests broadening adoption, industry growth and little reason for market participants to be gloomy.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!