How to apply Benner cycles to trading cryptocurrencies

What are Benner cycles?

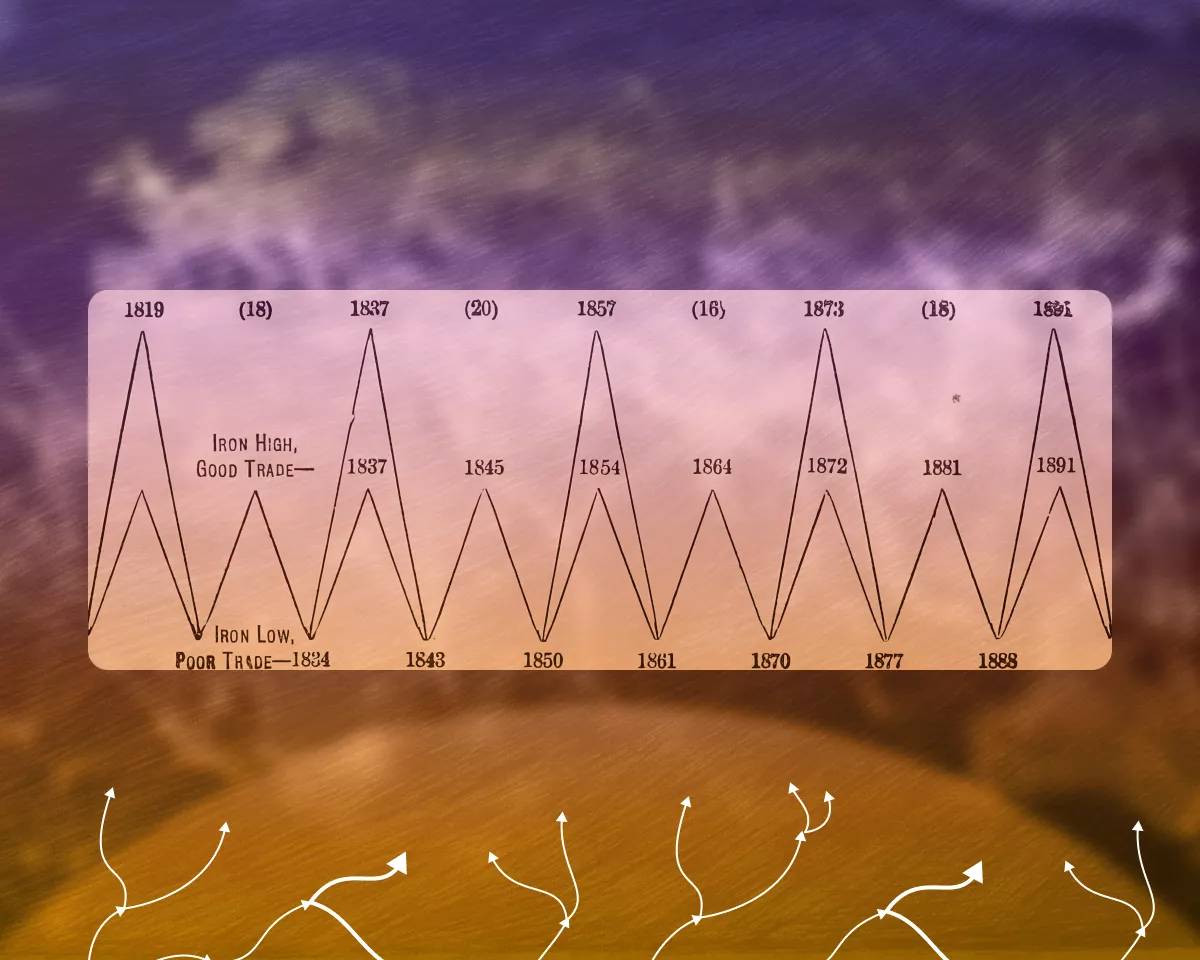

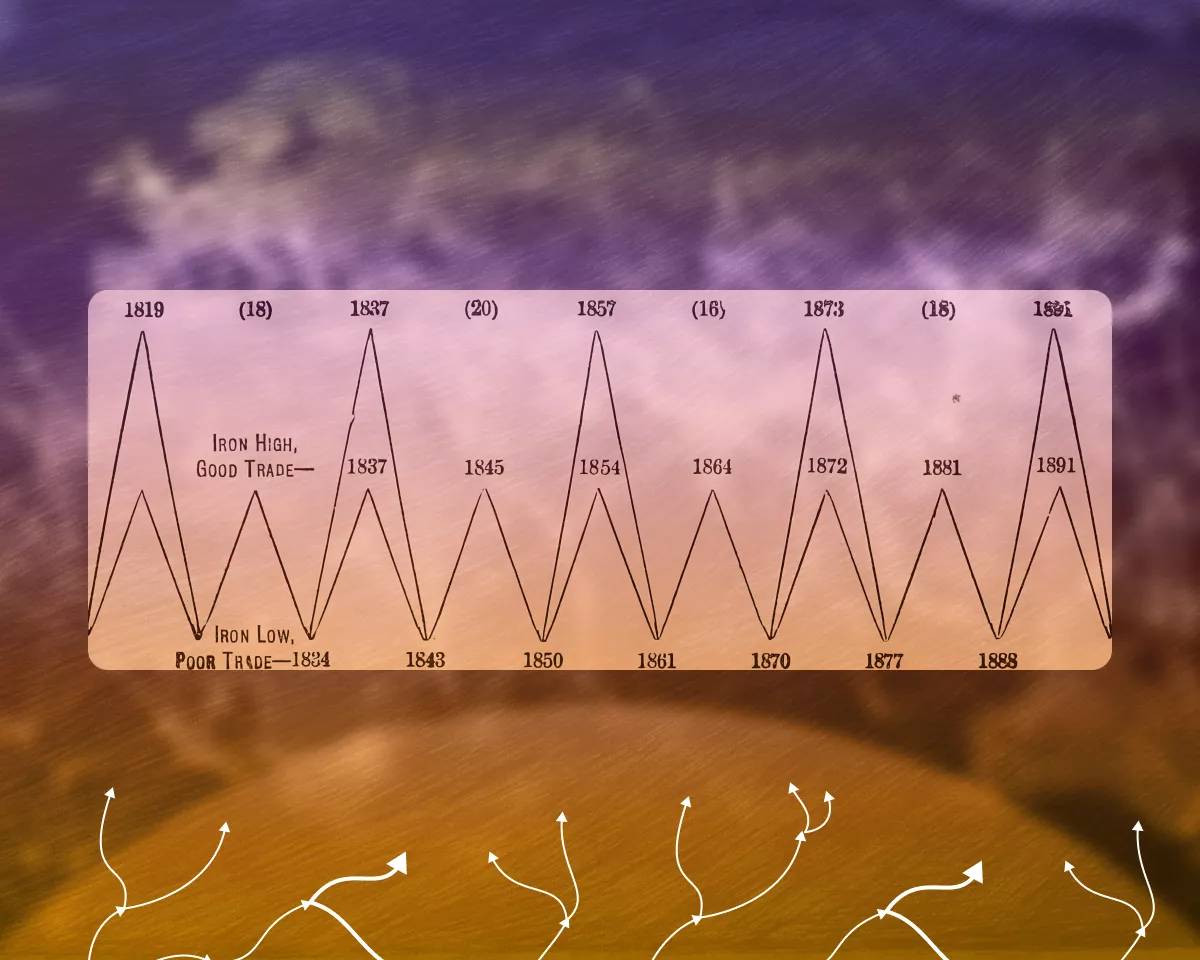

Benner cycles are a chart of market cycles from 1872 to 2059 that aims to forecast business conditions and changes in commodity prices. It is based on periods of peak activity in metal markets (pig iron) and harvests (corn, pork, cotton). The principle is simple: the healthier metallurgy and agriculture are, the more confident business feels overall.

The chart “Periods when money should be made” was compiled in 1872 by businessman George Tritch. The hypothesis gained wider fame thanks to an Ohio farmer, Samuel Benner, who in 1875 published the book “Benner’s Prophecies of Future Ups and Downs in Prices”.

How to use Benner cycles?

The Benner–Tritch cycle chart consists of three horizontal divisions: A, B, C.

Level A. Periods of maximum panic and uncertainty in markets, with alternating peaks every 16–20 years. The recommendation here is to stay out of the market or take conscious risk.

Level B. Years marked by economic activity and high prices for commodities and assets. Benner indicated that this is the best time to sell. These cycles alternate every 8–10 years.

Level C. A good time to buy assets and goods. The advice is to hold until the years corresponding to level B. Level C cycles occur every 7–11 years.

According to Charles Edwards, founder of investment firm Capriole Investments, backtesting the model showed a 91% success rate for trades. The strategy also identified the peaks of major crises with reasonable accuracy, including 1929, 1999, 2007 and 2020. The data were checked against the Dow Jones index.

Edwards, known for developing the bitcoin global price-floor indicator Hash Ribbons, drew the following conclusion:

“Market cycles repeat. Even though times, technologies, markets and regulation have changed a lot over 150 years, market cycles have remained the same.”

How to apply the cycles to cryptocurrencies?

The crypto market is still very young; its price history is too short to test against global models such as the Benner–Tritch cycles. But given bitcoin’s worldwide recognition in financial markets, one can consider digital gold as a commodity, like pig iron.

On that basis, the model suggests that the first cryptocurrency should have been bought in 2012 and held until 2016, with a peak of panic and uncertainty in the global market in 2019. Even these historical markers showed similarities with bitcoin’s price movements.

The next conditional buy signal for the first cryptocurrency is set for 2023, with a plan to hold BTC until 2026.

The next “good” year to buy is slated for 2032, with a target to hold the asset until 2034 and broad market panic in 2035.

It is noteworthy that some analysts reach bullish conclusions for bitcoin using entirely different data and metrics. For example, CMCC Crest co-founder Willy Woo noted that by 2035 bitcoin’s “fair value” will reach $1m, basing his estimate on the user-growth curve.

ARK Invest CEO Cathie Wood, though not “fitting” into the Benner–Tritch model, also projects a powerful growth cycle for bitcoin. Under her scenario, the first cryptocurrency could reach $258,500 to $1.5m by 2030.

Thus, for various reasons many analysts expect a strong impulse in the crypto market over the next decade, in line with the century-and-a-half-old cycle model described above.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!