How the Fed’s policy rate affects cryptocurrency prices

Key points

- The Federal Reserve’s policy rate is the interest rate at which banks make short-term loans to one another. If a bank must transfer or “cash out” funds for a client but lacks sufficient reserves, it borrows from another institution for a brief period at a minimal rate.

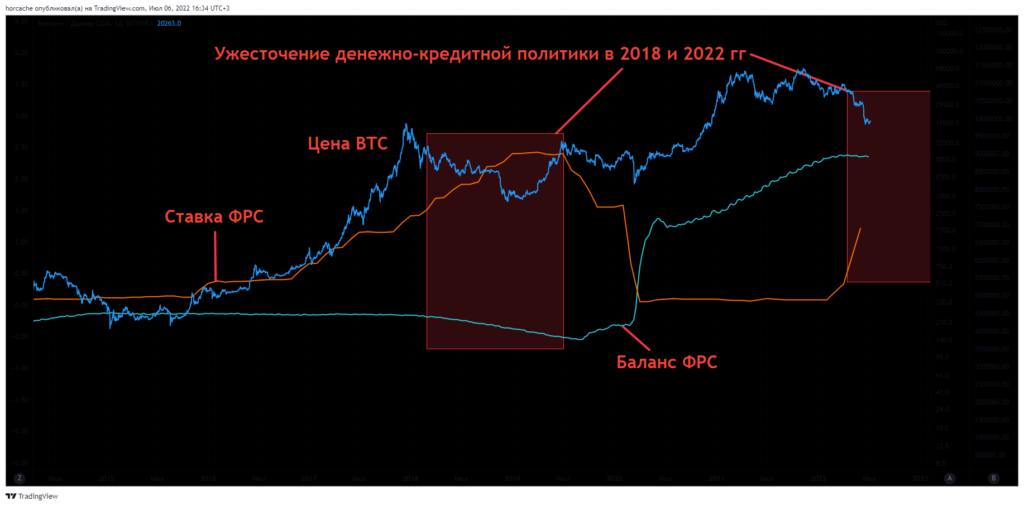

- The Fed’s policy rate is the main tool of US monetary policy. Changes to it ripple through the financial system and equity markets and affect the pricing of multiple asset classes, including bitcoin and other cryptocurrencies.

- History shows an inverse relationship between the Fed’s policy rate and bitcoin’s price: rate cuts tend to boost the market capitalisation of bitcoin and other digital assets, and increases do the opposite.

How are the Fed’s policy rate and risk linked?

Every financial asset carries a certain level of risk. From a macroeconomic perspective, assets are broadly divided into two types:

- Risk assets are instruments with variable returns that depend on investor behaviour and market conditions. Public equities fall into this category. Bitcoin lacks a settled legal status, but in some market phases behaves like a volatile, high‑risk asset whose price movements track stocks.

- Low‑risk or defensive assets offer modest returns but relatively stable prices. They serve as stores of value during downturns. Examples include some fiat currencies, precious metals (notably gold) and highly rated sovereign and corporate bonds. Rate hikes also raise the yields on US Treasuries, the world’s principal crisis hedge.

Why does bitcoin’s price move when the Fed raises rates?

During economic expansions the Fed keeps rates low, encouraging investment and reducing the overall savings rate. Because risk assets promise higher potential returns, they tend to attract more investor interest.

In recessions or crises the Fed raises rates. That pushes economic actors to save more, sell risk assets and seek “safe harbours” such as conservative instruments whose yields are rising.

When the Fed hikes, banks lift borrowing costs for households and businesses, making investment dearer. This slows activity across the economy and dampens demand for goods, services and other components of output.

Overtightening or ending a hiking cycle too late can trigger recession not only in the United States but elsewhere, given the dollar’s dominance.

In such conditions investors prefer assets with predictable income, such as government bonds, rather than volatile risk assets, a group that includes bitcoin.

The Fed’s rate is an important, but not decisive, driver of cryptocurrency prices. Investment decisions should not rest on this factor alone.

Who sees bitcoin as risky, and why?

Some investors view bitcoin as “digital gold,” a store of value; others focus on its high volatility.

At the start of 2022, Grayscale’s specialists classed bitcoin as a high‑risk asset, highlighting a long‑term uptrend outpacing gold and the cryptocurrency’s volatility as fertile ground for speculation.

In April, analysts at Arcane Research said the correlation between bitcoin’s price and the Nasdaq Composite, a proxy for America’s tech sector, had peaked. Tech stocks are seen as volatile “growth assets”.

In early June 2022, Bloomberg Intelligence commodity strategist Mike McGlone likewise drew parallels between the crypto market’s slump and the “great retracement” in high‑risk assets during the 2008 and 1987 crises. Although McGlone expects the first cryptocurrency to gain store‑of‑value status, he currently classifies bitcoin as a risk asset.

According to Kaiko, by June 2022 bitcoin had reached peak correlation with leading stock indices S&P 500 and Nasdaq 100, underscoring its volatile, high‑risk character.

The first cryptocurrency does not always move with risk assets. In 2020, VanEck Global’s fund managers recorded a record correlation between bitcoin and gold. In 2021, ARK Investment Management head Cathie Wood said big business was looking at bitcoin as a hedge against dollar inflation. A vivid example is MicroStrategy, which holds part of its capital in the first cryptocurrency.

What happens to bitcoin’s price when the Fed eases?

When the Fed lowers rates, it buys assets in the open market, injecting liquidity. Money becomes more plentiful, credit cheaper and the investment climate improves. This accelerates growth by giving businesses and households access to cheaper borrowing.

Easy policy and abundant cheap money lead investors to relax risk constraints and fund new technologies, R&D, construction, startups, funds and other risky instruments, including cryptocurrencies.

Another tool the Fed can use is quantitative easing. It was first deployed during the 2008 crisis. By expanding its balance sheet—effectively printing money—the Fed began buying in the US market unreliable securities and the bonds of large companies in financial distress.

In doing so the regulator propped up the economy and helped avert mass defaults. Quantitative easing, however, sharply increased the money supply and raised inflation risks.

Soon after, the Bitcoin network went live, positioned as a response to problems in the financial system and official policy.

The Fed turned to quantitative easing again, on a much larger scale, in spring 2020 when the United States went into lockdown during the pandemic.

From March to June 2020 the Fed pumped nearly $3 trillion into the economy. That not only halted the stock‑market slide but also unleashed a powerful rally in risk assets. Crypto followed suit.

That cycle, however, ended in a sharp rise in dollar inflation brought on by the Fed’s actions, which weighed on bitcoin’s price.

Will bitcoin remain a risk asset?

There is no definitive answer. In the past, researchers have repeatedly observed correlation between bitcoin and gold, the traditional defensive asset.

In the view of Pantera Capital’s founder Dan Morehead, the Fed is excessively manipulating the market by buying ever more distressed assets—already causing strains in US labour markets, Treasuries and mortgage lending. Problems in America’s economy will inevitably spill over to other countries.

He argues that bitcoin’s only problem is its rising correlation with high‑risk assets, particularly the S&P 500 during drawdowns. He is confident this is not a permanent state.

Morehead is convinced that, sooner or later, the paths of cryptocurrencies and traditional assets will diverge for good.

Quick answers to common questions

How does a Fed rate hike affect cryptocurrencies?

Raising rates is meant to “cool” the US economy. That tends to hurt equities. Although cryptocurrencies are a distinct asset class, they correlate closely with stocks, so their prices can fall when the Fed tightens. Correlations may shift towards defensive assets again in future, as they have before.

How will a Fed meeting affect bitcoin?

Until the US economy shows signs of sustained recovery, the Federal Reserve is likely to keep raising rates. At the July 2022 meeting the regulator lifted them by 0.75 percentage points. According to analysts, the Fed will raise rates for at least the next few meetings.

Why are cryptocurrencies falling?

One key reason prices fell in 2022 was the broader global downturn triggered by the pandemic. Disrupted supply chains lifted prices across whole categories of goods, while large‑scale liquidity programmes in developed economies pushed inflation to record levels.

What else to read?

What is the Austrian School of Economics?

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!