Institutional Investors Withdraw 10% of Ethereum Supply from Exchanges

Ethereum reserves on exchanges hit a low, with institutional investors accumulating.

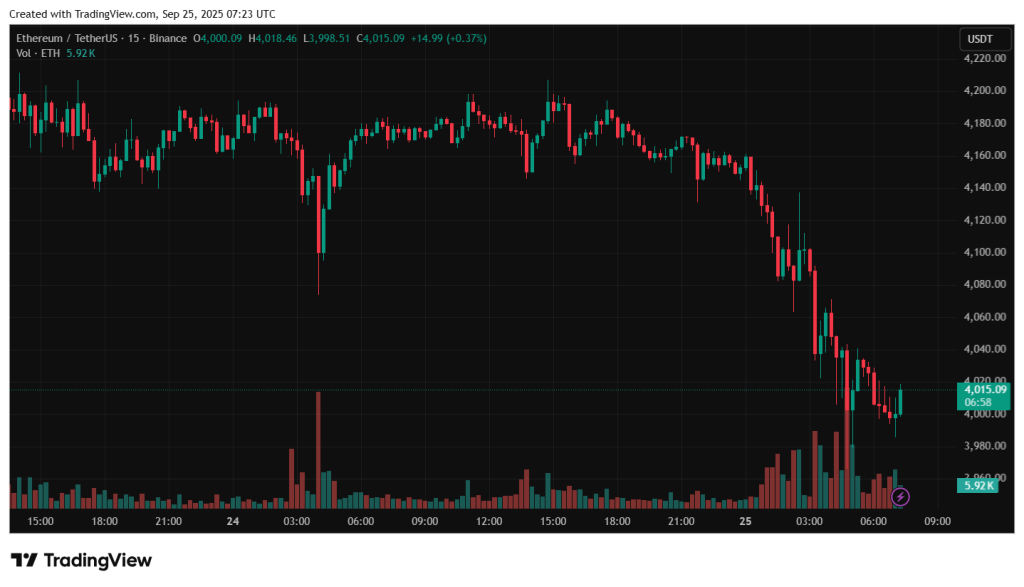

The price of the second-largest cryptocurrency by market capitalization fell below $4,000 as reserves of the asset on centralized exchanges dropped to their lowest level since 2016.

At the time of writing, Ethereum is trading at $4,015.

Ethereum reserves on trading platforms have been declining since mid-2020. Over the past two years, the available supply of the asset on exchanges has decreased by nearly 50%. The outflow accelerated from mid-July when balances fell by 20%.

According to Glassnode, 14.8 million ETH remain on centralized platforms.

CryptoQuant confirmed the trend: the ratio of exchange reserves to the total Ethereum supply reached 0.14 — the lowest level since July 2016.

The decline in CEX balances typically indicates that investors are transferring assets to cold wallets, into staking, or the DeFi sector for income generation.

Institutions Accumulate Ethereum

The primary reason for the outflow has been the active accumulation of Ethereum by large holders and investment funds.

Since April, around 68 organizations have acquired 5.26 million ETH for approximately $21.7 billion, according to StrategicEthReserve. This represents 4.3% of the total asset supply. Most of the coins are directed into staking rather than being held on exchanges.

Spot Ethereum-ETFs in the US have also attracted significant funds. They currently manage 6.75 million ETH worth nearly $28 billion (5.6% of the total issuance).

Thus, about 10% of the total supply has shifted to institutional entities, with accumulation rates accelerating in recent months. BTC Markets analyst Rachel Lucas described the development as “Ethereum’s Wall Street transformation.”

@ethereum is getting the Wall Street glow-up. Treasuries are stacking ETH, exchange supply hits 9-year low, and Tom Lee’s calling US$10K to US$15K by year-end. BitMine holds 2.4M ETH. @btcmarkets

— Rachael (@Rachael_M_Lucas) September 24, 2025

USDT Returns to Ethereum

Amidst this, Ethereum regained its lead in the supply of stablecoin USDT, surpassing the TRON network. The capitalization of USDT on Ethereum reached $80 billion, according to The Block.

Preferences in infrastructure for “stablecoins” are shifting. Despite lower fees on the TRON network, users increasingly opt for the developed DeFi ecosystem and institutional Ethereum.

The daily number of stablecoin transactions on the blockchain of the second-largest cryptocurrency by market capitalization approached 1 million. This indicates active use of USDT for payments and settlements, rather than mere static storage.

The return of Ethereum as the primary network for USDT comes amid the integration of stablecoins by traditional financial companies. Their choice of Ethereum could strengthen its position as the main settlement layer for complex financial products.

Back in September, SharpLink Gaming CEO Joseph Shalom described the ultimate goal as transferring the traditional financial structure to the blockchain.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!