June 2021 in Figures: Hashrate Slump Amid China’s Crackdown, Polygon Sets Records, Tether Halts the Machine

Key Highlights

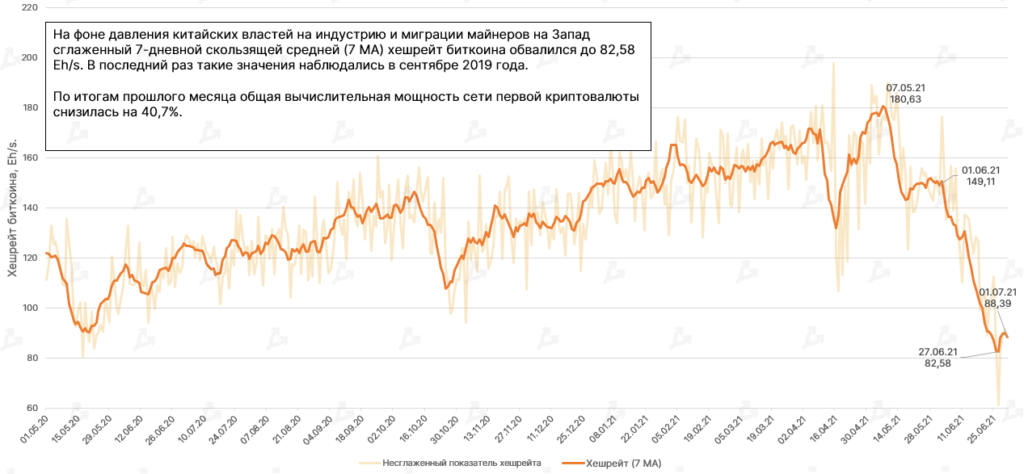

- Mining operations are leaving China en masse. Over the month, Bitcoin’s global average hashrate fell by about 40% to just above 80 EH/s.

- Bitcoin traded in a range of $28,600 to $41,340 and closed one of the worst quarters on record.

- Ethereum declined by 15%, but remained in the green for the second quarter.

- Volume on leading spot exchanges fell 52% to a five‑month low of $1.2 trillion.

- Volume on decentralized exchanges dropped 50% — from $143 billion to $68 billion.

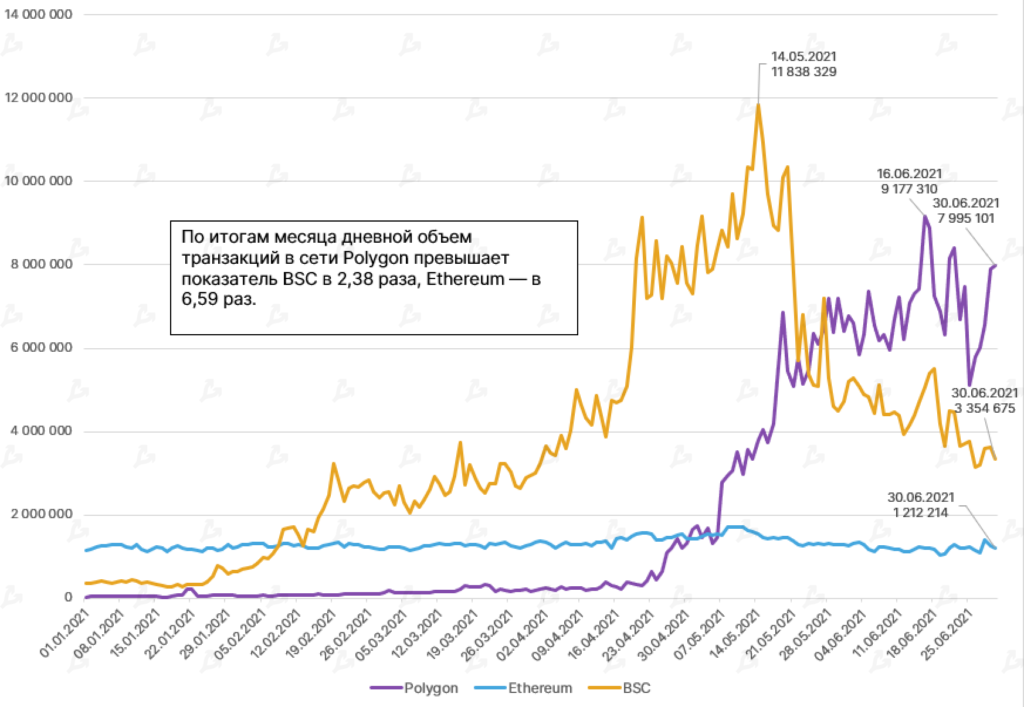

- Polygon’s daily on‑chain activity surpassed, by severalfold, both Binance Smart Chain and Ethereum.

- Bitcoin and Ethereum miners’ revenues declined by 43% and 53% respectively. Average network fees fell to yearly lows.

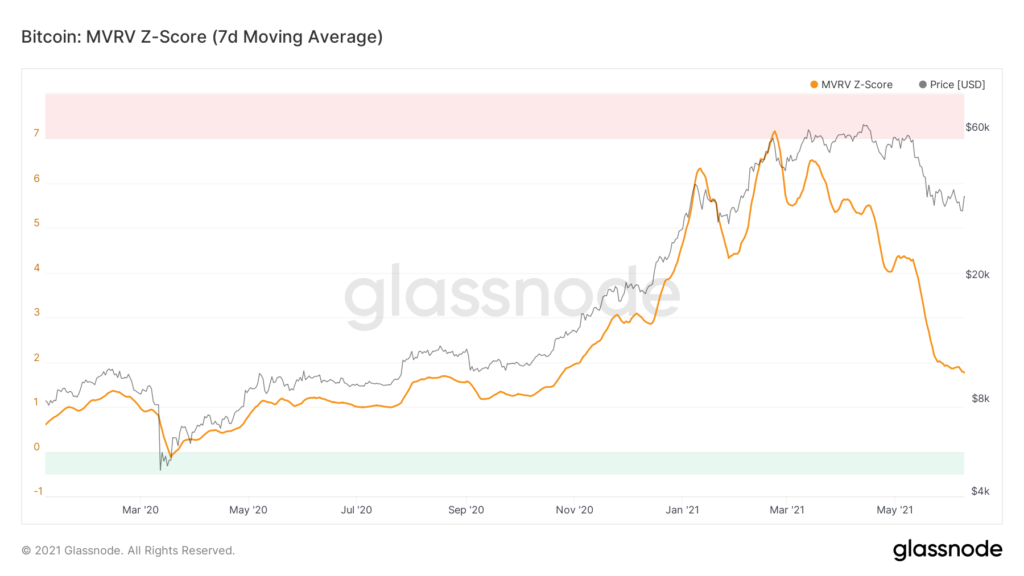

- Long‑term investors were accumulating cryptocurrency, with on‑chain indicators signalling Bitcoin oversold.

Leading Asset Dynamics

- June started at $37,280 (Bitstamp) and repeatedly attempted to break out of the range. The local high was $41,340 and the low $28,600.

- Bitcoin fell 6% in the first month of summer.

- The second quarter of 2021 was Bitcoin’s worst since 2012, with prices down 40%.

- In June, Ethereum fell 15%.

- From the May 12 peak of $4,380, the cryptocurrency was down 48%.

- Ethereum finished the second quarter up 18%.

- The market correction also hit popular altcoins. Bitcoin’s dominance rose from 41% to 45%.

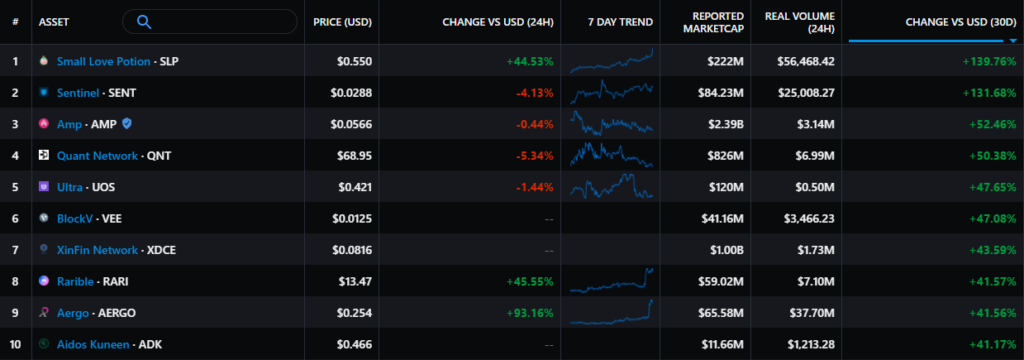

- Smaller, low-liquidity coins rose, with the notable exceptions of the AMP asset listed on Coinbase Pro and Rarible’s governance token.

Equities tied to cryptocurrencies regained some ground toward month‑end:

- Coinbase (COIN) shares rose 6.8%;

- The fundraising via a bond issue and the subsequent purchase of 13,005 BTC positively impacted MicroStrategy (MSTR), lifting its shares 42%;

- Galaxy Digital (GLXY) shares rose 11.5%.

June mood for mining company equities:

- Canaan (CAN): −8%;

- Ebang International (EBON): +5%;

- Riot Blockchain (RIOT): +39%;

- Hut 8 (HUT): +7%;

- Marathon Digital (MARA): +27%.

Macroeconomic Backdrop

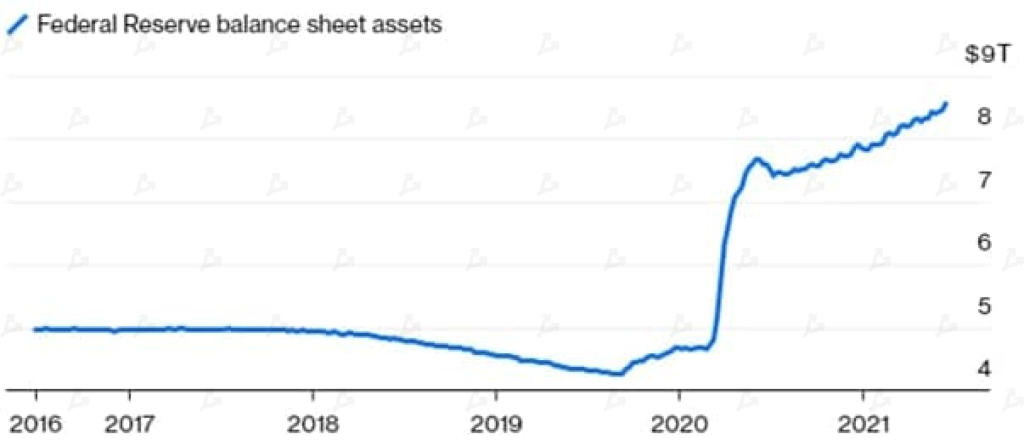

By mid‑June, the Fed’s balance sheet surpassed $8 trillion for the first time in history. By the week ending 24 June it stood at $8.15 trillion. Since the start of the year, the balance sheet is up 10.7%, and up 76.7% vs. the covid‑era low in 2020.

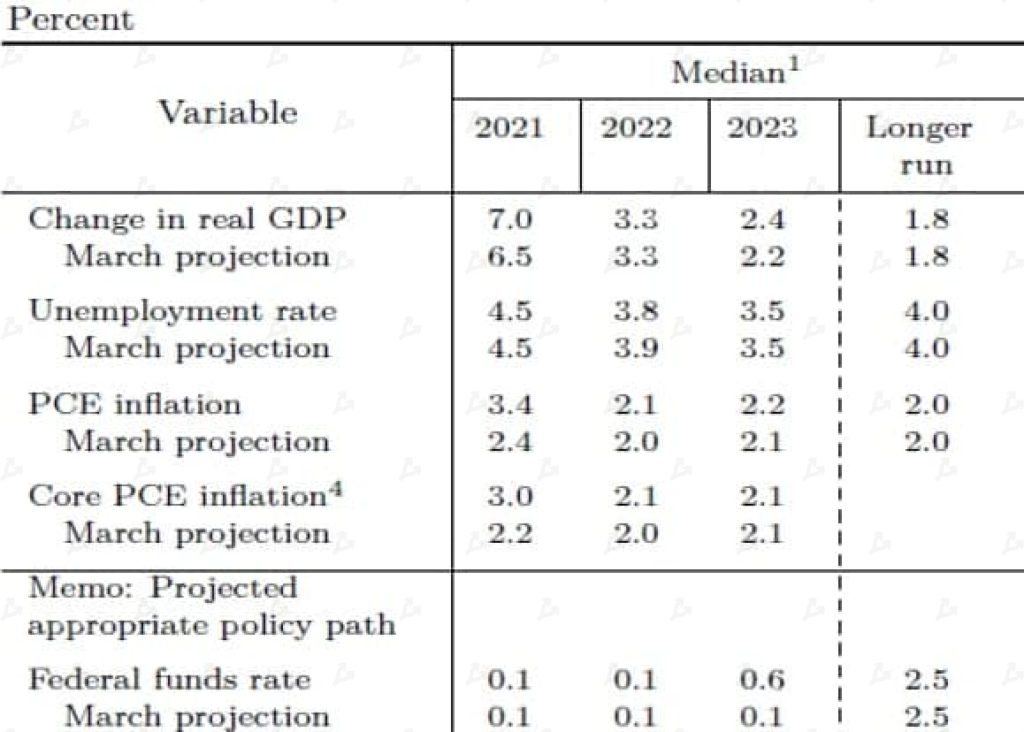

The June 16 FOMC gathering delivered surprises. Compared with March, the inflation projection for 2021 was raised by 1 percentage point—to 3.4%.

The path of rates points to a shifted consensus on the first move for the federal funds rate in 2023. Most members now anticipate two hikes in 2023. Seven of 18 expect a move in 2022. The rate‑hike probability priced into futures market stood at 57.2% for a first increase in September 2022, up from 38.8% a month earlier.

Revisions to the timelines affected expectations for tapering the QE program. According to the Bank of America June poll, nearly two‑thirds of fund managers expect a signal on this front by August–September.

A return to normal monetary policy could stress financial markets. The crypto market may come under pressure if it begins to behave more like risk assets, as observed in March 2020.

Market Sentiment and Correlations

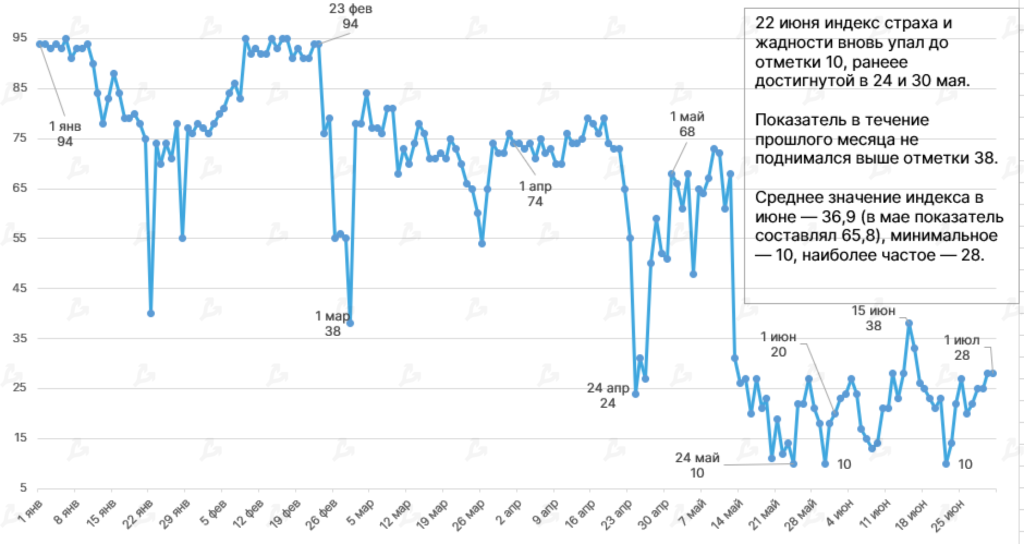

- Last month, markets were predominantly bearish: price movements at relatively low levels and a negative Fear & Greed index. The latter hovered around 28 most of the month, with readings dipping to 10 and never rising above 38.

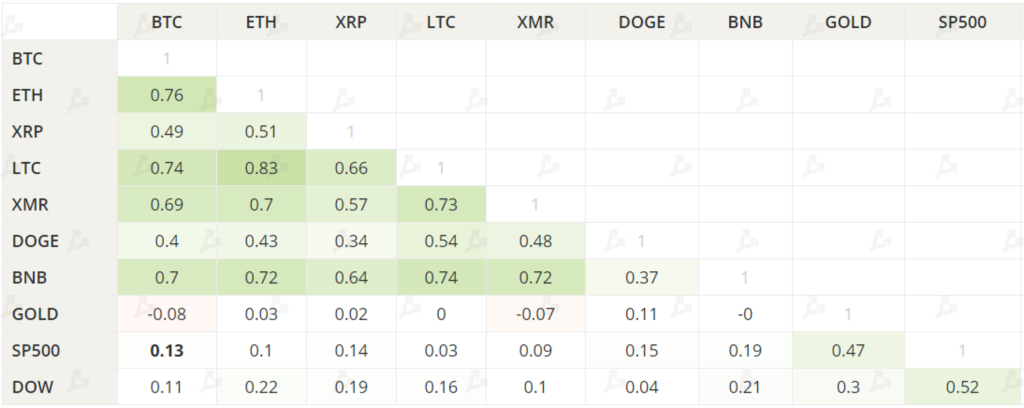

- Bitcoin’s correlation with other popular assets—Ethereum, Litecoin, Monero—strengthened. The statistical link with the S&P 500 fell markedly—from 0.25 to 0.13. Correlation with gold remains essentially absent, as before.

On‑Chain Data

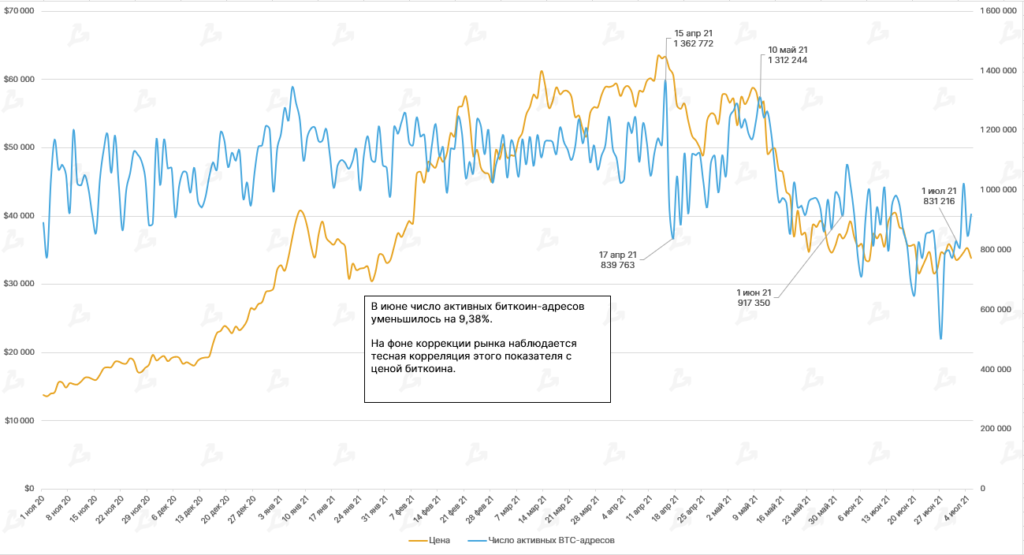

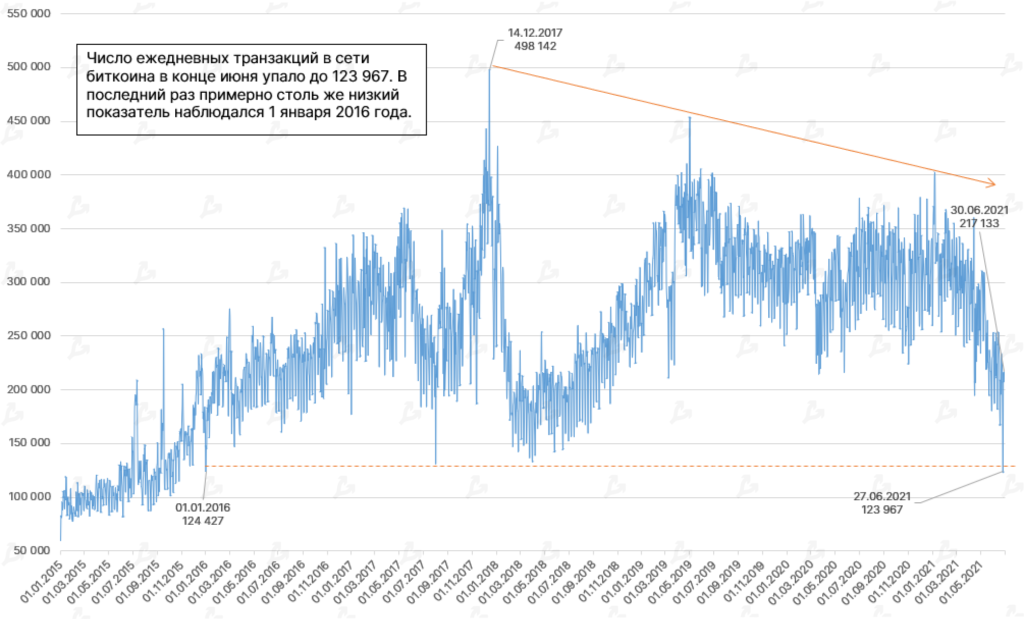

- The number of active Bitcoin addresses fell to levels last seen in February 2019. Over the month, the figure dropped by more than 9.38% — from 917,350 to 831,216.

- On‑chain activity fell sharply across on‑chain metrics for Bitcoin and Ethereum. Glassnode experts believe that this pattern signals a high degree of uncertainty about the price path.

- Values of the MVRV Z‑Score are approaching 1, where Bitcoin is neither overvalued nor undervalued by the market. The overbought zone was reached earlier this year in February. However, the deeply oversold zone seen in March 2020 remains well below reach.

- Based on NVT Price, the fundamental value of Bitcoin is slightly above $50,000. Therefore, BTC is currently undervalued by the market.

For more on on‑chain indicators, read ForkLog’s overview.

- Average fees for Bitcoin and Ethereum transactions fell to the lowest in 2021 — $4.36 (6 June) and $2.33 (26 June) respectively.

- The seven‑day smoothed hashrate for Bitcoin fell from 149.11 EH/s to just over 80 EH/s — a level last seen in September 2019.

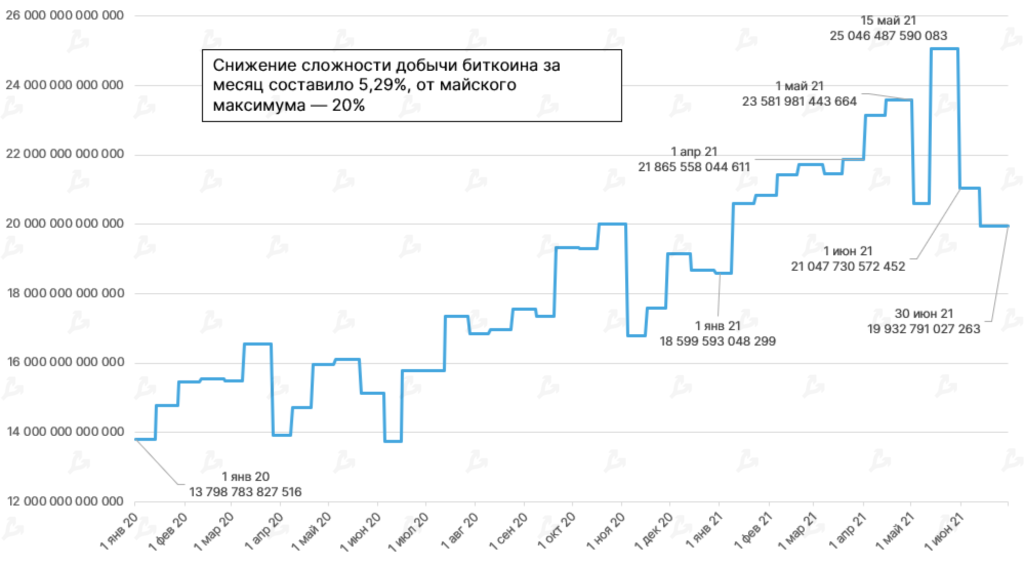

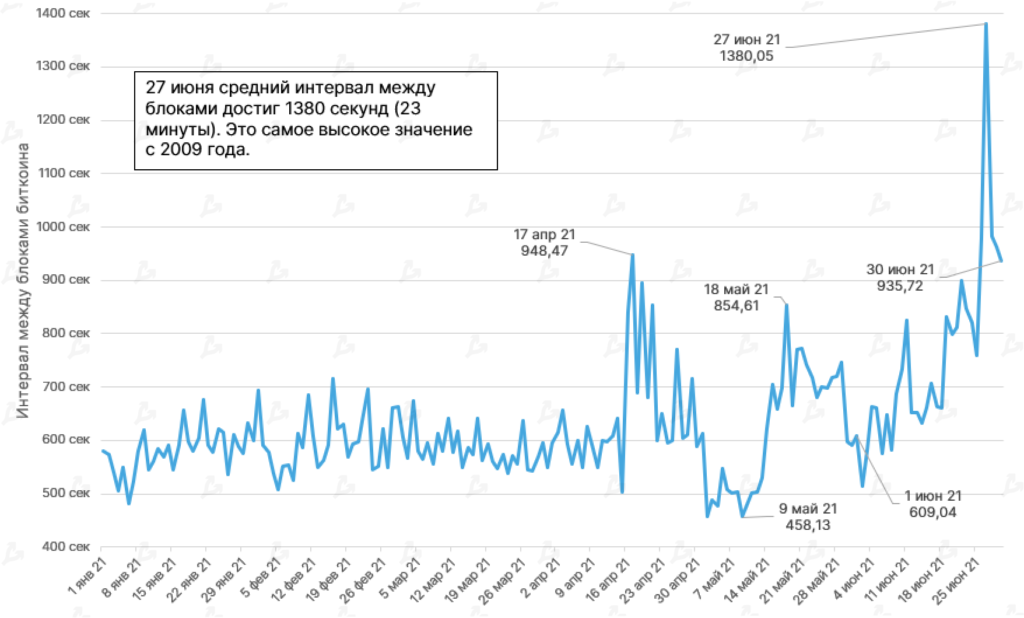

- June’s mining difficulty finished at 19.93 T. The month saw a 5.29% decline from the May peak of 20%. After the early July recalibration, difficulty fell a further 27.94% to 14.36 T. BTC.com expects a further 28% drop. Difficulty alignment with hashrate should stabilise miner revenues and the block interval.

- On June 27, the average block interval reached 1,380 seconds (23 minutes) — a level last seen in 2009.

- Because of the sharp hashrate drop, the interval between blocks rose to almost two hours.

Ethereum hashrate fell by 19.5%, with the drop from the May peak exceeding 22%.

Trading Volumes

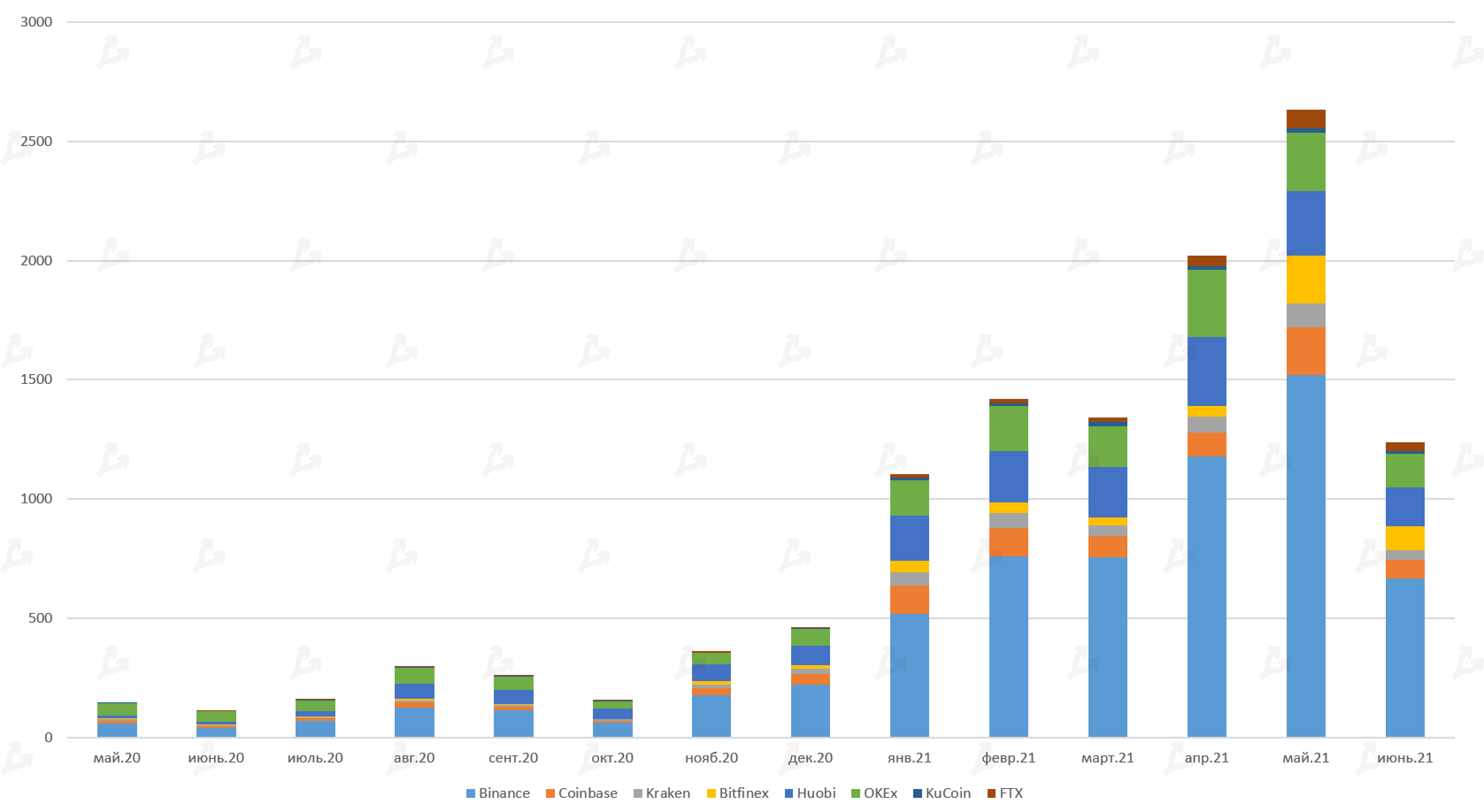

- Volume on leading spot platforms fell 52% in June, hitting a five‑month low of $1.2 trillion.

- Binance’s turnover fell from $1.5 trillion to $668 billion, Huobi from $270 billion to $141 billion, Coinbase from $201 billion to $77 billion.

Futures and Options

- In June, aggregate derivatives trading remained robust. Futures volume reached $2.1 trillion, versus $2.5 trillion in the prior month, a record.

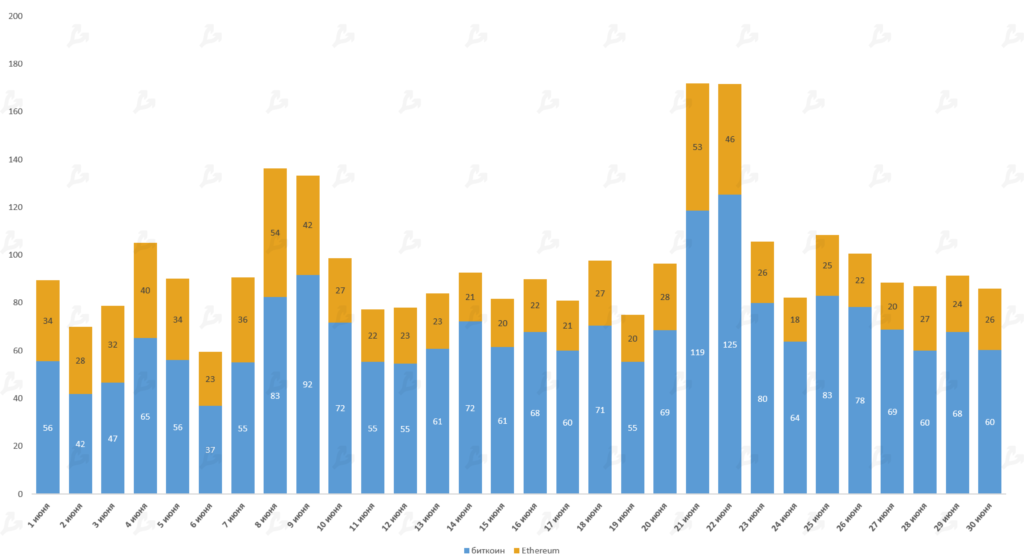

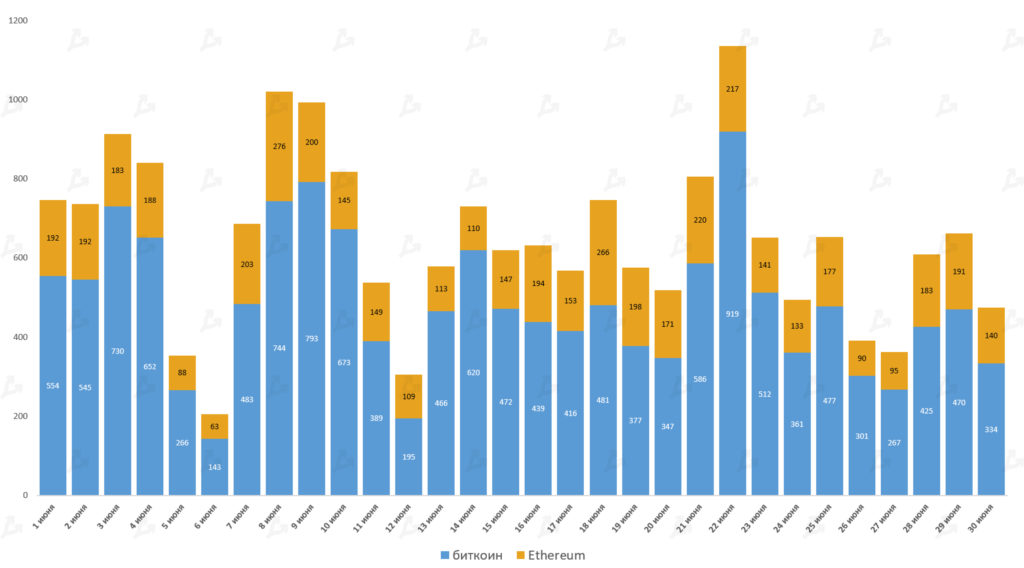

- During peak sessions (8–9 June and 21–22 June), when Bitcoin dipped to $30,000 and below, Bitcoin futures volume approached $100 billion in the first case and about $125 billion in the second.

- Similar dynamics were seen in Bitcoin options and Ethereum derivatives.

DeFi

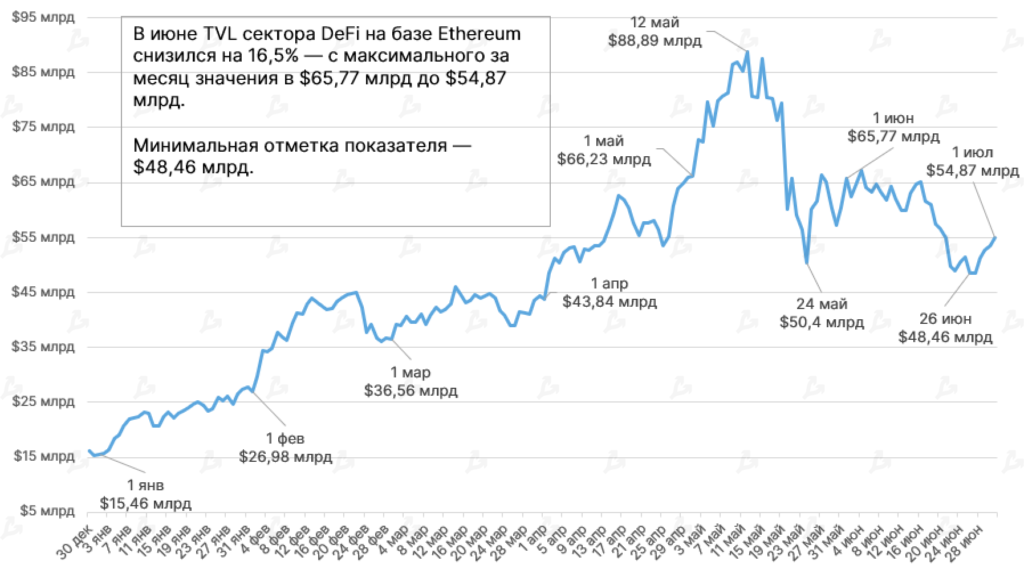

- Over June, the total value locked across DeFi tokens slipped in line with a May downturn, down 16.5% for the month.

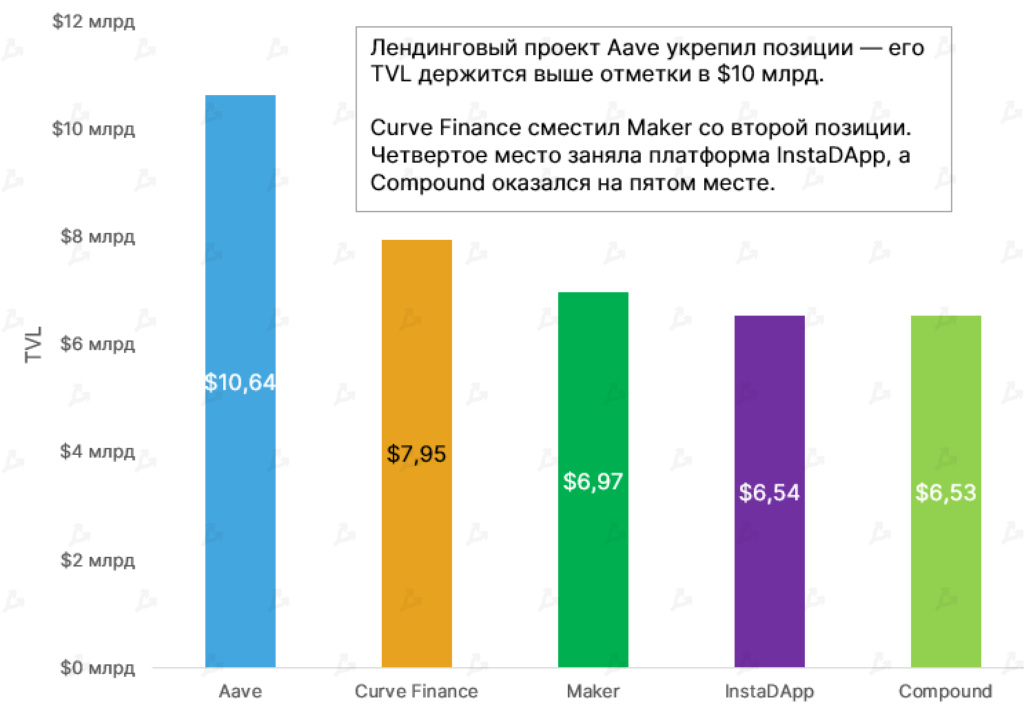

- Aave remained in first place by TVL, widening the gap from other big players. The move may have been helped by its integration with Polygon, which offers fast and cheap transactions. Curve Finance rose to second place, followed by InstaDApp in fourth place by TVL.

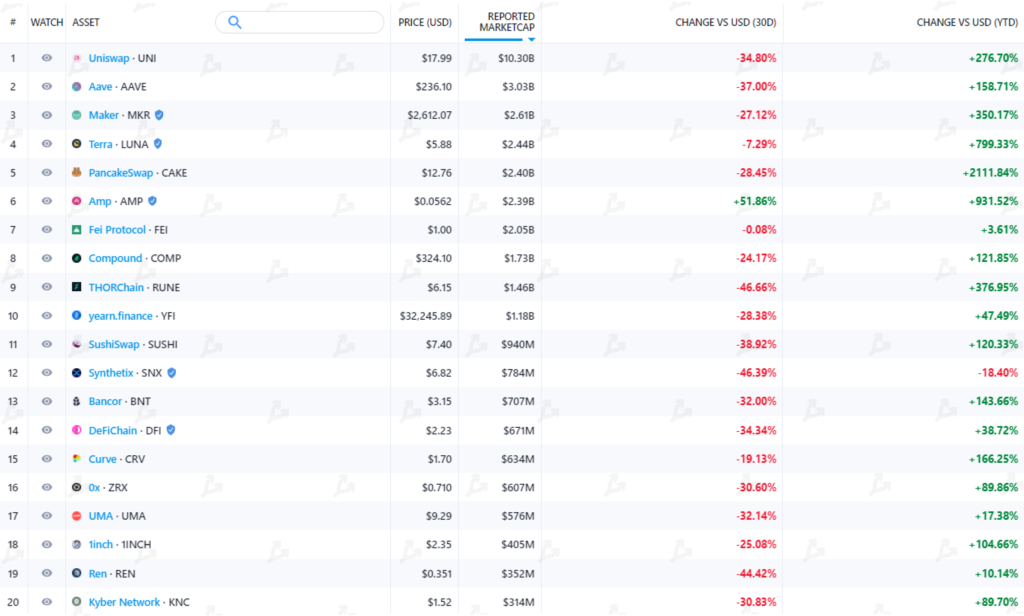

- In June, nearly all high‑capitalisation DeFi tokens declined. Among the top‑20, THORChain, Synthetix and Ren saw the deepest drops (>40%). The AMP token rose 51.86% in June against the market.

- The capitalisation of tokenised Bitcoins slowed its fall. By month’s end, the aggregate total fell 3% (vs. -27% in May). The total number of Wrapped Bitcoin (WBTC) held in the protocol reached 187,610, about 1% of the total BTC supply.

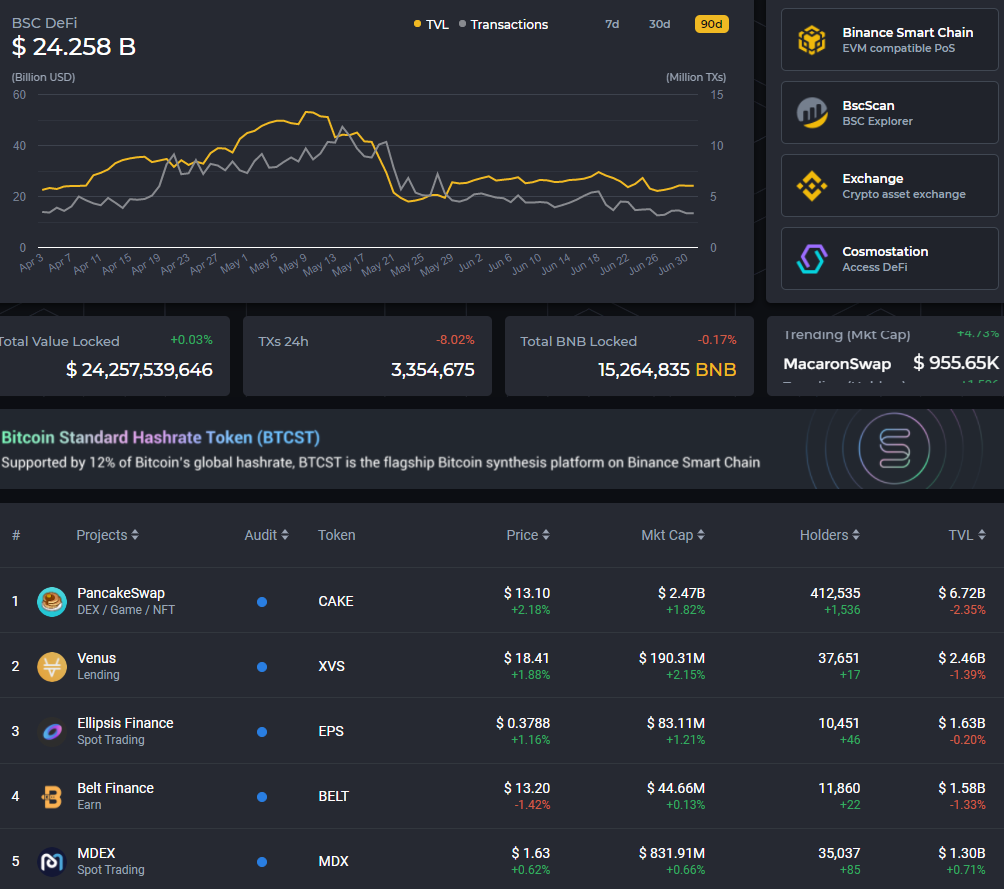

- According to DeFi Llama, Polygon’s ecosystem TVL stood at $8.12 billion (as of 1.07.2021). Binance Smart Chain’s TVL was $24.25 billion, per Defistation.

- The new ecosystem already outpaced Binance Smart Chain and Ethereum in on‑chain activity. In June, the daily transaction volume on Polygon exceeded BSC by 2.38x and Ethereum by 6.59x. The drive appears to be the lure of ultra‑low fees and high speeds.

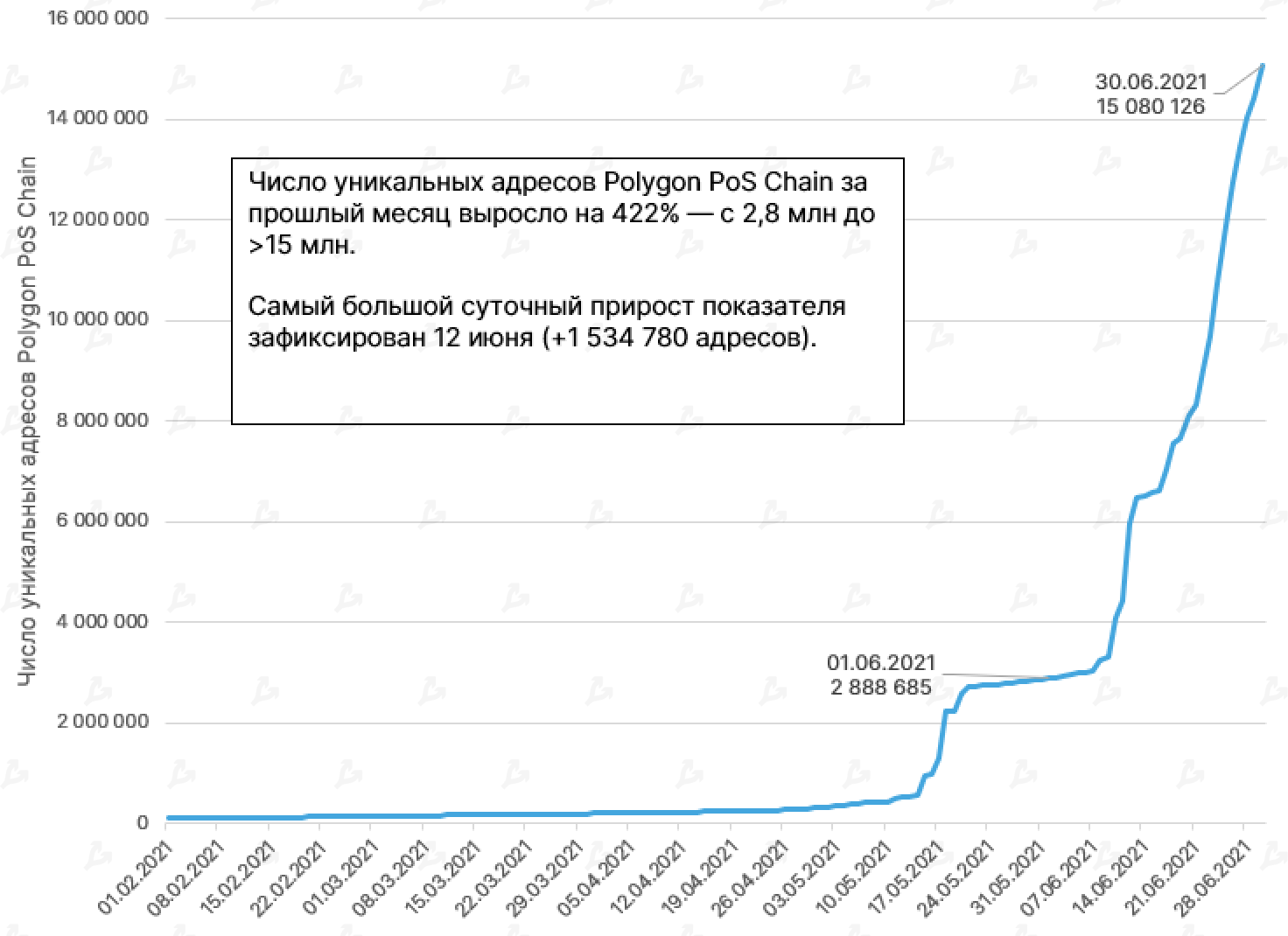

Both the number of unique Polygon addresses and the user base are clearly growing.

DEX

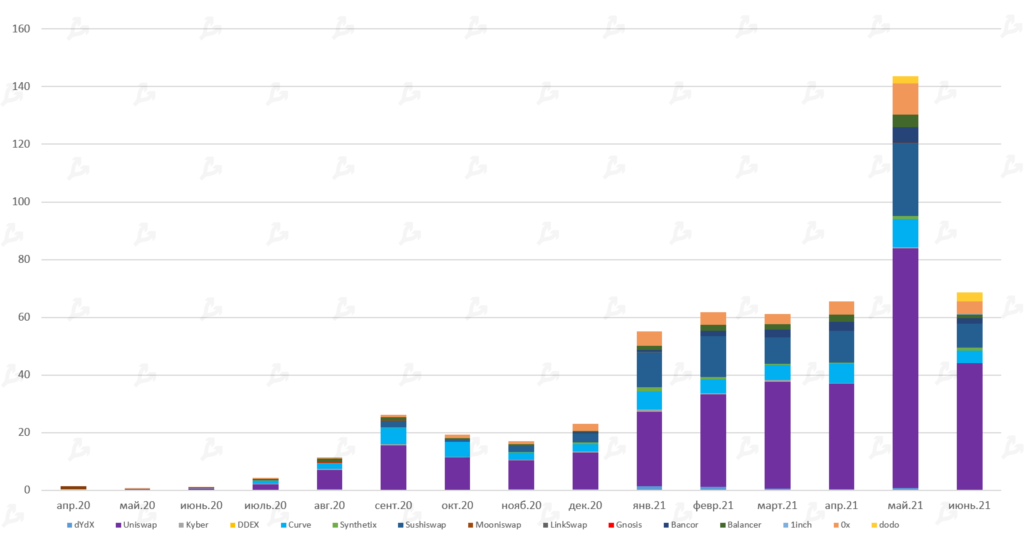

- In June, trading on Ethereum‑based DEXs fell 50% to $68 billion.

- Uniswap led the way with $43.8 billion in turnover; its market dominance rose above 64% in June.

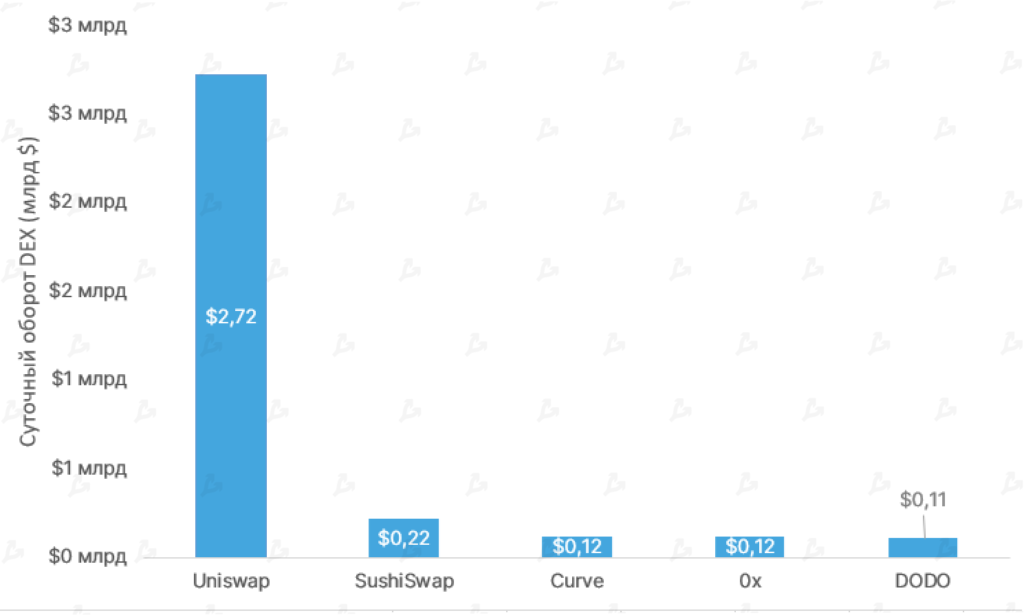

- Daily turnover on Uniswap surged to $2.72 billion, up 66.8% from May. The top‑5 by daily turnover also included the DODO platform.

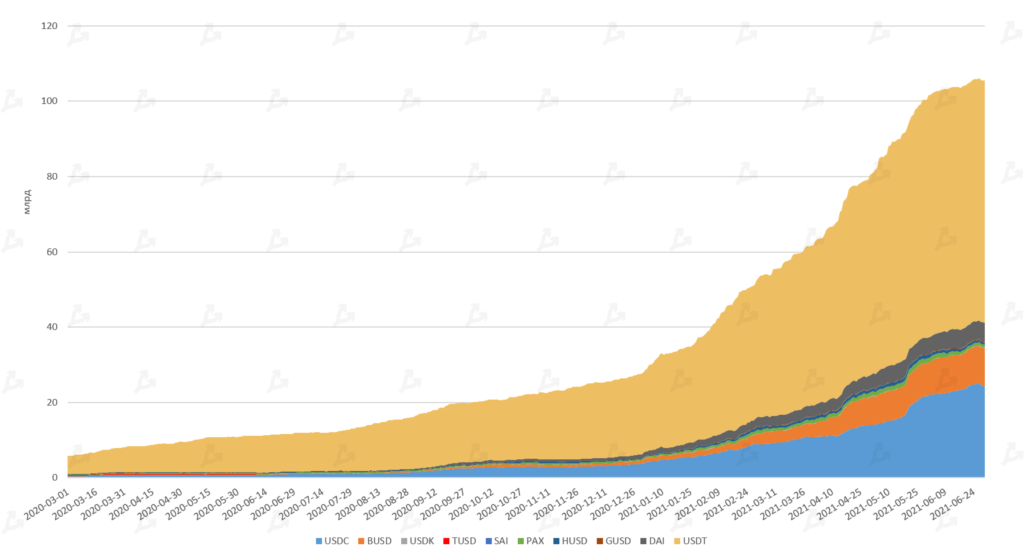

Stablecoins

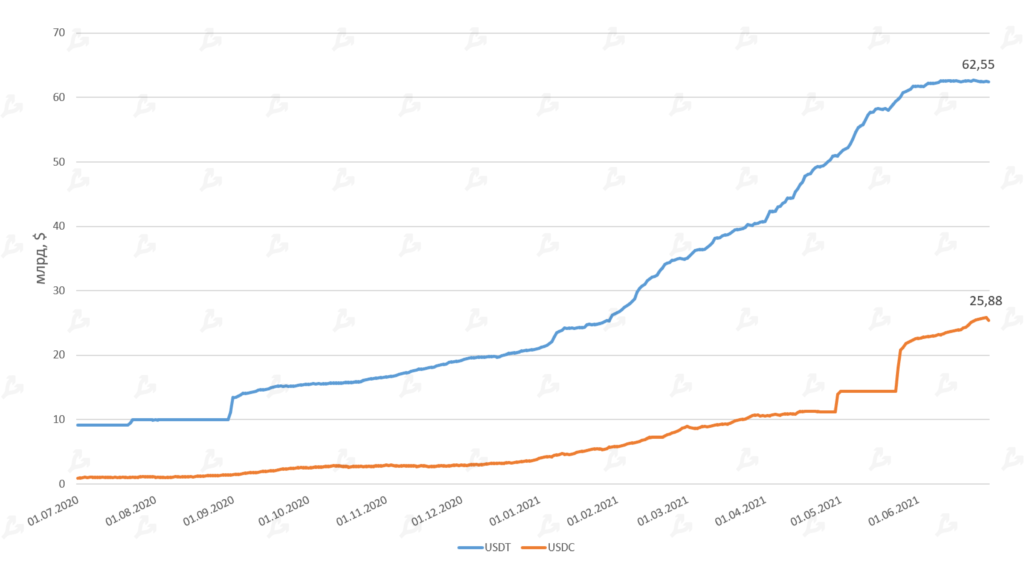

- The overall market capitalization of stablecoins in June reached $105 billion. The leading stablecoin, USDT from Tether, paused new issuance. Chief Technology Officer Paolo Ardoino said the move was due to lower open interest in Bitcoin futures.

- However, a competitor, USDC from Centre, accelerated issuance and announced support for 10 blockchains, the first of which was TRON.

- USDC’s market cap exceeded $25 billion in June. Messari analysts expect Tether’s share in the segment to drop below 50% if the trend continues (as of writing, it stands at around 60%).

Activity of Major Players

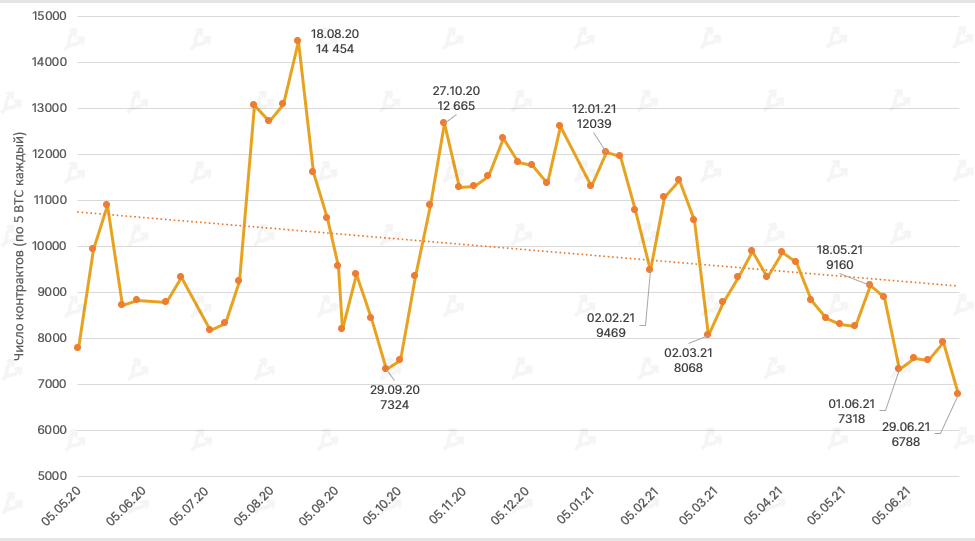

CME

- Open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) continues to decline, as does the overall number of traders. The trend has persisted since last year.

- Non‑Commercial traders are predominantly short; Nonreportable traders tend to hold longs. A small cadre of Commercials remains net long.

Major Venture Rounds

- Ledger, the hardware wallet maker, raised $380 million in a Series C round at a $1.5 billion valuation.

- Solana Labs raised $314 million from a16z and Polychain Capital.

- Decentralised autonomous organisation BitDAO raised $230 million from Peter Thiel and Alan Howard.

- SoftBank Latin America Fund invested $200 million in 2TM Group — parent company of Mercado Bitcoin.

- Emiswap raised $104 million.

- Amber Group raised $100 million at a $1 billion valuation.

- Chainalysis raised $100 million in a Series E. The analytics firm was valued at $4.2 billion.

- Bitwise Asset Management raised $70 million.

- Morgan Stanley backed Securitize in a Series B round worth $48 million.

- BSN founder company (China’s state blockchain) raised $30 million.

- Alan Howard invested $25 million in Copper, a crypto custodian.

- Kaiko raised $24 million.

- NFT marketplace Rarible raised $14.2 million in a Series A.

- TRM Labs raised $14 million from PayPal and others in a Series A round.

- NFT marketplace backed by Mark Cuban raised $13 million in a Series A.

- a16z led a $12 million Series A funding round for analytics firm Nansen.

Key Regulatory Developments

- Regulators criticised updated virtual assets bill. Later, Ukraine’s Parliament Committee approved an updated bill.

- On 30 June, the Ukrainian parliament passed a law regulating the issuance of a central bank digital currency (CBDC).

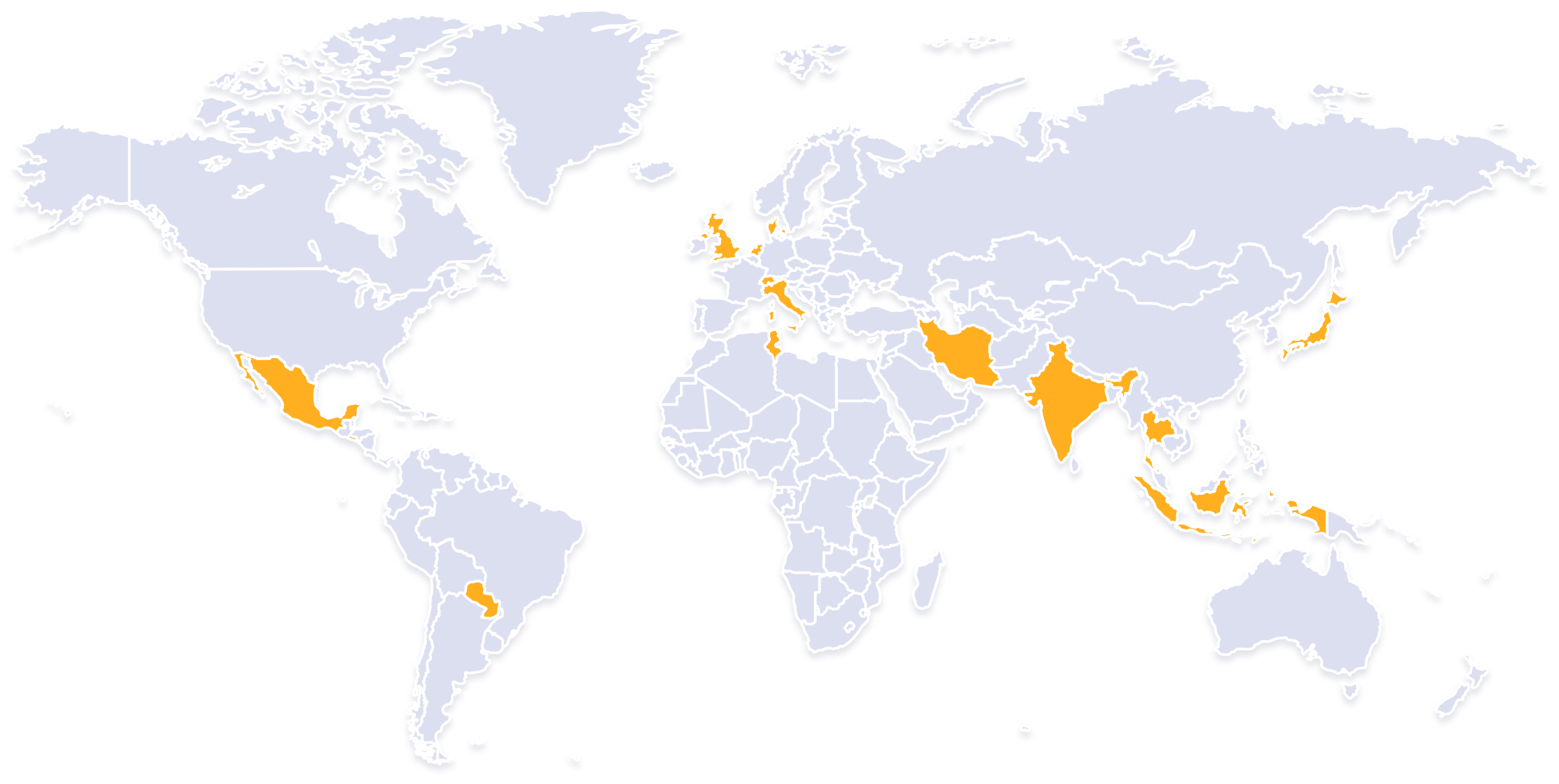

- China banned banks and payment systems from engaging in crypto‑related transactions.

- Authorities in several provinces ordered miners to halt operations. Among them are Xinjiang’s Xinjiang, Qinghai, Jiangxi, and Sichuan provinces (various placeholders listed).

- The tax authority called for increased funding to widen crypto tax administration.

- The US House of Representatives chair formed a crypto working group.

- Texas authorities allowed banks to hold crypto. The governor announced plans to create a regulatory framework for crypto and blockchain tech.

- The president signed a law introducing an extra mining levy.

Other Regions

Significant June Events

Venture firm Andreessen Horowitz (a16z) launched its third crypto fund, equipped with $2.2 billion. It will finance startups at various stages—from seed to late stage.

More than 90% of mined blocks signalled support for the Taproot upgrade — the criterion was met on block #687,284 during the difficulty adjustment on 12 June. The soft fork is expected around mid‑November 2021 on block #709,632.

On 24 June, the update activated in the Ropsten testnet; on 30 June in Goerli. In Rinkeby, London will hard fork on 7 July and, after successful tests, will be deployed in mainnet roughly 300–400k blocks later.

Quotes of the Month

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!