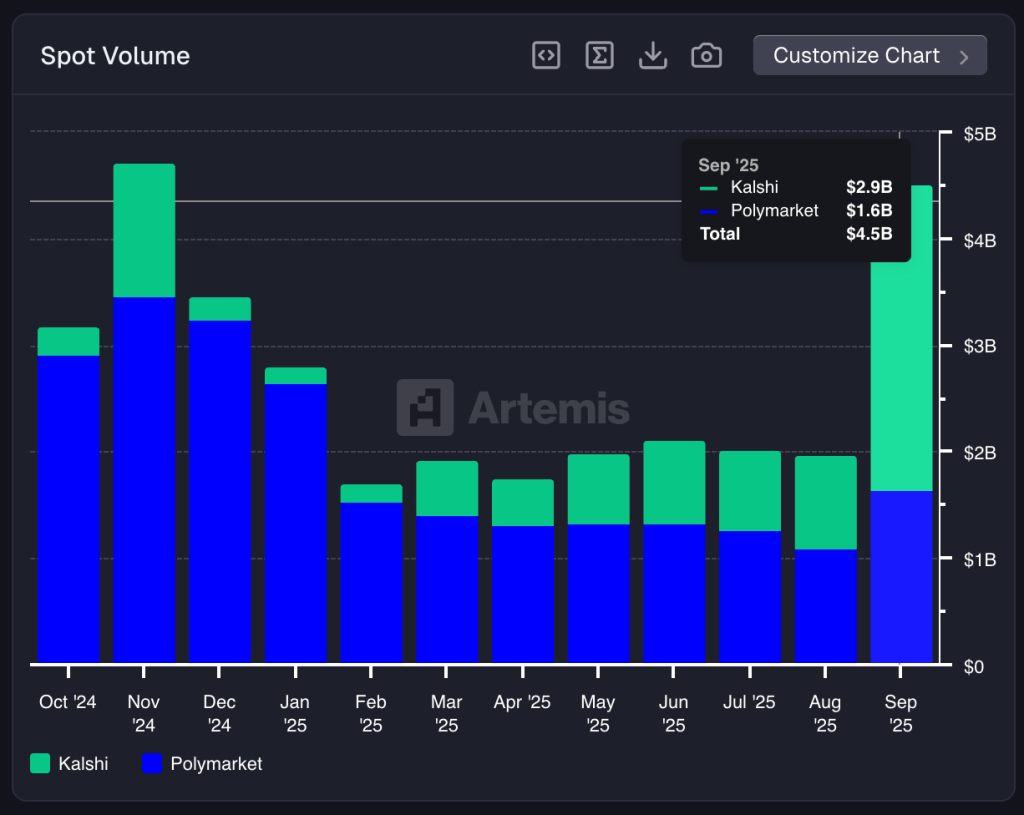

Kalshi and Polymarket Trading Volume Reaches $4.5 Billion

This marks the second-largest figure in history.

Amid growing institutional support, the combined monthly trading volume on prediction platforms Kalshi and Polymarket has reached $4.5 billion. This marks the second-largest figure in history, according to Artemis.

The previous record was set in November 2024 during the U.S. presidential elections, when the excitement around prediction markets pushed the figure to $4.7 billion.

Investment Competition

In September, Kalshi captured a larger market share—66.59% compared to Polymarket’s 33.41%. This was facilitated by the project’s partnership with Robinhood, allowing users to trade directly through the broker’s interface.

Earlier, the prediction platform also raised $300 million in a Series D funding round led by Andreessen Horowitz and Sequoia Capital, boosting Kalshi’s valuation to $5 billion.

Polymarket received $2 billion from its parent company, NYSE—Intercontinental Exchange. As a result, the platform’s valuation reached $9 billion. Its founder, Shayne Coplan, also disclosed two previously unknown funding rounds, one of which was $150 million led by Founders Fund.

New Investigation

Norwegian authorities have launched an investigation into Polymarket following a suspicious surge in activity before the announcement of the 2025 Nobel Prize winner. This was reported by Bloomberg.

According to the publication, several accounts placed large bets on Venezuelan politician Maria Corina Machado just hours before the official results, collectively earning about $90,000.

Christian Berg Harpviken, Director of the Nobel Institute, confirmed that officials are investigating a possible information leak.

“We are investigating whether someone managed to access confidential data and profit from it,” he stated.

Polymarket has faced similar challenges before. In 2022, the CFTC fined the platform $1.4 million for offering services without registration. Two years later, it became known that the Department of Justice was investigating the project. In 2025, the case was closed.

The project is now preparing to enter the U.S. market. In the summer, Polymarket acquired the regulated derivatives exchange QCEX for $112 million. Recently, the platform’s creator also hinted at the launch of a native token, POLY.

In October, Polymarket added Bitcoin support for account funding.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!