Leading Perpetual DEX Lighter Introduces Spot Trading with Ethereum

Lighter, a leader in perpetual contracts, adds spot trading with Ethereum.

Lighter, a leader in the perpetual contracts segment, has introduced spot trading capabilities.

We’re excited to introduce Spot on Lighter! You can now deposit, withdraw, and transfer ETH, the first native asset on our Ethereum L2.

Later this week, we’ll enable spot trading and begin rolling out additional markets. pic.twitter.com/NyB1sS9ueQ

— Lighter (@Lighter_xyz) December 4, 2025

The platform has started with the Ethereum market and plans to expand the list of available assets in the coming days.

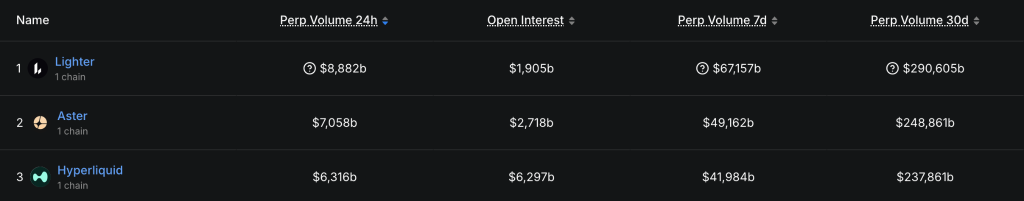

In October, Lighter launched its mainnet second layer based on EVM. In November, the exchange’s trading volume exceeded $295 billion, propelling it to the top of the perp-DEX segment, surpassing Aster on BNB Chain and Hyperliquid on its own HyperEVM.

The new functionality is part of an expansion strategy. Previously, Lighter added futures on stocks of companies like Coinbase and Robinhood, some currency pairs, and announced integration with Chainlink to work towards RWA.

Lighter, a leading perp DEX and the biggest ZK-based Ethereum rollup, has adopted Chainlink Data Streams as its official oracle solution powering its RWA markets.

With Chainlink, @Lighter_xyz gains access to high-fidelity pricing data for RWA markets, including commodities,… pic.twitter.com/t1iSq5BgdL

— Chainlink (@chainlink) November 5, 2025

Lighter is built as a specialized ZK rollup. Its founder, Vladimir Novakowski, a former Citadel quantitative trader, consistently advocates for creating L2 solutions optimized specifically for decentralized trading. This approach contrasts with competitors like Hyperliquid, which operate on the first layer.

The key argument is the reliability and ecosystem strength of Ethereum’s base layer.

In November of this year, Lighter raised $68 million at a valuation of $1.5 billion. The round was led by Founders Fund and Ribbit Capital.

Market Context

As in traditional finance, spot transactions in the crypto sector represent only a portion of the total turnover, where derivatives dominate.

The total trading volume of perpetual futures reached a record $1.2 trillion in October, driven by the market crash and excitement around platforms like Lighter and Aster.

Offering both types of trading is a common practice. For instance, centralized exchanges Coinbase and Kraken have been actively developing the derivatives segment this year.

At the end of November, former BitMEX CEO Arthur Hayes stated that by the end of 2026, stock prices will be determined by perp-DEX, not Nasdaq.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!