Maturity in question: DeFi’s paradoxical 2025

DeFi’s 2025: institutional growth, record lending, yet persistent hacks and setbacks.

“The DeFi sector has become mature and secure,” this statement by Vitalik Buterin could have served as the perfect epigraph to 2025—were it not for the harsher reality.

Almost simultaneously, the crypto community was jolted by news of the shutdown of the popular analytics service DappRadar. Shortly before that, Balancer lost $128m of assets due to a flaw in one of the platform’s key components, reminding everyone of the fragility of “financial Lego”.

This dichotomy ran through 2025. On one side were a powerful influx of institutional capital and record borrowing volumes, painting a picture of stability. On the other were stagnant metrics, a graveyard of shuttered projects and a relentless epidemic of exploits.

So what, in truth, does DeFi look like at the end of 2025: a hardened giant ready to integrate with global finance, or a colossus with feet of clay? Here is an attempt to untangle the contradictions.

Renaissance and consolidation: a facade of stability

Despite the underlying problems, 2025 did bring strong trends that created the appearance of unprecedented stability and growth in DeFi. Behind this facade stood two pillars: rapid institutionalisation and a healthier debt profile.

These shifts signalled a new phase in which speculative chaos gave way to more measured strategies.

Start with the core metrics.

TVL and the “blue chips”

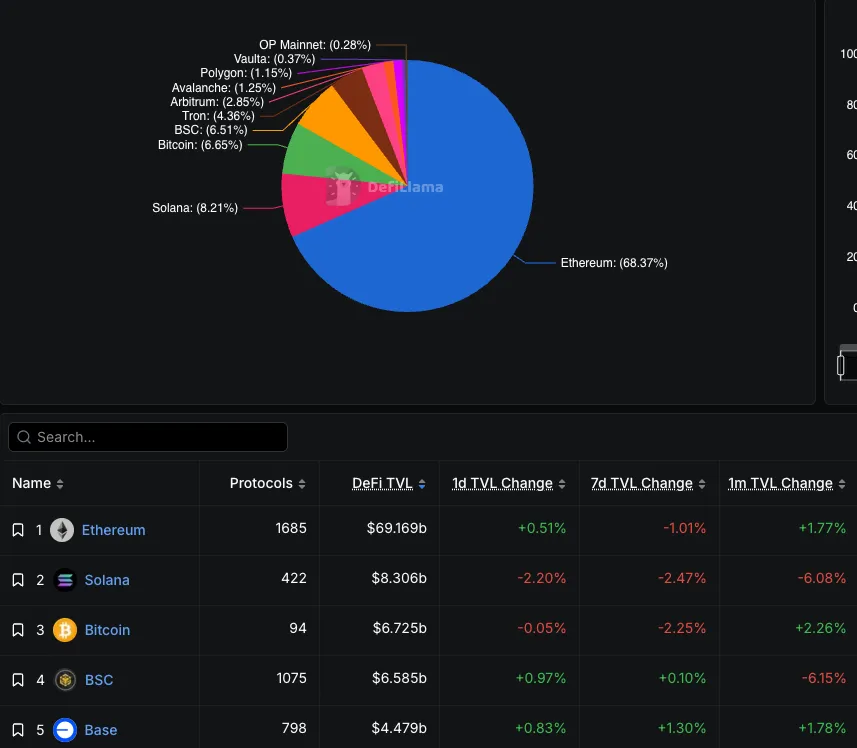

As of 30.12.2025, total DeFi TVL stands at roughly $118bn.

From mid‑spring the metric rose impressively, nearing the record peaks of late 2021—above $170bn—before market correction pulled it back.

As before, Ethereum’s ecosystem dominates—close to 70% share and nearly $70bn in TVL.

On 4 December a major Ethereum upgrade was activated: Fusaka. It targets scalability, efficiency and security for the second‑largest cryptocurrency.

The hard fork bundles ten improvement proposals. The centrepiece is EIP‑7594, introducing the PeerDAS protocol, which lets validators check slices of data rather than entire BLOB objects, improving data availability across the ecosystem.

Ethereum co-founder Vitalik Buterin called the protocol a critical piece of the network’s evolution, noting that “это буквально и есть шардинг”.

PeerDAS in Fusaka is significant because it literally is sharding.

Ethereum is coming to consensus on blocks without requiring any single node to see more than a tiny fraction of the data. And this is robust to 51% attacks — it’s client-side probabilistic verification, not… pic.twitter.com/OK81xBteER

— vitalik.eth (@VitalikButerin) December 3, 2025

The upgrade also more than doubles the L1 gas limit. Throughput is expected to reach 12,000 TPS.

Ether’s price initially rose 3.6% on the day, but the momentum faded.

Yet glitches followed: shortly after Fusaka’s rollout, the popular consensus client Prysm suffered a failure that took part of Ethereum’s validators offline. The bug, in v7.0.0, caused the client to generate stale blockchain states when processing attestations.

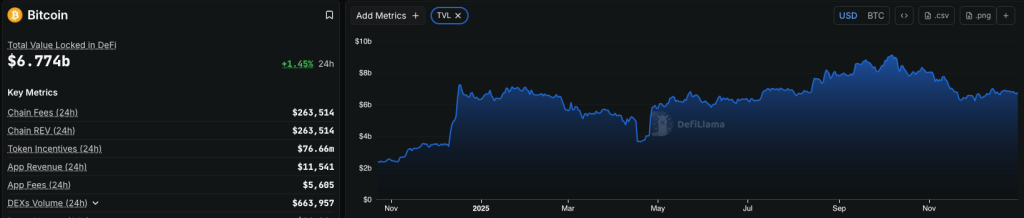

Second in the popularity rankings is the suite of Solana‑based DeFi protocols, with over $8bn in assets at work. The Bitcoin‑based ecosystem (BTCFi) sits third on DefiLlama at $6.7bn.

Fourth is BNB Chain, with TVL near $6.5bn. Fifth is the collection of apps on Base.

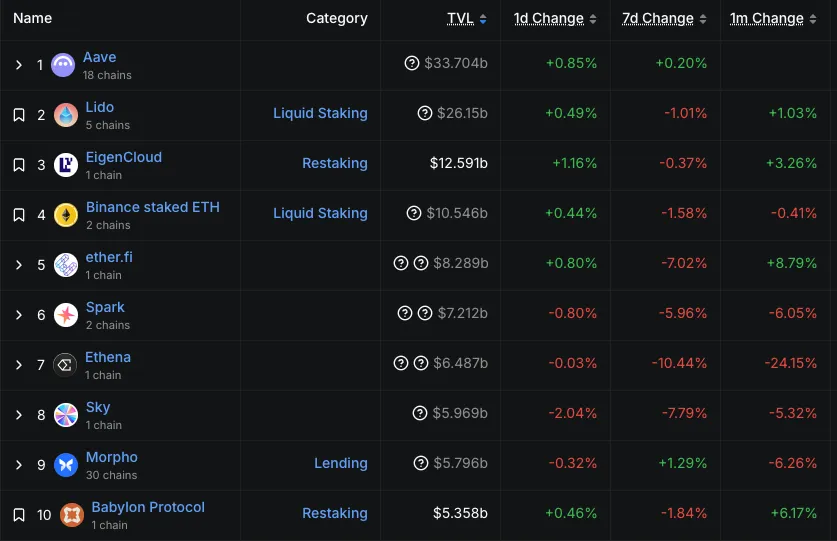

Below is the ranking of the largest protocols:

First is the lending protocol Aave, spanning 18 networks. Its TVL tops $30bn, far ahead of rivals.

The top three also include the liquid‑staking platform Lido—~$26bn—and the restaking project EigenLayer—~$12.5bn.

Rounding out the ten is the leading BTCFi project, Babylon, with TVL above $5bn.

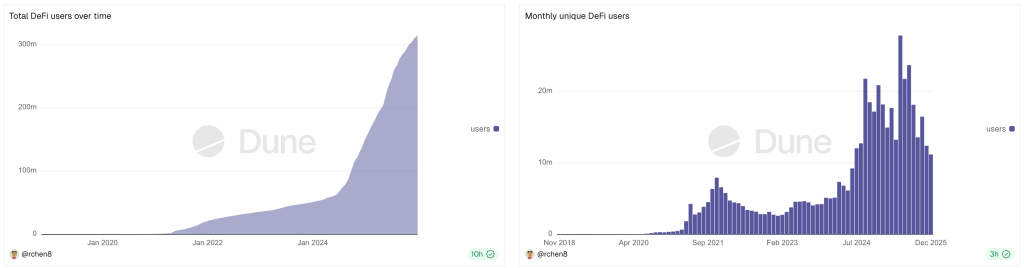

Growth in 2025 was hardly steady. Monthly unique users exceeded 27m in April, then slid to 11.8m by 30.12.2025.

Total adherents of “financial Lego” surpassed 300m in November.

DEX versus CEX

From early spring, leading DEXes such as Uniswap, PancakeSwap, Meteora and HumidiFi posted relatively steady growth. The first two are the sector’s largest, with a combined market share approaching 50%.

Notable, too, is the ratio of DEX volumes to total trading on CEX. In June it topped 20% for the first time, underscoring growing preference for decentralised venues. For comparison, in 2021 the ratio was just 6%.

Spot volumes on DEXs are far higher than in prior years. In October they hit a record $419.76bn despite the correction.

Perp‑DEXs such as Lighter, Aster and Hyperliquid won significant traction in 2025.

These are relatively new decentralised platforms for trading crypto and other derivatives with high leverage. They support many order types and push constant innovation. In autumn, for example, Hyperliquid launched user‑defined perp markets via HIP-3; their daily volume soon exceeded $500m.

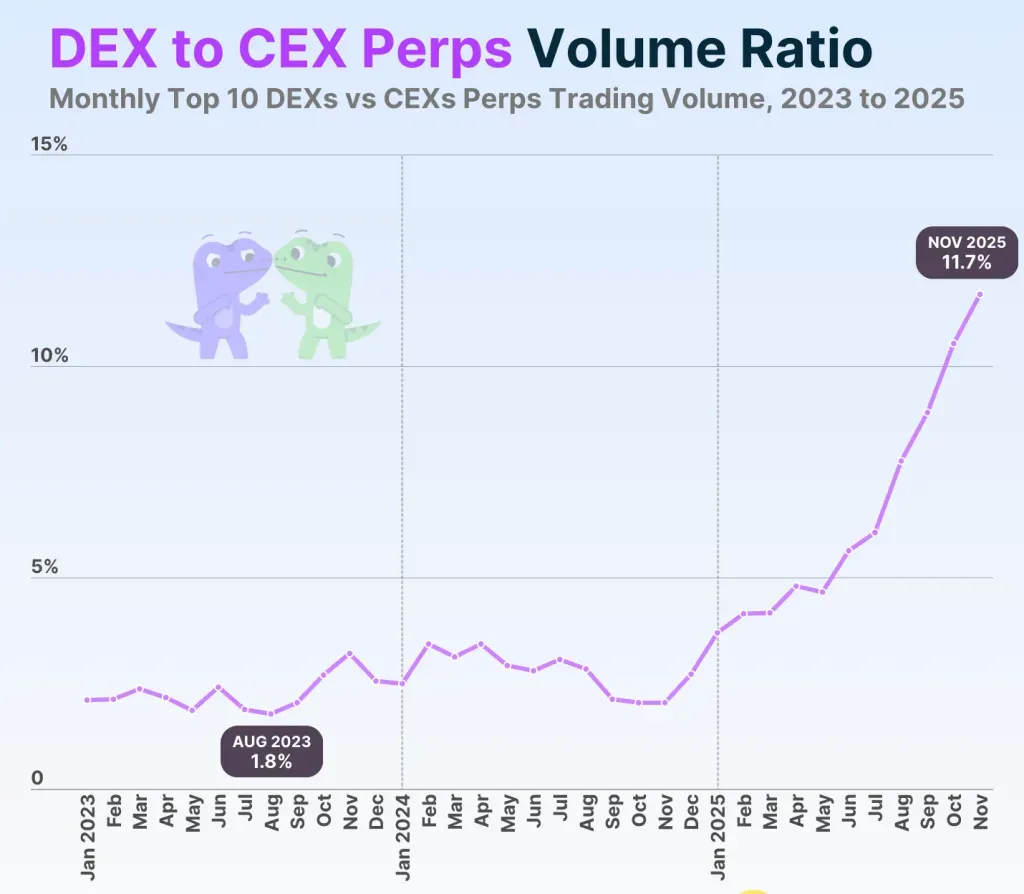

The chart below shows market shares converging as competition intensifies:

The ratio of DEX to CEX futures trading rose from 2.1% in January 2023 to 11.7% in November 2025.

“Analogous to the situation with spot trading, decentralised exchanges began actively increasing perps volumes, narrowing the gap with centralised platforms specifically this year. November 2025 was already the 14th consecutive month in which DEXs’ share of total perps volume showed a sequential monthly increase,” — noted CoinGecko.

Since the start of the year, Hyperliquid’s turnover totalled $2.74trn, comparable to America’s largest exchange, Coinbase. Analysts forecast a shift from simple tokenisation to the creation of synthetic instruments. Perp‑RWA will give traders rapid access to off‑chain markets without owning the underlying.

Coinbase Ventures expects “perpification of everything”: from private‑company shares to economic data. Investors could hedge with instruments linked to oil, inflation, credit spreads and volatility.

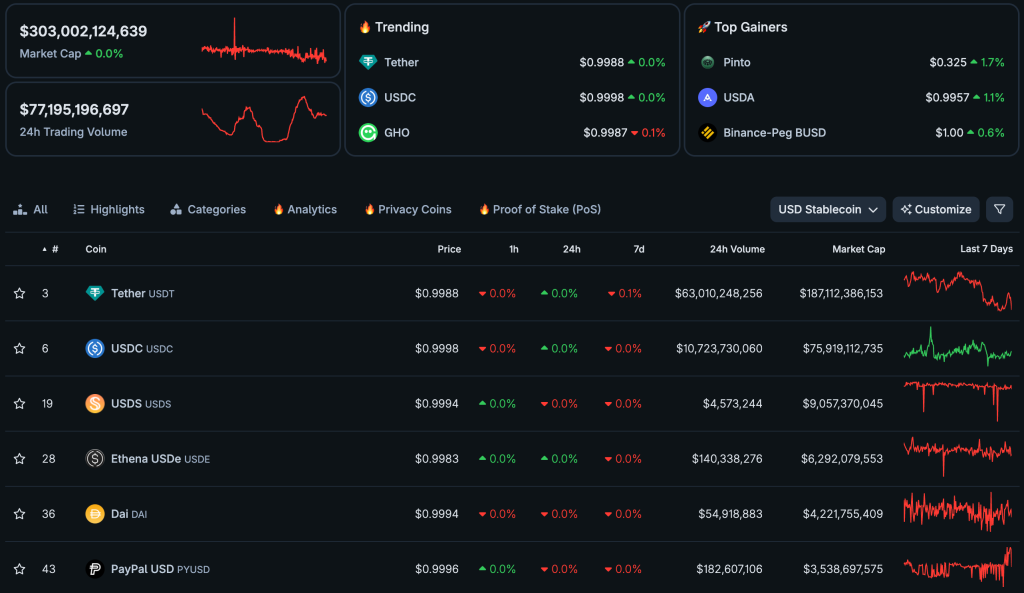

Institutionalisation via RWA and stablecoins

The chief bridge for big capital into DeFi has been the integration of real‑world assets and the rapid growth of stablecoins.

As ARK Invest notes, tokenising US Treasuries, real estate and private equity is no longer exotic; it has become a working mechanism for attracting liquidity.

The strategic importance of mass adoption is large. First, it boosts the sector’s legitimacy in the eyes of traditional investors and regulators. Second, capital backed by real assets materially deepens market liquidity.

Finally, it dampens systemic volatility, making DeFi instruments more predictable and appealing to conservative players.

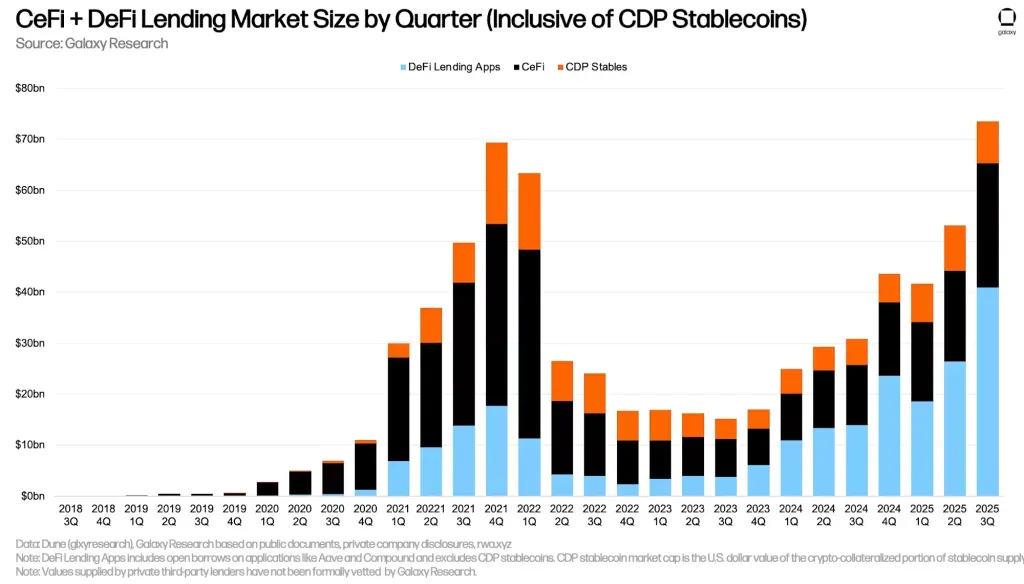

“Healthy” leverage: record borrowing and a new normal

Another marker of the year was an acceleration in crypto lending—borrowing across CeFi and DeFi hit a record $73.6bn.

The headline is impressive, but the nature of that debt matters more. Analysts increasingly say a new era of “healthy leverage” has arrived. Unlike prior cycles, when debt piled up behind risk‑hungry speculation, today a significant share is used for more conservative, longer‑term strategies.

The market seems to have learned from the cascading liquidations of the past. Yet the question lingers: is this leverage truly safer, or has the industry simply become better at masking systemic risk?

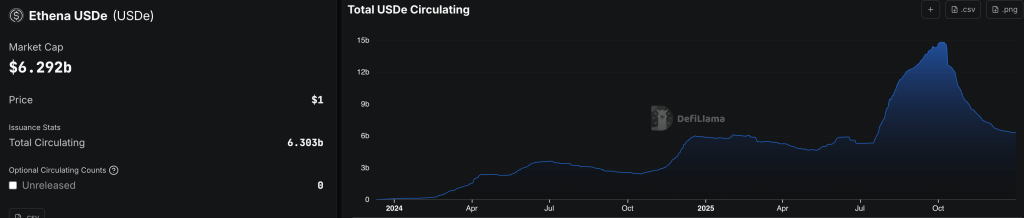

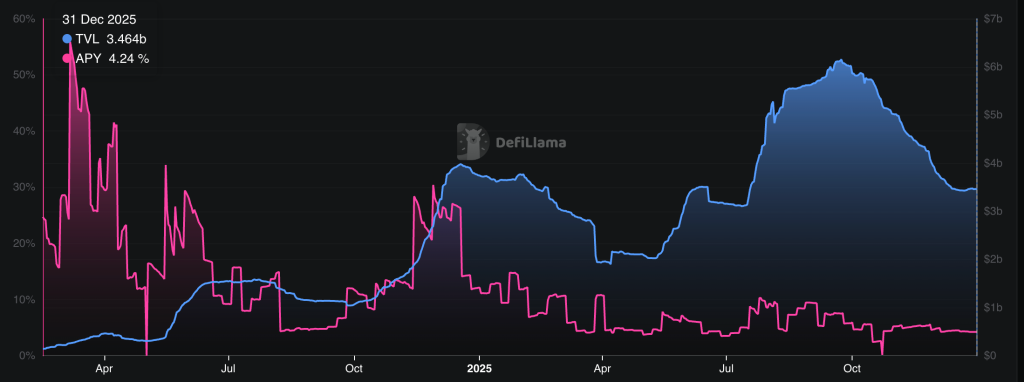

Complex derivatives and multi‑layered chains of rehypothecation obscure the true burden. The potential for hidden risk recalls that colossus on clay feet. In just a month, the capitalisation of Ethena’s synthetic stablecoin USDe plunged by more than 50%.

The drop came as yields fell to 4.3% APY from double‑digit levels early in the year.

According to The Block, the main driver was the unwinding of leveraged strategies in DeFi protocols such as Aave. Rehypothecation was profitable while USDe yields exceeded the cost of borrowing USDC. Once yields fell below 5.4%, positions were exited en masse.

The financial veneer, however impressive, began to crack amid deleveraging and the sector’s real pace of technological progress.

Innovation stalls

Against financial growth, technological progress in 2025 looked mixed. The influx of institutionally minded capital seeking stability and familiar RWA models may well have unintentionally slowed fundamental innovation, shifting emphasis from R&D on uncharted terrain to more conservative builds.

Big announcements and launches did not always yield breakthroughs. Some focal themes even “stalled”.

BTCFi: a stalled evolution

One of the year’s early narratives was BTCFi—an ambitious attempt to funnel Bitcoin’s vast liquidity into DeFi.

It was expected to be a new engine of growth. By year‑end, however, the promised “evolution” had largely paused.

Projects hit fundamental roadblocks. Building robust, truly decentralised bridges for moving value across networks remains unresolved: flaws in such designs can lead to multi‑billion‑dollar losses.

Economically, the conservative Bitcoin community has not embraced the push. Growth in related protocols was tepid, and core developers withheld support, prioritising the HODL ethos over complex DeFi constructs.

BTCFi remained a niche experiment—one of 2025’s chief technological disappointments.

x402: local success, with caveats

Amid the challenges, there were local wins. The x402 protocol, which proposed a micro‑payments design in a Click‑to‑Pay format, showed that DeFi can still innovate in specific niches.

Even so, the success was muted. Technical experts criticised the protocol, citing centralisation risks and inevitable architectural trade‑offs.

Six months after launch, the team shipped v2, aiming to build a “single payments layer for the internet”.

The solution became “multichain by default”: it works with native tokens on Base, Solana and other blockchains without custom logic. Updates included simplified scripting, better wallet handling and integration with traditional payment rails.

The upgraded protocol added dynamic payTo routing for subscriptions, pre‑payments and usage‑based billing. Developers also gained tools for paywalls and “lifecycle hooks” to monitor metrics.

The x402 case typifies a broader trend: the most successful products of 2025 solve point problems. They do not fix fundamentals such as scalability or security.

The harsh truth

Improving metrics and new launches mask the industry’s shoals: attrition and technical risk. TVL charts obscure the failure rate—and the fact a single smart‑contract bug can still inflict multi‑million‑dollar losses.

A graveyard of projects: from DappRadar to the Cosmos ecosystem

As in prior years, 2025 saw “weeding out” of weak and non‑viable ventures. But the process also hit once‑promising players with clear market value:

- DappRadar: the well‑known analytics platform shut down due to “financial unsustainability” after a prolonged hunt for a viable business model;

- the Cosmos ecosystem: in November, Comdex, Kujira, Evmos, Picasso/Composable, Quasar/Tower and Stride announced closures or critical restructurings.

The failures point to systemic issues that cannot be written off as team missteps, funding woes or developer flight.

An incurable ailment: hacks as a constant

The core problem contradicting Buterin’s safety thesis persists—hacks have not stopped.

Attacks on Stream Finance or Balancer are mere examples. In just the first quarter of 2025, the Web3 ecosystem lost about $6bn to rug pulls.

Other recent negatives include:

- unauthorised withdrawals totalling $3.1m from BNB‑based GANA Payment;

- the disappearance of the Hypervault team with $3.6m;

- an exit scam by CrediX on Sonic after a $4.5m exploit;

- an attack on the Flow blockchain causing $3.9m in losses;

- a $3.9m loss at Unleash Protocol.

Each incident harms the industry’s reputation and confirms that smart‑contract vulnerabilities remain—and that core security problems are unresolved. As long as code errors can vaporise vast sums, it is premature to claim maturity or readiness for mass adoption.

DeFi at a crossroads

In sum, 2025 was not a triumph but a maturation through crisis. The sector combined signs of adulthood with fundamental fragility.

RWA integration and adoption, the expansion of stablecoins and “healthy leverage” in crypto lending show an industry capable of attracting capital and building more durable models. Yet BTCFi’s underwhelming trajectory, a spate of project closures and persistent security incidents cast doubt on the ecosystem’s long‑term prospects.

Some experts remain optimistic: Chainlink co‑founder Sergey Nazarov is confident DeFi has already covered 30% of the path to mass adoption. Full acceptance, he says, will come by 2030.

Perhaps 2026 will be decisive. The sector must choose: to regain a course toward genuine decentralisation and technical robustness—or to settle as a high‑risk appendage to traditional finance.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!