Crypto lending hits a record $73.6bn

Crypto lending hit a record $73.6bn in Q3, topping the 2021 high

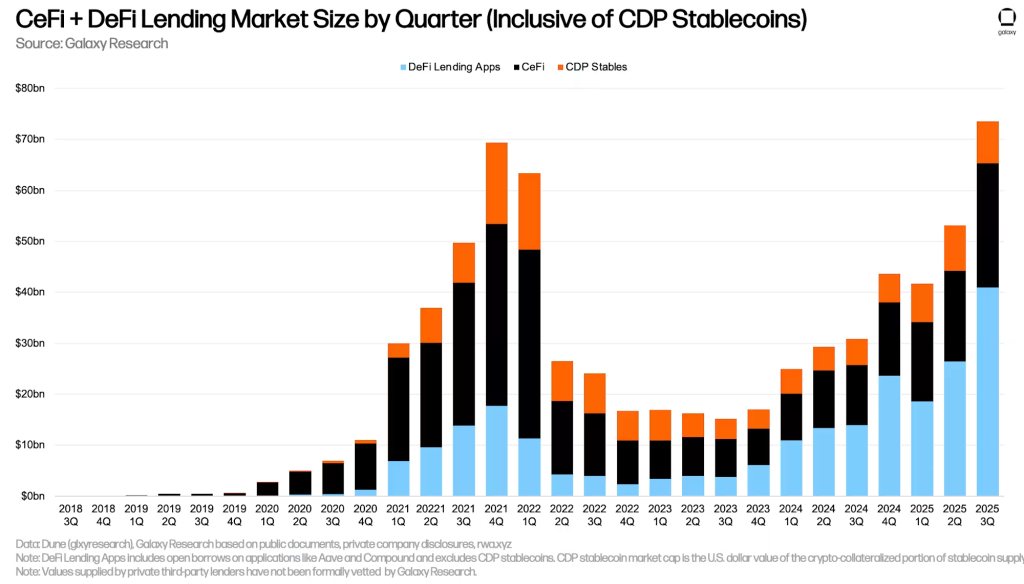

Crypto‑collateralised lending reached $73.6bn at the end of the third quarter, surpassing the previous high set in 2021, according to a report by Galaxy Research.

Analysts say activity has surged, though the market’s quality and structure have shifted markedly since the last peak. A defining feature is the rise of on‑chain lending, now 66.9% of the total.

Lending in decentralised finance (DeFi) rose 55% to a record $41bn. Specialists highlighted several drivers:

- Incentive programmes: many DeFi apps reward users for borrowing or maintaining debt with points or airdrops. That can make borrowing profitable despite some risk.

- Collateral innovation: new asset types such as Pendle Principal Tokens (PTs) let users borrow against stablecoins at more favourable LTV.

- Market reflexivity: rising crypto prices boost collateral values, allowing larger loans without adding borrower risk.

Centralised platforms (CeFi) also rebounded: outstanding loans rose 37% to $24.4bn. Even so, the market remains about a third below its 2022 peak.

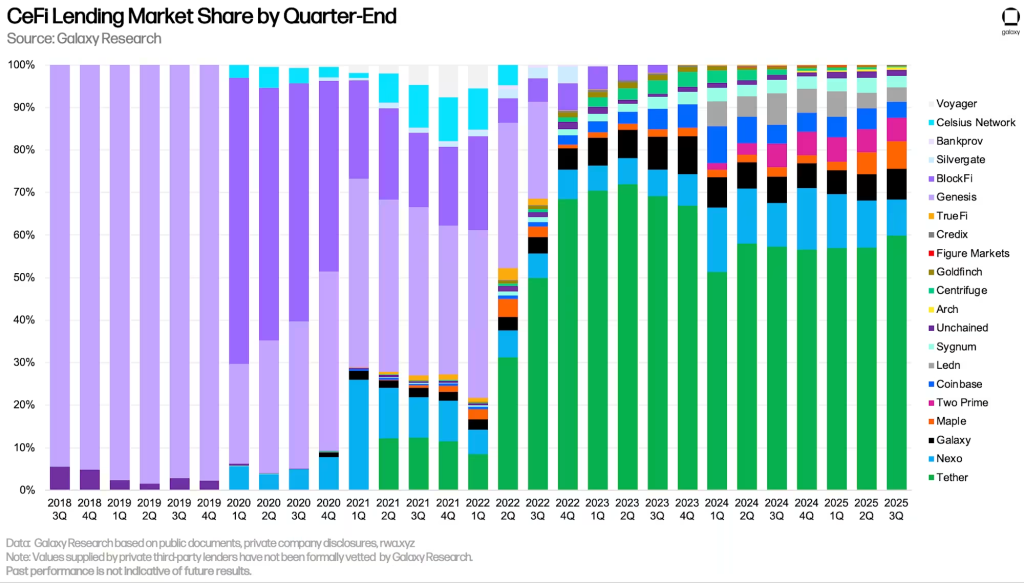

Firms that survived the last cycle have largely abandoned unsecured lending — they have shifted to fully collateralised models as they seek institutional capital or public listings. Against this backdrop, USDT and USDC have grown sharply in popularity as collateral, the experts noted.

Tether remains the dominant CeFi lender, controlling nearly 60% of tracked loans.

A shift within DeFi

Another trend in the third quarter: lending apps captured 80% of the market, while the share of CDP stablecoins such as DAI fell to 16%.

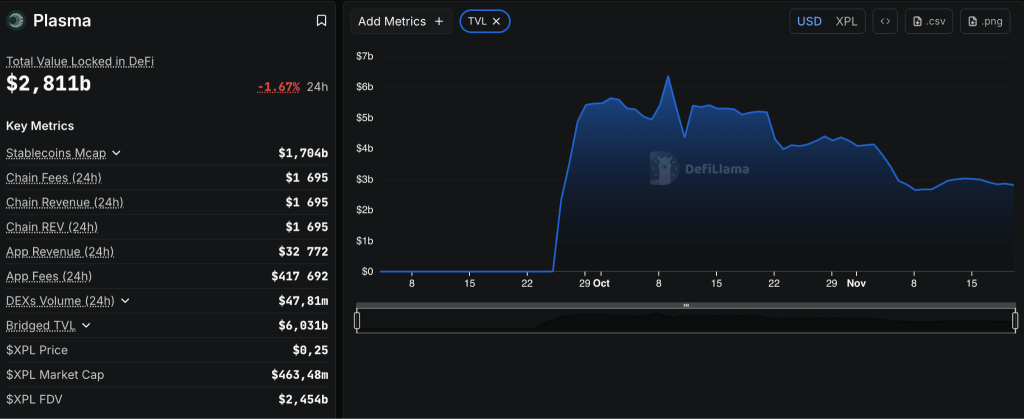

Activity was helped by deployments to new blockchains — for example, Aave and Fluid on Plasma, which attracted more than $3bn of borrowing within five weeks of launch.

October’s rout

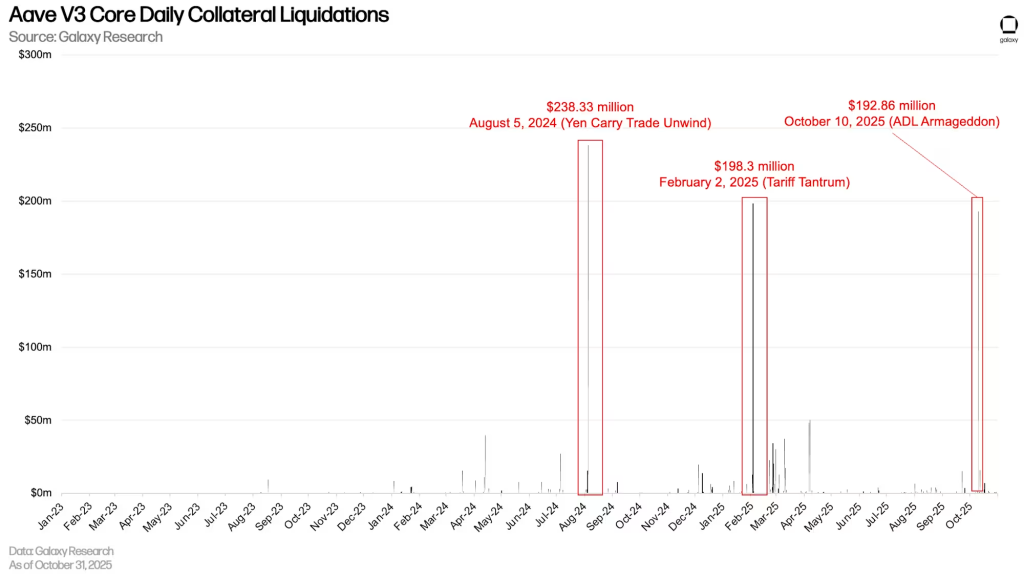

Soon after the quarter ended came a broad market sell-off triggered by excessive leverage, which led to $19bn of liquidations.

Aave V3 Core on Ethereum logged its third‑largest day of forced position closures in the protocol’s history, at $192.86m.

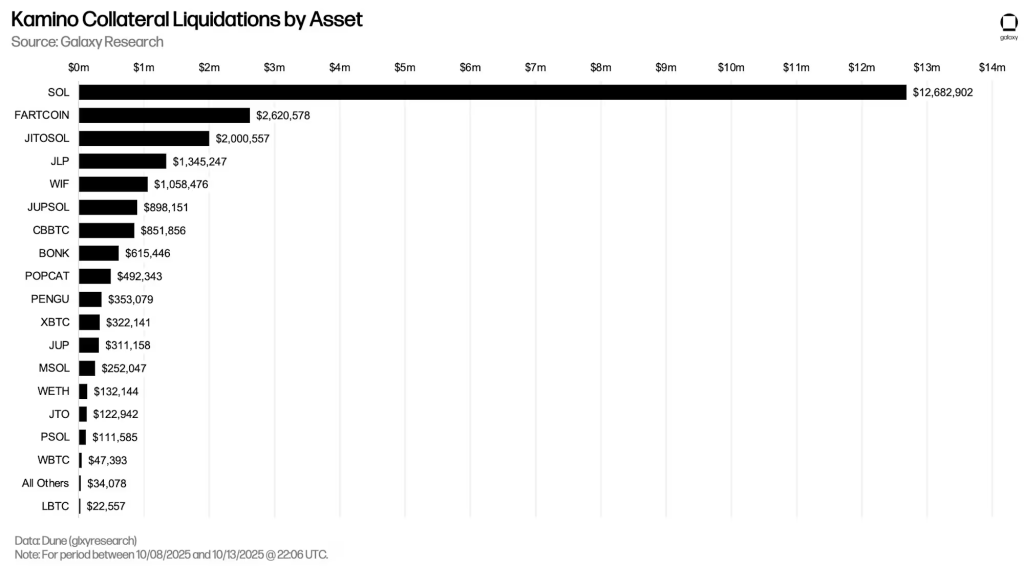

The Kamino platform also saw liquidations. Among the largest were $12.7m in WSOL and $2.6m in FARTCOIN.

Even so, Galaxy’s analysts say the rout does not reflect systemic weakness in the credit market. Most positions were mechanically protected from risk by exchanges’ auto‑deleveraging systems.

They conclude that leverage in crypto is rising again, but “on a more robust and transparent footing”. Collateralised structures have supplanted the opaque loans that fuelled the previous boom‑and‑bust cycle.

In May, lending DeFi protocols overtook decentralised exchanges by volume.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!