Bitcoin and Ethereum ETFs See $1 Billion Outflow in a Day

Outflows from exchange-traded funds are one possible reason for the decline in cryptocurrencies.

On August 19th, spot exchange-traded funds (ETFs) based on the two largest cryptocurrencies by market capitalization experienced outflows. BTC Markets analyst Rachel Lucas attributed this to macroeconomic uncertainty, reports The Block.

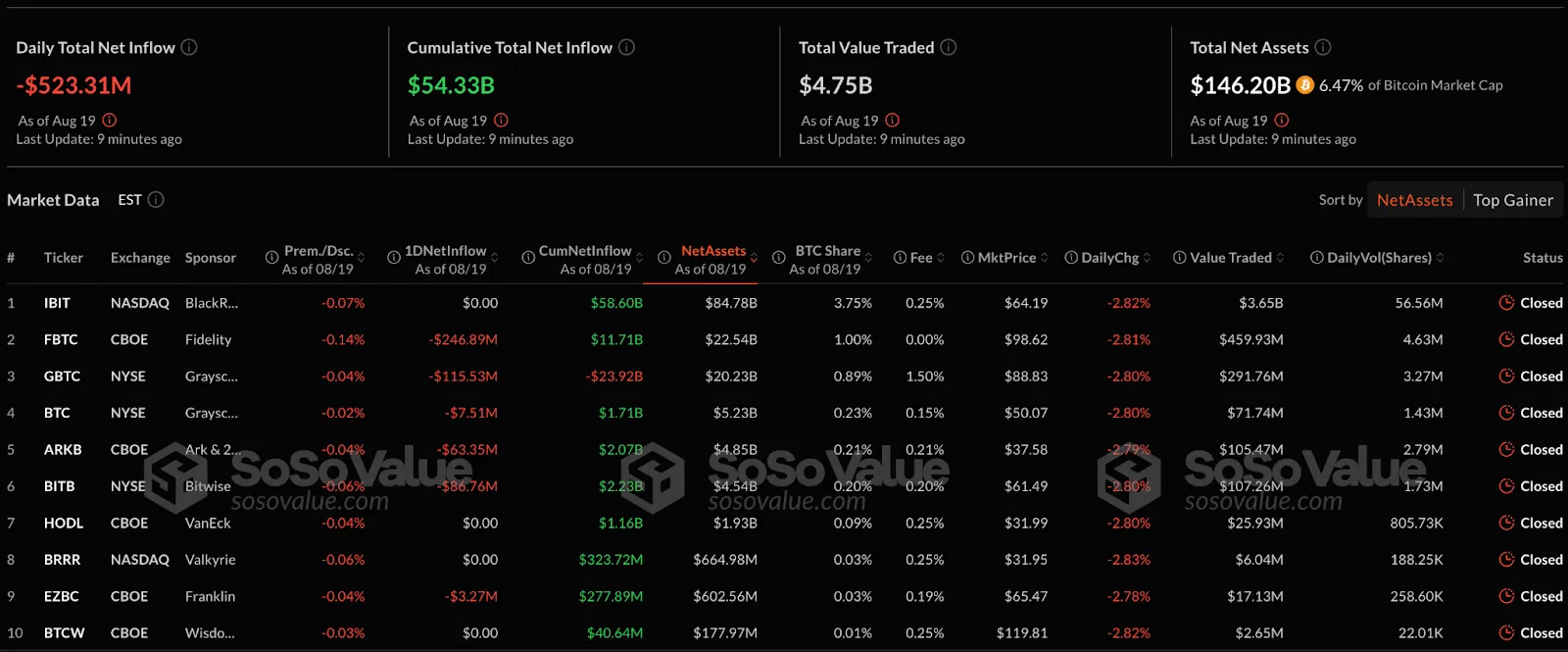

Bitcoin ETFs saw investors withdraw $523 million in a single day. The largest losses were incurred by investment products from Fidelity and Grayscale, amounting to $246.9 million and $115.53 million, respectively. BlackRock’s IBIT fund maintained a zero balance.

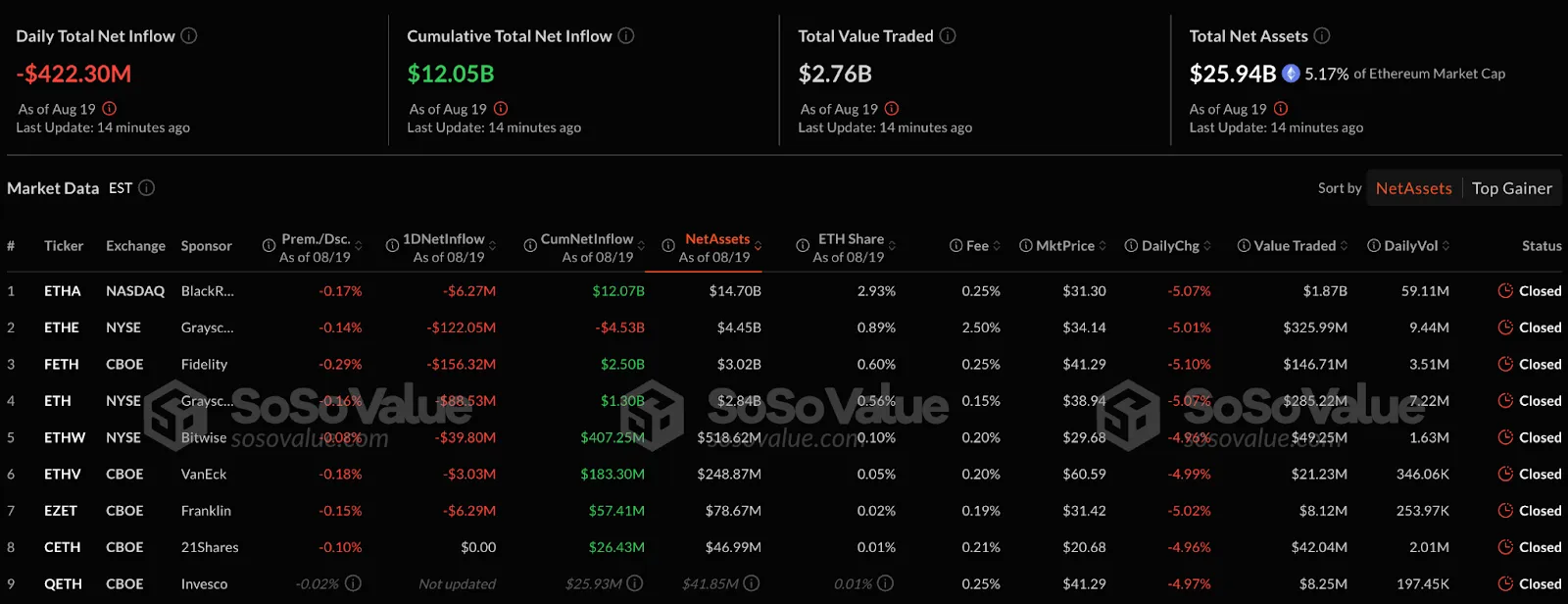

Ethereum ETFs lost $422 million, marking the second-largest outflow since the instrument’s launch. Funds from Fidelity and Grayscale saw withdrawals of $156.32 million and $122 million, respectively. Other funds experienced smaller losses.

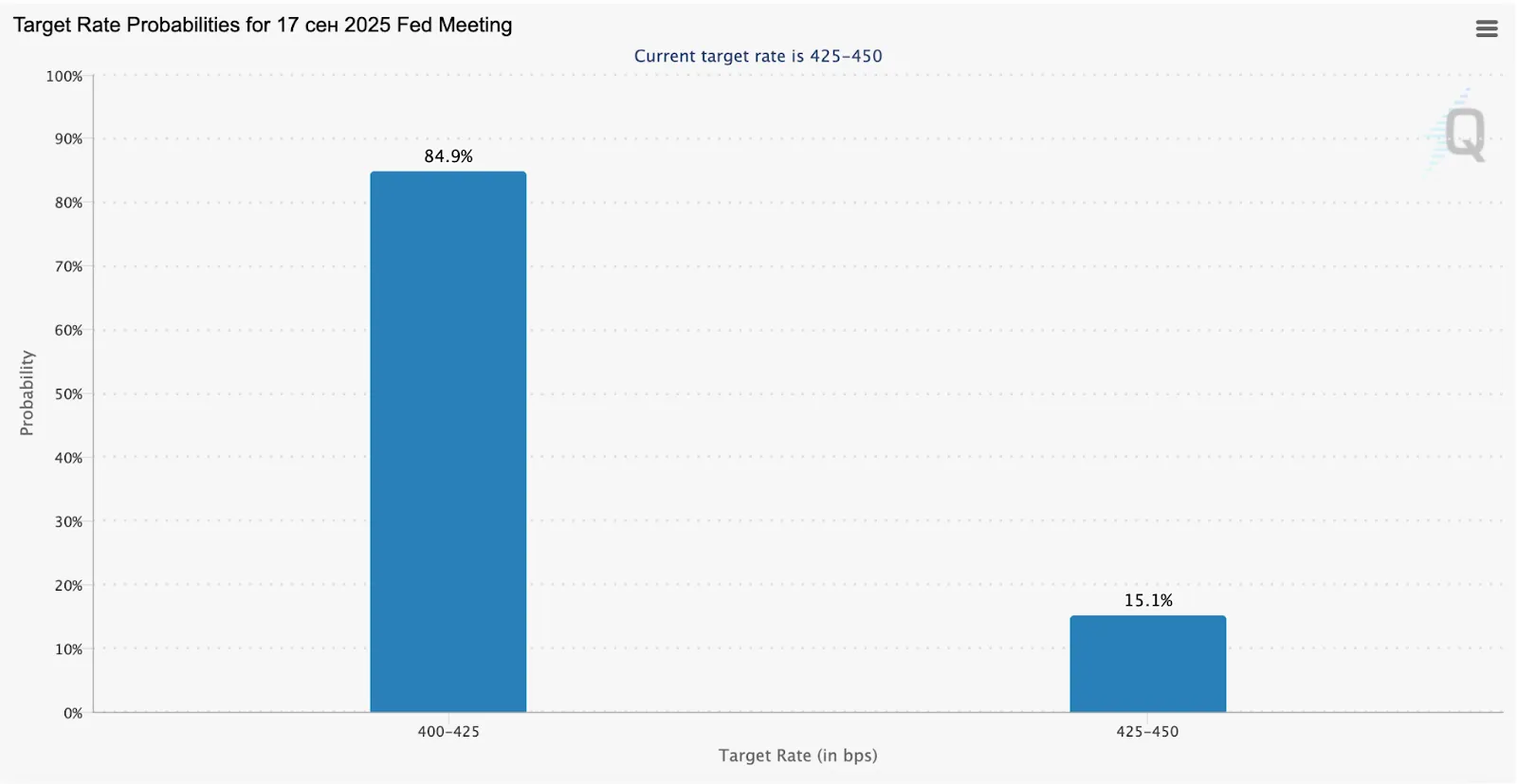

“The scale of these outflows indicates a shift in institutional investors’ positions: either funds are being withdrawn to lock in profits at recent highs and reallocate them into cash or treasury bonds, or we are witnessing a broader reaction to risk reduction due to renewed concerns about inflation, a strengthening US dollar, and uncertainty regarding Fed policy,” Lucas noted.

At the time of writing, 84.9% of market participants expect a rate cut. 15.1% believe it will remain unchanged.

Market Impact

Outflows from ETFs are one possible reason for the decline in Bitcoin and Ethereum. Over the past day, cryptocurrency prices have fallen by 1% and 0.7%, respectively.

At the time of writing, digital gold is trading below $114,000.

Meanwhile, the price of ether stands at $4208.

Investors are awaiting a speech by Fed Chair Jerome Powell at the Jackson Hole symposium on August 21st. Earlier, Lucas suggested that the conference could be the next catalyst for the crypto market.

“New Kings of Bitcoin”

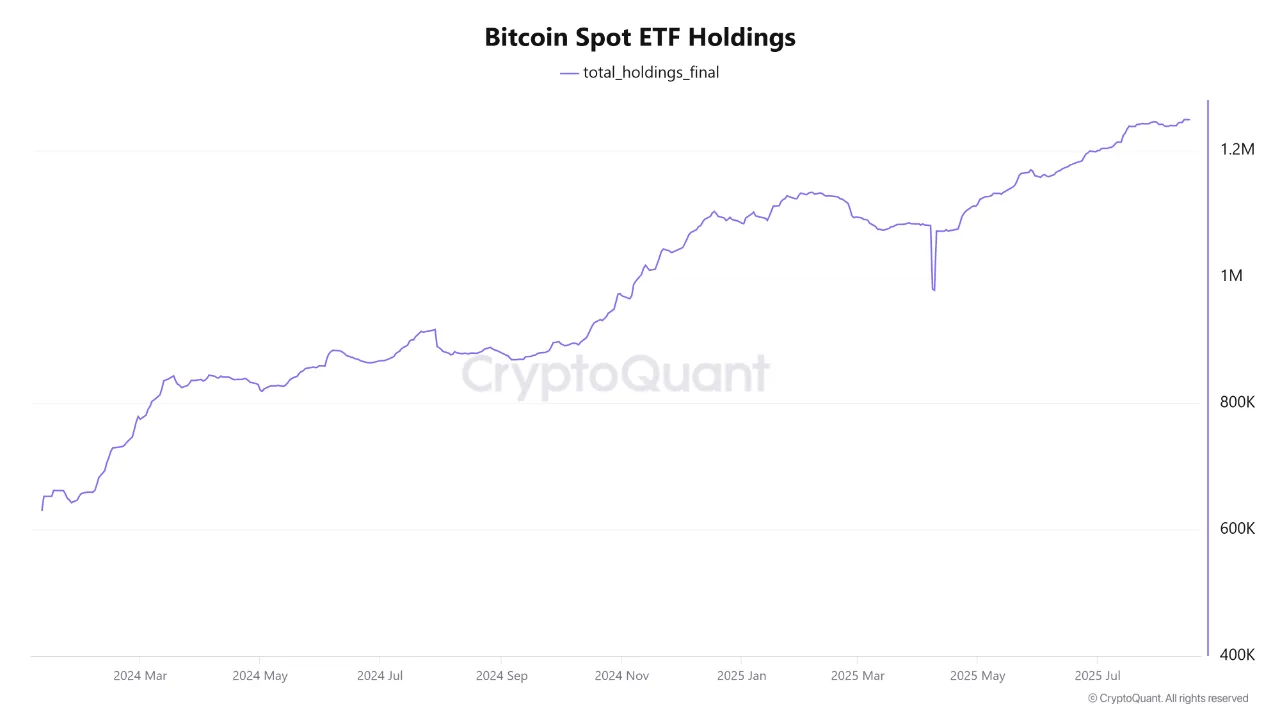

CryptoQuant analyst, known by the pseudonym CryptoOnchain, noted that Bitcoin ETFs have accumulated over 1.2 million BTC. According to him, this is a record figure, reflecting a high level of institutional investor confidence in the leading cryptocurrency.

The majority of assets are held by BlackRock, with the IBIT fund managing 748,968 BTC. Together with Fidelity, they control over 75% of the total Bitcoin in ETFs.

“Grayscale’s GBTC, once the sole giant with over 620,000 BTC, now holds only 180,576 BTC. […] The era of dominance by a single fund is over,” the expert emphasized.

Back on August 12th, NovaDius Wealth President Nate Geraci noted that half of the 20 most successful exchange-traded funds in the US are linked to cryptocurrencies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!