Bitcoin breaches the $19,000 level; Ethereum below $1,300

On Monday, September 19, the price of the first cryptocurrency failed to hold above $19,000. Over the past 24 hours the asset fell 7.8%, according to CoinGecko.

At the time of writing Bitcoin was trading near $18,460. The chart below shows that the price drop was accompanied by a spike in trading volume.

The second-largest cryptocurrency by market capitalization fell 10.8% over the past 24 hours, breaking below $1,300.

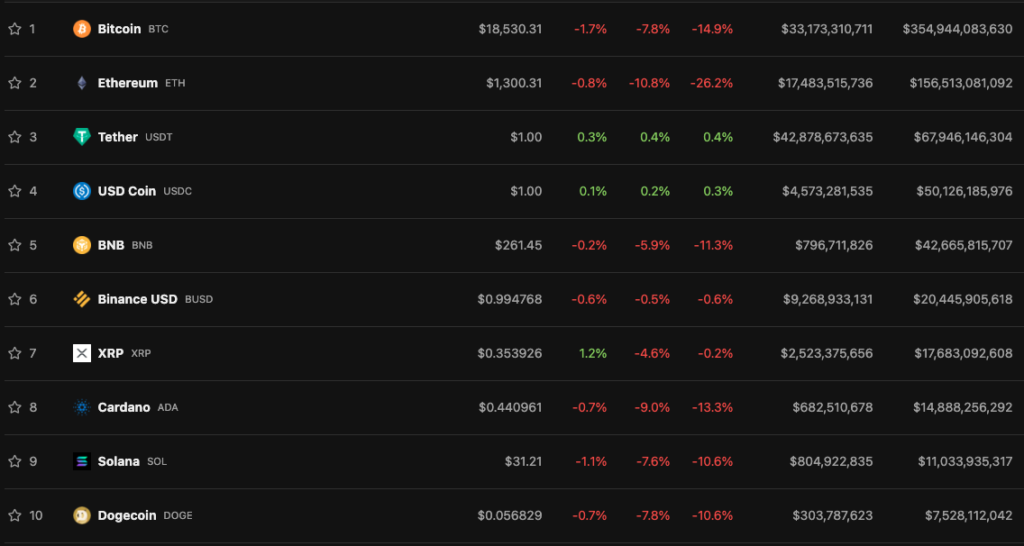

All top-10 crypto assets also moved into the red. The most notable decline was Cardano (-9%).

According to Coinglass, as a result of the market correction, futures positions were liquidated for more than $418 million. The majority of this was Ethereum — $168.6 million.

The cryptocurrency market’s total capitalization stood at $943.6 billion. Bitcoin’s dominance index was 37.6%, ETH 16.6%.

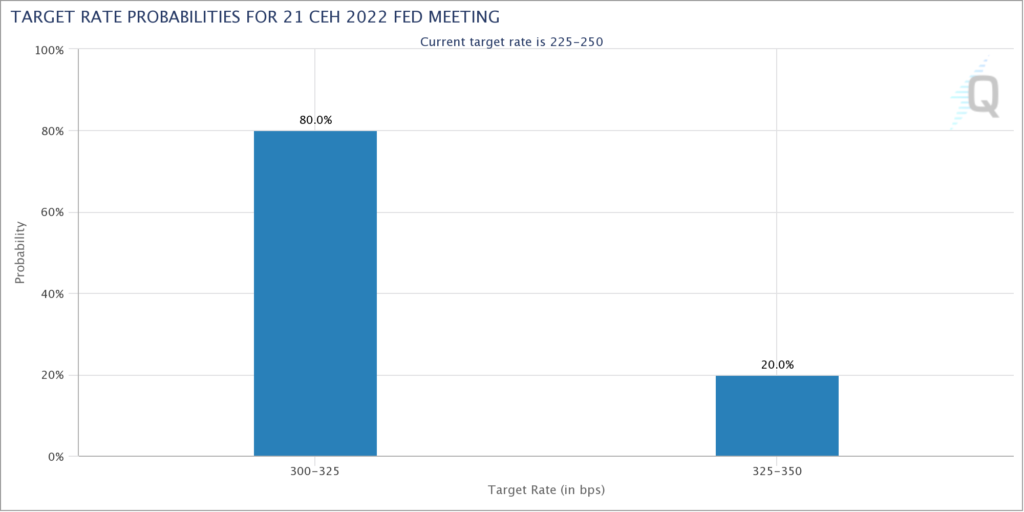

The week’s main event weighing on Bitcoin is the Fed meeting on September 21. According to the futures market, the probability of a 75-basis-point increase in the policy rate is 80%.

September 13 Bitcoin came under pressure amid the release of a macroeconomic report. According to the document, the year-over-year growth in consumer prices in the United States in August slowed to 8.3%, reinforcing expectations for the Fed to maintain an aggressive policy.

The rise of the core inflation indicator, contrary to forecasts, amplified the perception of Powell’s remarks at the Jackson Hole symposium. At that time the official warned of the intention not to rush with rate cuts to keep inflation expectations under control.

Bloomberg strategist Mike McGlone excluded the possibility of easing the Fed’s key rate in the near term. The analytical Twitter account Games of Trades noted that a critical moment had come for the S&P 500 ahead of Wall Street’s open.

#SP500 has reached its “line in the sand” level.

This is the point of sink-or-swim. Fly-or-fall. Fish-or-cut-bait. pic.twitter.com/ZaCfAfcHcE

— Game of Trades (@GameofTrades_) September 18, 2022

As reported in… former hedge-fund manager Jim Cramer of Cramer & Co. and host of Mad Money on CNBC said that monetary policy tightening by the Fed will lead to the ‘washout’ of speculative assets like cryptocurrencies.

Philosopher and author of The Black Swan Nassim Taleb described Bitcoin as a ‘tumor’, arising from the Federal Reserve’s accommodative monetary policy.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!