Bitcoin falls below $11,000 amid outflows from mining pools

On Thursday, September 3, Bitcoin’s price broke through the $11,000 support level. In a short span the quotes reached $10,720.

As shown in the chart below, the drop was accompanied by a surge in trading volume, indicating strong selling pressure.

Hourly chart BTC/USD on Bitstamp from TradingView.

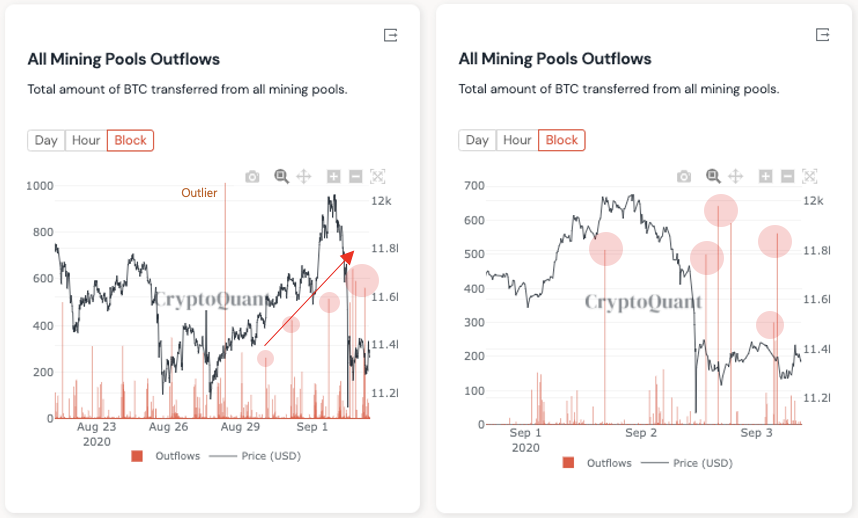

In the wake of Bitcoin’s 4.5% drop over 24 hours, CryptoQuant recorded outflows from mining pools.

Source: CryptoQuant.

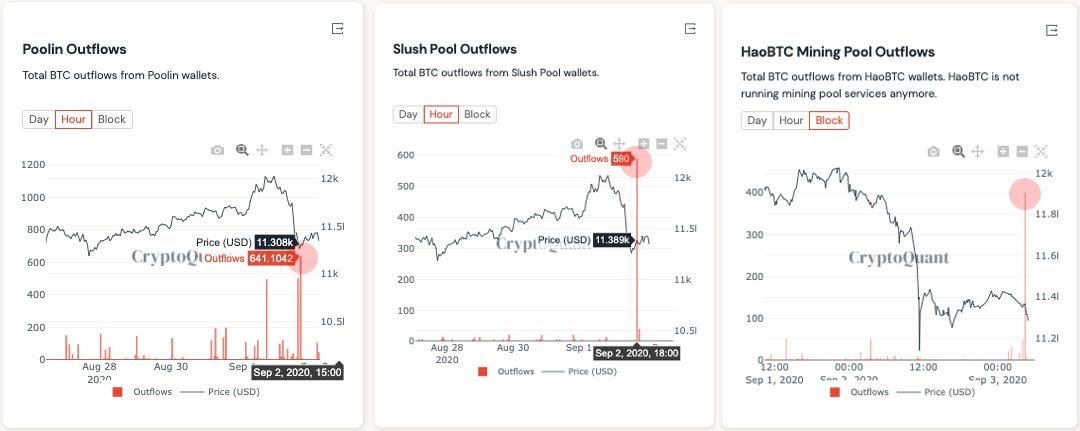

According to the company, in the wake of BTC’s price decline, three pools – Poolin, Slush and HaoBTC – withdrew 1,630 BTC on Wednesday, September 2.

Source: CryptoQuant.

As CryptoQuant CEO Ki En Ju stated in a comment to Cointelegraph, miners may take advantage of the situation to strengthen their positions, since Bitcoin is currently trading higher than most of 2020.

“I think this will be a miner war between those who expect Bitcoin’s price to rise and those who do not want that,” said Ki En Ju.

The market downturn, CryptoQuant’s CEO regards as unlikely, despite inflows to exchanges. In his view, miners are not leaving the market, but simply looking for opportunities to sell their cryptocurrency.

Analyst Michaël van de Poppe of the Amsterdam Stock Exchange suggested BTC could rise to $11,200, at which point altcoins would likely rebound. He called that level a critical threshold.

The breakdown occurred and we reached the next level.

That was a painful drop for me too, but I’m not going to cry in a corner.

Expecting a relief rally towards $11,200 to occur in which alts make a bounce too.

However, $11,200 is crucial threshold. pic.twitter.com/aBtNIpeTAW

— Crypto Michaël (@CryptoMichNL) September 3, 2020

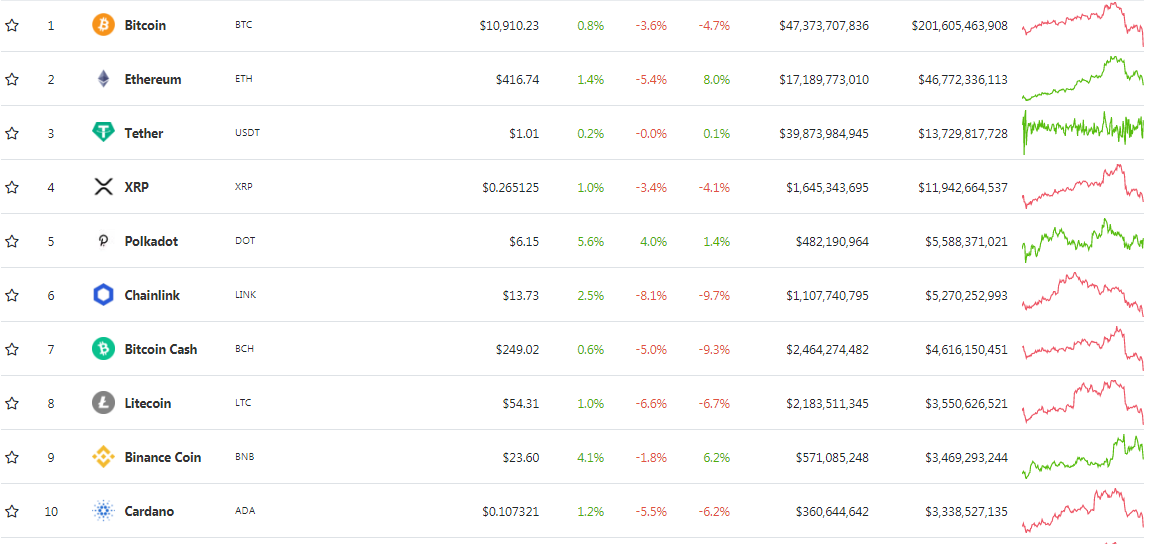

Together with BTC, almost all top-10 cryptocurrencies fell. Over the last 24 hours only DOT remained green. The biggest losers were LINK and LTC.

Source: CoinGecko.

Bitcoin began rising from the end of July and has not fallen below $10,000 yet. PhutureDAO co-founder Charles Stori partially linked the success of the first cryptocurrency with an increasing flow of investments into the DeFi sector.

Earlier, a new high was reached for the Bitcoins deployed in the Lightning Network. The total number of coins in payment channels stood at 1,060 BTC, worth $12.4 million.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!