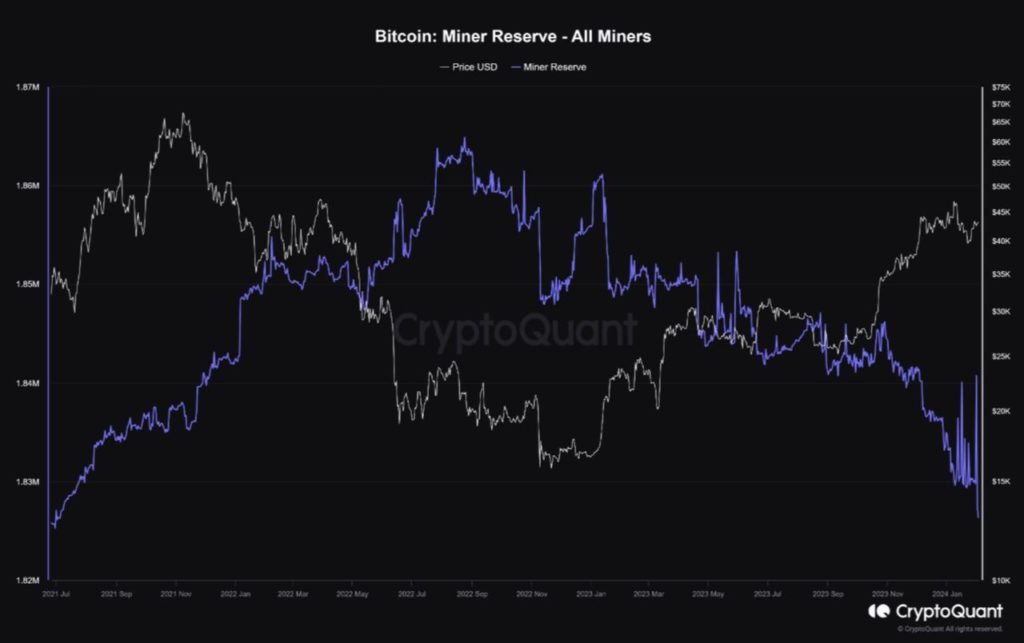

Bitcoin Miners’ Reserves Decline to July 2021 Levels

Bitcoin reserves held by miners have fallen to levels last seen in July 2021, according to observations shared by CryptoQuant analysts.

“In the past two days, miners’ reserves have dropped by more than 14,000 BTC, approximately $600 million,” noted the specialists.

The selling pressure following the approval of spot ETFs is largely driven by the actions of digital gold miners, according to a Bitfinex report.

Analysts suggest that miners are motivated to sell in preparation for the upcoming halving, which will halve the block reward and thus reduce the profitability of mining digital gold in the short term.

“Current sales provide capital for infrastructure upgrades and serve as a reminder of the significant impact miners have on market liquidity and pricing,” added the experts, warning of the inevitable continuation of reserve liquidation.

At the time of writing, Bitcoin is trading around $43,100 (+1.1% over the past 24 hours), according to CoinGecko.

Previously, popular blogger PlanB suggested that after the upcoming halving, Bitcoin will become scarcer than gold and real estate, with its price reaching $500,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!