Blofin Academy: Hong Kong Could Provide Liquidity to Spur Bitcoin Growth

Liquidity tightening despite the imminent end of the cycle of policy ФРС will continue to weigh on Bitcoin prices. The situation could be changed by Hong Kong’s transformation into a crypto hub for the industry, according to Blofin Academy.

«The tightening financial cycle seems to have ‘already ended’ to some extent, but liquidity pressure in the crypto market remains difficult to alleviate in the short term. Fortunately, in the afterwaves of the ‘post-rate hike era,’ Hong Kong is emerging as an important source of…

— Blofin Academy (@Blofin_Academy) April 27, 2023

Experts warned of recession or a full-blown crisis in the event of an overly aggressive rise in the Federal Reserve’s key rate.

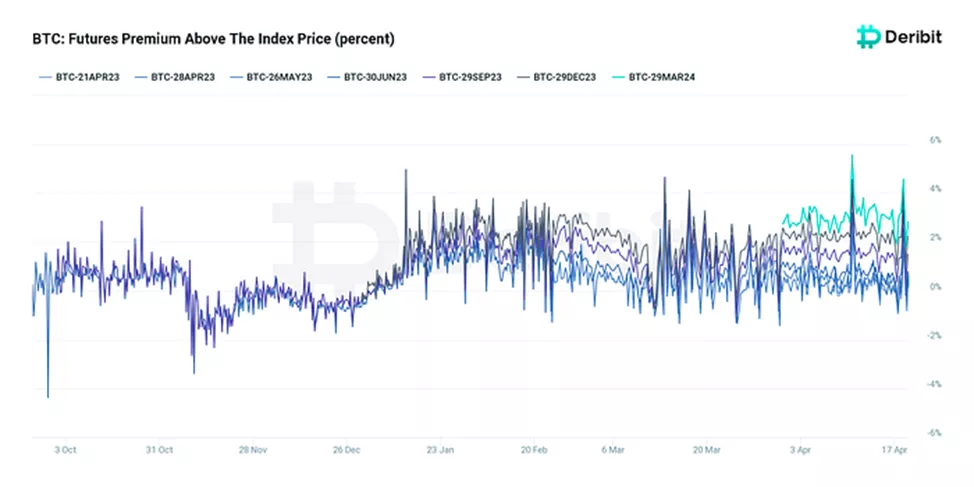

According to experts, the current 4% premium on annual Bitcoin futures reflects an expected turning in Fed monetary policy. Sentiments in the crypto derivatives space range from neutral to optimistic, which contrasts with the 2022 situation.

The rise in digital asset prices in recent months has created the impression that investors are ready to step beyond the cycle of rate changes. At the same time, liquidity pressure has not yet weakened, specialists warned.

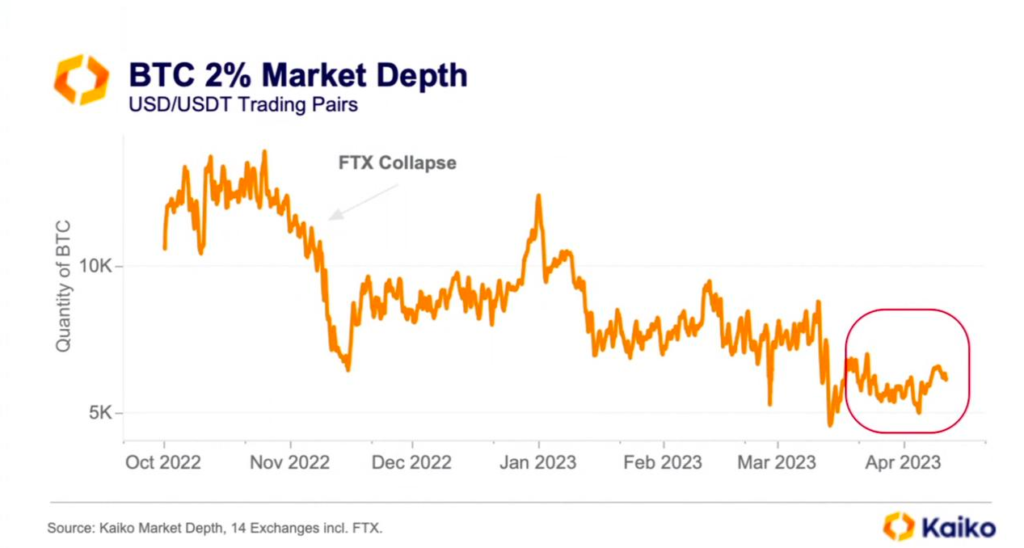

Against the backdrop of regulatory pressure, BTC/USD trading volume reached a new low since 2021. Liquidity of other instruments in the pair with Bitcoin remained subdued since October 2022. It has not recovered after the sharp drop in March.

Analysts described the widely held belief that the SVB collapse led to increased purchases of cryptocurrencies and improved liquidity conditions as a misconception. Most trades at that moment were conducted for hedging risks, rather than for subsequent trading. As a result, coins moved to long-term storage, reducing the available supply, they explained.

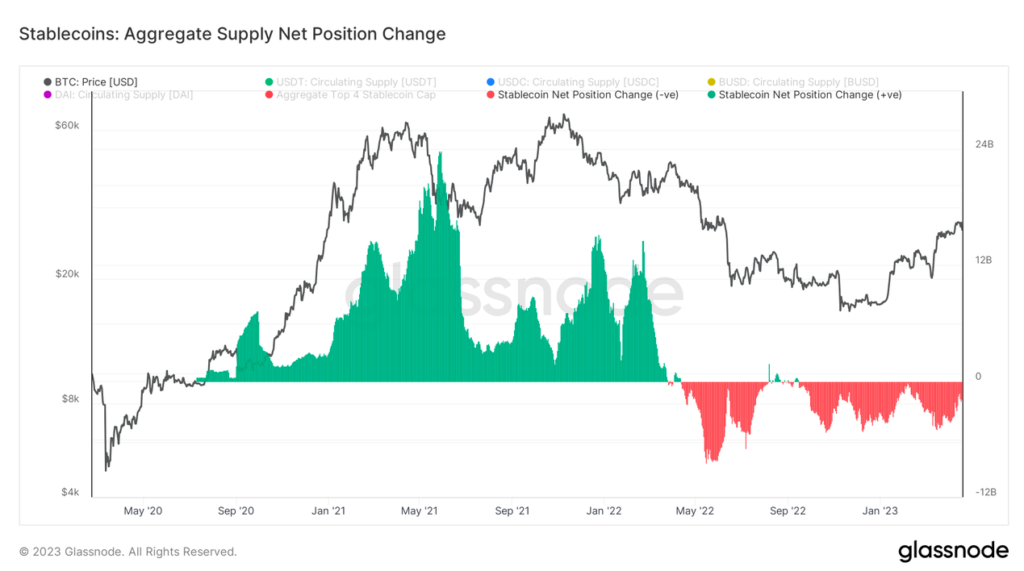

Notably, a contraction in the supply of stablecoins has been observed since April 2022. The trend formed under the influence of the Terra collapse, the bankruptcies of 3AC and FTX, which became a sign of investors’ loss of trust in the crypto market.

«Liquidity is being withdrawn into fiat, which leads to a decline in the valuation of digital assets. This situation is called passive deleveraging», — analysts explained.

Regarding prospects for improving liquidity in the crypto market in 2023, experts pointed to three distinct sources:

- a return of risk appetite;

- hedging in connection with the banking crisis;

- hedging due to geopolitical conflicts.

Analysts noted that only the first component is sustainable, while the second leads to hodling, and the third — has relatively small scale.

The Blofin Academy links a qualitative improvement in liquidity to a shift in the macroeconomic cycle, and, due to its dominant USD-denomination, to Fed policy.

Analysts expect a Fed rate cut no earlier than September. Until then, the market may feel the pressure of shrinking liquidity.

In this context, experts see a prospect for a stronger role for Asian traders amid an improving regulatory landscape in Hong Kong. Consequently, U.S. influence on crypto-market dynamics could weaken.

«Obviously, Hong Kong has the potential to become a new driver. The capacity of stablecoins in HKD may contend with USD. The authorities of the jurisdiction expressed support for trading platforms that use the local currency. Liquidity could be anchored by stablecoins in USD and HKD. As the bull market develops, Hong Kong’s role will rise», — the company explained.

Back in January 2023, the Finance Secretary of the Hong Kong Special Administrative Region said the jurisdiction to welcome crypto startups from around the world.

Earlier, Circle CEO Jeremy Allaire called regulatory actions the main factor behind the decline in the capitalization of USDC. The executive did not rule out the loss of the United States’ leading position in the sector in favor of the EU, Hong Kong, and the UAE.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!