BNB Chain to halve fees as it battles Base and Solana

BNB Chain validators propose halving fees and speeding up blocks to stay competitive.

BNB Chain validators have proposed lowering gas from 0.1 to 0.05 gwei and shortening block intervals from 750 ms to 450 ms.

Gas fees matter.

They decide where traders build, where liquidity flows, and where innovation happens.

That’s why validators on BNB Chain are proposing to halve fees and accelerate block speeds, keeping BNB Smart Chain (BSC) competitive with the fastest chains in crypto.

BNB… pic.twitter.com/sCdHutFfrJ

— BNB Chain (@BNBCHAIN) September 23, 2025

As a result, the cost per transaction could fall to $0.005, keeping the network competitive amid the rise of Solana and Base.

“BNB recently hit an all-time high above $1,000—a milestone worth noting. But it also raises the question: how do we ensure the network can deliver not only the current performance but is ready for the next stage of growth? The answer lies in performance and affordability,” the developers said.

In April 2024, gas was already reduced from 3 to 1 gwei (–67%), and then to 0.1 gwei (–90%) in May 2025. These steps cut the median fee by 75% (from $0.04 to $0.01) and lifted daily transactions by 140%—to more than 12 million.

“Some may ask about risks such as failed transactions, changes to validator rewards, or infrastructure load. With network utilisation below 30%, there is room for activity to grow, and gas will be adjusted if needed,” the developers explained.

A new principle

The community is discussing a new principle: as long as staking yield exceeds 0.5% per annum, BNB Chain will aim for the lowest possible fees—around $0.001 per transaction.

“This balances network growth with validator rewards, ensuring long-term sustainability,” the developers said.

Such a sharp cut in fees is meant to strengthen the network’s position as competition intensifies.

“What matters most is the community’s proposal. Validators and users together will determine where BNB Chain goes next,” project representatives stressed.

Room for improvement

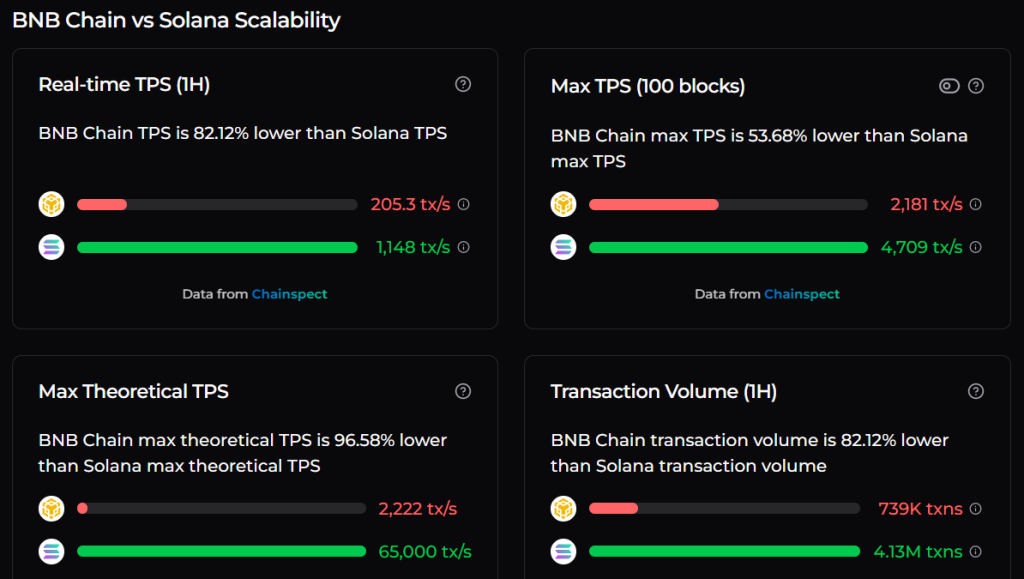

BNB Chain still lags Solana in throughput and daily transaction volume (TPS):

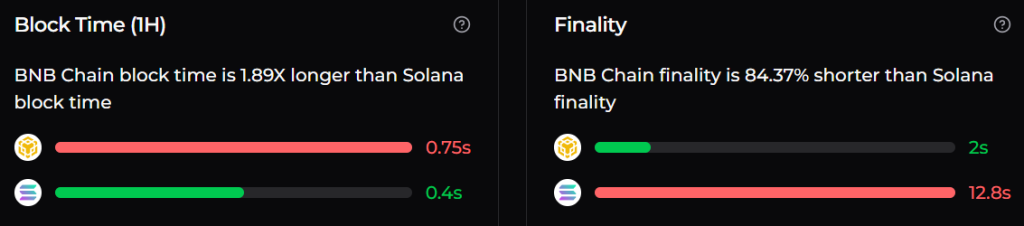

The inter-block interval is almost twice that of its rival; however, finality is 84.37% faster:

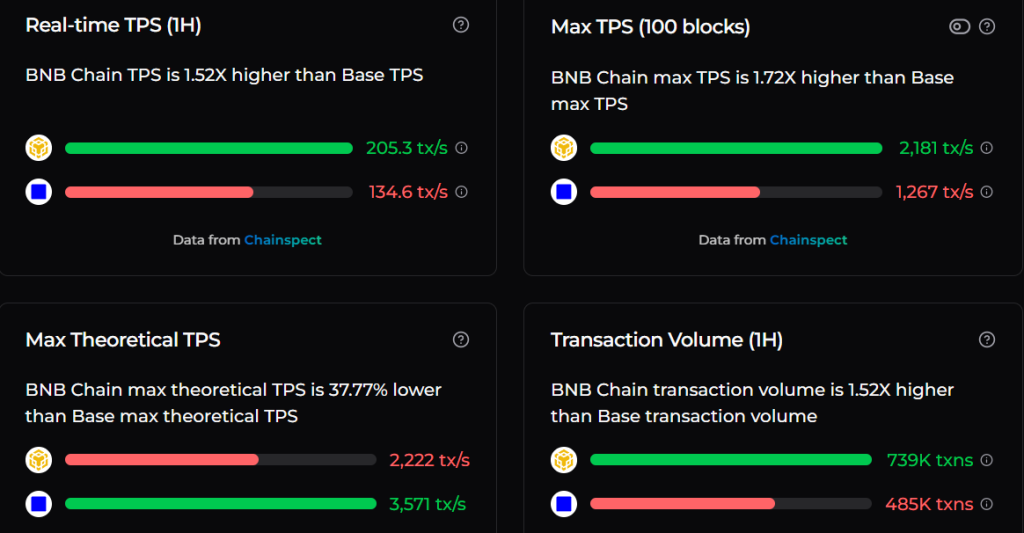

BNB Chain outperforms Base on real and peak TPS, as well as transaction volume:

It also holds a sizeable edge on inter-block interval and finality:

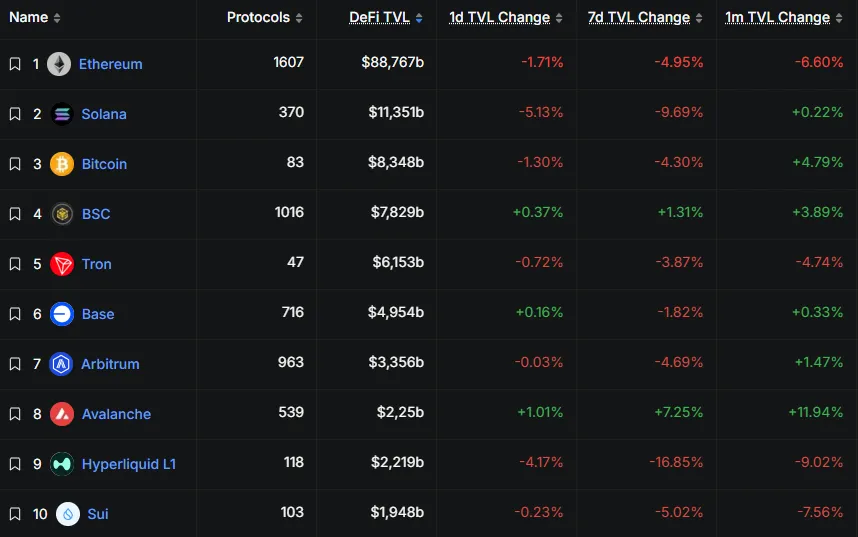

By aggregate TVL in DeFi applications, the BNB Chain ecosystem trails Solana ($7.82bn versus $11.35bn) but tops Base ($4.95bn).

The BNB Chain team plans to increase BNB Chain’s performance tenfold, creating a “next-generation blockchain” by 2026.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!