Experts identify the main winners from Binance’s settlement with US authorities

- Coinbase and Bybit are the beneficiaries of Binance’s settlement with US authorities.

- Binance regains liquidity position.

- Kaiko analysts see reasons for the platform to maintain its market share.

Coinbase and Bybit recorded the largest increase in the market share of centralized exchanges (CEX) after regulators’ settlement with Binance. These assessments are contained in the Kaiko report.

On November 21, as part of the deal with the authorities, the entity paid $4.3 billion, and Changpeng Zhao agreed to a $50 million fine and to step down as chief executive.

After the resignation of CZ, the company was led by Richard Teng. In a special feature, ForkLog examined the experience of the new head of the exchange and found out how former colleagues assess the prospects of the platform under his leadership.

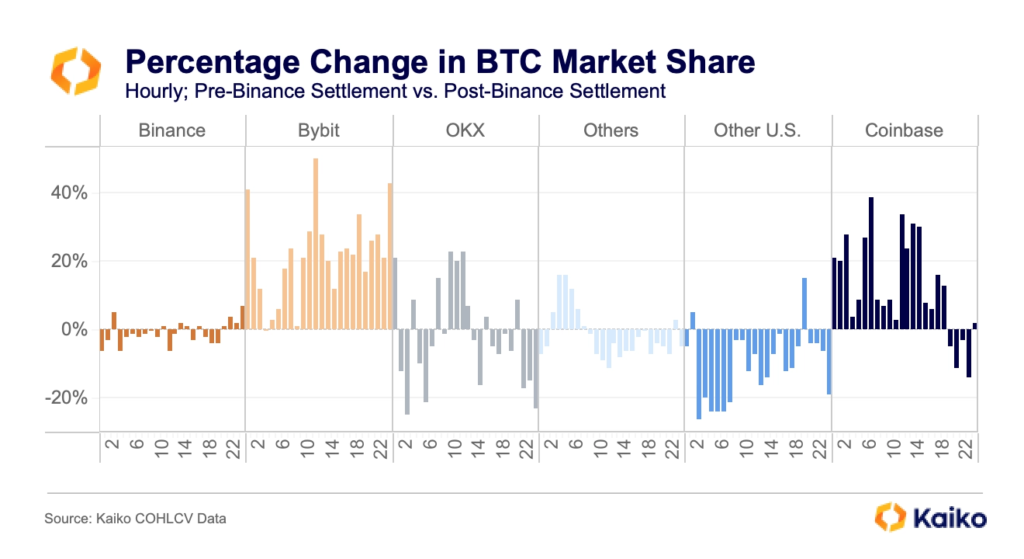

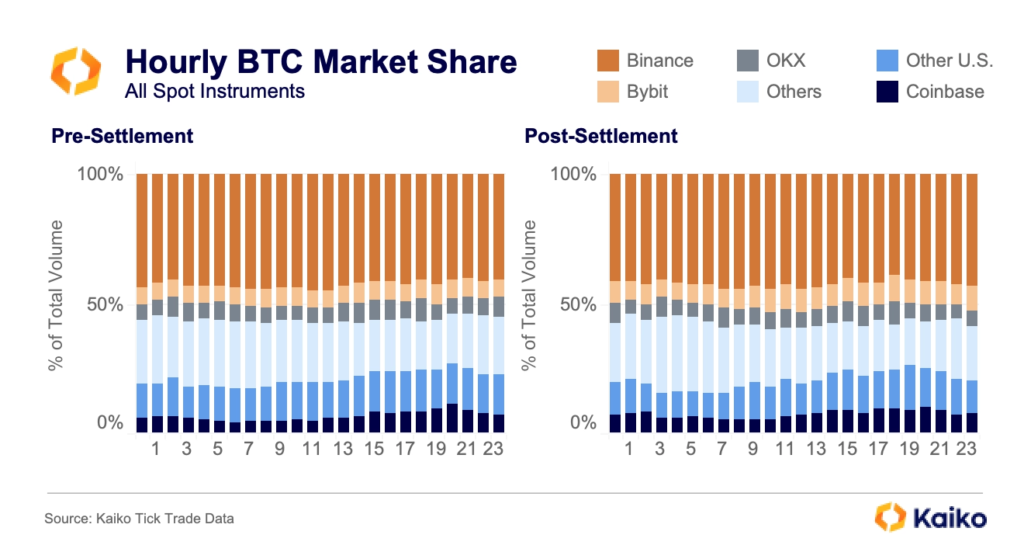

Using Bitcoin as a reference, experts deemed Bybit the “immediate winner” of Binance’s settlement with US authorities. The volume of trading Bitcoin on the platform jumped more than 20% in 16 of the 24 hours after the events.

«Given Binance’s dominance is so large, a drop in its market share to 4% during certain hours led to a 50% increase for Bybit and up to a 34% increase for Coinbase», — the analysts explained.

Experts also noted an additional boost to the latter’s stock. In November, the market capitalization of the largest US Bitcoin exchange rose by 75%, year-to-date — by 250%.

Coinbase’s share rose the most outside US trading hours after the settlement, while OKX’s metrics rose most noticeably at the start of the trading day in Western Europe.

Other platforms registered in the US showed weak results across the board, the analysts noted.

In summary, analysts noted that Binance ceded some market share to Bybit and Coinbase (outside the US session).

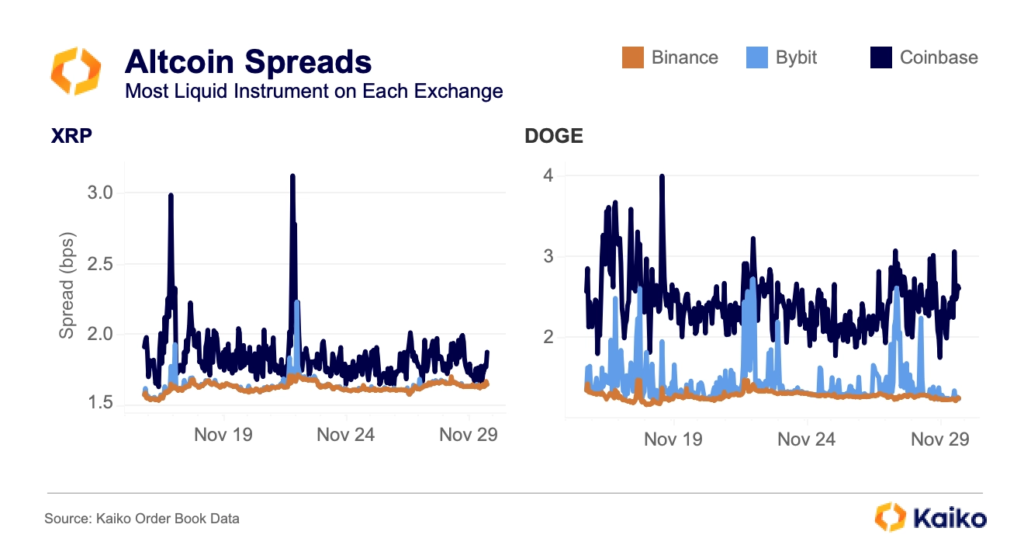

According to the analysts, despite an outflow of more than $1 billion over the following 24 hours, the platform did not show signs of a sharp liquidity decline. Market-depth metrics after the events began to recover. Bybit narrows the gap, while Coinbase still lags somewhat in terms of spread competitiveness, they added.

Experts urged not to rush forecasts given the absence of any “bleak” consequences for Binance.

«Despite the common belief that the platform would lose positions, there is also a scenario of heightened monitoring to ensure compliance with AML/KYC measures that would help preserve competitiveness. The turbulence of the past two years has shown there is a certain attachment to liquidity and volumes. Investors generally want to keep using exchanges they already trust», — the report says.

In their view, the saga is positive for all — the US government wins, Binance can continue to operate, and other platforms gain opportunities to grow.

As reported in October, CCData analysts noted a decline in the organisation’s market share over the last seven months .

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!