Glassnode Analyzes Decline in Bitcoin On-Chain Activity

The decline in daily transactions on the Bitcoin network is largely attributed to a drop in non-financial operations and the growing dominance of major players, according to analysts at Glassnode.

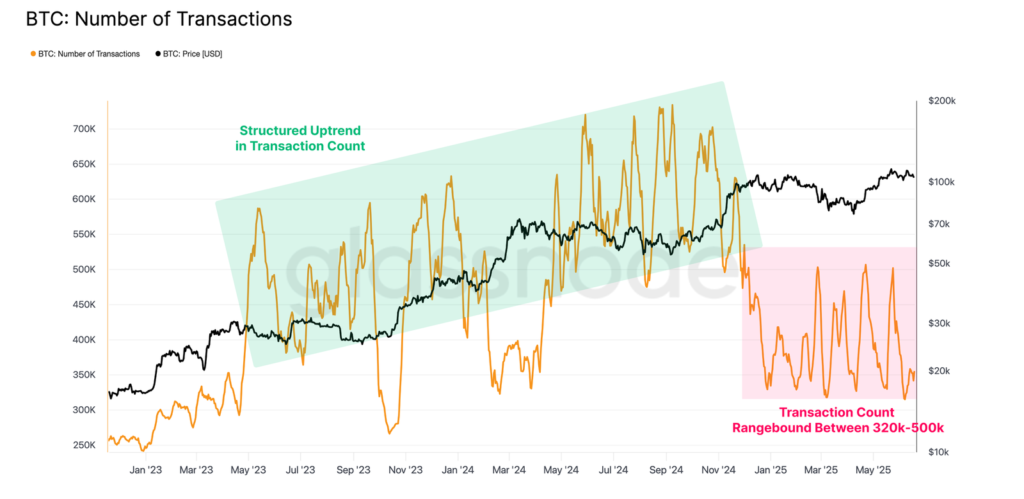

Throughout 2023-2024, the number of on-chain transactions per day showed an upward trend, peaking at 734,000 in November. Since the beginning of 2025, the figure has plummeted to between 320,000 and 500,000, approaching lows not seen since October 2023.

Meanwhile, the volume of daily transferred value remains at a historically high level, averaging $7.5 billion.

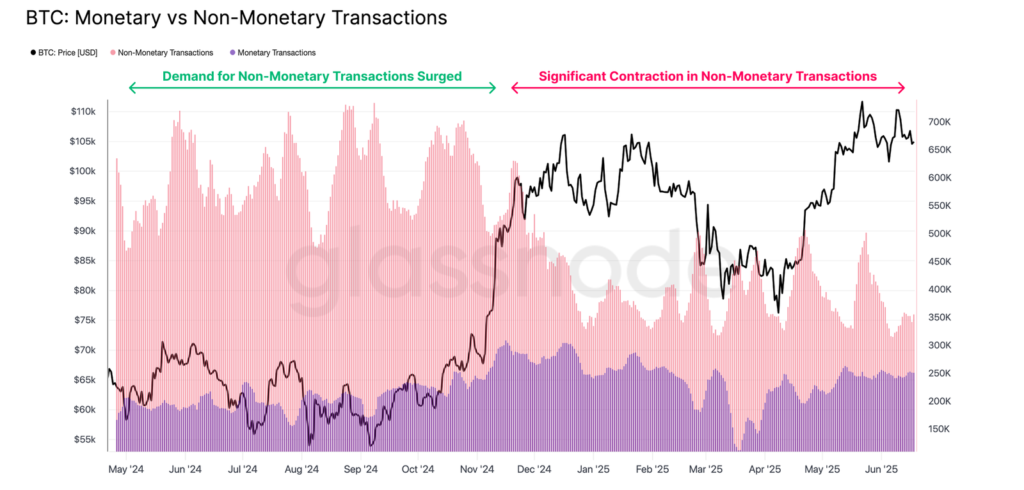

Experts suggest this indicates that the decline in blockchain transactions is linked to the waning hype around assets issued via Taproot (Ordinals) witness data and OP_Return (Runes) fields.

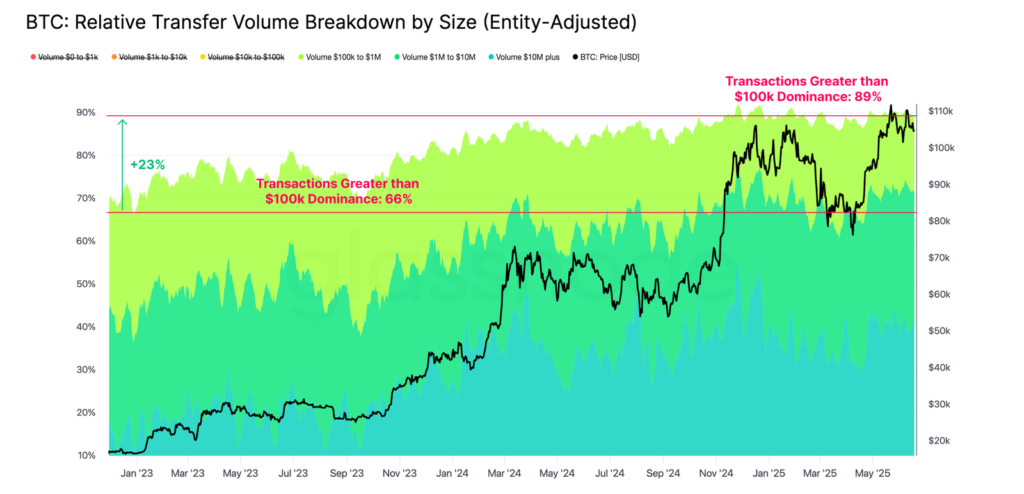

Glassnode also noted that the number of financial transactions remains roughly unchanged, but their average dollar value has reached $36,200. The share of transactions worth $100,000 or more has increased from 66% in November 2022 to 80% currently.

For comparison, in December 2022, transactions up to $100,000 accounted for 34% of the total, but now this figure has dropped to 11%.

“This trend supports the view that high-value participants are becoming increasingly dominant in on-chain activity,” analysts emphasized.

A significant portion of the Bitcoin economy has shifted off-chain, Glassnode stated. In the spot trading segment, centralized exchanges facilitate this. Over the past year, the average daily trading volume on CEX was about $10 billion, peaking at $23 billion in November, but such operations often do not involve asset transfers on the network.

Additionally, the current cycle has seen a sharp increase in trading activity in futures contracts and options, as well as the use of leverage.

According to analysts, the volume of the off-chain Bitcoin market regularly exceeds the total on-chain operations by 7-16 times.

Glassnode experts acknowledged that all these trends have put pressure on miners’ fee income. The share of network fees in revenue has already fallen below 1%. In June, the average figure was $530,000 per day.

Following the latest network difficulty adjustment, Bitcoin’s difficulty adjusted from its ATH by just 0.45%, continuing to pressure miners’ profitability.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!